第四次减半倒计时 和OKX 一起见证比特币新纪元

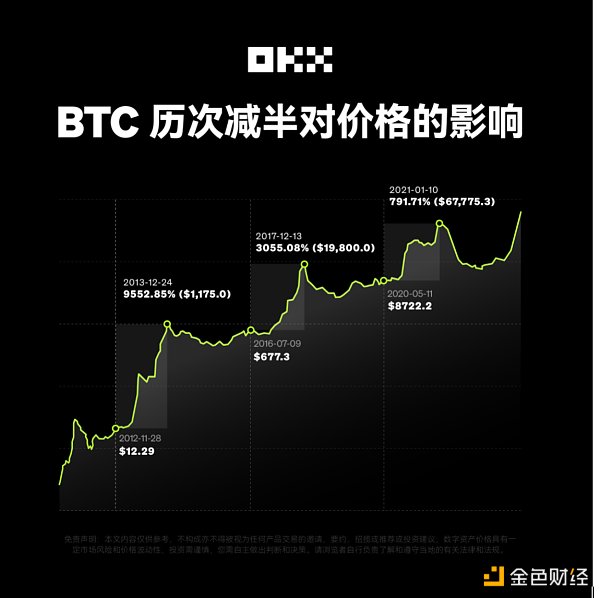

回顾过往,自2009年诞生以来,比特币共经历了三次减半事件,第一次减半时间是 2012 年 11 月,当时开采一个区块的奖励从 50 BTC 降至 25 BTC。第二次减半发生在 2016 年 7 月,区块奖励进一步减少至 12.5 个比特币。此后,比特币开始获得更多主流认可和采用,随着供需关系等因素影响,第二次减半后比特币的价格大幅上涨。虽然没有证据证明减半会带动价格变化,但“减半效应”的预期开始深值人心。

2020 年 5 月,迎来比特币第三次减半,挖矿奖励减少至 6.25 个比特币,这是最特殊的一次减半周期,当时正值全球疫情与宏观经济调整周期,影响市场走势的因素多且复杂。现在,第四次减半将近。

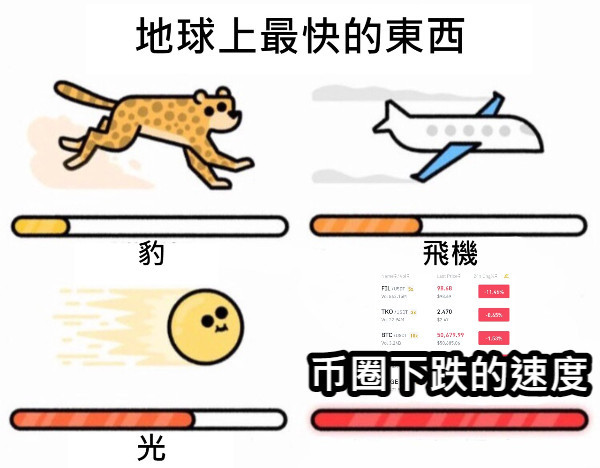

历史数据表明,比特币前两次减半后的时间内,比特币价格都实现了较为大幅度的增长。过往数据在一定程度上为人们观察和预测其市场未来走势提供了参考。

本次减半较以往有哪些不同?

一直以来,比特币价格上涨都与宏观经济周期、供需关系、政策法规以及生态创新有关。减半主要是供需关系的改变,这与以往历次减半并无太大不同,但需要关注的是,比特币现货ETF的通过以及铭文相关创新的出现正在推动比特币市场发生结构性变化。

据 SoSoValue 数据,比特币现货 ETF 3 月 28 日总净流入 1.79 亿美元。昨日灰度(Grayscale)GBTC 单日净流出 1.04 亿美元,目前 GBTC 历史净流出为 147.7 亿美元。昨日单日净流入最多的比特币现货 ETF 为贝莱德(BlackRock)IBIT,单日净流入约为 9512 万美元,目前 IBIT 历史总净流入达 139.6 亿美元。截止发稿前,比特币现货 ETF 总资产净值为 591 亿美元,ETF 净资产比率(市值较比特币总市值占比)达 4.25%,历史累计净流入达 121.2 亿美元。比特币 ETF 的持续采用可能会显著吸收卖压,潜在地重塑比特币的市场结构,提供新的稳定需求来源。

其实,不妨参考黄金 ETF 发展趋势来窥探比特币现货ETF的未来。2004年11月,美国首只黄金ETF——SPDR Gold Shares (GLD)诞生,短短三天内便积聚了超过10亿美元的资产。成立第一年,GLD的管理资产(AUM)迅速攀升至30亿美元以上。至2023年,全球黄金ETF的资产管理规模已达到约1,500亿美元,证明了这些投资工具对黄金市场的深远且持久的影响。

此外,铭文的出现重振了链上活动,截至 2024 年 2 月,已有超过 5900 万个类似 NFT 的收藏品被铭刻,为矿工带来了超过 2 亿美元的交易费用。随着Runes等比特币生态创新协议的陆续上线,比特币生态活力很可能被继续激发。

当然,更重要的是,比特币作为 Crypto 的基石,已在全球拥有超强的价值共识。

目前,比特币累计地址数超过了 1.2 billion。根据 tokenterminal,比特币的月活用户数约 13.7m,链上转上数据是 17.5m。链上数据的增长上,比特币的区块链大小大约为 507GB,比三年前增长了 70%。这些都反映了加密资产,尤其是比特币,使用率的爆炸性增长

与长期建设者OKX 一同迈进比特币生态新纪元

作为比特币生态发展的积极建设者,OKX 研发团队一直被比特币的起源及其极客精神所鼓舞,而这也是OKX 能够在第一时间进场展开生态建设支持工作的核心原因。

自去年开始,Oridinals 协议和 BRC-20 代币标准的诞生带来了铭文的热潮,让人们重新将目光投向了比特币上的资产发行协议,涌现出了像 Atomicals、Runes、BTC Stamps、Taproot Assets 等多样化的资产发行协议,也产生了 ARC-20、SRC-20、ORC-20 等。本质上来讲,铭文赛道为市场带来了一种 Fair launch 的新模式,给比特币生态带来了巨大的关注度,同时,也引起了人们对于比特币生态的重新关注。

除资产发行协议和扩容方案外,基建领域开始有越来越多的项目开始涌现,例如支持铭文的钱包、去中心化索引器、跨链桥、launchpad 等等都在百花齐放的发展中。在一层的资产发型协议及应用层的基础设施建设上,OKX Web3 团队一直在持续发力,此前率先支持Ordinals市场并创下佳绩。

早在去年7月,OKX Web3 Ordinals 市场已经成为BRC20代币交易量最大的Marketplace,如今随着比特币生态的不断发展,OKX Web3 团队几乎从钱包工具、浏览器、交易市场、协议标准、跨链桥以及比特币Layer2等等方方面面对比特币生态建设进行持续建设。一方面,OKX DEX 在早期就已支持比特币跨链交易,在二层扩容方案上,OKX Web3也在陆续支持相关项目的接入,例如 Babylon、Merlin、B²等。另外,最近值得关注的是,OKX Web3 钱包已上线 Runes 市场页面,将在第一时间支持该协议,届时用户可进行 Runes协议资产的铸造和交易等。

目前,OKX Web3 为用户提供了一站式的比特币生态探索体验。用户可以通过Web3钱包轻松获取、交易资产;发现并参与Bitcoin生态的热门项目;以及直接访问DeFi板块,实现比特币资产的链上质押,享受低Gas费用的链上收益等。

此外,作为 OKX旗下的投资基金,OKX Ventures 致力于坚持资助比特币生态创新发展,目前已投资ALEX,B^2 Network,Bitmap Tech,Babylon,bitSmiley,BounceBit,Nubit,Portal DeFi,Zeus Network等项目。据此前报道,OKX Ventures 将拿出 1000 万美金持续投入并支持BTC生态的新锐创业者,加速区块链技术的提高,同时提供服务和资源,帮助合作伙伴共同发展。

回顾比特币过去十余年的发展,每一次周期都是一次进化,作为陪伴与比特币成长并为其生态建设提供强有力支持的OKX也是如此。OKX 首席创新官曾在一次采访中表示,OKX 的团队研发人员有的2012年前后接触研究比特币白皮书,那时候还是比特币还只在极客圈子里流行,每一个创新想法都让人兴奋。此后OKX 的所有创新都会那些最初的精神所鼓舞。如今,比特币随着第四次减半的到来,已然进行到新的发展周期,对于OKX 来讲,不管是Web3业务还是交易所业务亦或是资助创新层面,仍将继续通过创新与比特币乃至加密行业进行下一个10年。

免责声明:

本文章内容仅供参考,不构成亦不得被视为任何产品交易的邀请、要约、招揽或推荐或投资建议;投资需谨慎,数字资产价格具有一定市场风险和价格波动性,尤其合约期权等交易更容易受到市场风险和价格波动的影响,投资数字资产存在风险,甚至可能会导致您损失全部投资金额;因此,数字资产交易未必适合所有投资者,您需了解产品的运作模式,自主做出判断和投资决策。请浏览者自行负责了解和遵守当地的有关法律和法规。

Looking back on the past, Bitcoin has experienced three halving events since its birth in, the first halving time was in, when the reward for mining a block was reduced from to the second halving in, and the block reward was further reduced to a bitcoin in, after which Bitcoin began to gain more mainstream recognition and adoption. With the influence of supply and demand and other factors, the price of Bitcoin rose sharply after the second halving. Although there is no evidence that halving will drive the price change, the expectation of halving effect began to be deeply rooted in people's hearts. The third halving of bitcoin mining reward was reduced to a bitcoin, which is the most special halving cycle. At that time, it coincided with the global epidemic and the macroeconomic adjustment cycle, and there were many and complicated factors affecting the market trend. Now the fourth halving is nearly historical data, which shows that the price of bitcoin has achieved a relatively large increase in the time after the first two halving. The past data provides a reference for people to observe and predict the future trend of its market to some extent. In the past, the increase in bitcoin prices has been related to the macro-economic cycle, policies and regulations on supply and demand, and ecological innovation. The halving is mainly the change of supply and demand, which is not much different from the previous halving. However, it should be noted that the adoption of bitcoin spot and the emergence of related innovations in inscriptions are promoting the structural changes in the bitcoin market. According to data, the total monthly net inflow of bitcoin spot was $100 million yesterday, and the net outflow of gray scale was $100 million yesterday. The special currency spot has a net inflow of about USD 10,000 for BlackRock in a single day. At present, the total historical net inflow has reached USD 100 million. Before the deadline for publication, the total net asset value of bitcoin spot has reached USD 100 million. The market value is higher than the total market value of bitcoin, and the cumulative historical net inflow has reached USD 100 million. The continuous adoption of bitcoin may significantly absorb selling pressure and potentially reshape the market structure of bitcoin, providing a new and stable source of demand. In fact, we might as well refer to the development trend of gold to spy out the future of bitcoin spot. The birth of the first gold in the United States is short. In a short period of three days, it accumulated more than $100 million in assets, and the assets under management in the first year of its establishment quickly climbed to more than $100 million. By, the asset management scale of global gold had reached about $100 million, which proved that these investment tools had a far-reaching and lasting impact on the gold market. In addition, the appearance of inscriptions revived the activities on the chain. As of June, more than 10,000 similar collections have been engraved for miners, bringing more than $100 million in transaction costs. With the online bitcoin ecological innovation agreement, etc. The power is likely to continue to be stimulated. Of course, what is more important is that Bitcoin, as the cornerstone, has a strong value consensus in the world. At present, the cumulative number of bitcoin addresses exceeds the number of monthly users of Bitcoin. The data on the chain is the growth of data on the chain. The blockchain size of Bitcoin has increased about three years ago, which reflects the explosive growth of encryption assets, especially the usage rate of Bitcoin, and the long-term builders have entered a new era of bitcoin ecology. The builder's R&D team has always been inspired by the origin of Bitcoin and its geek spirit, which is also the core reason for being able to enter the market to support the ecological construction in the first time. Since last year, the birth of agreements and token standards has brought about an upsurge of inscriptions, which has made people pay attention to the asset issuance agreements on Bitcoin again, and various asset issuance agreements such as the one have emerged. In essence, the inscription track has brought a new model to the market and brought a huge impact on Bitcoin ecology. At the same time, the attention has also aroused people's renewed concern about the bitcoin ecology. In addition to the asset issuance agreement and expansion plan, more and more projects have begun to emerge in the infrastructure field. For example, the wallet that supports the inscription is decentralized, the indexer crosses the chain bridge, and so on, all of which are in the development of flowers. In the infrastructure construction of the asset hairstyle agreement on the first floor and the application layer, the team has been making continuous efforts to take the lead in supporting the market and achieve good results. As early as last month, the market has become the largest transaction volume of tokens. With the continuous development of bitcoin ecology, the team has continued to build bitcoin ecology from almost all aspects, such as wallet tools, browsers, trading market protocols, standards, cross-chain bridges and bitcoin. On the one hand, it has supported bitcoin cross-chain transactions in the early stage, and it is also supporting the access of related projects in the second-floor expansion plan. For example, recently, it is noteworthy that the wallet has been launched and the market page will support the agreement in the first time, when users can cast and trade the agreed assets. It provides users with a one-stop bitcoin ecological exploration experience. Users can easily obtain trading assets through wallets, discover and participate in popular ecological projects, and directly visit the plate to realize the online pledge of bitcoin assets and enjoy low-cost online benefits. In addition, as its investment fund, it is committed to insisting on funding bitcoin ecological innovation and development, and has invested in projects such as it has been previously reported that it will spend US dollars to continuously invest and support emerging entrepreneurs in ecology to accelerate the improvement of blockchain technology. Providing services and resources to help partners develop together. Looking back on the development of Bitcoin in the past ten years, every cycle is an evolution, as well as accompanying the growth of Bitcoin and providing strong support for its ecological construction. The chief innovation officer once said in an interview that some team R&D personnel contacted and studied the white paper on Bitcoin years ago. At that time, Bitcoin was still only popular in geek circles, and every innovative idea was exciting. All innovations after that would be the original essence. Inspired by God, Bitcoin has now entered a new development cycle with the arrival of the fourth halving. For me, whether it is business or exchange business or financing innovation, it will continue to make a disclaimer with Bitcoin and even the encryption industry for the next year through innovation. The content of this article is for reference only and cannot be regarded as an invitation for any product transaction, solicitation or recommendation or investment advice. Investment should be cautious. The price of digital assets has certain market risks and price fluctuations, especially contracts. Options and other transactions are more susceptible to market risks and price fluctuations. Investing in digital assets is risky and may even cause you to lose all the investment amount. Therefore, digital asset transactions may not be suitable for all investors. You need to know the operation mode of products and make your own judgments and investment decisions. Visitors are responsible for understanding and abiding by relevant local laws and regulations. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。