牛市阶段性复盘:新资产发行模式将催生新的基础设施以及应用

作者:jolestar 来源:X,@jolestar

瀑布洗脸,群里一片哀嚎,推上也不再亢奋,冷静下来阶段性复盘一下这波牛市。

这波牛市还没有看到可复制的应用模式出来,没有 17 年 ICO,20 年 DeFi 那样各种项目齐发的盛况,所以我一直认为真正的牛市还没到来。但出现了许多新类型的资产发行模式的尝试,Bitcoin 上的新资产协议(Inscription,Atomicals,RGB/RGB++),各链的铭文协议,Meme Coin,图币,SFT 等。

作为一个 Builder,我看问题的角度是有没有可以构建应用的机会,这些尝试的启示是什么?我总结了两点。

CSV 模式的资产得到初步验证

首先,Bitcoin 的 Inscription 验证了一点:资产数据定义在链上,合法性校验在链下的模式是可行的,它预示了一种新的资产发行方式和扩容方式,这点我在 https://twitter.com/jolestar/status/1732711942563959185 有提到。Bitcoin 上衍生的所有协议,包括 RGB/RGB++,Atomicals 都属于这个范式,可以称为广义的客户端验证资产(Client-side validation)。而这种资产是介于 L1 和 Offchain(L2) 之间的一种资产,它可以定义一种协议内的桥,实现资产从 L1 到 Offchain 之间的迁移,这点 RGB++ 协议已经初步验证了,就是它的跃迁机制。而这种能力,所预示的一种区块链的扩容方式是资产从 Bitcoin 溢出到 Offchain(包括其他的公链)的基础设施,从而带来整个区块链生态的繁荣。

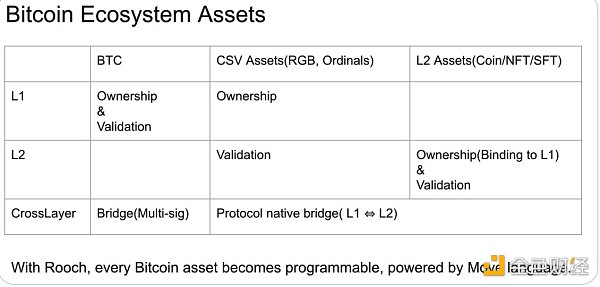

附上一张我在香港 @BTCSCYLab组织的 Bitcoin Layer2 Conference上分享的一张图:

这种模式有别于 Ethereum 的生态范式,资产的应用场景可以不再局限于 L1 提供的智能合约环境,而是通过 Offchain 的智能合约环境来提供,让应用的构建没有了技术瓶颈。

资产先行的应用启动模式正在验证

如果构建应用的技术瓶颈被突破,另外一个问题就是应用如何启动。传统的方式是构建应用,吸引用户,然后发行资产。而这波新资产发行模式想验证的途径是,资产先行,构建社区,然后基于社区构建应用,为资产提供使用场景。这种模式吸引用户和构建社区已经初步验证,但应用启动还需要摸索,有几个难题需要解决:

1. 公平分发容易吸引用户,也可以减少欺诈,但构建应用的初始化成本如何解决。

2. 构建应用需要时间,流动性太高的资产可能等不到应用诞生。所以初始化发行低流动性资产比较合适,成长后变为高流动性资产,但如何无缝切换,是一种探索的方向(ERC404,Movescriptions)。

虽然有许多难题,但这种模式的优势也很明显:

1. 资产先行,应用是资产的衍生品,而不是反过来,这样资产的生命周期才能超过应用的生命周期。

2. 只有这种模式,才能出现同一种资产在多个应用种中被使用的可组合场景,而这种组合能力,是区块链应用有别于 Web2 应用的最关键的点。

3. 这种模式下,应用团队可以不需要发行资产,直接通过给资产提供场景而获益,从而解决 Web2 应用开发团队的面临的合规问题。

而以上两个探索方向的结合,会促生大量资产以及应用出现,那时候百花齐放,才是真正牛市。

The author's source is a cry in the waterfall wash group, and it is no longer exciting. Calm down and make a phased resumption of this bull market. This bull market has not yet seen a replicable application model, and there is no grand occasion for various projects to be launched year after year. Therefore, I always think that the real bull market has not yet arrived, but there have been many new types of asset issuance models, such as new asset agreements, inscriptions on various chains, coins, etc. As a perspective, is there any chance to build applications? What is the enlightenment? I summarized the assets of the two-point model and got a preliminary verification. First of all, I verified that the model of asset data definition on the chain and legitimacy verification under the chain is feasible. It indicates a new way of asset issuance and expansion. I mentioned that all the protocols derived from this paradigm can be called generalized client verification assets, and this asset is an asset between and. It can define a bridge within the protocol to realize the migration of assets from to. The point protocol has been initially verified as its transition mechanism, and this ability indicates that a blockchain expansion mode is that assets overflow to infrastructure including other public chains, thus bringing the ecological prosperity of the whole blockchain. Attached is a picture I shared at the Hong Kong organization. This model is different from the ecological paradigm asset application scenario, which can no longer be limited to the smart contract environment, but can be provided through the smart contract environment, so that the application construction has no technical bottleneck. Production-first application startup mode is being verified. If the technical bottleneck of building applications is broken, another problem is how to start applications. The traditional way is to build applications to attract users and then issue assets. The way to verify this new asset issuance mode is to build assets first and then build applications based on communities to provide usage scenarios for assets. This mode of attracting users and building communities has been initially verified, but there are still several problems to be solved in application startup, which are fair distribution and easy to attract. Attract users can also reduce fraud, but how to solve the initialization cost of building an application takes time. Assets with too high liquidity may not wait for the birth of the application, so it is more appropriate to initialize and issue low-liquidity assets and turn them into high-liquidity assets when they grow up. However, how to seamlessly switch is a direction of exploration. Although there are many problems, the advantage of this model is also obvious. Assets are used first as derivatives of assets, not vice versa, so that the life cycle of assets can exceed the life cycle of applications. Only in this mode can the same asset be used in multiple application scenarios, and this combination ability is the most critical point that distinguishes blockchain applications from applications. In this mode, application teams can directly benefit from providing scenarios for assets without issuing assets, thus solving the compliance problems faced by application development teams. The combination of the above two exploration directions will promote the emergence of a large number of assets and applications. At that time, it is a real bull market. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。