非托管、资方强、快节奏 解析再质押龙头ether.fi的炼成之路

作者:Climber,比特币买卖交易网

3月18日,以太坊再质押协议ether.fi上线各大交易所。开盘冲高后回落至3美元附近,此后一路上涨,不到两周时间最高已涨至8.66美元。新项目短期有如此涨幅实属难得,加之再质押赛道大有愈演愈烈之势,身为龙头的ether.fi自然值得关注。

本文将全面解读这一赛道头部项目ether.fi,帮助读者了解该项目的同时,也以期找出其中的价值所在。

强势表现

从币价走势上看,ether.fi上市至今可谓表现亮眼。截止撰文,ETHFI币价最低为2.83美元,最高为8.66美元,期间涨幅为208%。对于交易所新上币种来说,短时间内两倍的涨幅也已较为客观。

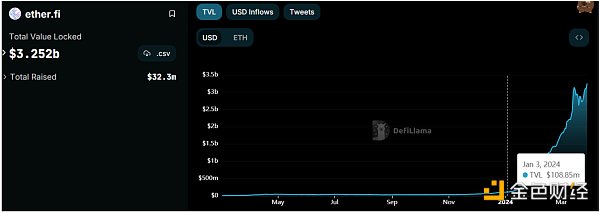

而从项目链上数据表现来看,据 DefiLama数据显示,当前ether.fi的TVL为32.52亿美元。从上图可以看出,约从今年1月开始,Ether.fi TVL就进入高增长模式,至今不过三个月时间就从1亿美元附近涨超30亿美元,涨幅高达30倍。

再对比同赛道其它竞争对手,可以很明显的看出,ether.fi遥遥领先其它同类对手,TVL约是第二名Renzo的两倍。而从TVL增幅来看,ether.fi、Renzo、swell network的月增幅均在100%左右,其中尤以Renzo为最。

对于再质押赛道TVL的普遍高增长,一位行业资深分析师表示,这主要是由于对能够提供共识安全的AVS服务的项目方有着巨大预期需求。同时,再质押赛道也被一众机构和资方所看好。

比特币买卖交易网曾在今年2月初的《再质押赛道持续升温 一文对比代表项目发展状况》一文中详细比较了头部几个项目的发展情况,并指出受以太坊坎昆升级影响再质押赛道爆发的可能,读者可移步查阅。

ether.fi简介

ether.fi 是一种建立在以太坊上的非托管质押协议,由Mike Silagadze 创立,并于2023 年推出。

与其它流动性质押协议不同的是,ether.fi允许参与者在代币质押时保留对其密钥的控制,并且可以随时退出验证器以收回他们的 ETH。

这主要体现在两个方面:

质押者生成并持有自己质押的 ETH 密钥。

NFT 是为每个通过 ether.fi 启动的验证器铸造的。

对于大多数其他委托质押协议,起点是质押者存入他们的 ETH,并与节点运营商匹配,节点运营商生成并持有质押凭证。尽管这种方法可以使协议成为非托管的,但实际上在大多数情况下它创建了一种托管或半托管的机制。这可能会让质押者面临重大且不透明的交易对手风险。

而通过 ether.fi,质押者可以控制他们的密钥并保留其 ETH 的保管权,同时将质押委托给节点运营商,这大大减少了他们遭受的风险。

技术原理上来说,在以太坊的 Pos 质押中,会产生两个密钥:提款密钥和验证密钥。提款密钥用于提取用户的资产,而验证密钥则是节点运营商需要在规定时间内,使用该密钥对区块验证,以此获得验证奖励。

ether.fi 通过密钥管理技术实现质押委托中的提款密钥和验证密钥分离管理,进一步优化了 ETH 质押服务的安全性。同时它还创建了一个节点服务市场,质押者和节点运营商可以在其中注册节点以提供基础设施服务,并且这些服务的收入与利益相关者和节点运营商共享。

用户可以通过将资金存入 ether.fi 并以质押奖励(供应方费用)的形式获得投资回报,在此过程中ether.fi 也能自动将用户的存款再质押给Eigenlayer来获取收益,Eigenlayer 利用质押的 ETH 支持外部系统(如 rollups、预言机),它通过建立经济安全层来提升ETH质押者的收益。

所有质押奖励的总和在质押者、节点运营商和协议之间分配,分别为 90%、5%、5%。用户总体可以获得:以太坊质押奖励;ether.fi 忠诚积分;重新质押奖励(包括 EigenLayer 积分);为 Defi 协议提供流动性的奖励。

融资信息方面:

ether.fi 在2023年2月2日完成530万美元融资,North Island Ventures、Chapter One和Node Capital 领投,BitMex 创始人 Arthur Hayes 参投。

此外,ether.fi还在今年2月完成 2300 万美元融资,融资有包括 Amber Group、BanklessVC、OKX Ventures等超 95 个投资机构及个人投资者的支持。

目前 ether.fi 在官方 Docs 公布了5名团队成员的信息,其中创始人 Mike Silagadze:目前是 DeFi 基金公司 Gadze Finance的 CEO,也是加拿大高等教育平台 Top Hat(2021年E轮融资1.3亿美元)的创始人。

代币经济学:

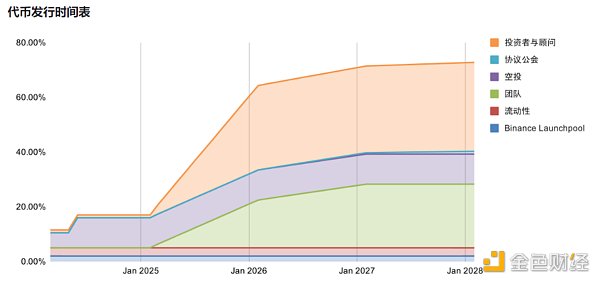

ether.fi 代币经济模型显示,ether.fi 代币 ETHFI 总供应量为 10 亿枚,初始流通供应量为 1.152 亿枚,代币分配中 2% 用于 Binance Launchpool、11% 将分配给空投、32.5% 分配给空投投资者和顾问、23.26% 分配给团队、1% 分配给 Protocol Guild、27.24% 分配给 DAO Treasury、3% 用于提供流动性。

但是从解锁时间上来看,ETHFI要到明年才会大幅释放,而到2026年才会达到60%以上,这从侧面反映出ETHFI的市面筹码具有一定的稀缺性。

不过从ether.fi 在3月18日的空投信息来看,奖励榜单排名前 20 个地址为 ether.fi 贡献了三分之一的 TVL(27.3 万枚 ETH)而获得了 996 万枚的 ETHFI 空投。

而获得空投数量最多的是 Justin Sun,其在 13 号向 ether.fi 存入 12 万枚 ETH(4.35 亿美元)从而获得了 345 万枚 ETHFI 空投。从质押空投比来看,约是1:3,也就是说用户质押1个ETF才能获得3个ETHFI,按ETHFI最高价来计算不过26美元。

项目进展与路线图

今年3 月,ether.fi开启了第 2 季积分活动 StakeRank,时间为 3 月 15 日至 6 月 30 日,奖励将占ETHFI 总供应的 5%。而不久前ether.fi进行了6800 万枚 ETHFI(总量的 6.8%)的空投,同时项目还与 Manta Network 发起了 Restaking Paradigm产品。

2月,DeFi 收益率市场 Pendle 宣布与以太坊质押协议ether.fi合作,在Arbitrum推出首个LRT资产eETH。1月,ether.fi宣布成立顾问委员会,成员包括独立以太坊教育家sassal.eth、Polygon创始人Sandeep Nailwal、Arrington Capital创始人Michael Arrington、以太坊基金会成员SnapCrackle.eth等。

去年11 月,ether.fi主网上线,并发布了流动性质押代币 eeth。而在10 月ether.fi 推出了流动质押代币(LST)eETH,同时还公布其去中心化路线图。5 月,ether.Fi 上线了主网第一阶段。

根据其官网路线图显示:

去年8月,ether.fi 与 Obol Labs 联合推出了第一个 DVT 主网验证器,然后将其纳入主网的第一批验证器中,这些验证器由地理上分散的一组小型独立运营商运行。

去年10 月,ether.fi开源了智能合约套件。11月,推出eETH,eETH 是 ether.fi 的 Liquid Stake 代币,用户将能够以完全无需许可的方式参与以太坊质押,按需买卖质押资产。

今年4 月,ether.fi预计将完成DVT 集成第二阶段。在 DVT 第 1 阶段,ether.fi与 Obol Labs合作提供主网 DVT - 由不同个人共享的验证,其中没有人拥有完整的验证器密钥。第二阶段将转向完全自动化集成,用户将到达、申请并开始作为单独的质押者,不受 ether.fi 和 Obol 的管理和协助。

同时,ether.fi也将实现DAO 治理和 TGE。

此外,ether.fi主网v3计划于第二季度初发布,将包含一些特殊功能,例如用户能够使用2 ETH Bond运行个人节点。

小结

从去年开始,围绕再质押赛道的讨论和研究越来越多。今年伊始,再质押赛道大有全面爆发的势头,而ether.fi作为赛道龙头率先登上交易所且表现优异,这不免让投资者更加看好该赛道。

对于青睐质押赚取的用户来说,安全性和收益率是最大的考量因素。ether.fi的DVT技术能够大幅保障用户质押标的的安全性,并且相对说也能为用户提供不错的收益。因此,仅就目前ether.fi的产品和服务来说确实具有一定的前景,不过在智能合约、技术安全层面依然有待时间检验。

Author Bitcoin Trading Network Month Day Ethereum Pledge Agreement was launched. After the opening of the major exchanges, it fell back to the US dollar. After that, it rose all the way to the US dollar in less than two weeks. It is rare for new projects to have such an increase in the short term. In addition, the re-pledge track has a growing trend. As a leader, it is naturally worthy of attention. This paper will comprehensively interpret the head project of this track to help readers understand the project, and also hope to find out its strong performance from the trend of currency prices. Today, it can be said that the performance is bright. As of the end of the author's writing, the lowest price of the currency is US$ and the highest price is US$. The increase of two times in a short period of time is also more objective for the new currency on the exchange. From the data performance on the project chain, it can be seen that the current price is US$ 100 million. From the above figure, it can be seen that it has entered a high growth mode since this year, but it has risen from US$ 100 million to over US$ 100 million in three months. Compared with other competitors on the same track, it can be clearly seen Its competitors of the same kind are about twice as many as the second place, and the monthly growth rate is about the same, especially for the general high growth of the re-pledge track. A senior industry analyst said that this is mainly due to the huge expected demand for the project side that can provide consensus and safe services, and the re-pledge track is also favored by many institutions and employers. The Bitcoin trading network has been heating up continuously at the beginning of this year, and the paper compares the development status of the re-pledge track in detail. The development of several projects and the possible outbreak of the re-pledge track due to the upgrade of the Ethereum in Cancun are pointed out. The introduction is an unmanaged pledge agreement based on the Ethereum, which was founded and launched in. Different from other liquid pledge agreements, participants are allowed to retain control of their keys when pledging tokens and can withdraw from the verifier at any time. This is mainly reflected in two aspects: the pledge generates and holds their own pledged keys for each person who passes the pledge. For most other entrusted pledge agreements, the starting point of dynamic verifier casting is that the pledgee deposits them and matches the node operator to generate and hold the pledge certificate. Although this method can make the agreement unmanaged, it actually creates a custody or semi-custody mechanism in most cases, which may expose the pledgee to significant and opaque counterparty risks, and the pledgee can control their keys and retain their custody rights while entrusting the pledge. To the node operators, this greatly reduces the risks they suffer. Technically speaking, in the pledge of Ethereum, two key withdrawal keys and verification keys will be generated to extract users' assets, while the verification key is that the node operators need to use this key to verify the block within a specified time to obtain verification rewards. The separation management of withdrawal keys and verification keys in pledge entrustment is realized through key management technology, which further optimizes the security of pledge service, and it also creates. In a node service market, the pledger and node operators can register nodes to provide infrastructure services, and the income of these services is shared with stakeholders and node operators. Users can get the return on investment by depositing funds and rewarding supplier fees by pledge. In this process, they can also automatically re-pledge their deposits to support external systems such as Oracle, which can improve the income of the pledger by establishing an economic security layer. The sum of the rewards is distributed between the pledger, the node, the operator and the agreement, respectively, so that the users as a whole can get Ethereum pledge rewards, loyalty points, re-pledge rewards, including points to provide liquidity for the agreement. In terms of financing information, the company completed $10,000 financing and led the founder to participate in the investment. In addition, it also completed $10,000 financing in this month, including the support of more than 10 investment institutions and individual investors. At present, the information of team members has been officially announced, among which the founder is currently a fund manager. The company is also the founder of the Canadian higher education platform with annual ring financing of $ billion. The token economics token economic model shows that the total supply of tokens is $ billion, and the initial circulation supply is $ billion. In the distribution of tokens, it is used to distribute airdrops to airdrops, investors and consultants, and teams to provide liquidity. However, judging from the unlocking time, it will not be released greatly until next year and will not reach the above level until 2008. This reflects from the side that the market chips are scarce. According to the airdrop information on March, the top address in the award list contributed one-third of 10,000 airdrops and won 10,000 airdrops, and the largest number of airdrops was that it deposited 10,000 billion dollars in the direction of the number, thus winning 10,000 airdrops. According to the ratio of pledged airdrops, it means that users can only get a total of 10,000 airdrops at the highest price. However, the progress and road map of the US dollar project was launched this month, and the first quarter points activity time will be from March to March, and the reward will account for the total supply. At the same time, the project also launched the monthly yield of products, the market announced its cooperation with the Ethereum pledge agreement, and announced the establishment of the advisory Committee in the first asset month, including the members of the independent Ethereum educator founder Ethereum Foundation, etc. Last month, the main online and released the mobile pledge token, and in February, it also announced its decentralized roadmap. The first phase of the main network was launched in the month. According to its official website roadmap, it was jointly launched with the first. A main network verifier is then incorporated into the first batch of verifiers of the main network. These verifiers are run by a geographically dispersed group of small independent operators. Last month, the smart contract suite was opened in the open source. Yes, token users will be able to participate in the on-demand trading of pledged assets in Ethereum pledge in a completely license-free way. It is expected that the second phase of integration will be completed this month. In the second phase, cooperation will be provided to provide verification that the main network is shared by different individuals, and no one has the complete verifier key. The second phase will be transferred. Users who integrate into full automation will arrive to apply and start to be independent pawnbrokers, which will not be managed and assisted. In addition, the main network is scheduled to be released at the beginning of the second quarter, which will contain some special functions, such as users can use the summary of running personal nodes. Since last year, there have been more and more discussions and studies around the re-pledged track. At the beginning of this year, the re-pledged track has a full-scale outbreak momentum and has been the first to board the exchange as a track leader with excellent performance, which inevitably makes investors more optimistic about the technical performance of the track, and safety and profitability are the biggest considerations for users who favor pledge to earn. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。