7万美元距离咫尺 比特币暴涨推手竟是一家“微”公司

3月5日晚间,加密社区沸腾了,因为时隔漫长的28个月,比特币再次刷新了历史高点,一度触及69080 USDT,突破了曾于2021年11月创下的前高69040.1 USDT,距离7万美元可以说是咫尺之遥。

不出意外的话,业内许多“比特币暴涨”分析会集中在减半、降息等宏观因素,但Koala考拉财经认为,这次市场上涨可能和一家“微”公司有关,它就是——微策略MicroStrategy,让我们在本文中进行深度分析。

暴涨前一天宣布募资6亿美元增持比特币,MicroStrategy为何总能精准把握时机?

实际上,就在3月5日晚间比特币暴涨之前,MicroStrategy“突然”发布公告宣布计划根据市场条件和其他因素,通过私募方式向合格机构买家发售本金总额为6亿美元的2030年到期的可转换优先票据。MicroStrategy还预计向票据的初始购买者授予在票据首次发行日(包括该日)起的13天内额外购买最多9,000万美元本金总额的选择权。

MicroStrategy是一家美国商业智能软件公司,其首席执行官Michael Saylor是比特币的坚定支持者,自2020年8月以来,MicroStrategy已将其资产负债表中的大部分资金转换为比特币,如今已经成为全球最大的比特币持有者之一。

MicroStrategy 能够如此精准地把握比特币价格上涨的时机,主要有以下几个原因:

MicroStrategy对比特币的长期看好:Michael Saylor认为,比特币是未来全球储备货币的最佳候选者,并将其视为一种对抗通胀的投资工具。因此,MicroStrategy一直致力于长期持有比特币,并不会因为短期价格波动而改变其投资策略。

对市场情绪的敏锐洞察:MicroStrategy一直密切关注比特币市场,并能够准确判断市场情绪的变化。在 2024年3月4日的公告之前,比特币价格已经连续上涨了几个星期,市场情绪正处于高涨时期。MicroStrategy选择在这个时候宣布募资增持比特币,无疑是抓住了市场情绪的最佳时机。

强大的资金实力:MicroStrategy是一家盈利能力较强的公司,拥有充足的资金实力。这使得MicroStrategy能够在短时间内募集大量资金,并迅速将其转换为比特币。

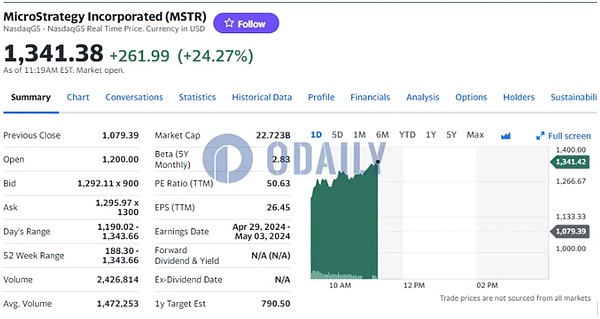

不仅如此,伴随着比特币价格上涨,MicroStrategy股价也突破1300美元,现报1341.38美元,日内涨幅为24.27%,年初至今涨幅已达105.25%。市场分析师认为,如果按照这一趋势,MicroStrategy有望近期创下2000年3月以来最高收盘价(当时其股价达到2267.50美元),不过其当前股价仍较2000年3月10日历史收盘高点3130.00美元有近60%的差距。

当然,MicroStrategy 的投资策略也存在一定的风险。如果比特币价格出现大幅下跌,MicroStrategy 的资产价值将遭受重大损失。

不过,从目前来看,MicroStrategy 的投资策略似乎是成功的,自 2020 年 8 月以来,MicroStrategy 持有的比特币价值已增长了数倍,为公司股东带来了丰厚的回报,据悉MicroStrategy董事长Michael Saylor在其公司股票和比特币价格连续上涨后,个人财富增加了约7亿美元,Michael Saylor是MicroStrategy最大的投资者,拥有该公司约12%的股份。他还透露2020年个人拥有17,732枚比特币,因此持股和持仓从本周初的22.7亿美元攀升至29.6亿美元。

MicroStrategy能带动加密巨鲸加持比特币吗?

Koala考拉财经了解到,当前MicroStrategy 共持有约193000 BTC,远超其他上市公司的比特币持有量,其平均购入价格为每枚 31544 USDT,按照 69000美元计算,浮盈超70亿美元。

市场分析认为,在MicroStrategy的带动下,可能会“刺激”更多加密巨鲸入场,比如就在其宣布会持续购入比特币之后不久,HODL15Capital 就注意到了一名神秘巨鲸的买入动作。因每次加仓均为约100枚 BTC ,该某神秘地址也得名为Mr. 100 ,该地址近期频繁加仓后合计已持有约 51064枚 BTC,价值约35亿美元。

作为一家大型机构投资者,MicroStrategy对比特币的持续看好,可能会对其他加密巨鲸产生影响,其投资策略也表明了其对比特币长期价值的信心,这可能会鼓励其他加密巨鲸继续持有或增持比特币,加上MicroStrategy的成功投资,可能会吸引其他加密巨鲸进行跟风投资,这也可能会导致比特币价格进一步上涨。

总结

就现阶段而言,绝大部分机构仍继续看好BTC长线的增长趋势,但也有部分从业者在提示潜在的回调风险。随着BTC刷新历史高点,当下投资者们最为关心的问题无疑是BTC能否在此站稳,继续保持上涨趋势,让我们拭目以待。

On the evening of March, the encryption community was boiling, because after a long time of months, Bitcoin once again reached a record high, and once touched and broke through the previous high distance of $10,000, which was set in June. It can be said that it is close at hand. If there is no accident, many bitcoin surge analysis in the industry will focus on macro factors such as halving interest rates, but Koala Finance thinks that this market rise may be related to a micro-company, which is a micro-strategy. Let's make an in-depth analysis in this paper and announce that the day before the surge, we will raise $100 million to increase He Zongneng accurately grasped the opportunity. In fact, just before the surge of Bitcoin on the evening of June, he suddenly announced that he planned to sell convertible priority notes with a total principal of US$ 100 million to qualified institutional buyers through private placement according to market conditions and other factors. It is also expected that the initial buyers of the notes will be granted the option to purchase up to US$ 10,000 in additional principal within the first issue date of the notes, including the day from that date. The CEO of the company is Bitcoin. The staunch supporters of Bitcoin have converted most of the funds in their balance sheets into bitcoin since September, and now they have become one of the largest bitcoin holders in the world. There are several reasons why they can grasp the timing of bitcoin price increase so accurately. They believe that Bitcoin is the best candidate for the future global reserve currency and regards it as an investment tool to fight inflation. Therefore, they have been committed to holding Bitcoin for a long time and will not change because of short-term price fluctuations. Changing its investment strategy, keen insight into market sentiment, has been paying close attention to the bitcoin market and can accurately judge the change of market sentiment. Before the announcement on January, the price of bitcoin had been rising for several weeks, and the market sentiment was in a period of high tide. It is undoubtedly the best opportunity to announce the fundraising and increase the holding of bitcoin at this time. Strong financial strength is a company with strong profitability, which enables it to raise a large amount of capital in a short time. Gold and quickly converted it into bitcoin. Not only that, but the stock price also broke through the US dollar. The intraday increase of the US dollar is now reported as the year-to-date increase. Market analysts believe that if this trend is followed, it is expected to hit the highest closing price since September, when its share price reached the US dollar, but its current share price is still far from the historical closing high of the US dollar. Of course, there are certain risks in the investment strategy. If the bitcoin price drops sharply, the asset value will suffer heavy losses. Great loss, however, the investment strategy seems to be successful at present. The value of bitcoin held has increased several times since January, which has brought rich returns to the shareholders of the company. It is reported that the chairman's personal wealth has increased by about $100 million after the price of his company's stock and bitcoin has risen continuously, which is the largest investor who owns about shares in the company. He also revealed that in 2000, his personal ownership and position have climbed from $100 million at the beginning of this week to $100 million. Can the encrypted whale bless Bitcoin koala? Finance has learned that the total amount of bitcoin held by other listed companies far exceeds that of other companies, and its average purchase price is over 100 million US dollars per piece. According to market analysis, it may stimulate more encrypted whales to enter the market. For example, shortly after it announced that it would continue to buy bitcoin, it noticed the buying action of a mysterious whale, because every time it added positions, it was also named as the mysterious address. After recent frequent adding positions, it has held about 100 million US dollars as a total. A large institutional investor's continued optimism about Bitcoin may have an impact on other cryptowhales, and its investment strategy also shows its confidence in the long-term value of Bitcoin, which may encourage other cryptowhales to continue to hold or increase their holdings of Bitcoin, and the successful investment may attract other cryptowhales to follow suit, which may also lead to a further increase in bitcoin prices. Summary: At this stage, most institutions continue to be optimistic about the long-term growth trend, but some practitioners are also. It is suggested that the potential callback risk, as the historical high point is refreshed, the question that investors are most concerned about now is undoubtedly whether they can stand firm here and continue to maintain the upward trend. Let us wait and see. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。