减半会推动比特币价格上涨吗?

作者:Christopher Bendiksen,CoinShares 比特币研究主管 翻译:善欧巴,比特币买卖交易网

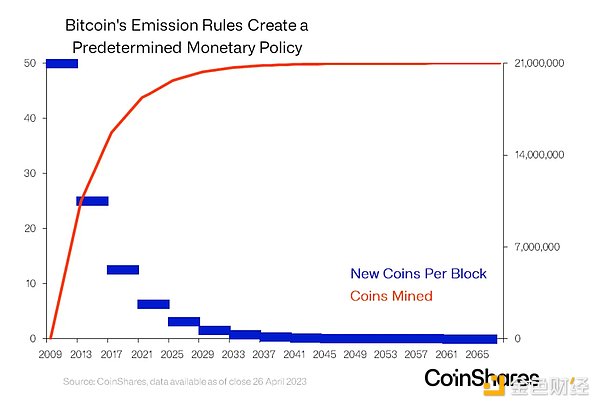

另一次减半即将到来。此时,大多数人都知道发生了什么——比特币持续的货币通胀率降低了一半。大约在接下来的 4 年里,这一比例将保持在新的水平,即 0.9% 左右,届时将再次减少一半。

我们之前已经详细介绍了减半的技术方面,所以这次我们不会深入讨论,但最终效果如下所示。完全可预测的货币通胀,随着时间的推移趋向于零,导致比特币的供应上限略低于 2100 万个比特币,并在 2140 年左右的某个时间达到。

我们还在上一次减半期间和之后以及多年来广泛讨论了该主题的非技术方面,但按照传统,对于所有新人,我们将对答案进行习惯性更新我们看到的一些最常见的问题:

减半对价格有影响吗?

减半是否已计入价格?

矿工将受到怎样的影响?

根本没有足够的时间在一篇文章中详细介绍所有这些内容,因此我们将极其简洁地回答后两个问题(为那些想要更深入的人建议一些来源)并重点关注第一个问题 -无论如何,这是最有趣的问题。

那么减半已经被定价了吗?不,也不可能。为了对有效市场假说进行彻底和必要的批判,我们引导感兴趣的读者阅读艾伦·法林顿和萨沙·迈耶斯所著的博学多才的《比特币是威尼斯》的第二章。至于矿工们,他们会没事的!

减半确实影响价格

但它可能不会以看起来最明显的方式产生影响——至少不会立即产生影响。我们的观点是,减半以两种方式影响价格,一种是缓慢且持续的,另一种是直接且暂时的:

这是“显而易见”的方式——它将持续供应率降低一半,从而减轻矿商的结构性抛售压力。只是这种效果并不是立竿见影的,而是随着时间的推移才会产生影响

但更直接的事实是,每次减半实际上都是一次巨大的营销活动。这让人们立即重新关注比特币(你不知道吗,这次它也没有死),为市场注入了肾上腺素,但此后很快就消退了

让我们更详细地看看它们。

减半带来的供应冲击

减半的“明显”影响是其对供应冲击的影响。一夜之间,供应量减少了一半,比特币的货币通胀率降低了 50%。然而,这在短期内并没有人们想象的那么有影响力。随着时间的推移,它的魔力大多会发挥作用。

作为一个思想实验,让我们考虑一下比特币发行量相对于当前来自美国的 ETF 流量的规模。按当前价格计算,ETF 每天消耗约 9,000 比特币。采矿网络每天生产约 900 个硬币。这意味着,即使矿工卖掉他们每天开采的所有代币,ETF 流量仍将消耗该数量的 10 倍。

减半后将是 20 倍。好吧,这是双倍的,但这不会改变这样一个事实,即ETF 获得这么多代币的唯一方法是通过向上重新定价,导致现有持有者将休眠代币添加回市场。

但这并不意味着没有效果。让我们想象一下价格比这里高 10 倍。在这样的水平上,相同的 ETF 流量每天只会消耗 900 个代币,完全平衡了持续的供应(假设市场上没有其他买卖)。在这个价格水平上,减半的影响会立即更大。

从长远来看,在流量恒定的情况下,减半实际上可以使价格水平维持在越来越高的水平,或者如果流量以与发行相同的速度下降,则价格水平可以维持在类似的水平。这绝对是一个重要的影响,但在短期内,它完全被猜测所淹没,寻找任何立竿见影的影响是毫无意义的。

减半作为营销活动

这是立即感受到效果的地方。每次减半临近,媒体都会以不朽的魅力来报道,在传统媒体上重新审视比特币。在这一点上,那些在上一次牛市中第一次听说比特币、但认为它已经死了的人会发现它实际上很好,而且往往表现比他们想象的要好得多。这一次的情况确实如此,价格已经逼近历史高点,甚至在减半之前就已经接近了。

即使报道在技术上并不总是准确的(请参见上面的屏幕截图作为示例),我们认为这种新的媒体关注是重新点燃周期性投机狂热的关键触发点之一,这种狂热往往会在大约每年一次的时候袭击比特币。 4年。此时,势头成为驱动力,经典的牛市上涨开始。每次的结果似乎都是一样的:价格在某个时刻呈抛物线走势,超前,随后出现残酷的调整。

我们不建议尝试对这些周期进行计时。我们认为,比特币是关于市场的时间而不是市场的时机。基本的投资案例很明确,一点点比特币就能大有帮助。

At this time, most people know what has happened. The continuous currency inflation rate of Bitcoin has been reduced by half, which will remain at a new level in the next year or so, and will be reduced by half again. We have introduced the technical aspects of halving in detail before, so we will not discuss it in depth this time, but the final effect is as follows: the completely predictable currency inflation will trend over time. Going to zero leads to the upper limit of bitcoin supply being slightly lower than 10,000 bitcoins and reaching it at some time around 2008. We have also discussed the non-technical aspects of this topic extensively during and after the last halving and for many years, but traditionally, we will update the answers for all newcomers. Some of the most common questions we see are halved. Does it affect the price? Is it included in the price? How will miners be affected? There is not enough time to introduce them in detail in an article. With these contents, we will answer the latter two questions very concisely, suggest some sources for those who want to go deeper, and focus on the first question. Anyway, this is the most interesting question. So, has the halving been priced? Isn't it impossible to make a thorough and necessary criticism of the efficient market hypothesis? We will guide interested readers to read the learned bitcoin written by Alan Farrington and Sasha meyers, which is the second chapter of Venice. As for the miners, they will be fine. It actually affects the price, but it may not affect the price in the most obvious way, at least not immediately. Our view is that halving the price will affect the price in two ways, one is slow and continuous, and the other is direct and temporary. This is an obvious way, and it will reduce the continuous supply rate by half, thus reducing the structural selling pressure of miners. It is only that this effect is not immediate, but it will affect over time, but the more direct fact is that halving is actually every time. A huge marketing campaign, which made people immediately pay attention to Bitcoin again, didn't you know that it didn't die this time? It injected adrenaline into the market, but it soon subsided. Let's look at the supply shock caused by halving them in more detail. The obvious impact of halving them is that the supply has decreased by half overnight, and the currency inflation rate of Bitcoin has decreased. However, this is not as influential as people think in the short term. Over time, most of its magic will play its role. Function as a thought experiment, let's consider the scale of bitcoin circulation relative to the current traffic from the United States. According to the current price, the bitcoin mining network produces about one coin every day, which means that even if miners sell all the tokens they mine every day, the traffic will still consume twice as much. Well, it will be twice as much after halving, but this will not change the fact that the only way to get so many tokens is to lead to the existing holders through upward repricing. Adding dormant tokens back to the market does not mean that it has no effect. Let's imagine that the price is several times higher than here. At this level, the same traffic will only consume one token every day, which completely balances the continuous supply. Assuming that there is no other business in the market, the impact of halving this price level will be even greater immediately. In the long run, halving the traffic can actually maintain the price level at a higher and higher level, or if the traffic drops at the same rate as the issuance, the price will be reduced. The level can be maintained at a similar level, which is definitely an important influence, but in the short term, it is completely overwhelmed by speculation. It is meaningless to look for any immediate impact. As a marketing activity, this is where the effect is immediately felt. Every time it is halved, the media will report it with immortal charm in the traditional media. At this point, those who heard about Bitcoin for the first time in the last bull market but thought it was dead will find that it is actually very good and often. The performance is much better than they expected. This time, the situation is indeed true. The price has approached an all-time high, even before it was halved. Even though the report is not always technically accurate, please see the screenshot above as an example. We think this new media attention is one of the key trigger points to rekindle the cyclical speculative fanaticism, which often attacks the Bitcoin year about once a year. At this time, the momentum becomes the driving force, and the classic bull market rises and starts every knot. If everything seems to be the same, the price will lead in a parabolic trend at a certain moment, and then there will be a cruel adjustment. We don't recommend trying to time these cycles. We think bitcoin is about the time of the market, not the timing of the market. The basic investment case is very clear, and a little bitcoin can help a lot. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。