区块链信任的演变:EigenLayer 如何改变游戏规则

作者:Juan Pellicer,IntoTheBlock研究员 翻译:善欧巴,比特币买卖交易网

随着 EigenLayer 的出现,以太坊生态系统正面临重大演变。这一创新框架由 Eigen Labs 团队开发,旨在提高整个以太坊网络的安全性和实用性水平。使用智能合约,EigenLayer 使 ETH 质押者能够通过验证各种新软件模块来扩大他们的参与度。这一发展不仅加强了网络的安全基础设施,还为新的价值创造选项和创新解决方案铺平了道路。

从历史上看,区块链一直在努力应对去中心化信任的挑战。虽然以太坊的可编程努力开启了模块化开发的新时代,但它导致了跨各种应用程序和服务的分散安全模型。EigenLayer 试图统一这一点,为从数据层到预言机网络的各种模块提供安全保护伞。其使命是将 EigenLAyer 转变为去中心化信任的市场。

TVL快速积累

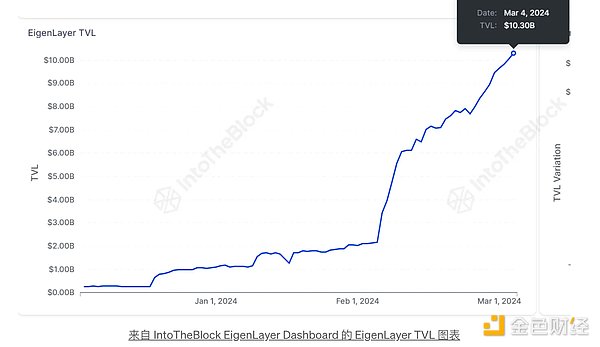

迄今为止,EigenLayer 需求的最佳指标之一是其在重新质押中实现的锁定总价值 (TVL),自 2023 年 6 月开放存款以来,该总价值已超过 100 亿美元。这一里程碑表明了以太坊社区对确保和通过 EigenLayer 增强网络基础设施。

前所未有的需求

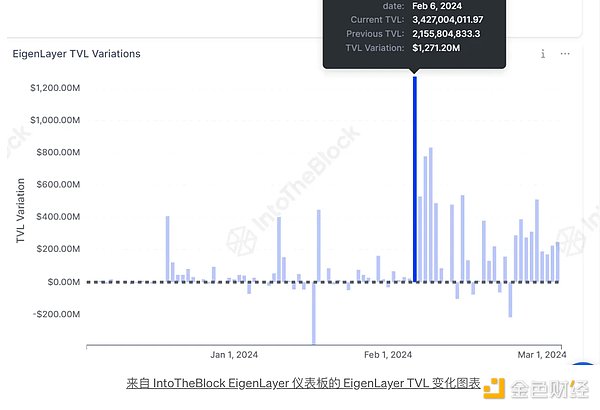

该平台的需求在 2 月 6 日达到了非同寻常的峰值,单日存款额就超过 10 亿美元。这种非凡的涌入展示了社区参与 EigenLayer 的渴望:

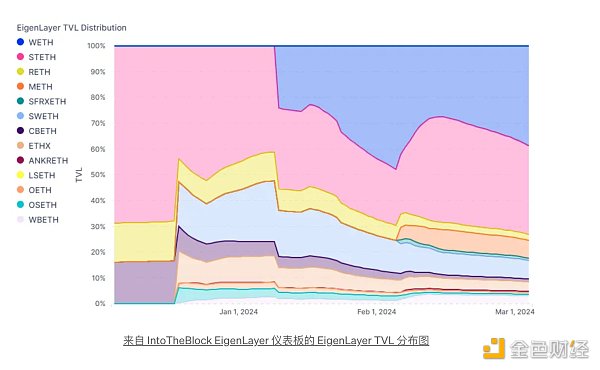

通过检查 TVL 的构成,可以明显看出存款主要由 WETH 和 stETH 组成,两者都得到 Eigenlayer 的支持。对于那些通过 EigenPods 直接从验证者进行质押的人来说,WETH 是首选方法。这一观察结果表明,以太坊持有者对参与重新抵押活动有着强劲的需求。此外,它可能表明许多持有者对直接持有流动性质押代币持谨慎态度,表明人们倾向于选择提供质押奖励而无需承担相关持有风险的替代机制:

EigenLayer工作原理

EigenLayer 为以太坊引入了一种新颖的框架,使 ETH 质押者能够通过一种称为重新抵押的机制为多个区块链模块的安全做出贡献。此过程聚合了各种模块(包括共识协议和数据层)的安全性,而不会破坏以太坊网络固有的信任。此外,它还允许质押者从他们选择保护的模块中赚取费用,从而为质押者开辟新的收入来源。该平台作为创新中心,允许测试和集成新的区块链技术,同时依赖以太坊验证者已建立的信任。

这些软件模块也称为主动验证服务(AVS),是需要自己的分布式验证语义进行验证的系统,例如侧链、数据可用性层、新虚拟机、守护者网络、预言机网络、网桥、阈值密码方案、和可信的执行环境。当前基于 EigenLayer 构建的一些 AVS 包括 EigenDA、Espresso、Witness Chain、Omni 和 Lagrange。

该平台旨在通过允许更广泛和更有效地利用质押资产来解决传统区块链验证模型的局限性。它为引导新的基于链的服务的挑战提供了解决方案,降低了建立新信任网络的复杂性和成本。通过创建更加互联和灵活的安全基础设施,EigenLayer 旨在培育一个无需许可的创新新时代,开发人员可以利用以太坊的集合安全性来启动和扩展新的应用程序和服务。

经济影响

除了提高安全性之外,EigenLayer 还为质押者引入了一种新颖的经济模型。通过参与验证额外的 AVS,质押者可以解锁新的收入来源,从而增强其所持资产的价值主张。此外,EigenLayer 充当新兴技术的测试网络,允许对传入的新颖概念(例如 Danksharding 和提议者/构建者分离)进行真正的验证。这是加速以太坊创新的关键点。此外,通过使安全资源的访问民主化,它降低了新项目的障碍,从而促成了之前因建立信任网络的挑战而受到限制的创新浪潮,而建立信任网络需要数十亿美元的集合安全。

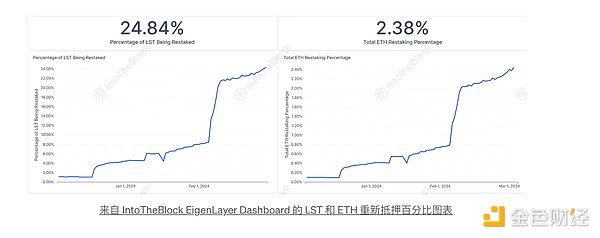

目前,所有流动性质押代币的 24.84% 已重新质押到 EigenLayer 上。这一重要比例(近四分之一的流动质押代币供应量)强调了以太坊中质押者向更具参与性角色的转变。此外,用于重新质押的以太坊总量份额继续稳步增长,目前占 ETH 总供应量的 2.38%:

以太坊LRT的兴起

Liquid Restake 代币(LRT)正在成为 Restake 生态系统的重要组成部分。LRT 协议充当聚合层,接受 ETH 或 Liquid Stake 代币(LST),将它们存入与 Eigenlayer 集成的服务中,并发行代表存入资金的“收据代币”。然后,该代币可以在 DeFi 领域使用,提高资本效率,并在降低风险时提供一层保护。

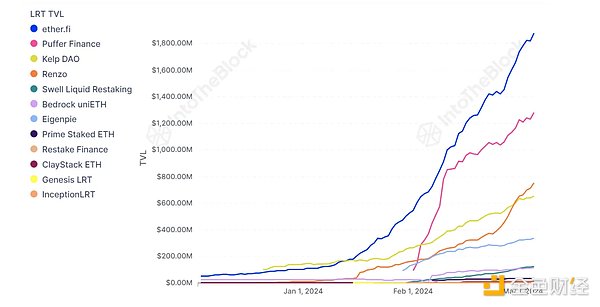

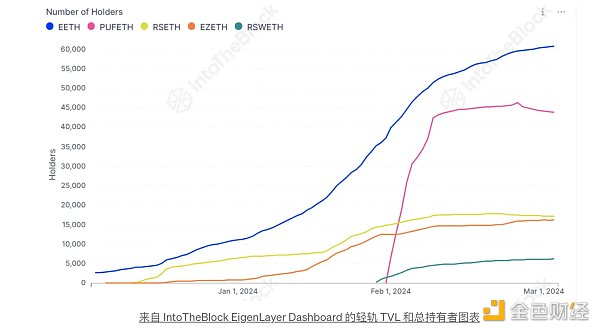

事实证明,对这些代币的需求非常高。在 10 多个轻轨协议中存入了超过 50 亿美元。如今,LRT 的持有者超过 100,000 个,仅计算那些持有大量(非灰尘)这些代币的地址:

Ether.fi 及其 eETH 代币作为 LRT 协议领域的先驱,TVL 超过 1.8B 美元。紧随其后的是来自 Puffer Finance 的 pufETH,该公司拥有超过 45,000 名持有者:

总体而言,EigenLayer 是一个变革性项目,它重新构想了如何在以太坊生态系统中实现安全性和验证。通过允许 ETH 质押者重新质押和验证各种 AVS,不仅增强了生态系统的安全性,而且在促进创新的同时开辟了新的经济机会。此外,轻轨的兴起凸显了对提高资本效率、降低风险的机制的需求不断增长,进一步说明了 EigenLayer 启动的生态系统。随着以太坊继续巩固其作为领先区块链的地位,EigenLayer 的作用是通过安全扩展和经济创新来塑造其未来。

The author's researcher translated Shanouba Bitcoin trading network. With the emergence, the Ethereum ecosystem is facing a major evolution. This innovative framework was developed by the team to improve the security and practicality of the entire Ethereum network. Using smart contracts, the pledge can expand their participation by verifying various new software modules. This development not only strengthens the security infrastructure of the network, but also paves the way for new value creation options and innovative solutions. Historically, blockchain has been Trying to cope with the challenge of decentralized trust, although the programmable efforts of Ethereum have opened a new era of modular development, it has led to a decentralized security model across various applications and services, trying to unify this point and providing a security umbrella for various modules from the data layer to the Oracle network. Its mission is to transform into a decentralized trust market and rapidly accumulate demand so far. One of the best indicators is the total locked value it has achieved in re-pledge, which has been the total price since the opening of deposits in January. The milestone that the value has exceeded US$ 100 million shows the unprecedented demand of the Ethereum community to ensure and enhance the network infrastructure. The demand of this platform reached an extraordinary peak on January, and the amount of deposits in a single day exceeded US$ 100 million. This extraordinary influx showed the desire of community participation. Through the inspection of the composition, it can be clearly seen that the deposits are mainly composed of and composed of both, which is the first choice for those who pledge directly from the verifier. This observation shows that Taifang holders have a strong demand to participate in re-mortgage activities. In addition, it may indicate that many holders are cautious about directly holding liquid pledge tokens, indicating that people tend to choose an alternative mechanism to provide pledge rewards without taking related holding risks. The working principle introduces a novel framework for Taifang, enabling the pledger to contribute to the security of multiple blockchain modules through a mechanism called re-mortgage. This process aggregates various modules, including consensus agreements and numbers. According to the security of the layer, it will not destroy the inherent trust of the Ethereum network. In addition, it also allows the pledgee to earn fees from the modules they choose to protect, thus opening up a new source of income for the pledgee. As an innovation center, the platform allows the testing and integration of new blockchain technologies and relies on the trust established by the Ethereum verifier. These software modules are also called active verification services, which are systems that need their own distributed verification semantics to verify, such as the side chain data availability layer, the new virtual machine guardian network. Network Oracle Network Bridge Threshold Cryptography Scheme and Trusted Execution Environment are currently based on some constructions. The platform aims to solve the limitations of the traditional blockchain verification model by allowing wider and more effective use of pledged assets. It provides a solution to the challenge of guiding new chain-based services, reduces the complexity and cost of establishing a new trust network, and aims to cultivate an innovative new era without permission by creating a more interconnected and flexible security infrastructure. In order to use the collective security of Ethereum to start and expand new applications and services, the economic impact not only improves the security, but also introduces a novel economic model for the pledgee. By participating in the verification, additional pledgees can unlock new sources of income, thus enhancing the value proposition of the assets they hold. In addition, it acts as a test network for emerging technologies, allowing real verification of incoming novel concepts, such as separation from proponents and builders, which is the key point to accelerate the innovation of Ethereum. In addition, through Democratize the access to security resources, which reduces the obstacles of new projects, thus contributing to the wave of innovation that was previously limited by the challenge of building a trust network. Building a trust network requires billions of dollars of collective security. At present, all liquid pledged tokens have been re-pledged to the top, which is an important proportion. Nearly a quarter of the supply of liquid pledged tokens emphasizes the change of the pledge in the Ethereum to a more participatory role. In addition, the total share of the Ethereum used for re-pledge continues to grow steadily. The rise of Ethereum, which used to account for the total supply, tokens are becoming an important part of the ecosystem. Agreements act as an aggregation layer to accept or deposit them in integrated services and issue receipt tokens representing the deposited funds. Then the tokens can be used in the field to improve capital efficiency and provide a layer of protection while reducing risks. It turns out that the demand for these tokens is very high. More than 100 million dollars have been deposited in several light rail agreements. Today, only those who hold a large amount of non-dust are counted. The addresses of these tokens and their tokens, as pioneers in the field of agreements, surpassed the US dollar, followed by the company, which has more than 100 holders. Generally speaking, it is a revolutionary project. It re-conceives how to realize security and verification in the Ethereum ecosystem. By allowing the pledger to re-pledge and verify all kinds of things, it not only enhances the security of the ecosystem, but also opens up new economic opportunities while promoting innovation. In addition, the rise of light rail highlights the importance of improving capital efficiency and reducing risks. The increasing demand for the mechanism further shows that the startup ecosystem, as Ethereum continues to consolidate its position as a leading blockchain, plays a role in shaping its future through security expansion and economic innovation. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。