CoinGecko:历次减半比特币平均上涨3230%

原文作者:Shane Neagle,CoinGecko,原文来源:coingecko

每次减半后比特币价格表现如何?

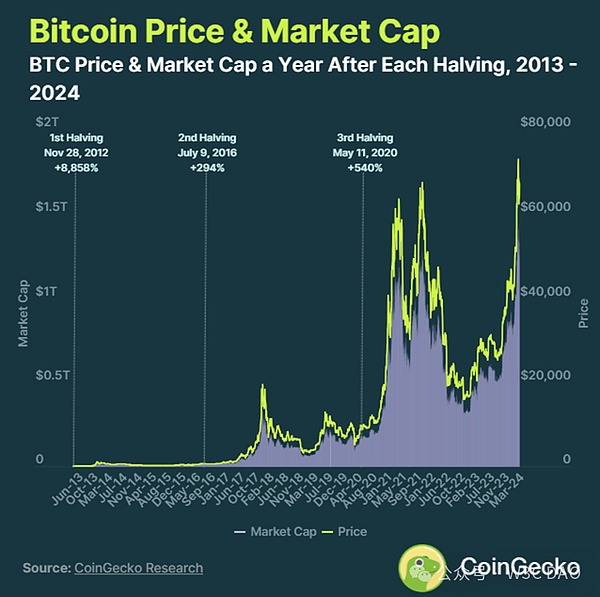

每次减半后,比特币价格在一年内平均上涨3230%。然而,考虑到比特币在早期的新颖性,缺乏市场成熟度,以及收益递减的情况。

在进一步研究减半的收益递减之前,比特币价格在前三次减半中究竟是如何表现的?

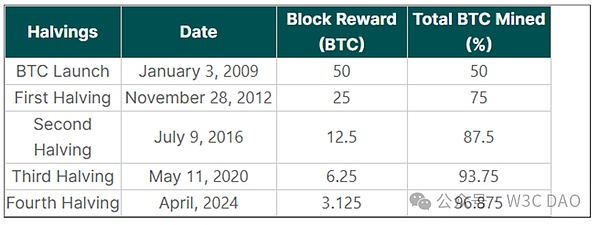

当比特币主网于2009年1月3日上线时,区块奖励是丰厚的50 BTC。

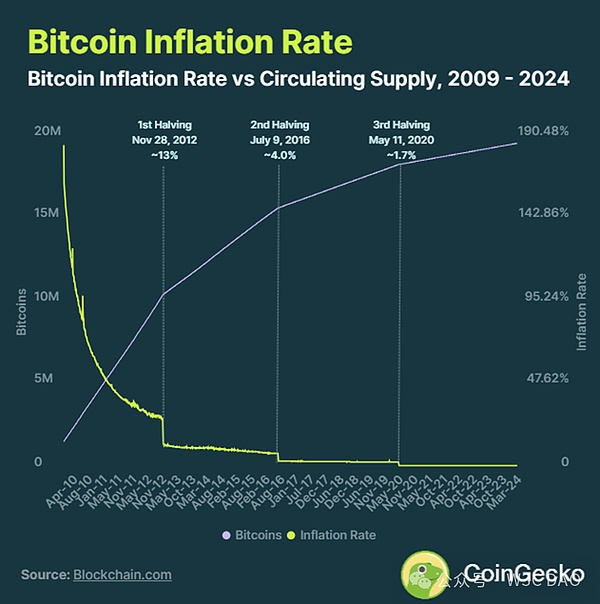

第一次减半:2012年11月28日,从50 BTC降至25 BTC。在12个月内(截至2013年11月28日),BTC的价格从大约12美元上涨到1075美元,导致估值上涨8,858%。到2022年1月,比特币的通胀率从25.75%上升到12%。

第二次减半:2016年7月9日,从25 BTC降至12.5 BTC。在12个月内(截至2017年7月9日),比特币价格从约650美元上涨至2,560美元,导致估值上涨294%。到2016年8月,比特币的通胀率从8.7%上升到4.1%。

第三次减半:2020年5月11日,从12.5 BTC降至6.25 BTC。在12个月内(截至2021年5月11日),BTC的价格从约8,727美元上涨至55,847美元,导致估值上涨了540%。到2020年6月,比特币的通胀率从3.7%升至1.8%。

从这种模式来看,很明显,比特币减半往往会带来递减的回报。

尽管第三次减半后的涨幅大于第二次减半后的涨幅,但美联储货币供应的增加给这一点蒙上了阴影。通过增加M2货币供应量,美联储有效地重新定价了比特币。

这一点在美联储于2022年3月开始通过新一轮加息周期抑制资产价格、扭转趋势后变得明显。

比特币市值减半前后

在2012年11月28日比特币首次减半的前一周,比特币的市值仅为1.233亿美元。减半后的一天,上升至1.303亿美元。在三个月内,到2013年2月底,比特币的市值达到了3.352亿美元。仅仅一个月后,比特币就以9.474亿美元的市值接近10亿美元的里程碑。

2016年7月9日的第二次减半则是另一番景象。由于预期会减半,比特币的市值在一个月前升至119亿美元的年度高点。一周前,比特币的市值为102亿美元。三个月后,市值实际上跌至96亿美元。在市场调整之后,直到2017年1月,比特币才达到164亿美元的历史新高。

最后,比特币在2020年5月的第三次减半始于1825亿美元。在三个月内,比特币的市值增加到2173亿美元。

市场事件和成熟度比减半发挥更大的作用,尽管它们是跳跃点。2016年8月,Bitfinex遭到黑客攻击,抵消了3个月的涨幅。然而,这只是延迟到2017年1月新的ATH市值。

为什么比特币减半很重要?

实际上,比特币减半是一种抑制通胀的机制。与法定货币不同的是,根据央行的行动,法定货币的通货膨胀率是不可预测的,比特币的通货膨胀率是可预测的,不可改变的,并且每次减半都会下降。

在每四年一次的减半事件中,矿工保护和处理比特币交易的奖励会减半。随着新比特币的供应流入减少,现有比特币的价格变得更具吸引力。

比特币减半收益递减

由于比特币的供应量是有限的,大约为2100万比特币,所以比特币的新流入会放缓。随着越来越多的比特币进入流通供应,市场变得更加饱和,比特币的定价也更加有效。

目前,比特币的93.3%已经被开采出来,即2100万比特币中的1960万比特币,通货膨胀率约为1.74%。

这意味着,如果需求超过目前1.74%的通胀率,比特币价格将会上涨。反过来,在2024年4月20日左右,比特币的第四次减半需求只需要超过不到1%的通货膨胀率。

减半后的市场动态

比特币减半只是比特币减半后价格预测的基线。鉴于比特币的通货膨胀率将在第四次减半后降至1%以下,需求将更容易超过它。

然而,这一需求是否会实现,有多种因素:

抛售的压力

比特币的感知

全球市场流动性

加密货币监管

宏观经济条件

加密市场事件

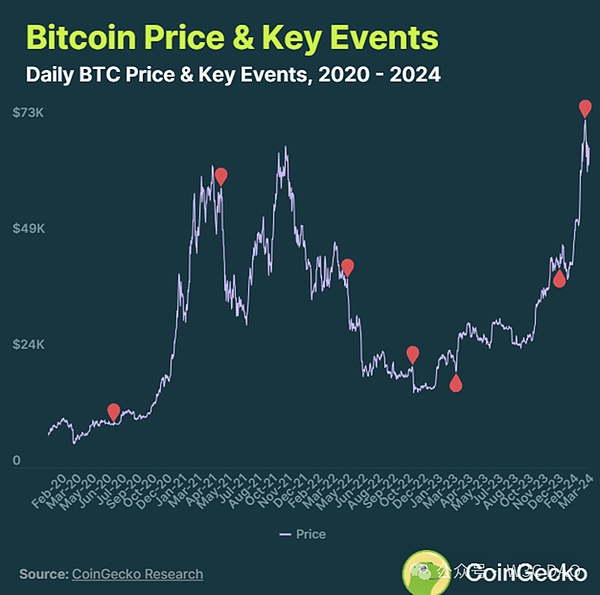

在2020年至2024年期间,所有这些因素都在第三次减半之后发挥了作用。有些比其他多。举个例子,当埃隆·马斯克(Elon Musk)在推特上说“你现在可以用比特币买一辆特斯拉”时,比特币在一个月后达到了接近6.5万美元的价格。

同样,当马斯克把比特币描绘成不够环保的时候,比特币的价格暴跌了。此外,2022 年全年多个中心化加密货币交易所的崩溃只会放大市场流动性收紧以及美联储的加息周期。

监管不确定性、利率上升、加密货币崩溃和通货膨胀之间的动态,引发了比特币的资本外流。随着这些FUD供应最终耗尽,比特币在美国地区银行业危机后再次上涨。

在没有这些包袱的情况下,比特币的市场比以往任何时候都更加成熟。我们可以用比特币的市值来表示这种成熟度。

比特币减半前后的抛售压力

在2024年4月比特币第四次减半之前,比特币年初表现强劲。此后,比特币突破了2021年创下的69,044.77美元的历史新高,创下了73,737.94美元的新高。

这是由于对加密资产的乐观情绪激增。其中,成功推出已获批准的比特币ETF尤为突出。这一里程碑有助于将比特币的合法性提升到一个新的高度,为市场的积极情绪做出贡献。

散户和机构投资者现在都可以通过股票参与比特币价格敞口,而无需直接托管比特币。截至3月25日,9个获批的比特币ETF已累计超过473.6万比特币,而Grayscale的比特币流出量为269.4万。美国的现货比特币ETF总共持有823.9万比特币,占比特币开采总量的4.2%。

虽然比特币ETF自成立以来一直有资金流入,但由于费用缺乏竞争力,它们能否跟上Grayscale的抛售压力尚不确定。最重要的是,随着哈希率和难度的增加,比特币矿工可能会获利了结,因为预计挖矿成本会增加。

虽然分析师预测比特币价格在减半后会出现看涨的结果,但这种预测可能会被挫败或推迟,因为另一个抛售压力来自Mt. Gox价值20万BTC(约合139亿美元)的分配计划,以偿还债权人。

在这些不利因素之前,比特币价格将遇到两个炒作事件:

第四次减半将于2024年4月实现

美联储首次降息,预计在2024年5月或6月

总的来说,比特币的市场定位从未像现在这样稳固。比特币ETF将带来新一代投资者和新的营销攻势。与此同时,在以债务为基础的货币制度下,法定货币将继续疯狂贬值。

这使得比特币对投资者来说是一个独特的选择,因为它的供应是预先确定的,与需求无关。随着比特币通胀低于1%,需求门槛的降低可能会超过未来的抛售压力。

How does the bitcoin price behave after each halving? However, considering the early novelty of bitcoin, lack of market maturity and diminishing returns, how did the bitcoin price behave in the first three halving before the halving of returns? When the bitcoin main network was launched on the year, the block reward was rich. The first halving was from the year, month and day to the price within a month. The rise of about US dollars to US dollars led to the valuation rising to February, and the inflation rate of Bitcoin rose from about US dollars to about US dollars within a month as of June, and the inflation rate of Bitcoin rose from about US dollars to about US dollars as of June, and the inflation rate of Bitcoin rose from about US dollars to about US dollars as of March, and the valuation rose from about US dollars to about US dollars as of June, and the inflation rate of Bitcoin halved from this mode. Although the increase after the third halving is greater than that after the second halving, the increase of the Fed's money supply casts a shadow on this point. By increasing the money supply, the Fed effectively re-priced Bitcoin, which became obvious after the Fed began to curb the reversal of asset prices through a new round of interest rate hikes in June. The market value of Bitcoin was only one day after the first halving of Bitcoin on June. In three months, the market value of Bitcoin reached $ billion by the end of 2008. Only one month later, the market value of Bitcoin approached the milestone of $ billion. The second halving on January was another scene. Due to the expectation of halving the market value of Bitcoin, it rose to an annual high of $ billion a month ago. The market value of Bitcoin actually fell to $ billion a week ago. After the market adjustment, it did not reach an all-time high of $ billion until June. Finally, The third halving of bitcoin in June began with $100 million. In three months, the market value of bitcoin increased to $100 million. Market events and maturity played a greater role than halving. Although they were jumping points, hacking in June offset last month's increase. However, this was only delayed until June. Why is it important to halve bitcoin? In fact, halving bitcoin is a mechanism to curb inflation. Unlike legal tender, the inflation rate of legal tender is unpredictable according to the actions of the central bank. The inflation rate of bitcoin is predictable and unchangeable, and it will decrease every time it is halved. In the event of halving every four years, the reward for miners to protect and deal with bitcoin transactions will be halved. With the decrease of the supply inflow of new bitcoin, the price of existing bitcoin will become more attractive. As the supply of bitcoin is limited, it is about 10,000 bitcoins, so the new inflow of bitcoin will slow down, and as more and more bitcoins enter the circulation supply market, it will become more full. And the pricing of bitcoin is also more effective. At present, bitcoin has been mined, that is, the inflation rate of 10,000 bitcoins is about 0, which means that if the demand exceeds the current inflation rate, the price of bitcoin will rise. Conversely, the demand for bitcoin will be halved for the fourth time around June, and the market dynamics after the inflation rate is halved are only the baseline of price forecast after the bitcoin is halved. In view of the fact that the inflation rate of bitcoin will be reduced to 0 after the fourth halving, It will be easier for demand to exceed it. However, will this demand realize the pressure of selling by many factors? The perception of bitcoin is global market liquidity, encrypted currency supervision, macroeconomic conditions and encrypted market events. During the period from to, all these factors played a role after halving for the third time. For example, when Elon Musk said on Twitter that you can buy a Tesla with bitcoin now, bitcoin reached a price close to 10,000 US dollars a month later. Similarly, when Musk put it, When bitcoin was portrayed as not environmentally friendly, the price of bitcoin plummeted. In addition, the collapse of several centralized cryptocurrency exchanges in the whole year will only amplify the tightening of market liquidity and the Fed's interest rate hike cycle, regulatory uncertainty, rising interest rates, and the dynamic between cryptocurrency collapse and inflation triggered the capital outflow of bitcoin. With these supplies eventually exhausted, Bitcoin rose again after the banking crisis in the United States. Without these burdens, the bitcoin market is more than ever before. We can use the market value of bitcoin to express this maturity. The selling pressure before and after the bitcoin was halved for the fourth time in June showed strong performance at the beginning of the year. Since then, bitcoin has broken through the all-time high of the US dollar set in, and reached a new high of the US dollar. This is due to the surge of optimism about encrypted assets, especially the successful launch of approved bitcoin. This milestone is helpful to raise the legitimacy of bitcoin to a new height and make the market positive. Emotional contribution: retail investors and institutional investors can now participate in bitcoin price exposure through stocks without directly hosting bitcoin. As of March, the approved bitcoin has accumulated more than 10,000 bitcoins, and the outflow of bitcoin is 10,000. The spot bitcoin in the United States holds a total of 10,000 bitcoins, which accounts for the total amount of bitcoin mining. Although bitcoin has been flowing in since its establishment, it is uncertain whether they can keep up with the selling pressure due to the lack of competitiveness of fees. The most important thing is that with the hash rate and difficulty. With the increase of the price, bitcoin miners may make a profit because the mining cost is expected to increase. Although analysts predict that the price of bitcoin will be bullish after halving, this prediction may be frustrated or postponed because another selling pressure comes from a distribution plan worth about one trillion dollars to repay creditors. Before these unfavorable factors, bitcoin prices will encounter two hype events, and the fourth halving will be realized in June, and the Federal Reserve will cut interest rates for the first time. The market positioning has never been so stable. Bitcoin will bring a new generation of investors and a new marketing offensive. At the same time, under the debt-based monetary system, legal tender will continue to depreciate wildly, which makes Bitcoin a unique choice for investors, because its supply is predetermined and has nothing to do with demand. As bitcoin inflation falls below the demand threshold, it may exceed the selling pressure in the future. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。