底层区块链数据表明:当前仍处于加密牛市早期

摘要

在 ETF 资金流入的推动下,比特币飙升至新高。我们与之前的周期比较,看看这次从回撤中复苏来得有多「早」。而对底层区块链数据的观察表明,我们仍处于整个周期的早期阶段。

上周二,比特币时隔 28 个月再次站上 69,000 美元大关,从 2021 年 11 月上一个峰值开始的下跌中恢复过来,随后不断刷新历史纪录。这次从下跌中复苏并跌创新高,是在美国对现货 ETF 需求强劲的背景下实现的,这些 ETF 在不到 2 个月的交易中吸引了 89 亿美元的资金净流入。

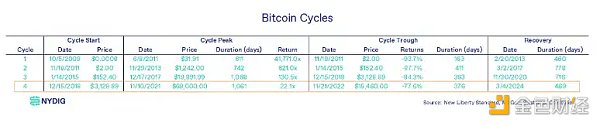

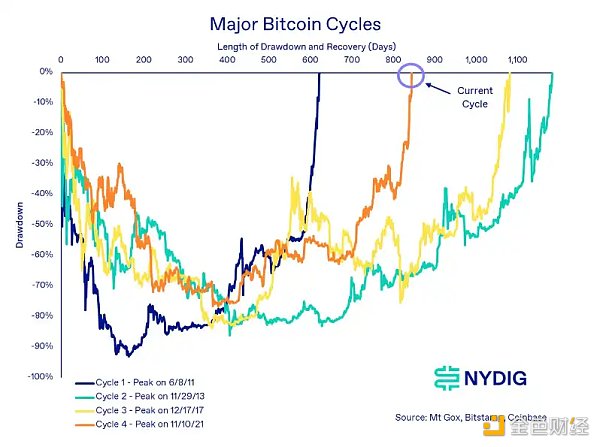

与之前的比特币周期相比,这次复苏比前两个周期要早得多。本次周期的复苏是在 2022 年 11 月 21 日(FTX 崩溃后)比特币价格触及 15,460 美元低谷的 469 天之后出现的,而前两个周期分别用了 778 天和 716 天才从价格谷底恢复。(WEEX 唯客注:第一个周期可以忽略不计,因为比特币在诞生一年多以后才有稳定的价格。)

换句话说,前两个周期与当前周期的触底时间大致相同,但当前周期的回升速度要快得多。考虑到目前该资产类别的规模约为 1.2 万亿美元,与 2013 年峰值时仅为 205 亿美元的复苏进程相比,这确实令人惊叹。

当我们庆祝历史新高时,我们希望深入研究底层区块链,了解它所揭示的网络及其使用情况,而暂不考虑价格的影响。虽然市场和交易活动通常是讨论的焦点,尤其是在创下新高的当下,但我们更要关注区块链数据所揭示的当前周期信息。

所有权

长期持有者尚未交出筹码

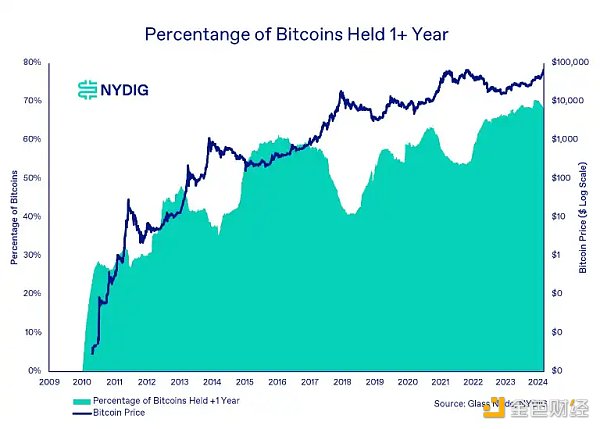

根据链上数据,长期持有者(根据比特币躺在区块链上一年以上未动的百分比来确定)并没有对他们的头寸进行重大调整。

从历史上看,一年未动的代币百分比往往与比特币的价格趋势相反。通常随着币价上涨,长期持有者会抛售他们手中的币。然而,这种预期行为尚未实现,表明长期持有者目前正在维持其头寸。

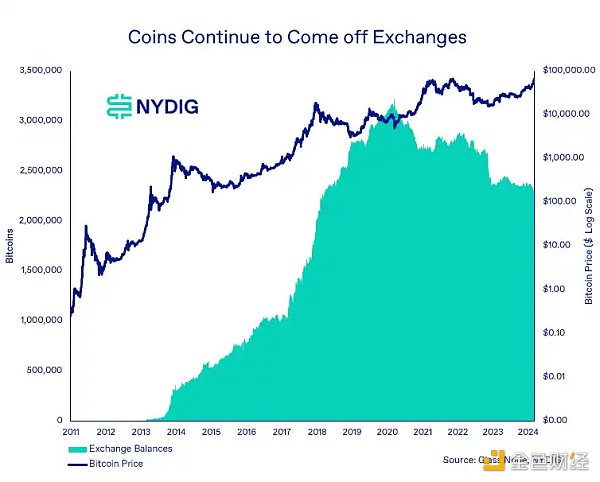

CEX 余额继续减少

余额离开 CEX 是上个周期的主要叙事之一,并且没有任何改变的迹象,投资者继续在交易所购买比特币,然后将其提取到托管服务商和自托管钱包。考虑到 2022 年灾难性的交易对手和平台风险,投资者存款持续流出交易所从长远来看是一件好事。

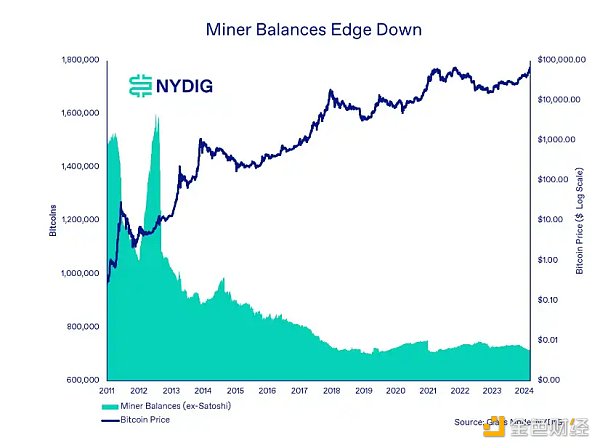

矿工持币余额略有下降

虽然趋势不像交易所余额那么明显,但矿工余额最近略有下降。这可能与价格上涨、资本需求或 4 月份减半之前的设备升级有关。

网络使用情况

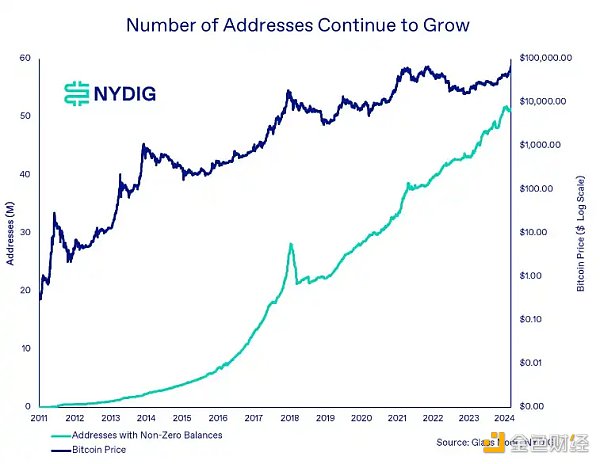

用户规模代表指标持续增长

作为网络规模的代表,最近,持有非零余额的地址数突破了 5,000 万个。该指标在过去 2 轮牛市顶峰时出现过高峰和修正,是梅特卡夫定律(Metcalfe』s Law)下网络规模和估值的重要指标。(WEEX 唯客注:梅特卡夫法则是一个用于描述网络价值与其用户数之间关系的指标。其基本观点是,网络价值与其用户数的平方成正比,因为网络中每增加一个用户,不仅这个用户自身会从网络中获得价值,他也会通过与其他用户的互动来增加整个网络的价值。)

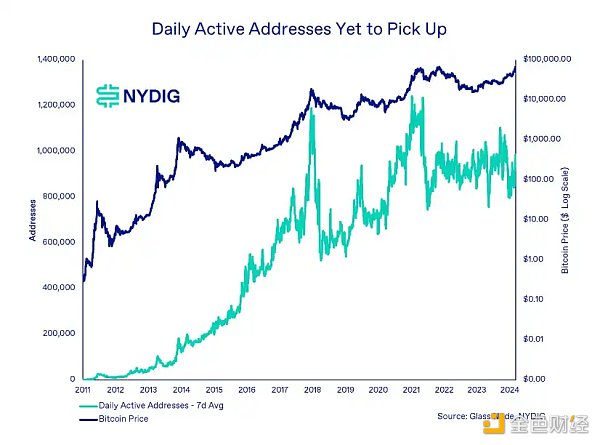

每日交互独立地址数未显著增长

每天在网络上交互的独立地址数尚未出现显著增长。这对于当下周期来说是一个积极迹象,因为在前两个牛市周期顶峰附近,该指标也达到了峰值。

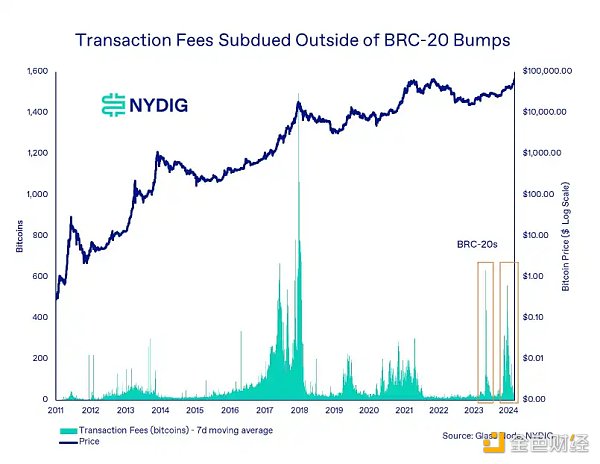

交易费用

从历史上看,交易费用表现出一定的周期性:在价格周期高点或附近达到峰值。虽然最近出现过两次交易费用上涨,但都与 BRC-20 有关。除此之外,我们还没有看到通常在周期性高点前后出现的周期性交易费用上涨。

结语

比特币在短短几个月内取得了长足进步。就在一年多以前,该行业还在努力应对 FTX、Genesis 和许多其他具有系统重要性的加密实体崩溃的影响。毫无疑问,ETF 在将比特币推向历史新高方面发挥了重要作用。

虽然这次反弹在很大程度上是由金融市场推动的,但对基础区块链数据的研究表明,尽管当前周期正在轰轰烈烈进行中,但市场可能还远未达到顶峰。

The author's global research director compiled the abstract of Weike Research Institute. Driven by the inflow of funds, Bitcoin soared to a new high. Let's compare it with the previous cycle to see how early the recovery came from the retracement. The observation of the underlying blockchain data shows that we are still in the early stage of the whole cycle. Last Tuesday, Bitcoin once again stood at the dollar mark and recovered from the decline that started from a peak in last year, and then constantly set a new record. This recovery from the decline and hit a new high in the United States. Under the background of strong spot demand, these transactions in less than a month attracted a net inflow of hundreds of millions of dollars. Compared with the previous bitcoin cycles, this recovery was much earlier than the previous two cycles. The recovery in this cycle appeared after the bitcoin price hit the bottom of the dollar after the collapse on January, and the first two cycles took days and days respectively to recover from the bottom of the price. The first cycle can be ignored because bitcoin did not have a stable price until more than a year after its birth. In other words, In other words, the bottom time of the first two cycles is roughly the same as that of the current cycle, but the recovery speed of the current cycle is much faster. Considering that the scale of this asset class is about one trillion US dollars at present, compared with the recovery process of only one hundred million US dollars at the peak of the year, this is really amazing. When we celebrate the historical high, we hope to deeply study the underlying blockchain and understand the network and its usage it reveals, regardless of the impact of price for the time being, although the market and trading activities are usually the focus of discussion, especially when hitting a new high. At present, but we should pay more attention to the current cycle information revealed by blockchain data. Long-term holders have not handed over their chips. According to the data on the chain, long-term holders have determined that they have not made major adjustments to their positions according to the percentage of bitcoin lying on the blockchain for more than one year. Historically, the percentage of tokens that have not been moved for one year is often contrary to the price trend of bitcoin. Usually, long-term holders will sell their coins as the price of coins rises, but this expected behavior has not yet been realized. It shows that long-term holders are currently maintaining their position balance, which continues to decrease. Leaving the balance is one of the main narratives of the last cycle, and there is no sign of any change. Investors continue to buy bitcoin on the exchange, and then withdraw it to the custody service provider and the self-custody wallet. Considering the disastrous counterparty and platform venture capitalists' deposits in 2000, it is a good thing that the miners' currency balance continues to flow out of the exchange in the long run. Although the trend is not as obvious as the exchange balance, the miners' balance is the highest. This may be related to the price increase, capital demand or equipment upgrade before the month is halved. As the representative of network scale, the number of addresses with non-zero balance has recently exceeded 10,000. This indicator has peaked and revised at the peak of the bull market in the past, which is an important indicator of network scale and valuation under Metcalfe's law. Metcalfe's law is an indicator used to describe the relationship between network value and its number of users. The point is that the value of the network is directly proportional to the square of the number of users, because every additional user in the network will not only gain value from the network, but also increase the value of the whole network through interaction with other users. The number of independent addresses interacting on the network every day has not increased significantly, which is a positive sign for the current cycle, because the index has also reached the peak transaction cost near the peak of the previous two bull markets. On the whole, transaction costs show a certain periodicity and peak at or near the high point of the price cycle. Although there have been two recent increases in transaction costs, they are all related. In addition, we have not seen the periodic increase in transaction costs that usually occurs around the high point. Conclusion Bitcoin has made great progress in just a few months. Just over a year ago, the industry was still trying to cope with the impact of the collapse of many other systemically important encryption entities, which undoubtedly pushed Bitcoin to the calendar. The historical high has played an important role. Although this rebound is largely driven by the financial market, the research on the basic blockchain data shows that although the current cycle is going on vigorously, the market may still be far from reaching its peak. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。