比特币正面临需求冲击:什么是需求冲击

作者:James Butterfill

在大宗商品领域,需求冲击是指由不可预见的事件引发的基本商品或原材料需求的突然和重大变化。积极的需求冲击源于需求增加,可能是由于技术创新、政策变化或消费者偏好的转变,推高了价格上涨。21 世纪初,中国经济繁荣,房地产开发加速,引发大宗商品需求冲击,导致钢铁价格在 2000 年至 2008 年间上涨了 793 %。金融危机后经济增长放缓,加上供应反应造成的大规模增产,导致钢铁价格在接下来的十年中下跌了 80%。

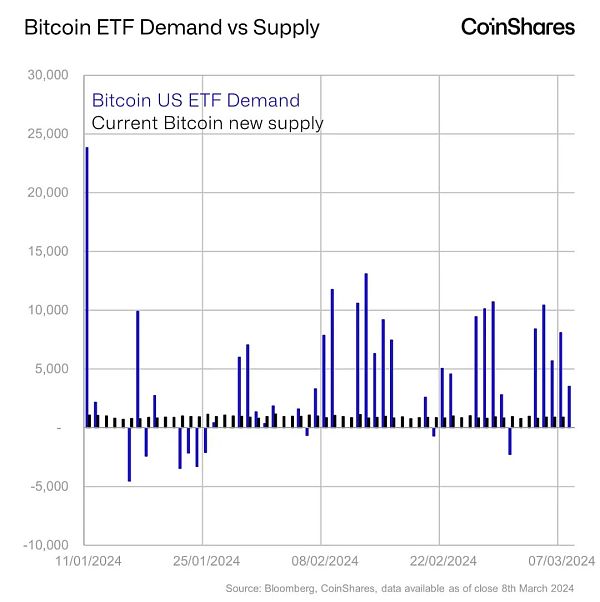

我们认为比特币目前正在经历积极的需求冲击。美国证券交易委员会(SEC)批准了基于现货的 ETF,这使得超过 14 万亿美元的资产可以在传统市场被投资,虽然这是众所周知的,但其时机并不明确,由此产生的资金流入的规模也并未达成广泛共识。到目前为止,1 月 11 日推出的 ETF 已经导致了 4500 个比特币(仅限交易日)的日均需求量,而与此同时,新的比特币日均开采量仅为 921 个。

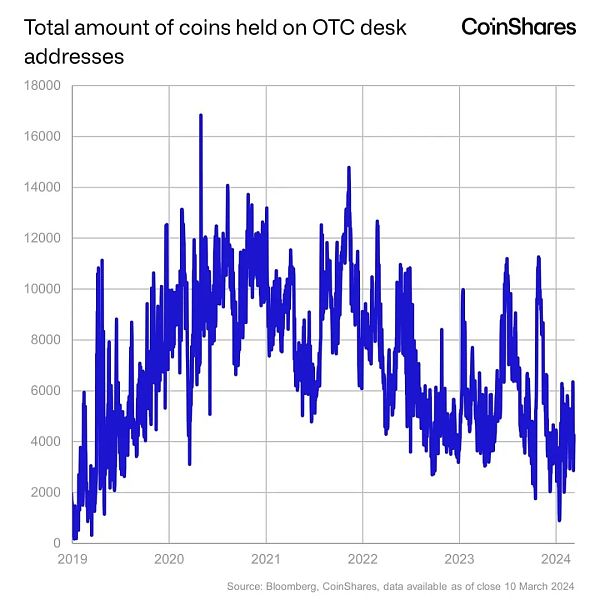

这导致了我们最近几周比特币价格的大幅上涨,因为新开采的比特币供应跟不上需求,导致 ETF 发行人不得不主要从二级市场采购。我们可以在数据中看到这一点,其中 OTC 市场持有量自2020年的峰值以来已经下降了 74%,这很可能是由于近年来的 ETF 需求。

在前两个月中,美国 ETF 见证了创纪录的 100 亿美元流入,而比之下,iShares 在 2005 年首次推出的首个黄金 ETF 在前两个月的净流入仅为 2880 万美元。在 2020 年的前两个月,即在减半之前,ETP 的流入量为 4.36 亿美元,占其管理总资产的 11%,与今天非常相似,最近的流入量也占 11%,即使按名义价值计算,今天的流入量也是 2020 年的 23 倍。

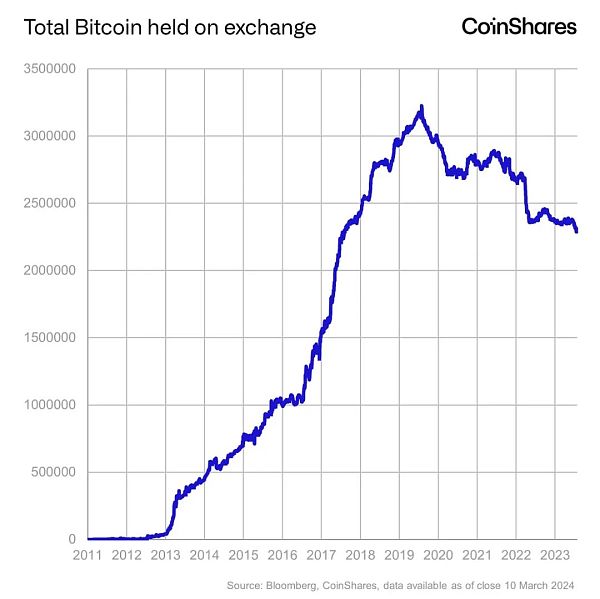

我们还看到交易所持有的比特币大幅减少,自 2020 年以来,其比特币持有量已经下降了 29%,因为投资者正在越来越多地利用 ETP,或者自行保管比特币,这反映了他们越来越多地将其视为一种价值储存工具。

按照目前每天约 4500 个比特币的需求速度,需要 573 天才能将平衡汇兑,所以很明显还有很长的路要走。

在大宗商品市场出现需求冲击后,通常会有供应反应。随着时间的推移,供应商会根据新的需求条件调整其生产水平。在需求受到积极冲击的情况下,生产商可能会提高生产能力或寻求提高效率以满足更高需求。然而,比特币与大宗商品市场的不同之处在于,比特币有一个固定且不可变供应量机制模型,其编程设计为每 210,000 个区块或大约每 4 年供应量减半。

最终,市场会在供需交汇处寻求新的平衡。这种调整过程可快可慢,取决于冲击的程度,鉴于比特币供应不灵活,因此只有在价格层面才能寻求到新的平衡。这就是为什么近几个月来我们看到比特币价格上涨如此迅猛的原因,ETF 的发行需求和即将到来的减半加剧了这个问题。

减半是众所周知的信息,至少在理论上应该已经被计入价格预期模型。有人可能会争辩说,2020 年后价格减半的涨幅更多的是美国 ”COVID 刺激支票“ 措施的结果,而非减半本身。从统计学上讲,我们只有 3 个先前事件样本可以作为参考,因此得出任何结论都是危险的,我们已经在这篇文章中提供了更多细节。然而,如果有大量的交易与该事件有关,那么它可能会变成一种自我实现的预言,尤其是在目前期货市场交易者对该事件的定位较低的情况下。

无论如何,今年比特币价格还有其他几个支撑因素,其中最重要的利好进展是美国的平台允许注册投资顾问(RIAs)在客户投资组合中包含比特币 ETF。然而,我们认为这些资金流入最终会减少,从而减少它们对价格的影响。如果这些资金在今年晚些时候开始减少,我们预计比特币价格将与利率预期重新保持一致。由于美联储预计将在今年晚些时候降息,这可能会成为对比特币的额外价格支撑。

In the field of commodities, the author's demand shocks refers to the sudden and significant changes in the demand for basic commodities or raw materials caused by unforeseen events. The positive demand shocks stems from the increase in demand, which may be due to the change of technological innovation policies or the change of consumer preferences, which pushed up the price. At the beginning of the century, China's economic prosperity and the acceleration of real estate development led to the rise of the commodity demand shocks, which led to the increase in steel prices between and. After the financial crisis, the economic growth slowed down and the supply response caused a large-scale increase in production. As a result, the price of steel fell in the next decade. We believe that Bitcoin is currently experiencing a positive experience in demand shocks. The US Securities and Exchange Commission has approved spot-based assets, which allows more than one trillion dollars of assets to be invested in the traditional market. Although this is well known, the timing is not clear, and the scale of the resulting capital inflow has not reached a broad consensus. So far, the launch on March has led to an average daily demand for Bitcoin limited to trading days, while at the same time, it is new. The average daily exploitation of bitcoin is only one, which has led to a sharp increase in the price of bitcoin in recent weeks. Because the supply of newly mined bitcoin can't keep up with the demand, the issuer has to mainly purchase from the secondary market. We can see this in the data, in which the market holdings have declined since the peak of 2000, which is probably due to the fact that the demand in recent years witnessed a record inflow of billions of dollars in the first two months, compared with the net amount of the first gold launched in 2000. The inflow was only $10,000 in the first two months of 2008, that is, before it was halved, the inflow was $100 million, which was very similar to today's total assets under management. Even in nominal terms, today's inflow was twice that of 2008. We also saw that the amount of bitcoin held by the exchange decreased significantly since 2008, because investors are using bitcoin more and more or keeping it by themselves, which reflects that they increasingly regard it as a value storage tool. According to the current demand speed of about 100 bitcoins per day, it takes genius to balance the exchange, so obviously there is still a long way to go. After the emergence of demand shocks in the commodity market, there is usually a supply response. As time goes by, suppliers will adjust their production level according to the new demand conditions. In the case of positive impact on demand, manufacturers may increase their production capacity or seek to improve efficiency to meet higher demand. However, there is one difference between bitcoin and the commodity market. The fixed and unchangeable supply mechanism model is programmed to halve the supply in each block or about every year. Eventually, the market will seek a new balance at the intersection of supply and demand. This adjustment process can be fast or slow depending on the degree of impact. In view of the inflexible supply of Bitcoin, a new balance can only be sought at the price level, which is why we have seen the price of Bitcoin rise so rapidly in recent months. The issue demand and the upcoming halving have intensified this problem. It is well known. At least in theory, the known information should have been included in the price expectation model. Some people may argue that the increase of half the price after the year is more the result of the US stimulus check measures than the half itself. Statistically speaking, we only have a sample of previous events for reference, so it is dangerous to draw any conclusions. We have provided more details in this article. However, if there are a large number of transactions related to this event, it may become a self-fulfilling prophecy, especially in At present, traders in the futures market have a low position on this event. In any case, there are several other supporting factors for the price of Bitcoin this year. The most important positive development is that the platform in the United States allows registered investment consultants to include Bitcoin in their clients' portfolios. However, we believe that these capital inflows will eventually decrease, thus reducing their impact on the price. If these funds start to decrease later this year, we expect that the price of Bitcoin will be in line with interest rate expectations again, which may become additional price support for Bitcoin because the Federal Reserve is expected to cut interest rates later this year. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。