颠覆还是泡沫?加密货币引领掘金新浪潮

来源:Archetype;编译:比推BitpushNews Yanan

ETHDenver 2024的一个亮点是观察来自不同阵营的参会者们就一个议题展开的激烈辩论。

在辩论中,一方阵营持积极进取的冒险心态,预测整个行业即将迎来超级周期。而另一方则为理解当下市场情绪的狂热而苦寻基本面支撑。

短期来看,我认为双方或许都言之成理。尽管当前公/私募市场情绪高涨可能已偏离基本面,但加密市场仍具备大幅持续上涨的潜在利好因素。

但仔细审视,本次加密货币牛市可能与以往有所不同。

以往的牛市虽然刺激了用户增长,但这种增长更多类似于杠杆放大后的市场波动效应,而非真正的市场接纳。

如今,推动市场波动的流动性浪潮即将让位于三大主要利好的永久性结构转变:

1. 宏观环境的巨变驱使全球市场与加密市场产生相关性

2. 去中心化基础设施&中间件逐渐接近Web2水平

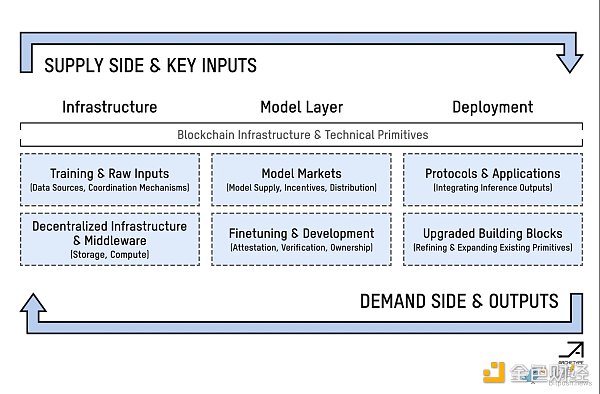

3. 基于区块链的开源人工智能

宏观环境与加密货币主网

近期由人工智能热潮和经济乐观情绪共同驱动的公募和私募市场繁荣掩盖了若干正在发生的长期结构性变化。事实上,当前全球格局正朝着与疫情前截然不同的方向演变,呈现出碎片化和跨境竞争的特征。

这些新的动态将对现有主流势力构成重大挑战,同时也为加密货币实现全球化应用提供了千载难逢的机遇。加密货币的第一个十年可以被视为一个非凡的测试网络阶段,以草根社区开发、狂热的高峰和艰难的低谷为标志。历经十余年发展,加密货币如今已蓄势待发,准备成为全球互操作性网络的主网。在亟需经济交流和科技创新的时代,它将成为一个中立的平台,容纳各类经济活动和技术革新。

为什么?

对加密货币而言,这些长期结构性变化恰逢其时,犹如强劲的利好之风。

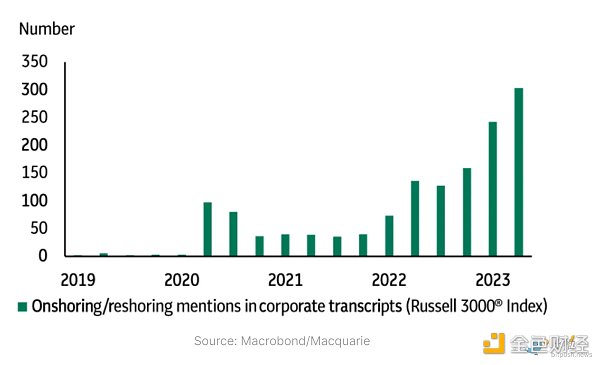

过去二十年来支撑全球贸易的底层架构正经历着真正的结构性转变,而国际关系的破裂进一步加速了这一进程。 2023 年,全球供应链和贸易渠道的重组步伐明显加快,并已成为企业和政府共同关注的核心议题。

企业回流趋势与贸易格局分化

与此同时,全球超过一半的人口及近60% 的全球国内生产总值 (GDP)所在的国家和地区即将迎来选举。而随着数场重大军事冲突实时上演,贸易保护主义成为主要焦点。

同样与加密行业息息相关的是国际竞争形式的演变。国家间的竞争不再局限于传统军事手段,而是延伸至金融、科技等领域。

例如,就俄罗斯出兵乌克兰,美国对俄罗斯实施国际金融制裁。而反过来,欧佩克及俄罗斯则利用能源资源进行反制。

此外,科技民族主义兴起,各国纷纷采取补贴和制裁措施,推动本国半导体及其他关键产业的发展。

这些因素导致全球贸易渠道朝碎片化方向发展,并加剧了贸易壁垒的形成。发达国家利润空间承压,近40%的全球人口所在的中低收入国家则面临更严峻的生存挑战。

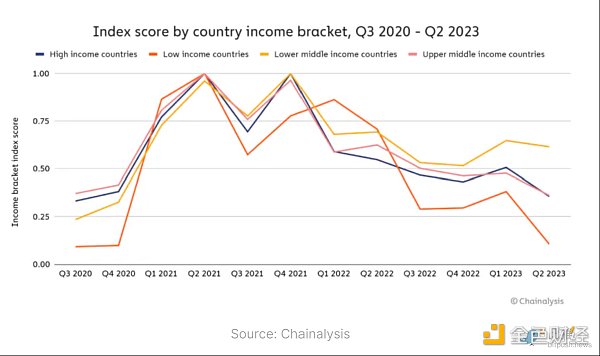

而对于中低收入国家的个体来讲,加密货币则成为了自己解决日常经济难题的利器,而这一利器的重要性也随着这些国家面临的系统性挑战而日益凸显。相关数据也佐证了这一点:当地缘政治紧张局势加剧时,加密货币在草根阶层的采用率不仅没有下降,反而呈现加速增长的态势。

同样地,对于私营企业而言,上述因素的汇合显著增加了经营成本,且限制了它们进入新消费市场的渠道,而这一切都发生在资本不再免费的时代。

过去几年的贸易战和关税壁垒已对企业和国内经济造成负面影响,随着企业适应新的贸易现实,这些负面影响还可能进一步加剧。

因此,企业和个人需要抓紧做出抉择:

是在日益碎片化的经济和市场中苦苦挣扎,还是拥抱一个以现代化科技为基石,建立于无需许可的市场之上的去中心化未来?

这个十字路口让我想起了一个有趣的历史类比:

15 世纪,君士坦丁堡陷落于奥斯曼帝国之手,新统治者接管了连接“丝绸之路”东西方贸易的地理枢纽。然而,奥斯曼帝国随后便采取了限制陆路贸易路线的举措——要知道,这些陆路路线曾经兴盛了数个世纪。此举迫使欧洲列国转而向海洋寻求新的贸易路线,由此开启塑造了现代世界的“大航海时代”。

这一次,区块链将成为新世界财富与风险的聚集地,等待着那些敢于扬帆起航的探索者。

加密货币迈向企业级应用

除了上述论点之外,我们还需要关注另一个重要方面:加密货币一直以来都是大型企业探索新技术的试验场。

然而,鉴于本文所述的各种因素,传统企业对加密货币的探索正从研发阶段转向生产应用阶段。

企业将加快探索数字资产和链上生态系统的步伐,将其视为开拓全新市场的关键手段。 曾经被视为带有炫耀性质的区块链应用项目,如今正日益演变为关乎企业生存发展的重要使命。

资本配置者将加大加密原生部署和参与力度,以抵御全球风险和不确定性带来的“贝塔”敞口(译者注:beta exposure,衡量资产波动性相对于大盘的风险)。在旧有世界中,可以躲避风险的避风港将所剩无几。

不同地区存在的系统性挑战(通货膨胀、资本管制、冷战/热战等)将进一步提升数字资产的相关性和需求。无需许可的区块链基础设施将从草根社区兴起,最终走向全球化。

诚然,经济和地缘政治挑战一直是推动用户拥抱加密货币的重要因素,尤其是在发展中市场。

然而,未来几年全球需要应对的挑战的规模和范围,为加密货币成为自由贸易和文化领域的 “事实标准”也提供了千载难逢的契机。

机构资金流入

实现上述愿景的关键在于引入机构,使其参与链上资金活动。

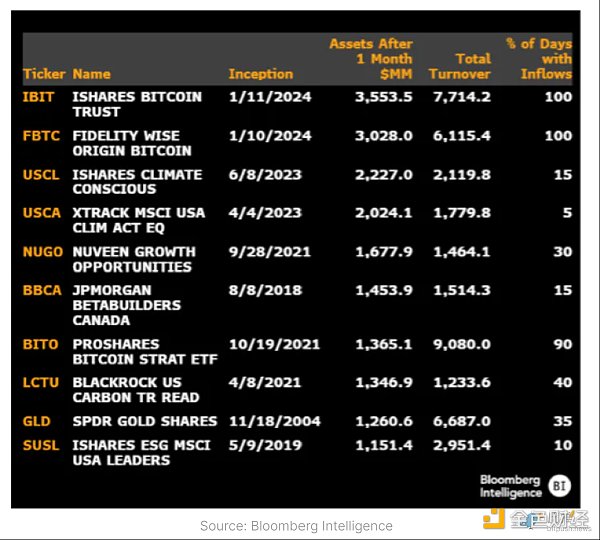

批准现货比特币ETF标志着该领域的重要转折点,以太坊似乎也将迎来类似的局面。

迄今为止,比特币ETF已经累计吸引了超过 75 亿美元的净流入资金,其中贝莱德和富达推出的相关产品首月募集资金规模创下过去 30 年来所有ETF之最。

这种令人难以置信的强劲势头最终将使大型机构能够加入到链上经济大军之中,与超过 5200 万美国人和全球其他 5 亿用户并肩作战。

宏观层面的重大转变犹如点燃加密货币黄金时代的火花,而机构资金的流入则将成为助燃剂。

中间件与基础设施升级驱动增长

外部环境利好频出,我们是否做好了迎接机遇的准备?

我相信答案是肯定的。

继 2022 年的崩盘导致大量投机者恐慌出逃之后,加密原生社区进行了深刻的反思,检视导致泡沫形成的过激行为和不足。

随着资本和人才围绕着“全面系统升级”这一概念进行整合,堆栈的各个层面都取得了巨大进展,为即将到来的大规模应用周期奠定了基础。

全年的私募资金流向也反映了这一趋势。年初,金融基础设施占据了最大份额的融资,其次是钱包,年末再次由前者占据主导地位,L2/互操作性项目位居第二。

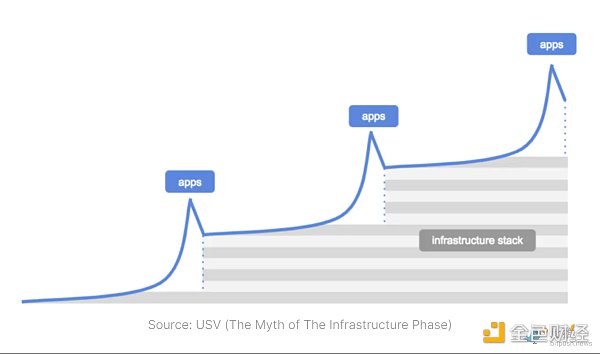

在这一切之中,尤其引人注目的是,基础设施与应用之间的飞轮效应(译者注:飞轮效应指的是持续投入小量努力带来逐渐积累的巨大成效)开始发挥作用,其意图比以往任何时候都更加集中。

加密原住民不断增长的需求正推动着技术栈定向且聚焦的改进,而这些改进又催生了新的用例和应用场景。

卓越的用户界面/用户体验助力加密普及

2023 年第一季度,ERC-4337 标准发布,旨在将外部所有权账户 (EOA) 转变为智能合约钱包,以实现可定制性、更佳的私钥恢复机制以及更加简化的用户体验。

更具影响力的是,像 Privy* 这样的团队通过嵌入式钱包简化了用户注册流程,既能最大限度减少用户摩擦,又能让开发人员设计更具情境的体验。

Privy助力Friend.Tech在短短几周内迅速获取了10万个地址,实现了爆炸式的早期用户增长。此后,Privy继续为OpenSea、Zora、Blackbird等平台的用户注册提供支持,其服务在过去13个月中已覆盖全球150多个国家的200多万用户。

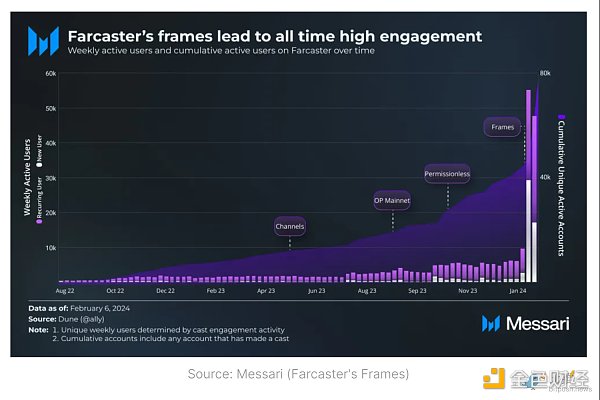

与此同时,Farcaster* 推出的 Frames 功能——一种允许用户直接在 Casts 中嵌入互动体验的新型原语——正带来变革性的影响,并已极大地刺激了平台活动。

Farcaster 拥有超过 400 万个 Casts 和800 多万次互动,这或许预示着加密原生消费者应用正靠近规模临界点,蓄势待发。

模块化浪潮下的新兴设计空间正变得更大、更好

以太坊当初旨在突破比特币的局限性,如今,新一代项目正瞄准以太坊自身架构缺陷,掀起一波模块化浪潮。

此前周期也出现过替代性 L1 和侧链,但没有一个能够撼动以太坊主网在用户、总锁仓量 (TVL)、开发者和活动方面的主导地位。

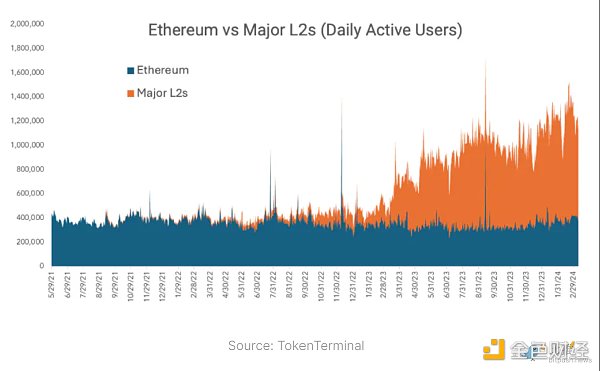

这一局面随着 Arbitrum 和 Optimism 等 Rollup 的兴起而发生改变。这些项目通过将计算任务转移至以太坊链下,实现了更高的吞吐量和更低的费用。

尽管这些新兴L 2 在规模上已经可以与以太坊本身相媲美,甚至在某些情况下还超越了以太坊,但区块链应用开发者们仍在寻求进一步优化 L1 堆栈的可能性,他们的志向更为远大。

原因在于,尽管 L2 上的日活跃用户数量在过去一年里增长了 8 倍,但用户实际进行的大部分操作与历史上的 L1 活动并没有太大区别。因此,业界逐渐达成共识:仅仅将交易转移到更廉价的执行环境还不足以实现真正新颖的链上体验。

实际上,我们需要从数据可用性 (Data Availability,DA) 到状态访问瓶颈和并行执行等各个方面来重建区块链底层组件的架构。

独立的数据可用性 (DA) 层正在被陆续推向市场,其目标是扩展到与 Web2 性能相当的水平(例如 EigenDA、Celestia、Avail)。这些 DA 层将与升级后的虚拟机结合使用,其中一些基于 EVM,另一些则使用替代引擎,例如 Move(Move Labs*)或 Solana 虚拟机 (Eclipse)。其中一些项目正在构建仅用于优化执行的 L2 (MegaETH),而另一些项目则从头开始启动全新的 L1 (Monad)。

与此同时,EigenLayer 通过重新质押的方式提供共享安全层,使新一代项目能够以最小化启动原生流动性需求的方式进行发布,从而减少偏离以太坊本身核心安全模型的需要。

所有这些都意味着,Web3 建设者可以使用的底层基础设施、工具和设计选项的成熟度和性能正以前所未有的速度接近顶峰。

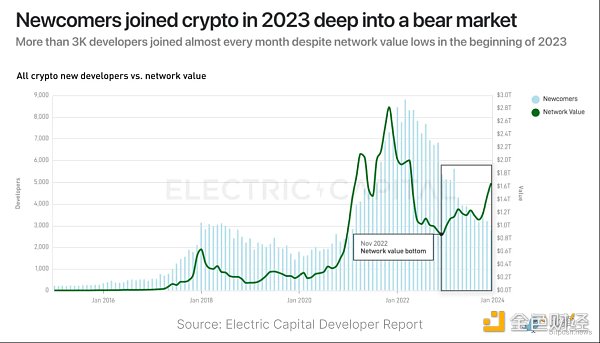

加密货币的价值观与基础设施、工具和中间件的升级相互促进,也引领着我们关注一个积极的信号:开发者正在流向加密领域。

在区块链上进行开发不仅应该是一项更有意义的事业,而且应该成为一项技术性能更优异的创举,从而切实赋予开发者设计开放互联网未来的能力。

即使是在艰难的市场环境下,现有开发者的较高留存率和新开发者的涌入,有力地证明了区块链领域在吸引和培养开发者方面所做的努力取得了成效。

开源人工智能与加密赛道

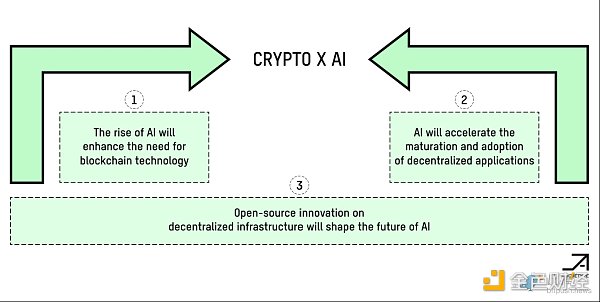

最后,我们坚信加密货币和人工智能——这两个本身就代表着范式转变的技术——的融合将成为现代史上最具变革性的时刻之一。

经过多年压力测试,区块链赛道成功设计出适用于数字时代,尤其是生成式人工智能时代,且无需许可的系统。加密货币的工具包可以解决一系列相关问题,例如资源和流动性协调、资产所有权、数据来源、证明等。至关重要的是,区块链生态系统和技术栈的成熟恰逢其时,能够满足人工智能革命的需求。

尽管区块链在简化现有机器学习 (ML) 流程方面还有很大潜力,但最激动人心的机会将出现在加密货币和人工智能融合、实现全新结果的领域。

最令人兴奋的新型设计空间将涵盖以下领域:

支持共享、无需许可的数据存储库的去中心化存储,通过检索增强生成 (RAG) 技术实现更好的训练或性能更高的模型。

零知识证明用于模型或内容验证、训练或用户数据隐私保护,或支持边缘计算和本地(客户端)推理。

新型信息市场和更好的机制来收集更高质量的数据——基础模型需要更专业的数据输入才能继续发展。

自主代理通过智能合约进行交易,使它们能够使用机器操作的私钥积累资源、知识和资产。

随着加密赛道影响从计算供应到数据市场,再到强大基础模型的集体创建与货币化等一切领域,开源人工智能/机器学习性能将被加密货币大幅提升,从而在未来几年推动人类生产力发展和开放协作生态的打造。

加密货币将成为人们接触人工智能崛起的最佳方式。投资者们既可以通过像 ETH 这样的蓝筹资产进行间接投资,也可以直接持有或通过代理、模型、网络和数据集进行投机。

接下来是什么?

我们正处于该行业的一个拐点。经过多年的奋斗,冲破市场、现有势力和监管的重重阻力,局势终于发生了转变。

一系列重要风口汇聚在一起,共同引领我们迈向一个去中心化的未来——可以说,加密时代已经到来。基础设施和中间件迎来发展高峰,使得链上体验实现了阶跃式发展,但我们仍需要注意一点。

在理想情况下,模块化不仅能实现专业分工,还能使控制权和故障点分散到多个参与者身上。然而,这些新框架中的每一环都涉及不同的技术和安全假设、激励机制、代币分配路线图、风投机构、基金会架构和内部政治。

过去一年残酷的经济衰退中,加密领域建设者们做出的努力令人钦佩,我们不应忽视他们的贡献。然而,随着行业回暖,一些代币为了蹭热度,会包装成与其他项目的“合作关系”,但实际上并没有真正的技术或业务结合。此外,一些项目会通过公关手段制造虚假繁荣,比如花钱雇佣水军发帖宣传,或者通过激励措施鼓励用户参与,但这些行为并不能代表项目真正获得了用户的认可。因此,我们需要警惕行业信息茧房和虚假信号活动,不要被表象迷惑,要理性判断项目的价值。

未来几年,对于不断涌现的项目,我们共同肩负着责任,要求它们在技术设计选择、代币集中度、价值分配、理念和治理等方面都保持负责任的态度。

这才是加密货币披荆斩棘,走向辉煌之道。

One of the highlights of the source compilation comparison is to observe the heated debate on a topic among participants from different camps. In the debate, one camp predicted that the whole industry was about to usher in a super cycle with an aggressive and adventurous attitude, while the other side struggled for fundamental support to understand the current market sentiment. In the short term, I think both sides may make sense. Although the current high sentiment in the public and private markets may have deviated from the fundamentals, the encryption market still has the potential for a substantial and sustained rise. However, a close look at this bull market of cryptocurrency may be different from the past. Although the previous bull market stimulated the growth of users, this growth is more similar to the market fluctuation effect after leverage amplification than the real market acceptance. Now the liquidity wave that promotes market fluctuation is about to give way to the permanent structural transformation of the three major advantages. The great changes in the macro environment have driven the global market and the crypto market to be correlated, and the decentralized infrastructure middleware has gradually approached the level. Open source labor based on blockchain. Intelligent macro-environment and cryptocurrency main network The recent prosperity of public offering and private offering driven by artificial intelligence upsurge and economic optimism has concealed some long-term structural changes that are taking place. In fact, the current global pattern is evolving in a completely different direction from that before the epidemic, showing the characteristics of fragmentation and cross-border competition. These new trends will pose a major challenge to the existing mainstream forces, and at the same time provide a once-in-a-lifetime opportunity for cryptocurrency to achieve global application. The last decade can be regarded as an extraordinary test network stage, marked by the frenzied peak and difficult trough of grassroots community development. After more than ten years of development, cryptocurrency is now ready to become the main network of global interoperability network. In the era of urgent need for economic exchanges and technological innovation, it will become a neutral platform to accommodate all kinds of economic activities and technological innovations. Why are these long-term structural changes just in time for cryptocurrency, like a strong positive wind in the past two decades? The underlying structure supporting global trade is undergoing a real structural transformation, and the breakdown of international relations has further accelerated this process. The pace of restructuring of global supply chain and trade channels has obviously accelerated in and has become the core topic of common concern for enterprises and governments. At the same time, more than half of the world's population and nearly half of the countries and regions where global GDP is located are about to usher in elections, and with several major military conflicts, trade protectionism is staged in real time. The main focus is also closely related to the encryption industry, which is the evolution of international competition forms. The competition between countries is no longer limited to traditional military means, but extends to financial technology and other fields. For example, when Russia sent troops to Ukraine, the United States imposed international financial sanctions on Russia, while in turn OPEC and Russia used energy resources to counter it. In addition, the rise of technological nationalism has led to the adoption of subsidies and sanctions by various countries to promote the development of their own semiconductors and other key industries. Trade channels are developing in the direction of fragmentation and the formation of trade barriers is intensified. The low-and middle-income countries where the profit margins of developed countries are under pressure are facing more severe survival challenges. For individuals in low-and middle-income countries, cryptocurrency has become a sharp weapon to solve their daily economic problems, and the importance of this sharp weapon has become increasingly prominent with the systematic challenges faced by these countries. Relevant data also support this point. When geopolitical tensions intensify, cryptocurrency exists. The adoption rate of grassroots has not declined, but has shown an accelerated growth trend. Similarly, for private enterprises, the convergence of the above factors has significantly increased operating costs and restricted their access to new consumer markets, all of which happened in an era when capital is no longer free. Trade wars and tariff barriers in the past few years have had negative effects on enterprises and the domestic economy, and these negative effects may be further aggravated as enterprises adapt to the new trade reality, so enterprises and individuals need to do it quickly. Deciding whether to struggle in the increasingly fragmented economy and market or embrace a decentralized future based on modern science and technology and built on an unlicensed market reminds me of an interesting historical analogy. Constantinople fell into the hands of the Ottoman Empire in the century, and the new rulers took over the geographical hub connecting the East and West trade of the Silk Road. However, the Ottoman Empire subsequently took measures to restrict land trade routes. You know, these land routes used to flourish. This move, which has flourished for centuries, has forced European countries to turn to the ocean to seek new trade routes, thus opening the era of great navigation that has shaped the modern world. This time, the blockchain will become a gathering place for wealth and risks in the new world, waiting for those explorers who dare to set sail to move towards enterprise-level applications. In addition to the above arguments, we need to pay attention to another important aspect: cryptocurrency has always been a testing ground for large enterprises to explore new technologies. However, in view of various factors and traditions mentioned in this paper, The exploration of cryptocurrency by enterprises is shifting from the research and development stage to the production and application stage. Enterprises will speed up the exploration of digital assets and on-chain ecosystems as a key means to open up new markets. Blockchain application projects, once regarded as ostentatious, are now increasingly evolving into an important mission related to the survival and development of enterprises. Capital allocators will increase the deployment and participation of cryptocurrencies to resist the beta exposure brought about by global risks and uncertainties. In the old world, there will be few safe havens to avoid the risks. There will be few systemic challenges in different regions, such as inflation, capital control, cold war and hot war, which will further enhance the relevance and demand of digital assets. The unlicensed blockchain infrastructure will rise from grassroots communities and eventually go global. It is true that economic and geopolitical challenges have always been important factors to promote users to embrace cryptocurrencies, especially in developing markets. However, the scale of challenges that the world needs to deal with in the next few years. And the scope of cryptocurrency has also provided a golden opportunity for cryptocurrency to become the de facto standard in the field of free trade and culture. The key to realizing the above vision is to introduce institutions to participate in on-chain capital activities. The approval of spot bitcoin marks an important turning point in this field, and it seems that Ethereum will also usher in a similar situation. So far, bitcoin has attracted a net inflow of more than 100 million US dollars, of which the scale of funds raised by BlackRock and Fidelity in the first month has reached the highest in the past year. This incredibly strong momentum will eventually enable large institutions to join the on-chain economy. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。