Ethena能否续写Luna传奇?引领算稳赛道掀起新风暴?

作者:Ken

币安最近几期上线的新币挖矿项目,质量明显有所提升,例如 AEVO、ETHFI 以及 Ethena 等,无论是挖矿收益,还是代币上线后的后续表现,都还是相当亮眼的。

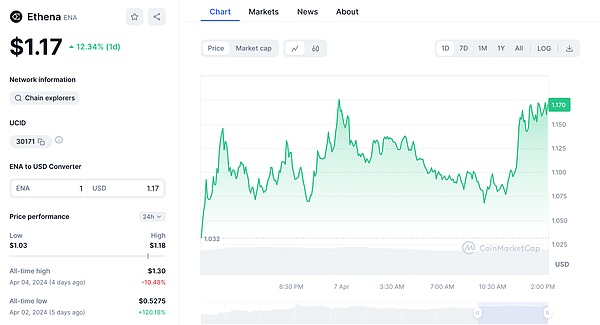

就拿4月2日上线的算法稳定币 Ethena(ENA)来说,上线后价格从低位到现在,已经有 120% 的涨幅。

Ethena 到底有哪些创新之处呢?

一、Ethena 创新之处

Ethena 项目的灵感来源于 BitMEX 的创始人 Arthur Hayes 在去年发表的 Dust on Crust 这篇文章。

文中提到他对新一代稳定币的构想,即创建一个由等量 BTC 现货多头和期货空头共同支撑的稳定币。

Ethena Labs 把 Arthur 的构想变成了现实,但并没有使用 BTC 作为开仓的主要标的资产,而是选择了 ETH。

也就是说,Ethena 是建立在以太坊上的合成美元协议,它推出了一个美元稳定币 USDe,ENA 为其平台代币。

USDe 其实是一个算法稳定币,和 USDT、USDC 的铸造机制不同,通过 Ethena 协议铸造的稳定币 USDe,它的底层资产并不是美元,而是 ETH。

具体来说,USDe 的抵押资产是由等量的现货 ETH 多头以及期货 ETH 空头共同构成,这样就可以实现对冲,也就是我们常听说的套保。

因此,无论 ETH 价格涨跌,USDe 都可以保持“稳定”,用专业术语来讲,就是实现了「Delta 中性」。

而且这些 ETH 资产并没有存储在中心化交易所,而是托管在 Copper、CEFFU、Cobo 这些平台,这样就可以在一定程度上规避交易所跑路或挪用等风险。

二、收益来源

稳定币赛道的竞争非常激烈,面对 USDT、USDC、DAI 这样的老牌稳定币,USDe 如何才能获取更多的市场份额呢?

USDe 最大的亮点就是收益率,USDe 质押用户可分享来自抵押资产的两重收益。

首先,2024年是质押年,质押及再质押赛道的项目越来越多,USDe 的底层资产(例如ETH等)至少可以通过这些质押平台来获取相对稳定的质押收益,例如可以把 ETH 质押在 Lido 等平台,从而获取 4% 左右的年化收益,这样就可以保证一个最基本的稳定收益。

其次,可以在这些期货平台上获取一定的资金费率。虽然资金费率是一个不稳定因素,但对于空头头寸而言,长期来看资金费率为正的时间占大多数,这也意味着整体上收益会呈正向。

我们看看 Ethena 具体的 APY(年化收益率)。

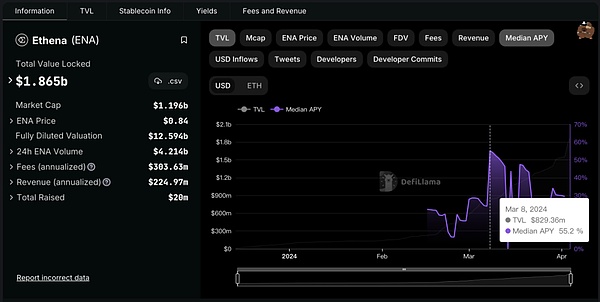

根据 defillama 平台统计,Ethena 的 Median APY 最低为 5% 左右,最高达到了 55%左右,远高于其他 DeFi 平台所提供的收益率。

三、融资

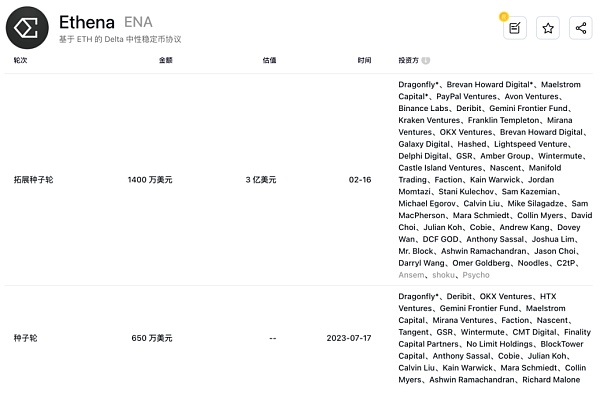

Ethena 通过两轮融资共融了 2050 万美元,最近一次融资发生在今年 2月16日,以3亿美元的估值完成了 1400万美元融资。

Ethena 投资团队非常豪华,例如 Binance Labs、OKX Ventures、Dragonfly 等,其中,OKX Ventures、Dragonfly 在两轮融资中都参与了。

在 Ethena 投资团队中我们还看到了 Paypal、Franklin 等这些传统金融巨头的身影。

另外,多个 CEX 平台、衍生品交易平台的创始人也参与了 Ethena 的投资。

四、TVL 及 Revenue

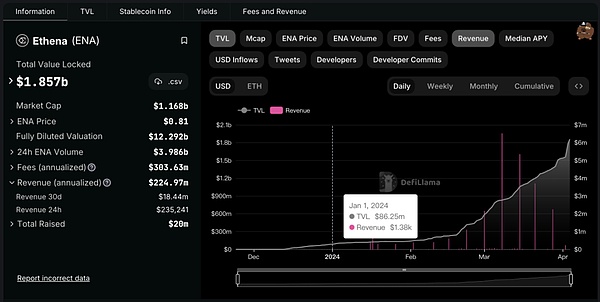

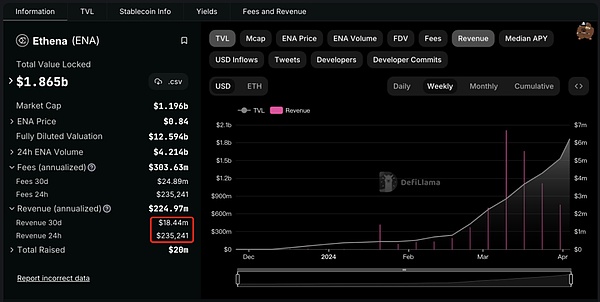

根据 defillama 平台统计,Ethena TVL 增速非常快,今年年初时只有 8600 多美元,目前已达到了 18.57亿美元,3个月的时间,TVL 就增长了 21倍,Ethena 平台所提供的远高于其它平台的 APY 功不可没。

目前,USDe 的铸造量也已经突破了19亿枚。

据 defillama 平台数据显示,Ethena 平台平均月 Revenue(收入)可以达到 1800 多万美元,每天 Revenue 平均可以达到 23多万美元,和其他 DeFi 平台的盈利能力相比,Ethena 平台的盈利能力可以说是相当强悍。当然了,这种高收益能否持续还有待观察。

五、风险

Ethena 面临的风险主要来源于:

1、质押平台风险

把 USDe 的底层资产放在质押平台赚取收益,当然需要面临一些风险,例如质押平台被黑客攻破等,当然了,这不仅仅是 USDe 所要面临的风险。

2、期货合约平台的风险

例如平台作恶、受到黑客攻击等。

3、资金费率风险

虽然空头头寸的资金费率大多数时候为正,但也存在转负的可能性,如果在加权质押收益之后的综合收益率为负,对于「稳定币」的影响比较大。

总之,虽然算法稳定币不是 Ethena 的原创,但相比 Luna 来说,Ethena 有许多创新之处,例如 Ethena 使用的是持有现货 ETH 多头和期货 ETH 空头,以这种对冲的模式来实现 USDe 价值的稳定。

目前,稳定币的市场份额已经超过了 1500 亿美元,并且还在持续增长中,其中 USDT 就超过了 1000 亿美元,而 Ethena 旗下的 USDe 目前还不到 20亿美元,距离 USDT 还有50多倍的差距。

另外,如果说 USDT 的发行是由项目方决定,那么 USDe 的发行则由用户来决定,最终 USDe 的规模有多大,将由用户来决定,如果 Ethena 能够持续提供高收益,那么将会吸引更多用户来铸造,这种模式如果能够持续下去,USDe 的规模很可能会超出我们的想象,随着 USDe 的规模越来越大,平台持续平稳运行,那么 USDe 的应用场景会越来越多,也将会嵌入到更多的 DeFi 应用中,甚至有可能会成为基础稳定币。

而 ENA 作为 Ethena 平台代币,将会捕获 Ethena 平台发展所带来的价值,随着 USDe 规模越来越大,使用场景越来越丰富,ENA 价格自然会水涨船高,目前 ENA 市值已突破 10亿美元,如果对标 LUNA 上百亿美元的市值,ENA 的未来空间还是非常大的。当然了,Ethena 的这种创新模式能否持续,还需等待时间的验证,我们拭目以待。

P.S 本文不构成任何投资建议。

The quality of the new coin mining project launched by the author Bi 'an in recent issues has obviously improved. For example, both the mining income and the follow-up performance of the token after it was launched are still quite eye-catching. Take the algorithm of stabilizing the coin launched on March as an example. What are the innovations of the price increase since it was launched? The inspiration of this innovative project comes from the article published by the founder last year, which mentioned his idea of creating a new generation of stable coins, that is, creating a stable coin with the same amount of cash. The idea of the stable currency supported by the head and the futures short position has become a reality, but it has not been used as the main target asset for opening positions, but has chosen the synthetic dollar agreement based on the Ethereum. It has introduced a dollar stable currency as its platform token, which is actually an algorithm to stabilize the currency sum. The casting mechanism of the stable currency cast through the agreement is different. Its underlying asset is not the dollar, but the mortgage asset is composed of the same amount of spot bulls and futures short positions. In this way, hedging can be realized, which is what we often hear, so it can remain stable regardless of the price rise and fall. In professional terms, it is neutral, and these assets are not stored in the centralized exchange, but are hosted on these platforms, so that to some extent, the risks such as running away or misappropriation of the exchange can be avoided. The competition of the stable currency track is very fierce. How can we gain more market share in the face of such an old stable currency? The biggest highlight is the quality of yield. Mortgage users can share the double benefits from mortgaged assets. First, the year is the pledge year, and more and more projects are pledged and re-pledged on the track. For example, at least these pledge platforms can obtain relatively stable pledge benefits. For example, they can pledge on the platform to obtain the left and right annualized benefits, which can ensure a most basic stable income. Secondly, they can obtain a certain capital rate on these futures platforms. Although the capital rate is an unstable factor, for short positions, In the long run, the capital rate is positive for most of the time, which also means that the overall income will be positive. Let's take a look at the specific annualized rate of return picture. According to the statistics of the platform, the lowest rate of return is around, and the highest rate is around, which is much higher than the rate of return provided by other platforms. Three financing pictures have merged with $10,000 through two rounds of financing. The most recent financing took place on March this year, when the valuation of $10,000 was completed. The investment team was very luxurious, for example, in both rounds of financing. In the capital team, we also saw the figures of these traditional financial giants, and the founders of several other platforms' derivatives trading platforms also participated in the investment. 4. According to the statistics of the platform, the growth rate is very fast. At the beginning of this year, only a few dollars have now reached 100 million dollars, which has doubled in a month. The contribution provided by the platform is far higher than that of other platforms. The current casting volume has also exceeded 100 million pictures. According to the platform data, the average monthly income of the platform can reach more than 10 thousand dollars, and the average daily income can be increased. Compared with the profitability of other platforms, the profitability of the platform can be said to be quite strong. Of course, it remains to be seen whether this high income can last. 5. The risks mainly come from the risk of the pledge platform. Putting the underlying assets on the pledge platform to earn income, of course, you need to face some risks, such as the hacking of the pledge platform. Of course, this is not only the risk of the futures contract platform, such as the risk of the capital rate of the platform being hacked. Although the capital rate of short positions is positive most of the time, there is also the possibility of turning negative. If the comprehensive rate of return after weighted pledge income is negative, it will have a greater impact on the stable currency. In short, although the algorithm for stabilizing the currency is not original, there are many innovations in comparison, such as using the hedging model of holding spot bulls and futures bears to realize the stable value. At present, the market share of stable currency has exceeded 100 million US dollars and is still growing, among which it exceeds. There is still a gap of many times when it has reached $100 million, but it is less than $100 million at present. In addition, if the distribution is decided by the project side, then the final scale will be decided by the users. If it can continue to provide high income, it will attract more users to cast this model. If it can continue, the scale is likely to exceed our imagination. With the increasing scale of the platform, more and more application scenarios will be embedded. In more applications, it may even become a basic stable currency, and as a platform token, it will capture the value brought by the development of the platform. With the increasing scale and richer usage scenarios, the price will naturally rise. At present, the market value has exceeded 100 million US dollars. If the market value of tens of billions of US dollars is marked, the future space is still very large. Of course, it will take time to verify whether this innovative model can last. This article does not constitute any investment advice. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。