加密货币分析师表示:比特币 ETF 需求可能会上升

Young Ju 指出,新的 BTC 鲸鱼的链上成本基础约为 56,000 美元,预计如果 BTC 达到这一价格水平,大量资本将涌入现货比特币 ETF 市场。

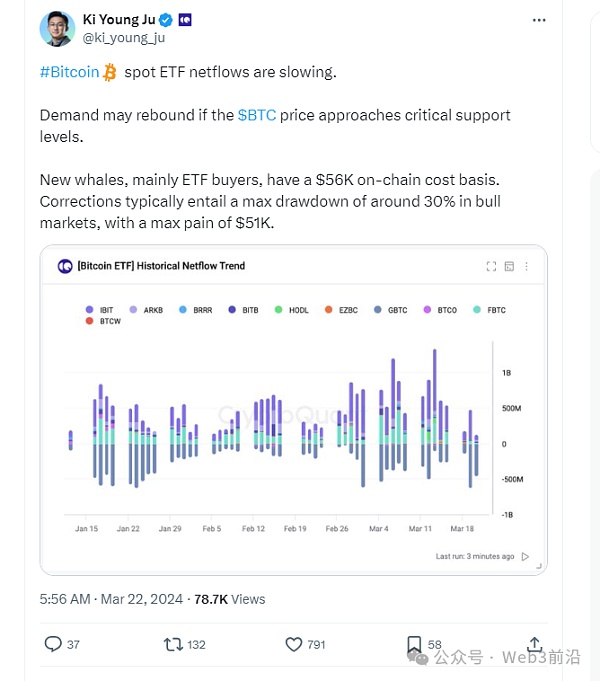

在比特币价格下跌的背景下,近期比特币ETF现货市场一片惨淡。尽管净流量持续下降,CryptoQuant 的著名分析师兼首席执行官 Ki Young Ju 预测现货比特币 ETF 市场可能会复苏。

3 月 22 日,Ki Young Ju在X 上发帖表示,即使 BTC 价格继续下跌,现货比特币 ETF 净流量也可能会上升。该分析师利用历史净流量趋势的数据指出,当加密货币追踪到一定的支撑位时,对比特币 ETF 的需求通常就会出现。

根据分析公司 BitMEX Research 的数据,这些 BTC ETF 在过去四个交易日中录得负流量。这种情况的标志是Grayscale 的 GBTC 大幅流出,而其他 ETF(主要是市场领导者 BlackRock 的 IBIT 和 Fidelity 的 FBTC)的流入量创历史新低。

Young Ju 指出,新的 BTC 鲸鱼,尤其是 ETF 买家,其链上成本基础约为 56,000 美元。这表明重要的比特币持有者,特别是 ETF 投资者,通常以 56,000 美元的平均价格购买比特币。

根据这种模式,加密货币量化专家预计,如果 BTC 达到上述价格门槛,将会有大量资金流入现货比特币 ETF 市场。

比特币

$64,606

过去一周价格在 62,000 美元至 68,000 美元之间波动。然而,Young Ju 表示,考虑到调整通常最多会下降 30%,这种下降是合理的。随着 BTC 最近达到 73,750 美元的峰值,分析师预测该资产的价格可能会跌至 51,000 美元。

然而,在过去 48 小时内,BTC 的价格从历史新高 73,835 美元下跌了 13%,一度跌至 60,000 美元附近。此次调整是由于市场过热造成的,分析师将其称为“减半前回撤”,距离比特币减半事件还有大约 30 天。

CryptoQuant 的一份报告显示,鉴于新投资者的投资流量相对较低,且价格估值指标仍低于过去市场顶部的水平,比特币牛市周期尚未结束。

与此同时,即将到来的比特币减半事件预计将推动比特币价格上涨,迎来抛物线上升趋势。根据CoinMarketCap的减半倒计时,距离比特币下一次减半事件还有不到31天。

It is pointed out that the chain cost base of the new whale is about US dollars. It is expected that if this price level is reached, a large amount of capital will flood into the spot bitcoin market. In the context of falling bitcoin prices, the spot bitcoin market is bleak recently, although the net flow continues to decline. The famous analyst and CEO predicted that the spot bitcoin market may recover, and posted on April that even if the price continues to fall, the net flow of spot bitcoin may rise. The analyst pointed out by using the data of historical net flow trend. When cryptocurrency reaches a certain level of support, the demand for bitcoin usually appears. According to the data of the analysis company, the signs of this situation that negative traffic has been recorded in the past four trading days are a large outflow, while the inflow of other major market leaders has reached a record low. The source Qi Yingzhu pointed out that the cost base of new whales, especially buyers, is about US dollars, which shows that important bitcoin holders, especially investors, usually buy bitcoin at the average price of US dollars. According to this model, experts predict that if the above price threshold is reached, a large amount of money will flow into the spot bitcoin market. The price of bitcoin fluctuated between US dollars and US dollars in the past week. However, considering the adjustment, it usually falls at most. This decline is reasonable. With the recent peak of US dollars, analysts predict that the price of this asset may fall to US dollars. However, in the past hour, the price has fallen from a record high of US dollars to near US dollars. This adjustment is due to the market. Analysts caused by overheating call it the retreat before halving. A report shows that the bull market cycle of Bitcoin is not over yet, given that the investment flow of new investors is relatively low and the price valuation index is still lower than the previous level at the top of the market. At the same time, the upcoming bitcoin halving event is expected to push the price of Bitcoin to rise and usher in a parabolic upward trend. According to the countdown, the next bitcoin halving event is less than a day away. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。