从“怀疑者”转变为“真信徒” 贝莱德被比特币“涨服了”?

作者:华尔街日报;编译:比推BitpushNews Mary Liu

早在 2017 年,贝莱德首席执行官拉里·芬克 (Larry Fink)就将比特币称为“洗钱指数”,他也多次抨击加密货币,称其为“客户跟本不想投资的东西”。

现在,他说他是比特币的忠实信徒。他的公司贝莱德管理着增长最快的比特币基金,并与数字资产行业的头部参与者建立了合作伙伴关系。

Larry Fink在贝莱德的大转变为比特币赋予了合法性,并表明华尔街越来越渴望利用这个长期以来被认为是狂野西部的市场。

通过低成本且受欢迎的现货ETF,贝莱德为主流投资者打开了像投资股票一样轻松买卖比特币的大门。

贝莱德首席运营官Rob Goldstein在接受采访时表示:“我们认为我们使命的核心部分是提供选择和机会,这对我们的客户来说是一个重要的话题。”

比特币的弹性也在这一决定中发挥了作用。该代币自推出以来就经历了大起大落,然而,每次崩溃之后,另一个繁荣周期就会开启,进而吸引更多的投资者。

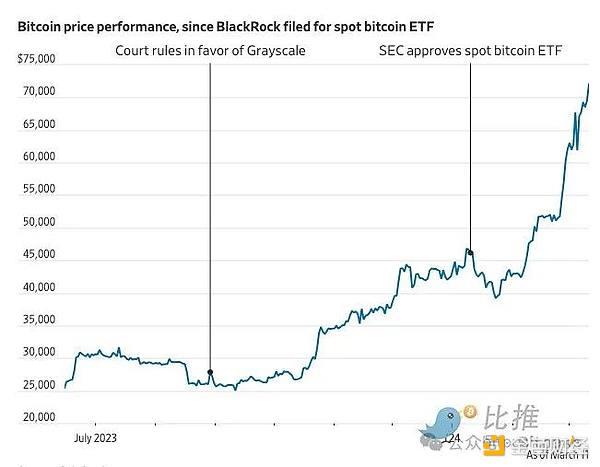

如今,比特币价格重回历史新高,一度逼近 73,000 美元,这在 16 个月前看起来是不可能的,当时,加密货币交易所FTX骤然倒塌,比特币徘徊在 16,000 美元附近。

行业批评人士表示,他们对贝莱德对加密货币的拥抱感到惊讶,因为该公司在向客户提供这种波动性资产的投资时面临着声誉风险。

美国证券交易委员会(SEC)互联网执法办公室前负责人John Reed Stark表示,贝莱德等公司显然是被“费用游戏”吸引了。

他说:“具有讽刺意味的是,它应该是去中心化的,但比华尔街巨头更去中心化的是,它从各个可能的角度收取费用,并兜售无人理解的东西。”

贝莱德目前对其比特币 ETF 资产收取的平均费用约为 0.19%。该基金已经达到了费用减免门槛,即投资者为前 50 亿美元资产或基金推出的第一年支付 0.12% 的费用,第一年后,费用将上涨至 0.25%。

贝莱德坚称,它对加密行业进行了多年研究,以制定数字资产战略,并为客户提供他们想要的东西。

据知情人士透露, 2022 年加密货币崩盘后比特币的反弹让贝莱德坚定了坚持这一策略的信念。

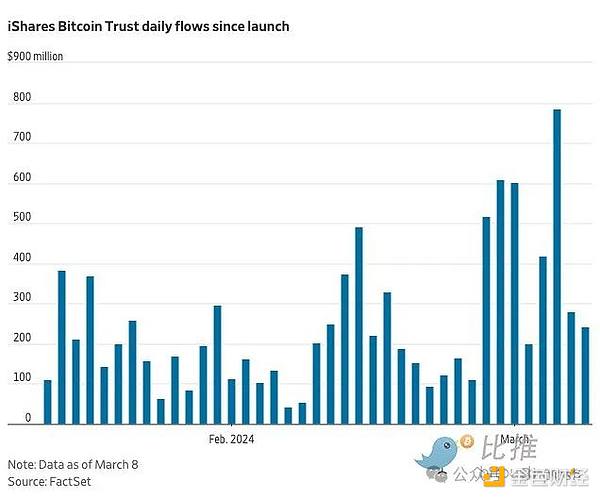

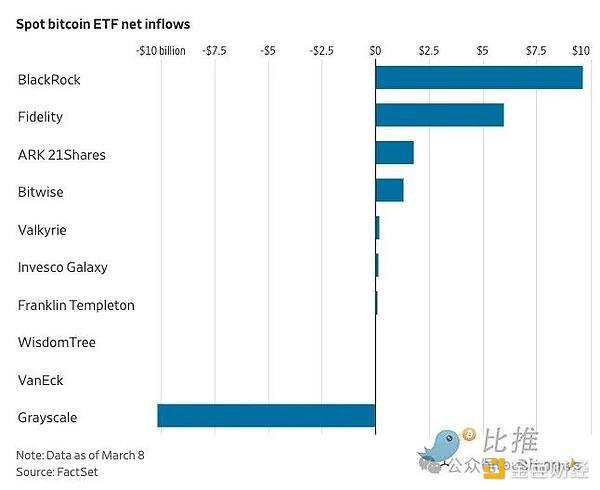

贝莱德是比特币最新一轮上涨的重要推手之一。在 1 月份推出的 9 只现货比特币 ETF 中,其 iShares Bitcoin Trust 在净流入方面处于领先地位。事实上,该 ETF 是有史以来最快吸收超过 100 亿美元资产的ETF 。

许多主流投资者在 6 月份开始买入比特币,当时贝莱德加入了现货比特币ETF的竞赛,因为这家资产管理公司在 ETF 申请方面有着近乎完美的获批记录,另外,法院裁决迫使SEC重新考虑竞争对手的申请,这更加坚定了人们对申请获批的信心。

倡导对金融部门进行监管的组织Better Markets总裁兼首席执行官Dennis Kelleher表示,贝莱德迅速成为比特币市场领导者并不奇怪。

“贝莱德拥有无与伦比的市场渗透力、无与伦比的分销网络和强大的营销力量,所有这些特性都给普通投资者带来了虚假的安慰。”

贝莱德对加密货币的看法与其最大竞争对手先锋集团(Vanguard)截然不同。Vanguard 由传奇投资者 Jack Bogle 创立,表示没有计划推出现货比特币 ETF,也不会在其经纪平台上提供加密相关产品。这家管理着 8.7 万亿美元资产的资产管理公司在最近的一篇博客文章中称比特币“更多的是一种投机而非投资”。

除了比特币 ETF 之外,贝莱德还与一些最大的加密货币参与者建立了合作伙伴关系。它持有稳定币公司CircleInternet Financial 的少数股权,并在政府货币市场基金中管理着超过 250 亿美元的储备,支持 Circle 的USD Coin。

贝莱德还与加密货币交易所CoinbaseGlobal 合作,通过与 Coinbase 机构部门的集成,为资产管理公司 Aladdin 软件平台的用户提供直接访问加密货币的机会,贝莱德还为专业客户管理私人比特币信托。据知情人士透露,该信托基金的资产已超过 2.5 亿美元,大多数客户此后已将资金转移到新的 ETF。

贝莱德对比特币的接受是渐进的。疫情期间,该公司全球固定收益首席投资官Rick Rieder开始在其基金中配置比特币期货。据知情人士透露,贝莱德数字资产主管Robbie Mitchnick也帮助芬克转变为比特币信徒。

2022年是芬克对数字资产的立场开始发生明显变化的一年。

在当年 4 月的一次电话会议上,他表示他的公司正在广泛研究加密货币领域,并看到客户的兴趣不断增加。

同月,贝莱德参与了 Circle 的 4 亿美元融资,到了夏天,贝莱德悄然推出了私人信托——其首个面向美国机构客户的现货比特币产品。该公司用自己的资金为该基金提供种子资金,并与外部投资者一起扩大规模。

同年,贝莱德还与 Coinbase 建立了合作伙伴关系,允许在加密货币交易所拥有比特币的机构客户使用其软件工具套件 Aladdin 来管理其投资组合并进行风险分析。Coinbase也是其现货比特币 ETF 的托管商。

如今,贝莱德的加密货币野心已不再局限于比特币,该资产管理公司正在向 SEC 提交一项待决申请,要求推出持有以太坊的 ETF,以太坊是市值第二大的加密货币,也是以太坊区块链上的原生代币,监管机构的截止日期为五月,届时将对多项此类申请作出决议。

As early as 2008, Larry Fink, CEO of BlackRock, called Bitcoin a money laundering index. He also repeatedly criticized cryptocurrency as something that customers didn't want to invest in. Now he says that he is a loyal believer in Bitcoin. His company BlackRock manages the fastest growing bitcoin fund and has established a partnership with the head participants in the digital asset industry. The great transformation in BlackRock has given Bitcoin legitimacy and shows that Wall Street is increasingly eager to use it. The market that has long been regarded as the wild west has opened the door for mainstream investors to buy and sell bitcoin as easily as investing in stocks through the low-cost and popular spot BlackRock. The chief operating officer of BlackRock said in an interview that we believe that the core part of our mission is to provide choices and opportunities, which is an important topic for our customers to change from skeptics to true believers. BlackRock was overwhelmed by bitcoin, and the elasticity of bitcoin also played a role in this decision. Since its launch, it has experienced ups and downs. However, after each collapse, another boom cycle will open and attract more investors. Now, the price of bitcoin has returned to a record high and once approached the US dollar, which seemed impossible last month. At that time, the cryptocurrency exchange suddenly collapsed and Bitcoin hovered near the US dollar. Industry critics said that they were surprised by BlackRock's embrace of cryptocurrency because the company faced a reputation when it provided investments in such volatile assets to customers. The former head of the Internet Law Enforcement Office of the US Securities and Exchange Commission said that BlackRock and other companies were obviously attracted by the fee game. He said that ironically, it should be decentralized, but it is more decentralized than the Wall Street giants. It collects fees from all possible angles and sells things that no one understands. From skeptics to true believers, BlackRock has been convinced by bitcoin. The average fee charged by BlackRock for its bitcoin assets at present is about that the fund has reached the fee reduction gate. The threshold is the fees paid by investors for assets or funds with a value of 100 million US dollars in the first year. After the first year, the fees will rise until BlackRock insists that it has studied the encryption industry for many years to formulate a digital asset strategy and provide customers with what they want. According to informed sources, the rebound of Bitcoin after the cryptocurrency crash in 2000 has strengthened BlackRock's belief in adhering to this strategy and changed from a skeptic to a true believer. BlackRock was convinced by Bitcoin, which is an important driving force for the latest round of bitcoin rise. In fact, it should be the fastest in history to absorb more than 100 million dollars of assets. Many mainstream investors began to buy bitcoin in January. At that time, BlackRock joined the competition of spot bitcoin because the asset management company had a nearly perfect approval record in the application, and the court ruling forced people to reconsider the application of competitors, which strengthened people's confidence in the approval of the application and advocated the financial sector. The president and CEO of the regulatory organization said that it is not surprising that BlackRock has quickly become a leader in the bitcoin market. BlackRock has unparalleled market penetration, unparalleled distribution network and strong marketing power. All these characteristics have brought false comfort to ordinary investors. BlackRock's view on cryptocurrency is completely different from its biggest competitor Pioneer Group, which was founded by legendary investors and said that it has no plans to launch spot bitcoin and will not provide encrypted phase on its brokerage platform. In a recent blog post, the asset management company, which manages trillions of dollars of assets, said that bitcoin is more a speculation than an investment, and BlackRock has changed from a skeptic to a true believer. Besides bitcoin, BlackRock has also established partnerships with some of the largest cryptocurrency participants. It holds a minority stake in the stable currency company and manages more than 100 million dollars of reserve support in the government money market fund. BlackRock also exchanges with cryptocurrencies. Cooperation provides users of asset management company's software platform with direct access to cryptocurrency through integration with institutional departments. BlackRock also manages private bitcoin trust for professional customers. According to informed sources, the assets of the trust fund have exceeded US$ 100 million, and most customers have since transferred their funds to the new BlackRock. The acceptance of bitcoin is gradual. During the epidemic, the company's global fixed-income chief investment officer began to allocate bitcoin futures in his fund. According to informed sources, BlackRock's number was revealed. The word asset manager also helped Fink to become a bitcoin believer. The year of 2008 was the year when Fink's position on digital assets began to change obviously. At a conference call in that month, he said that his company was extensively studying the cryptocurrency field and saw the increasing interest of customers. In the same month, BlackRock participated in the billion-dollar financing. In the summer, BlackRock quietly launched a private trust, its first spot bitcoin product for American institutional customers. The company used its own funds to provide seed capital for the fund. In the same year, BlackRock also established a partnership with institutional customers who own bitcoin in cryptocurrency exchange, allowing them to use their software tool suite to manage their portfolios and conduct risk analysis. BlackRock is also the custodian of its spot bitcoin. Now BlackRock's cryptocurrency ambition is no longer limited to bitcoin. The asset management company is submitting a pending application for the launch of Ethereum, the second largest cryptocurrency with market value, and the original token on the Ethereum blockchain. The deadline for the regulatory authorities will be May, when a number of such applications will be decided. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。