比特币生态 VS以太坊生态:接下去的领头羊是谁?

最近一段时间以太坊上涨非常强势,继前几日突破3500U、创2022年5月以来新高之后,这两天又突破4000U,且从过去30天的涨幅来看,以太坊以62%的涨幅超过了比特币,确实在不少人的意料之外。

不过细数以太坊的生态发展情况,从不断增长的通缩数据、一路测试顺利即将上线主网的坎昆升级,到如今的质押和再质押ETH量一路高涨,以及接下来5月份的ETH现货ETF的通过预期,确实多重利好叠加,ETH价格一路高歌猛进也是情理之中的事情。

那么,接下来这些利好真的会一一兑现吗?目前以太坊的生态发展情况到底如何?来看数据说话。

以太坊通缩情况

过去532天比特币和以太坊通胀/通缩数据趋势图,来源:ultrasound.money

以太坊自2023年1月16日开始,正式进入通缩阶段,即每日新产生的ETH数量少于被燃烧的ETH数量。具体来说,目前ETH的年通缩比率为0.239%。

对比行业龙头比特币,年通胀比率是1.716%,虽然总量是有限的,但每天在持续不断地产出新的比特币。因此,当我们说“比特币总量有限、所以每一枚比特币都是非常珍贵”的时候,更能凸显目前通缩状态下ETH的价值。

随着以太坊生态的蓬勃发展,以太坊的燃烧总量持续增加,让以太坊的通缩比率增大,从而让市场上流通的以太坊越来越少。

再质押赛道迅猛发展

不仅仅是以太坊的通缩比率增大让流通的以太坊越来越少,随着以太坊上流动性质押、再质押赛道的发展,大量以太坊被锁定在链上,导致流通中的以太坊数量进一步急剧减少。

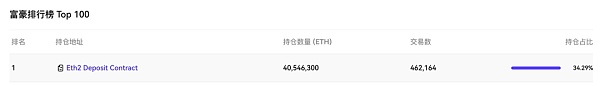

OKLink以太坊质押合约相关数据显示,目前以太坊的总质押量已经超过4000万枚,占以太坊流通市值的34%以上,验证者总数突破126万,虽然大多数验证者都是奔着以太坊的升值和质押收益率来的,但不管怎样,对于以太坊整个网络的安全性来说,都是很大的利好。

以太坊质押合约数量,数据来源:OKLink

而且,据Stakingrewards相关数据,作为质押金额遥遥领先的公链,以太坊在过去7天的质押流量一直是净流入的状态,和排名靠后几名的公链对比明显,现阶段以太坊质押对投资者的吸引力显而易见。

质押市值排名前五公链一览,数据来源:stakingrewards

当然,近期以太坊质押量的暴涨,离不开再质押(restaking)赛道的发展。

再质押最先是由Eigenlayer的创始人提出的,其核心是允许将已经质押在以太坊主链上面的ETH,再次质押在其他协议上面,让其他协议能共享到以太坊的安全性,从而降低其链自身的安全成本。参与再质押的投资者,不仅可以获得质押以太坊的收益,而且还有再质押的收益。

所以,再质押创造了一个三方共赢的结果:

对于使用再质押的协议来说,在享有与以太坊几乎同等级安全性的同时降低了安全成本,而且,吸引大量ETH持有者进入生态、参与其生态发展;

对于ETH质押者来说,不仅同时享有以太坊质押和再质押的收益,而且还有大量Airdrop预期;

另外,对于以太坊主链来说,再质押机制让其自身的资产拥有更多赋能场景,且刺激持有者锁定ETH带来更大的升值空间。

因此,以Eigenlayer为龙头的再质押赛道在这几个月中迅猛发展,而且,也吸引越来越多的机构资本入局。以Eigenlayer为例,从2022年5月到现在不到两年时间,已经完成了四轮融资,最近一期融资由a16z注入,单笔融资达到1亿美元,目前四轮累计融资达到1.6亿美元以上,作为一个新兴赛道,再质押确实已经迎来风口。

目前,Eigenlayer的总TVL已经超过110亿美元,在所有DeFi项目中TVL仅次于Lido和AAVE,排名第三。流动性再质押赛道的相关项目TVL都增长显著,7日增幅都在10%以上。

流动性再质押赛道相关项目TVL增幅情况,数据来源:defillama

再质押协议的迅猛发展以及生态Airdrop预期,刺激更多的ETH持有者参与到ETH的质押和再质押中,从ETH质押比例和再质押协议TVL的快速增长可见一斑。这些都让流通中的ETH数量进一步减少,给ETH带来新的上升空间。

坎昆升级

当然,坎昆升级对于以太坊来说,自然也是非常大的利好因素。

对以太坊主网来说,坎昆升级是一次重要的硬件升级,主要提升以太坊主网的可扩展性、安全性和可用性。

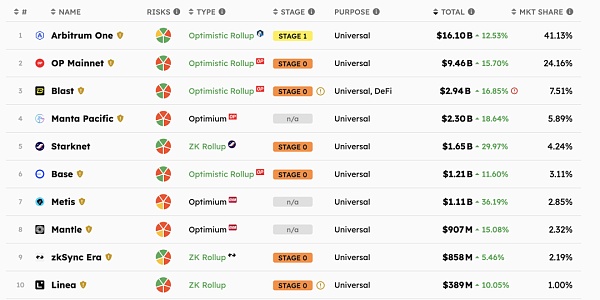

当然,对用户来说最大的感知是,以太坊在经过坎昆升级之后,其Layer2上面的费用会降低很多,在目前的基础上,降幅可能达到14倍以上,大致相当于Solana等公链的Gas费水准,而且也会大大提升Layer2的吞吐量。这点,主要是因为坎昆升级中的EIP-4844大大降低了Layer2协议中数据上ETH主链的成本,以及推动了以太坊分片计划的进程。

以太坊链上各Layer2项目TVL增长情况一览,数据来源:L2BEAT

除此之外,本次坎昆升级还有一个比较重要的升级是EIP-4788,优化了以太坊共识层和执行层之间信息的互通问题,这个改进非常利好流动性质押、再质押赛道以及跨链桥相关项目,提升了他们的安全性和运营效率。

因此,总的来说,坎昆升级不仅大大降低了Layer2的费率、提升吞吐量,利好以太坊上Layer2的发展,方便吸纳大量新的资金进入Layer2参与生态建设,而且,对于流动性质押、再质押赛道也是一大利好,坎昆升级的成功,将带来以太坊生态的再次突破。

目前,坎昆升级已经在以太坊的所有测试网(包括Georli、Sepolia和Holesky)上成功部署,计划于今年3月13日上线主网,上线日期近在咫尺,以太坊及生态相关项目的价格也一定程度上反应了坎昆升级的预期。

以太坊现货ETF通过的概率

自SEC在今年1月10日批准了10支比特币现货ETF之后,人们开始把目光转向以太坊现货ETF。

毕竟,比特币现货ETF的通过,对比特币以及比特币生态来说都是极大的利好,短期内比特币的涨幅就是最好的证明。

但是,以太坊ETF会如期通过吗?

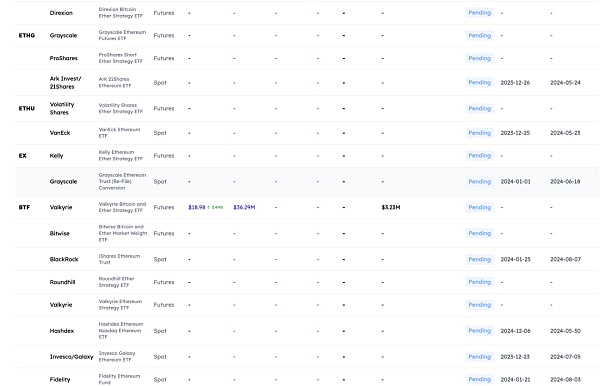

目前,已经有包括贝莱德(BlackRock)、Hashdex、ARK 21Shares、VanEck等在内的7家机构申请了以太坊现货ETF,在SEC数次推迟批准之后,最晚将于今年5月份决定是否批准相关机构的以太坊现货ETF申请(见下图)。

以太坊现货/期货 ETF申请情况跟踪图表,来源:blockworks

当然,以太坊现货ETF是否通过的关键在于SEC将以太坊认定为商品还是证券。目前的分歧在于,以太坊的整个机制和比特币有很大的不同,以太坊没有固定的总量,而且以太坊的持有者可以将其质押以换取收益。

这点,让不少人认为以太坊有被认定为证券的风险。

但是,在去年6月份SEC起诉Ripple的案件中,SEC列出了67种属于证券的Token,其中并没有ETH。而且,SEC曾起诉多家CEX,因为他们上线了一些SEC认定为证券的Token,ETH也并未包含其中。也就是说,SEC目前并没有公开、明确地指出ETH为证券。

更重要的是,去年美国证券监管机构已经批准了以太坊期货ETF,这种批准暗示了ETH是商品而不是证券,因此ETH现货ETF的批准,很可能是迟早的事情。

未来ETH现货ETF的通过,想必会如比特币现货ETF一样,给以太坊及以太坊生态带来大量资金和资源,打开整个生态的发展格局和天花板。

小结

如果说去年是比特币及比特币生态占据整个加密行业舞台聚光灯的一年,那么,2024年的以太坊生态,在坎昆升级、现货ETF预期及持续通缩、质押数飙升的多重利好下,必定也会写下浓墨重彩的一笔。

这轮牛市冲锋陷阵的主角是比特币生态的铭文及基建,还是以太坊生态的质押、再质押赛道?我们拭目以待。

Recently, the rise of Ethereum has been very strong, and it has broken through in the past two days after it broke through the new high since January. Judging from the increase in the past day, the increase of Ethereum has surpassed Bitcoin, which is indeed unexpected by many people. However, counting the ecological development of Ethereum, it has been successfully tested from the ever-increasing deflation data, and Cancun, which is about to go online, has been upgraded to the current pledge and re-pledge, and the passing of the spot in the next month is expected to have multiple positive superimposed prices. It is also reasonable to make great strides all the way, so will these benefits really be fulfilled one by one? How do you look at the current ecological development of Ethereum? The data talks about the deflation of Ethereum. The trend chart of inflation and deflation data of Bitcoin and Ethereum in the past days comes from Ethereum, which has officially entered the deflation stage since March, that is, the number of new products generated every day is less than the number burned. Specifically, the current annual deflation rate is the comparison, although the total amount is limited. Yes, but new bitcoins are constantly produced every day. Therefore, when we say that the total amount of bitcoins is limited, every bitcoin is very precious, it can highlight the value in the current deflation state. With the vigorous development of the ecology of Ethereum, the total amount of burning of Ethereum continues to increase, which makes the deflation rate of Ethereum increase, thus making fewer and fewer Ethereum circulating in the market. The rapid development of the track is not only the increase of deflation rate of Ethereum, but also the decrease of Ethereum circulating. The development of the track of liquid pledge and re-pledge leads to a sharp decrease in the number of ethereum in circulation, and the relevant data of ethereum pledge contract show that the total pledge amount of ethereum has exceeded 10,000, and the total number of verifiers accounting for the circulation market value of ethereum has exceeded 10,000. Although most verifiers come for the appreciation and pledge yield of ethereum, it is a great benefit to the security of the whole network of ethereum anyway. The source of quantity data and according to relevant data, the pledge flow of the public chain Ethereum, which is far ahead as the pledge amount, has been in a state of net inflow in the past few days. Compared with the public chains ranked in the lower position, it is obvious that the attraction of the pledge of Ethereum to investors at this stage is obvious, and the pledge market value ranks among the top five public chains. The source of data, of course, the recent surge in the pledge amount of Ethereum cannot be separated from the development of the re-pledge track. The core of re-pledge was first put forward by the founder of Ethereum. Re-pledge above the chain allows other protocols to share the security of Ethereum, thus reducing the security cost of the chain itself. Investors who participate in re-pledge can not only get the benefits of pledge Ethereum, but also the benefits of re-pledge, so re-pledge creates a win-win result for all three parties. For the protocols that use re-pledge, they enjoy almost the same level of security as Ethereum, reduce the security cost and attract a large number of holders to enter the ecology and participate in its ecological development. For the pledgee, it not only enjoys the benefits of pledge and re-pledge of Ethereum at the same time, but also has a lot of expectations. In addition, for the main chain of Ethereum, the re-pledge mechanism allows its own assets to have more empowerment scenarios and stimulates the lock-in of holders to bring more appreciation space. Therefore, it is thought that the re-pledge track of the leading company has developed rapidly in these months and attracted more and more institutional capital. For example, four rounds of financing have been completed in less than two years from January to now. At present, the accumulated financing in four rounds has reached more than 100 million dollars. As a new track, the re-pledge has indeed ushered in the wind. At present, the total has exceeded 100 million dollars. Among all the projects, the related projects of the liquidity re-pledge track are growing significantly. The increase of the above-mentioned liquidity re-pledge track related projects is attributed to the rapid development of data sources, re-pledge agreements and ecological expectations, which stimulate more holders to participate in the pledge and re-pledge. The rapid growth of mortgage ratio and re-pledge agreement can be seen, which further reduces the number in circulation and brings new room for growth. Of course, Cancun upgrade is also a very big positive factor for Ethereum. Cancun upgrade is an important hardware upgrade for Ethereum's main network, which mainly improves the scalability, security and availability of Ethereum's main network. Of course, the biggest perception for users is that after the upgrade of Ethereum in Cancun, its expenses will be greatly reduced. On the current basis, the decline may reach more than twice the fee level of equal public chain, and the throughput will be greatly improved. This is mainly because the Cancun upgrade greatly reduces the cost of the main link on the data in the agreement and promotes the process of the Ethereum fragmentation plan. In addition, there is a more important upgrade in Cancun, which is to optimize the information exchange between the consensus layer and the executive layer of Ethereum. This improvement is very good. Beneficial to the track of liquid pledge and re-pledge, as well as the projects related to the cross-chain bridge, have improved their safety and operational efficiency. Therefore, in general, the Cancun upgrade not only greatly reduced the rate and improved the throughput, but also facilitated the development of Ethereum, attracting a large number of new funds to participate in the ecological construction, and it is also a great benefit to the track of liquid pledge and re-pledge. The success of the Cancun upgrade will bring about another breakthrough in the ecology of Ethereum. At present, the Cancun upgrade has been successful in all test networks of Ethereum, including and. The deployment plan is to go online on April this year, and the online date of the main network is close at hand. The prices of Ethereum and eco-related projects also reflect the expected upgrade in Cancun to a certain extent. The probability of the spot passing of Ethereum has started to turn to the spot after the approval of a bitcoin spot on May this year. After all, the spot passing of bitcoin is of great benefit to bitcoin and bitcoin ecology, and the increase of bitcoin in the short term is the best proof. But will Ethereum pass as scheduled? After several organizations, including BlackRock, have applied for the spot of Ethereum. After several delays in approval, it will be decided whether to approve the spot application of Ethereum of the relevant organizations at the latest this year. See the following figure for the tracking chart of the spot futures application of Ethereum. Of course, the key to whether the spot of Ethereum will pass is whether it will be recognized as a commodity or a securities. At present, the difference is that the whole mechanism of Ethereum is very different from Bitcoin, and the holder of Ethereum can pledge it in exchange for income, which makes many people think that Ethereum is at risk of being recognized as securities, but last month. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。