万事达U卡 银联U卡 能否保证安全出U不被冻卡

引言:

买卖虚拟货币,最怕的就是收到黑钱。

一旦被冻卡,解冻有多难,经历过的朋友都知道。据我们的办案经验,各地公安对买卖虚拟货币的当事人普遍抱有负面印象,即使被冻卡的当事人本身是无辜的,在与公安机关沟通解冻银行卡时,也会被要求以“退赔被害人涉案款”为解冻的前提条件,更有甚者,还会被扣上“帮信罪”、“掩隐罪”的帽子(可参阅这篇文章了解→《【吐槽贴】买U卖U,会遇到的一些魔幻事》)。

所以怎么才能不被冻卡?这是币圈人,尤其是游走币圈从冻友们普遍关心的问题。

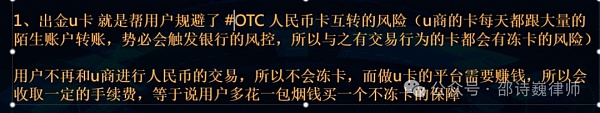

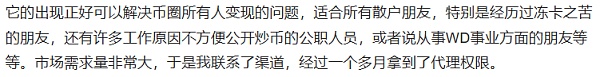

最近就有个冻友咨询邵律师,给我发来了网上看到的一些资料(如图),问:好多人都在用的万事达U卡,能用吗?用U卡出金是不是就不会被冻卡了?

所以今天写篇小文,来聊聊各种U卡,以及使用U卡的利弊,为有此类疑问的朋友做个解答。

U卡是什么?

U卡的使用方式,可以简单概括为,将虚拟货币(包括但不限于USDT)从钱包地址发送到万事达卡的链上地址,用户可以在中国境内直接使用该卡刷卡消费,也可以直接在ATM机从该卡中提现为人民币。

持卡人可绑定支付宝、美团、饿了么等APP,丝滑的将U卡作为支付工具在国内消费,无需再通过OTC的方式走一道虚拟币兑换法币的流程。

根据我国相关政策,比特币等虚拟货币被视为一种特定的虚拟商品,不具有与货币等同的法律地位,在我国不能且不应作为货币在市场上流通使用。但使用国际U卡的支付方式,似乎神奇的实现了将虚拟币等同于法币的功能?

其实并非如此。用户充值进入U卡的虚拟币会被卡片的运营方结算为外币,用户在国内使用U卡交易,和其他具有国际支付功能的银行卡并无区别,因为存在国际结算协议,国内的商户、支付宝等平台收取的仍然是法币。

U卡可分为实体卡和虚拟卡,例如, “银联U卡”和“万事达U卡”等为实体U卡,“dupay”为虚拟U卡。各类卡的费率及使用条件略有不同,详见下图。

(来源:up大话闲游)

使用U卡的利弊

1、可远离冻卡风险

我们经常说买卖虚拟货币虽然国内并不禁止,但风险确实还挺高的,轻则冻卡,重则涉及刑事犯罪。你把U卖给别人,如果别人转给你的款项是其或者其上游违法犯罪所得(比如杀猪盘骗来的,或网赌跑分洗钱的等),那么被冻卡的概率非常大。

所以,被冻卡的原因在于,一、你使用的是国内的银行卡,二、你收到了异常的往来款(法币),触发了银行的风控系统。

但是U卡这个东西,本身就是国外的银行卡,而且卡里收到的也不是法币,是虚拟货币,和国内的银行也没啥关系,当然不会被冻卡了。

那有人会问:假如我的万事达U卡收到了黑U呢?会有什么风险?会被冻结吗?

2、U卡收到黑U怎么办?

有了U卡,就不需要将自己手中的U通过OTC的方式变现为法币,自然不会存在收到赃款的问题。但卡里会不会收到黑U,这个问题确实难以完全避免。

但需要明白一个概念,U本身是不会被标记为黑U的,只有地址会是黑的。如果在一个案件当中,行为人是通过U来走账的,币安、OK等大型交易所会将涉案相关的地址拉黑,如果收到了从被交易所拉黑的地址中转入的U,那么收U的账号就会被交易所封掉,账户内的币只进不出。

用U卡收U,不走交易所,就不会触发交易所的风控机制。所以收到黑U,也不影响消费和取现。除非,这些U卡的发卡机构有相关的KYT风控措施(Know Your Transaction,了解你的交易。KYT是一种金融机构用来监控和跟踪金融交易是否存在欺诈或可疑活动的过程,可以帮助金融机构识别每笔交易的来源和去向,评估交易风险,采取相应的措施,以及向监管部门报告可疑交易),在此前提下,收到黑U会确实存在卡被冻结的风险。

据网传,中国央行要求万事达u卡等国际U卡提供取款异常的客户名单,但似乎没有看到权威的官方消息。

3、使用U卡交易能避免帮信罪、掩隐罪等刑事风险吗?

涉及帮信、掩隐罪的原因在于,自己的银行卡中收到了上游的涉案赃款。所以很多人认为,卡里收到的是U,不涉及银行卡收款,那么就不存在刑事风险。但并非如此。

各类U卡均不支持转账,只能消费或取现,所以不存在通过U卡本身与他人交易,进行上下游的转入转出,确实大大降低了不法交易的可能。但是还是会有人利用U卡做搬砖套利生意:双方约定好U兑法币的差价后,利用自己的U卡帮他人收U,从ATM上取现的差额就是自己的利润。如果转入的U是诈骗所得,上游将诈骗所得的¥→USDT→汇入你的U卡→套现为¥,这一整个链条下来,不是掩隐是什么?

并且,以万事达U卡为例,开卡费300U,月管理费1欧,充U费率1%,ATM取现费率2%,成本那么高都有人愿意给你U让你给他套现,这不明摆着有问题吗?这种交易模式还主张自己主观不明知?么有律师能救得了你。。

4、被认定为非法买卖外汇的法律风险

关于买卖USDT涉及非法经营罪的法律风险,邵律师此前已写过多篇文章做过科普→(《越来越多的U商可能会被定非法经营罪》,《OTC商家涉刑风险之非法经营罪》《介绍他人买卖外汇,小心非法经营罪!》,《帮人换汇,被判非法经营罪》),所以本文当中就不再赘述。

在 USDT→汇入U卡→套现为¥ 的交易链条中,如果上游的U是外币换来的,那么分为2种情况:

①兑换人民币是不以经营为目的的纯自用,系行政违法行为,被外汇管理机关发现,会被处以行政罚款。

②如果是以赚差价为目的的高频次、收取不特定对象的交易,被司法机关认定为倒买倒卖外汇、变相买卖外汇的,则会被定性为非法经营罪。

5、U卡骗局

自己申请U卡还是有一定门槛的,所以很多小白会去找代理,但代理也是鱼龙混杂,如果不幸遇到了骗子,维权也是很难的。比如,骗子给你的U卡是一张二手卡,在指导你操作过程中,发给你的充值链接其实是授权,当你把大额的U充值到卡中,你会发现卡里的U被神奇的转走了。

写在最后:

所以,回到本文最初的问题本身:U卡能不能用?答案是可以,但仅限自用,将自己手中的U变现。它更像是超市的充值卡,即存即用。如果想用它来进行搬砖套利,或者把它作为换汇的工具,那么由此引发的法律风险还是很高的。

有问题的从来不是工具本身,而是使用它的人。

国内U卡代理行业也存在诸多问题,比如,宣传有了U卡之后出U就不会冻卡了,比如,在讲述U卡的优势的时候,列举此卡适合网赌人员、断卡惩戒人员使用,适合公职人员炒币……等等。这么明目张胆的宣传,不是等着国家出手么?

(网络上U卡代理商的宣传文案)

邵律师判断,U卡在我国未来的生命周期应该不会很长。很简单的道理:

首先,它增加了虚拟货币在我国的使用场景,与我国一直以来的相关政策当中,对虚拟币的否定态度相违背。

其次,国家打击“两卡”犯罪,开展“断卡”行动已经好几年了,这种U卡代理推广,有没有让被“断卡惩戒”人员使用此卡的意思在里面?

所以说,这玩意儿很容易被玩坏的。

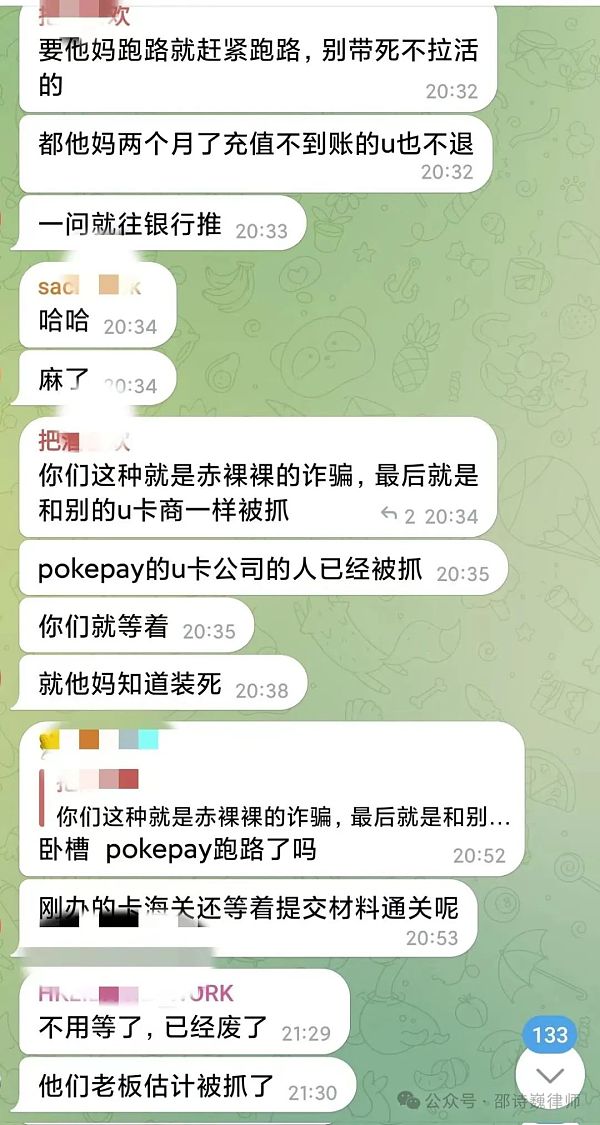

据说小道消息,U卡好几个项目方被各地警方按头了,出现了充值不到账以及ATM无法取现的问题,也不知是真的假的。

Introduction The biggest fear of buying and selling virtual currency is how difficult it is to receive black money once it is unfrozen by frozen cards. Friends who have experienced it all know that according to our experience in handling cases, public security everywhere generally have a negative impression on the parties who buy and sell virtual currency. Even if the parties who have been frozen cards are innocent, they will be required to refund the money involved in the case when communicating with the public security organs to unfreeze the bank cards. What's more, they will be labeled as the crime of helping the letter and concealing the crime. Please refer to this article to learn about the trade fair. How to avoid being frozen is a common concern of people in the currency circle, especially those who wander around the currency circle. Recently, a frozen friend consulted Mr. Shao and sent me some information seen on the Internet, as shown in the picture. Can MasterCard, which is used by many people, work? Will it not be frozen if you use the card to make money? So today, I will write a small article to talk about various cards and the advantages and disadvantages of using the card. For friends who have such questions, how to use the card can be simple. Summarized as sending virtual currency including but not limited to the chain address sent from wallet address to MasterCard, users can use the card to swipe their cards directly in China, or they can directly withdraw money from the card on the machine as RMB. Cardholders can bind Alipay, Meituan is hungry, etc., and use the card as a payment tool to spend in China without going through the process of converting virtual currency into legal currency. According to China's relevant policies, virtual currency such as Bitcoin is regarded as a specific virtual commodity. The legal status of currency equivalence cannot and should not be used as currency in the market in China, but the payment method using international cards seems to magically realize the function of equating virtual currency with legal currency. In fact, this is not the case. The virtual currency that users recharge into the card will be settled as foreign currency by the card operator. There is no difference between the use of cards by users in China and other bank cards with international payment functions, because there is an international settlement agreement, and the legal currency cards collected by domestic merchants such as Alipay are still separable. For physical cards and virtual cards, such as UnionPay cards and MasterCard, the rates and conditions of use of physical cards are slightly different. See the picture below for details. The advantages and disadvantages of using cards can be far away from the risk of frozen cards. We often say that although buying and selling virtual currency is not prohibited in China, the risk of frozen cards is really high. If you sell them to others, if the money transferred to you by others is the proceeds of their or their upstream crimes, such as swindling pig-killing or online gambling, money laundering will be involved. The probability of being frozen is very high, so the reason for being frozen is that: first, you use a domestic bank card; second, you receive an abnormal current payment in legal tender, which triggered the bank's risk control system. But the card itself is a foreign bank card, and what is received in the card is not legal tender, which has nothing to do with domestic banks. Of course, it will not be frozen. Then someone will ask if my MasterCard is hacked, what risks will it be frozen? What should I do if the card is hacked? You don't need to turn the way you pass into legal tender. Naturally, there will be no problem of receiving stolen money, but it is really difficult to completely avoid the problem of whether the card will be hacked. However, it is necessary to understand that a concept itself will not be marked as black, only the address will be black. If in a case, the actor will blacken the address related to the case through the currency security and other large exchanges, and if the account received from the hacked address is received, it will be blocked by the exchange. The exchange will not trigger the exchange's risk control mechanism unless the coins in the account can't get in or out, so receiving the black card will not affect the consumption and cash withdrawal, unless the card issuers of these cards have relevant risk control measures to understand that your transaction is a process used by financial institutions to monitor and track whether there is fraud or suspicious activity in financial transactions, which can help financial institutions identify the source and destination of each transaction, assess the transaction risk, take corresponding measures and report suspicious transactions to the regulatory authorities. There is indeed a risk that the card will be frozen after receiving the black meeting. It is rumored that the central bank of China requires MasterCard and other international cards to provide a list of customers with abnormal withdrawals, but it seems that there is no authoritative official news. Can the use of card transactions avoid criminal risks such as the crime of helping the letter to conceal? The reason for the crime of helping the letter to conceal is that the upstream money involved has been received in your bank card, so many people think that the card received does not involve bank card collection, so there is no criminal risk, but it is not the case. All kinds of cards do not support transfer. Accounts can only be consumed or cashed out, so there is no transaction between upstream and downstream through the card itself, which greatly reduces the possibility of illegal transactions. However, there will still be people who use the card to carry out arbitrage business. After the two sides have agreed on the difference between the exchange of legal tender, they will use their own cards to help others collect the difference from the cash withdrawal, which is their own profits. If the fraud proceeds are transferred upstream, the fraud proceeds will be remitted to your card for this whole chain. What is it? Take MasterCard as an example. The monthly card fee management fee, the European charge rate and the cash withdrawal rate are so high that people are willing to give you cash. Isn't it obvious that there is a problem? This trading model also advocates that you are subjectively unaware that no lawyer can save you from the legal risk of illegal trading of foreign exchange. Lawyer Shao has written many articles and done popular science before, and more and more businessmen may be convicted of illegal business. The crime of illegal business involving criminal risks involves introducing others to buy and sell foreign exchange carefully. The crime of illegal business is convicted of illegal business, so I won't go into details in this article. In the transaction chain where the remittance card is cashed in, if the upstream is exchanged in foreign currency, it can be divided into two situations. The exchange of RMB is purely for personal use without the purpose of business. If the administrative illegal act is discovered by the foreign exchange management authorities, it will be punished by administrative fines. If the transaction of collecting unspecified objects at high frequency for the purpose of earning the difference is recognized by the judicial authorities as buying and selling foreign exchange in disguise, it will be classified as non-business. There is still a certain threshold to apply for a card by running a crime card scam, so many white people will go to an agent, but the agent is also a mixed bag. It is also very difficult to defend their rights if they unfortunately meet a liar. For example, the card given to you by a liar is a second-hand card, and the recharge link sent to you in the process of guiding your operation is actually authorized. When you recharge a large amount of money into the card, you will find that it has been magically transferred and written at the end, so go back to the original question of this article. The answer is yes, but it is only for personal use. It is more like a prepaid card in a supermarket that can be 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。