买卖虚拟货币要交税了?——上海市税务局发文解读

引言:

2024年1月3日,国家税务总局上海市税务局在公众号发文《个人所得税经营所得和分类所得常见误区》,其中指出:

于是币圈又炸了,不少朋友来问,邵律师,虚拟货币交税是不是意味着虚拟货币以后在我国交易合法了?国家是不是认可虚拟货币了?那税务局会查我之前的账吗?我要补缴多少税款?

甚至还看到了这种让人笑掉大牙误导公众的营销文。

所以邵律师觉得还是有必要帮助大家分析一下,上海税务这篇文里到底说了个啥?

1.买卖虚拟货币,需要缴纳个人所得税?

1、让币圈朋友激动不已的上海税务发布的原文如下:

误区三:个人通过网络买卖虚拟货币不需要缴纳个人所得税。

正解。需要缴纳个人所得税。

《关于个人通过网络买卖虚拟货币取得收入征收个人所得税问题的批复》(国税函〔2008〕818号)规定:个人通过网络收购玩家的虚拟货币,加价后向他人出售取得的收入,属于个人所得税应税所得,应按照“财产转让所得”项目计算缴纳个人所得税。

2、邵律师解读

首先,时间上,原文中一问一答所对应的法律依据是2008年9月28日生效的《国家税务总局关于个人通过网络买卖虚拟货币取得收入征收个人所得税问题的批复》,比特币是什么时候有的?——2008年11月1日由中本聪提出,2009年1月3日诞生。

从时间维度上看,很显然,草拟该规定的人当时不会知道比特币,泰达币这些新鲜的概念。

其次,内容上,“个人通过网络收购玩家的虚拟货币”,很显然,这里指的是游戏平台中玩家的游戏币,游戏币也是“虚拟货币”,币圈朋友忘了吗?

所以,该批复的意思是说,买卖游戏币所得收入属于个税中的“财产转让所得”,是要征税的。和大饼没啥关系。

税务局肯定在想,你们币圈是想干嘛,碰瓷是吗?如果你们真的这么想的话,倒也不是不可以考虑……?

2.距离大饼征税,还有多远?

虽说本次是闹了个大乌龙,但邵律师认为,此后国家对加密货币(为和游戏虚拟货币做区分,以下均表述为加密货币)征税是迟早的事儿。主要理由为以下几点:

1、对加密货币征税,有依据么?

自2013年至今,我国相关部门针对加密货币有一系列的发文。其中,根据2013年12月的五部委通知,比特币被定性为一种虚拟商品,不能作为货币在市场上流通使用。根据2017年94公告,未禁止个人之间进行加密货币的交易。此后的发文中,也从未否定过这两条观点。

根据《个人所得税法》第二条,以下下列各项个人所得,应当缴纳个人所得税:“(八)财产转让所得”。个人之间进行加密货币的交易,例如U商低买高卖赚差价,或者是普通的炒币者,所获得的差价收益,可不就是个税法当中的财产转让所得么。

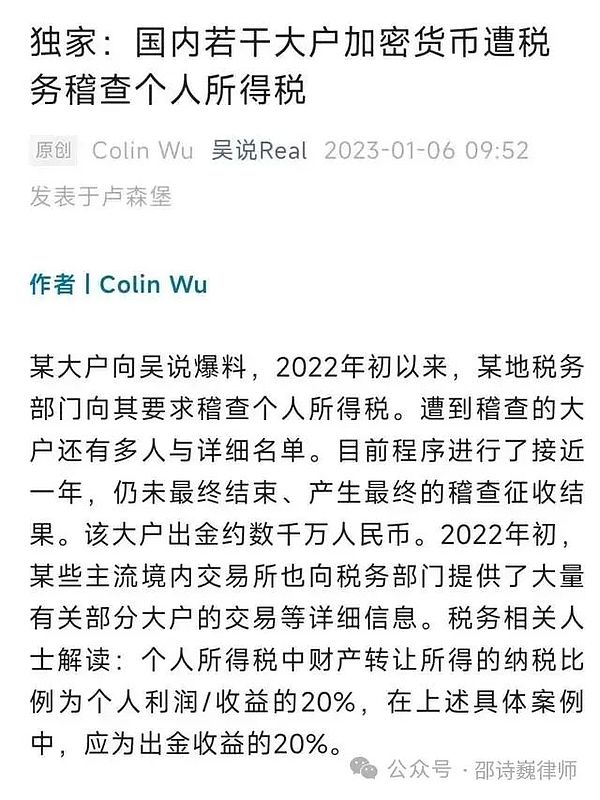

而且据一些小道消息称,国内某些大户已经被税务部分要求稽查个人所得税。

2、对于我国而言,如果要征税,有哪些利弊?

国家在出台相关的政策规定之前,必然会全面充分的考量这一决定的利弊。那么对于我国来说,加密货币征税有哪些好处和坏处?——这决定了将来会不会在国内实施加密货币征税。

邵律师暂且提出几点粗浅的看法:

A 征税的好处:

当然是国家的钱更多啦,税收是国家收入的重要来源,国家有了更多的钱,就可以利用税收政策,调节经济结构,增强国家宏观调控力度。另外,征税也能够有效填补一些高收入人群利用虚拟货币逃税的漏洞。

B 征税的坏处:

结合目前的政策来看,税务部门还真不能“轻举妄动”,根据我国既往政策,打击ICO,整治挖矿,将虚拟货币相关业务活动定性为非法金融活动等等,若税务部分突然来了个对加密货币征税,那岂不是各政府部门之间互相打脸了么,岂不乱套?

征税,社会公众们朴素的理解就是,国家承认加密货币合法。那会不会演变成了公众认为国家鼓励交易加密货币,引发全民炒币等蝴蝶效应,那到时候可能真的会影响到人民币在我国的法币地位(即使到时候再怎么主张加密货币不是货币,仅是商品)。炒币也会让外汇对敲(以加密货币为工具非法买卖外汇,可参考邵律师此前的文章《介绍换汇,判刑8年(上)》《介绍换汇,判刑8年(下)》)、利用虚拟货币转移资产等不法行为更猖獗。——为了收税,会不会捡了芝麻,丢了西瓜?这些必然是立法者会考虑的问题。

C 征税会面临的挑战:

虽说加密货币在2008年就有了,但至今对大多数人来说,仍然是新兴事物。目前来看,想要对加密货币征税,技术难度很高。加密算法,智能合约,分布式账本,这些概念连警察叔叔在办理刑事案件时都头大,想要做一个加密货币版的“金税四期”?目前显然并不具备相应条件。

3、其他国家对加密货币的认识如何?

棘手的问题,不妨看看其他人是怎么处理的。要不要征税,也可以参考一下别国的做法。

早在2014年,美国国税局发布的 2014-21 号通知中,就明确了加密货币的征税方式。2017年4月,日本政府修订了《资金结算法》,承认比特币是一种合法的支付方式,并为交易所制定了一系列标准和规则。2021年2月22日,据韩国企划财政部介绍,韩国政府将从明年开始对1年内超过250万韩元的加密货币等虚拟资产所得按照20%的税率征税(但似乎至今未落地)。

总而言之,加密货币的价值已被很多主流国家所认可,只是定性上有不同区分,例如,被定位为商品、数字资产,有经济价值的电子凭证,货币支付方式,证券等等。征税问题,部分国家也已制定相关方案。

写在最后:

加密货币会不会征税,邵律师认为:在不确定的将来某个时间,会。但收多少,怎么收,可能要解决一系列的复杂问题之后,在各部门协调的基础之上,税务部门才会出台真正能够落地的方针政策。

Introduction State Taxation Administration of The People's Republic of China Shanghai Taxation Bureau issued a document in WeChat official account on January, which pointed out that the currency circle had been bombed again, and many friends came to ask Shao if the virtual currency was legally traded in China in the future, and whether the state recognized the virtual currency. Will the tax bureau check my previous accounts? How much tax should I pay? I even saw this kind of marketing picture that made people laugh and misled the public, so Shao felt that it was still necessary. It is necessary to help you analyze what is said in the article "Shanghai Taxation". The original text published by Shanghai Taxation, which makes friends in the currency circle excited by personal income tax, is as follows: Three people buy and sell virtual currency through the Internet without paying personal income tax. The official reply on the issue of collecting personal income tax on the income of individuals buying and selling virtual currency through the Internet stipulates that individuals buy players' virtual currency through the Internet to increase the price. The income obtained after selling to others belongs to personal income tax. Taxable income should be calculated and paid according to the items obtained from property transfer. Lawyer Shao interprets the first time. The legal basis corresponding to the question and answer in the original article is State Taxation Administration of The People's Republic of China's reply on the issue of collecting personal income tax on individuals' income from buying and selling virtual currency through the Internet, which took effect on, when was Bitcoin proposed by Satoshi Nakamoto on, and the date was born on, and from the time dimension, it is obvious that the person who drafted the regulation was born. At that time, I didn't know these new concepts of Bitcoin Teda Coin. Secondly, in terms of content, individuals bought players' virtual currency through the Internet. Obviously, this refers to the game currency of players in the game platform. The game currency is also a virtual currency, remember? So the reply means that the income from buying and selling game currency belongs to a tax, and the income from property transfer has nothing to do with pie. The tax bureau must be wondering what your currency circle is trying to do, right? If you really think so, it's not. You can't consider how far it is from the pie tax. Although this time it was a big oolong, Shao believes that it is a matter of time before the country distinguishes cryptocurrency from game virtual currency. The main reasons are as follows: Is there a basis for taxing cryptocurrency? Since 2000, relevant departments in China have issued a series of documents on cryptocurrency, in which five ministries and commissions informed that Bitcoin can not be classified as a virtual commodity and circulated in the market as currency. According to the announcement of 2000, the transaction of cryptocurrency between individuals has not been prohibited, and these two views have never been denied in subsequent articles. According to Article 2 of the Individual Income Tax Law, the following personal income should be subject to personal income tax. 8. The transaction of cryptocurrency between individuals, such as buying at a low price and selling at a high price, or the difference income obtained by ordinary speculators, is not just the income from property transfer in the tax law, and according to some gossip, some large domestic households have already What are the advantages and disadvantages for our country if we want to levy taxes? The country will definitely fully consider the advantages and disadvantages of this decision before introducing relevant policies and regulations. So for our country, what are the advantages and disadvantages of cryptocurrency taxation? This determines whether cryptocurrency taxation will be implemented in China in the future. Lawyer Shao put forward some superficial views for the time being. The benefits of taxation are of course that the country has more money, and taxation is an important source of national income. With more money, we can use tax policy to adjust the economic structure and strengthen the macro-control of the country. In addition, taxation can effectively fill the loopholes of some high-income people using virtual currency to evade taxes. Considering the current policy, the tax authorities really can't act rashly. According to China's previous policy, we will crack down on mining and characterize virtual currency-related business activities as illegal financial activities. If the tax department suddenly comes to tax cryptocurrency, wouldn't it be a slap in the face between various government departments? The simple understanding of the public is that the state recognizes that cryptocurrency is legal. Will it evolve into a butterfly effect that the public thinks that the state encourages the trading of cryptocurrency, which will trigger the speculation of the whole people? That may really affect the status of RMB as legal tender in China, even if it is argued that cryptocurrency is not just a commodity speculation, it will make foreign exchange confront each other and illegally buy and sell foreign exchange with cryptocurrency as a tool. Please refer to Shao's previous article to introduce the exchange sentence. Illegal acts such as using virtual currency to transfer assets in the next year are more rampant. Will you pick up sesame seeds and lose watermelon in order to collect taxes? These are bound to be issues that legislators will consider. The challenges that taxation will face. Although cryptocurrency has been around since, it is still a new thing for most people. At present, it is very difficult to tax cryptocurrency. Encryption algorithm, intelligent contract and distributed ledger are concepts that even police uncles want to be cryptocurrency when handling criminal cases. At present, the fourth edition of the Golden Tax obviously does not have the corresponding conditions. How difficult is the understanding of cryptocurrency in other countries? Let's take a look at how others deal with it. Whether to levy taxes or not can also refer to the practices of other countries. As early as 2000, the US Internal Revenue Service issued Notice No.1, which clarified the taxation method of cryptocurrency. In September, the Japanese government revised the fund settlement law, recognized Bitcoin as a legal payment method, and formulated a series of standards and rules for the exchange. According to the Ministry of Planning and Finance of South Korea. This paper introduces that the South Korean government will levy taxes on the income of virtual assets such as cryptocurrency exceeding 10,000 won in the year from next year, but it seems that it has not yet landed. In short, the value of cryptocurrency has been recognized by many mainstream countries, but there are qualitative differences, such as electronic certificate currency payment securities with economic value, etc. Some countries have also formulated relevant plans to write down whether cryptocurrency will be taxed at the end. Come to a certain time, but how much to collect may have to solve a series of complex problems, and then the tax department will issue policies that can really land on the basis of coordination among various departments. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。