2024年Q1 Web3区块链安全态势、反洗钱分析回顾(一)

本章作者:Beosin 研究团队Mario、田大侠Donny

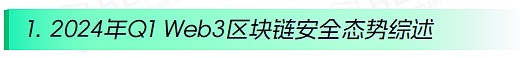

据 Beosin Alert 监控及预警显示,2024 年第一季度 Web3 领域因黑客攻击、钓鱼诈骗和项目方 Rug Pull 造成的总损失达到了 7.78 亿美元。其中主要攻击事件 39 起,总损失金额约 6.17 亿美元;项目方 Rug Pull 事件 43 起,总损失约 7550 万美元;钓鱼诈骗总损失金额约 8624 万美元。

2024 年第一季度总损失约 7.78 亿美元,同比增长约 126%,环比增长约 72%。其中黑客攻击事件损失金额高于 2023 年的任何一个季度。

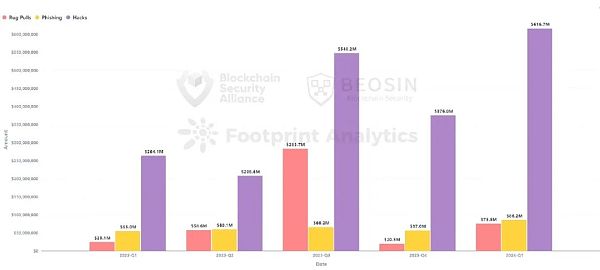

2 月的总损失金额达到了 4.22 亿美元,为 2024 年第一季度损失金额最高的月份。

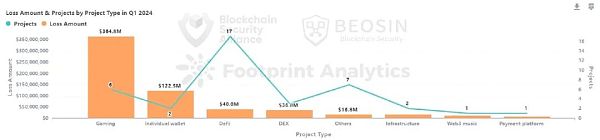

从被攻击项目类型来看,游戏平台首次成为损失金额最高的项目类型。6 次针对 Web3 游戏平台的攻击共造成了 3.65 亿美元的损失,占所有攻击损失金额的 59%。

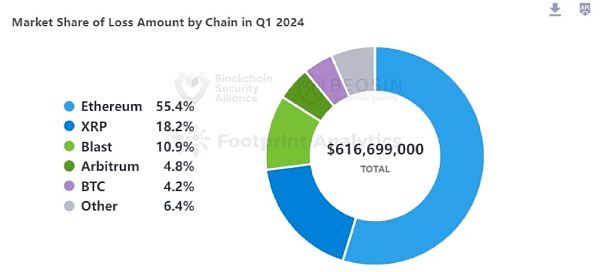

从各链损失金额来看,Ethereum依旧为损失金额最高、攻击事件最多的链。18 次 Ethereum 上的攻击事件造成了 3.42 亿美元的损失,占到了总损失的 55.4%。

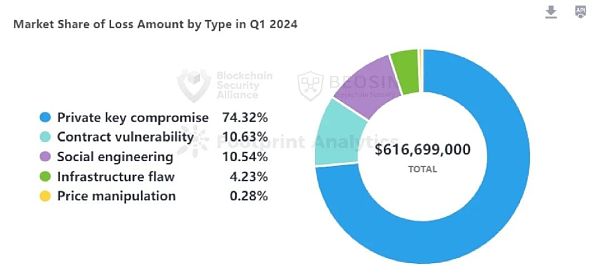

从攻击手法来看,本季度共发生 13 次私钥泄露事件,造成损失达到了 4.58 亿美元,占到了总攻击损失金额的 74.3%,是占比最高的攻击类型。

从资金流向来看,本季度大部分被盗资产被冻结和追回。约有 3.03 亿美元(49.2%)被盗资金被冻结,7945 万美元(12.9%)被盗资金被追回。

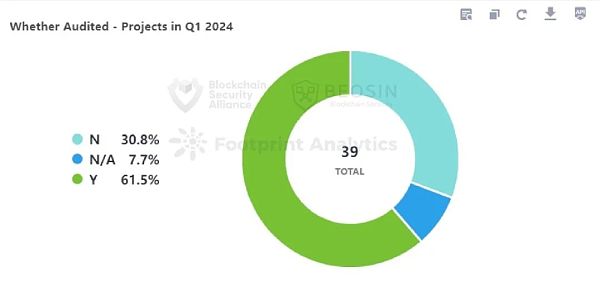

从审计情况来看,被攻击的项目中,经过审计的项目方比例有所增加。

39 起主要攻击事件共造成损失 6 亿 1670 万美元

2024 年第一季度,Beosin Alert 共监测到 Web3 领域主要攻击事件 39 起,总损失金额达 6 亿 1670 万美元。其中损失金额超过 1 亿美元的安全事件共 2 起,损失在 1000 万美元 - 1 亿美元区间的事件共 5 起,100 万美元 - 1000 万美元区间的事件 21 起。

损失金额超过千万美元的攻击事件(按金额排序):

● PlayDapp - 2.9 亿美元

攻击方式:私钥泄露 链平台:Ethereum

2 月 9 日,区块链游戏平台 PlayDapp 遭到攻击,黑客地址铸造了 2 亿枚 pla 代币,价值 3650 万美元。而后 PlayDapp 与黑客谈判失败,黑客于 2 月 12 日又铸造了 15.9 亿枚 PLA 代币,价值 2.539 亿美元,并将部分资金发送到 Gate.io 交易所。事后项目方将 PLA 合约暂停,并将 PLA 代币迁移到了 PDA 代币。

● Chris Larsen (Ripple联合创始人) - 1.12 亿美元

攻击方式:私钥泄露 链平台:XRP

1 月 31 日,Ripple 联合创始人Chris Larsen 表示,自己的四个钱包遭到黑客攻击,共计被盗约 1.12 亿美元。币安团队已成功冻结了攻击者窃取的价值 420 万美元的 XRP。

● Munchables - 6230 万美元

攻击方式:社会工程学 链平台:Blast

3 月 26 日,基于 Blast 的 Web3 游戏平台 Munchables 遭遇攻击,损失约 6250 万美元。疑似项目方因雇佣朝鲜黑客为开发者而遭受攻击。事后所有被盗资金已由黑客归还。

● FixedFloat - 2610 万美元

攻击方式:安全结构漏洞 链平台:Ethereum

2月17日,加密交易所 FixedFloat 遭遇攻击,损失约 2610 万美元,黑客已将大部分被盗资金转移到了 eXch 交易所。2月20日,FixedFloat表示,此事攻击”不是我们的员工所为,而是一次由我们安全结构漏洞引起的外部攻击“。

● Curio Ecosystem - 1600 万美元

攻击方式:合约漏洞 - 访问控制漏洞 链平台:Ethereum

3 月 23 日,RWA 基础设施 Curio Ecosystem 遭受攻击,损失约 1600 万美元。

● Somesing - 1158 万美元

攻击方式:私钥泄露 链平台:Klaytn

1 月 27 日,韩国 Web3 社交音乐服务遭受攻击,损失了 7.3 亿枚原生代币SSX,价值 1158 万美元。

● Jihoz.ron (Ronin联合创始人) - 1000 万美元

攻击方式:私钥泄露 链平台:Ronin

2 月 23日,Ronin 联合创始人 jihoz.ron 的两个地址因私钥泄露损失约 1000 万美元。

游戏平台首次成为损失金额最高的项目类型

本季度损失最高的项目类型为游戏平台,6 次针对 Web3 游戏平台的攻击共造成了 3.65 亿美元的损失,占所有攻击损失金额的 59%。游戏平台首次成为损失金额最高的被攻击项目类型。

排在第二位的受害者类型为个人钱包。两次个人钱包被盗事件造成了 1.225 亿美元的损失。这两起个人钱包被盗事件均为知名项目方联合创始人被盗(Ripple 联创和 Ronin 联创)。

39 次黑客攻击事件中,共有 17 起事件发生在 DeFi 领域,占比约 43.6%。这 17 次 DeFi 攻击事件共导致了 3996 万美元的损失,排在所有项目类型的第三位。

其他被攻击的项目类型还包括:DEX、基础设施、支付平台、Web3音乐平台等。

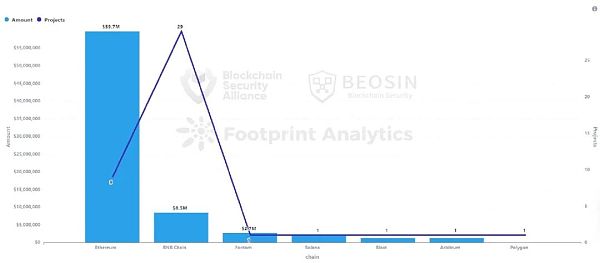

Ethereum为损失金额最高、攻击事件最多的链

和 2023 年相同的是,Ethereum 依旧是损失金额最高的公链。18 次 Ethereum 上的攻击事件造成了 3.42 亿美元的损失,占到了总损失的 55.4%。

损失金额排名第二的公链为 XRP,来自一次 Ripple 联合创始人Chris Larsen 钱包被盗事件。

损失金额排名第三的公链为 Blast 。3 次 Blast 链上的攻击事件共造成 6750 万美元的损失。Blast 链在各大新兴公链中损失金额排名第一位。

本季度 BNB Chain 仅发生了 4 次主要安全事件,损失约 801 万美元,损失金额和事件数量排名都较 2023 年大大下降。

74.3%的损失金额来自私钥泄露事件

本季度共发生 13 次私钥泄露事件,造成损失达到了 4.58 亿美元,占到了总攻击损失金额的 74.3%。和 2023 年相同,私钥泄露事件造成的损失依旧是所有攻击类型的第一位。造成较大损失的私钥泄露事件有:PlayDapp(2.9 亿美元)、Ripple 联合创始人 Chris Larsen(1.12 亿美元)、Somesing(1158 万美元)、Ronin 联合创始人 Jihoz.ron(1000 万美元)。

39 起攻击事件中,有 21 起来自合约漏洞利用,总损失达 6556 万美元,排名第二。

损失金额排名第三的攻击手法为社会工程学攻击,3 次社会工程学攻击造成损失约 6500 万美元。

按照漏洞细分,造成损失前三名的漏洞分别为:算法缺陷(2278万美元)、访问控制漏洞(1632万美元)、业务逻辑漏洞(1128万美元)。出现次数最高的漏洞分别为业务逻辑漏洞,21 起合约漏洞攻击中有 7 次是业务逻辑漏洞。

Atom Asset (AAX) 逃避反洗钱(AML)分析

近期,一家已倒闭的香港交易所 Atom Asset (AAX) 开始将资金从其钱包转移到各种去中心化交易所和中心化平台,据称是为了逃避反洗钱(AML)控制。在被发现之前,最后一次已知的涉及 AAX 交易所钱包的交易发生在 2023 年 10 月和 2022 年 11 月。在倒闭之前,AAX 是香港最大的加密货币交易所之一,拥有超过 200 万用户。

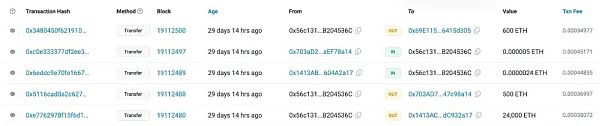

根据Beosin团队的分析,发现自2024年1月29日起,AAX交易所开始将25100枚ETH从其交易所钱包向外转移,其中转移资金共分了三笔,分别是一笔500ETH、一笔600ETH、一笔24000ETH。转移资金根据当前价格换算超7400万美元。

AAX交易所事件来龙去脉

2022 年 11 月 13 日,就在加密货币交易所 FTX 申请破产后两天,AAX 也因交易对手风险暴露而停止提款并清除了所有社交渠道。最初,AAX 将冻结归因于针对涉嫌恶意攻击的安全措施。

2022年11月15日,AAX交易所发布声明表示其平台需要进行维护,除暂停提现外,将对衍生品进行自动清算。此后,AAX停止了平台运行和社交媒体的更新。

而蹊跷的事就在于:沉寂426天后,AAX交易所钱包开始活动,开始有大额资金开始转出至其它地址,尝试躲避AML工具的识别和监控!

link: https://etherscan.io/address/0x56c1319b31a5316a327bd889d58c8633b204536c

AAX交易所事件链上资金分析

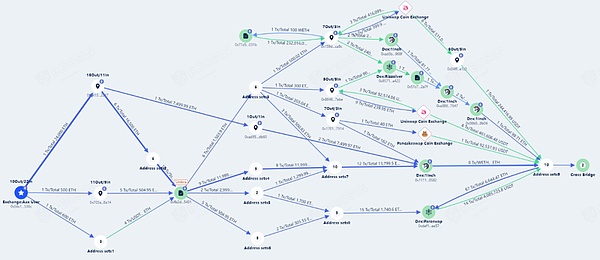

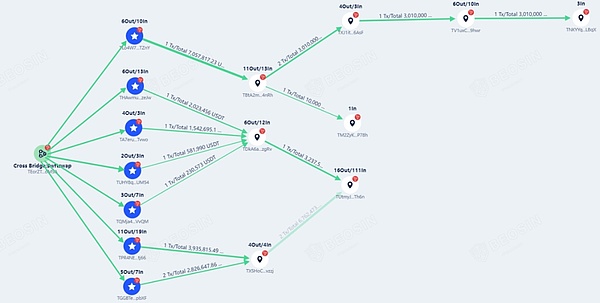

Beosin KYT反洗钱分析平台对AAX交易所钱包近期的链上活动进行了深入研究,发现了一系列风险活动。首先,所有的25100枚ETH已被转移,操作人员采取了各种手段将部分ETH兑换为USDT,然后通过跨链桥将资金转移到不同的区块链上,以进行资金的清洗。

Beosin KYT反洗钱平台

其中,大部分资金被转移到了Tron区块链上,并通过一些地址进行中转,然后沉淀在某些地址中,未曾转移。这种行为表明了明显的逃避AML的企图,试图掩盖资金的真实来源和去向。

Beosin KYT反洗钱平台

香港警方针对诈骗活动迅速采取行动,逮捕了两名与AAX相关的人员,目前正在努力绘制转移资金的路径并找回受影响用户的资产。

AAX交易所利用去中心化交易所、加密货币兑换和跨链桥等技术手段,试图模糊资金流动的路径和来源。这为监管机构和AML分析平台带来了巨大的挑战。

大部分被盗资产被冻结和追回

据 Beosin KYT 反洗钱平台分析显示,2024 年第一季度被盗的资金中,约有 3.03 亿美元(49.2%)被盗资金被冻结,7945 万美元(12.9%)被盗资金被追回。该比例大大高于 2023 年。

约有 1.055 亿美元的被盗资金转入了各交易所,占比约 17.1%。和 2023 年相比,今年黑客向交易所转入被盗资金的比例大幅增加。这为交易所反洗钱和合规提出了更高的要求。

共有 3012 万美元(4.9%)转入了混币器:2990 万美元转入了 Tornado Cash;21.6 万美元转入了其他混币器。和去年相比,2024年第一季度通过混币清洗的被盗资金大幅减少。

经过审计的项目方比例有所增加

39 起攻击事件里,有 12 起事件的项目方没有经过审计,24 起事件的项目方经过了审计。经过审计的项目方比例略高于 2023 年,这表明整个 Web3 行业项目方对安全的重视程度提高了。

12 个没有经过审计的项目中,合约漏洞事件占了8起(66.7%)。相比之下,24 个经过审计的项目中,合约漏洞事件占了 13 起(54.2%)。这显示出审计在一定程度上能够提高项目的安全性。

43 起 Rug Pull 事件共损失 7550 万美元

2024 年第一季度,共监测到项目方 Rug Pull 事件 43 起,涉及金额达 7550 万美元。

损失金额排名前5的Rug pull事件为:Bitforex(5650万美元)、Hector Network(270万美元)、MangoFarm(200万美元)、OrdiZK(140万美元)、RiskOnBlast(130万美元)。这 5 起 Rug Pull 事件分布在 Ethereum、Fantom、Solana 和 Blast 四条链。

Ethereum 链上总共 Rug Pull 涉及金额达到了5968万美元,占总损失的79%。BNB Chain 链上发生了最多的 Rug Pull 事件,共 29 次,占总事件数量的 67.4%。

和上个季度相比,2024 年第一季度因黑客攻击、钓鱼诈骗、项目方 Rug Pull 造成的总损失大幅上升,达到了 7.78 亿美元。本季度币价上涨因素对总金额的增加有一定的影响,但总体而言,Web3 安全领域形势依旧不容乐观。

本季度造成危害最大的攻击类型为私钥泄露,约 74.3% 的损失金额来自私钥泄露事件,这一趋势和 2023 年数据一致。从项目类型来看,私钥泄露事件遍布于Web3各个领域:游戏平台、DeFi、个人钱包、基础设施、NFT、支付平台、博彩平台、数据存储平台等。各个Web3项目方/个人用户都需要提高警惕,离线存储私钥、使用多重签名、谨慎使用第三方服务、对特权员工进行定期安全培训。

本季度大部分资产被冻结和追回,这标志着全球监管体系的完善和反洗钱力度的加强。本季度黑客向交易所转入被盗资金的比例也大幅增加,这需要交易所及时识别黑客行为,积极配合执法机构和项目方冻结资金和进行调证。目前交易所和执法机构、项目方、安全团队的合作已经有了较为明显的成果,相信未来会有更多被盗资金能够追回。

本季度 39 起攻击事件中,依然有 21 起来自合约漏洞利用,建议项目方在上线前寻求专业的安全公司进行审计。

According to the monitoring and early warning, Tian Daxia, the research team of the author of this chapter, showed that the total loss caused by hacking, phishing fraud and the project side in the first quarter of 2008 reached $ billion, of which the total loss from the main attack was about $ billion, and the total loss from the project side was about $ million. The total loss from phishing fraud in the first quarter of 2008 increased by about $ billion year-on-year, and the total loss from hacking was higher than that in any quarter of 2008, reaching $ billion. Yuan was the month with the highest loss in the first quarter of, and the game platform became the item type with the highest loss for the first time according to the types of the attacked items. The attacks against the game platform caused a total loss of $ billion, accounting for the loss of all attacks. From the perspective of the loss of each chain, the attacks on the chain with the highest loss amount still caused a loss of $ billion, accounting for the total loss. From the perspective of the attack methods, there were several private key leaks in this quarter, which caused losses of $ billion. From the perspective of capital flow, most of the stolen assets were frozen and recovered in this quarter, with about $100 million of stolen funds frozen and $10,000 of stolen funds recovered. From the audit situation, the proportion of audited projects in the attacked projects has increased, and major attacks have caused losses of $100 million. In the first quarter of 2000, the total losses from major attacks in the field have reached $100 million, of which the losses exceeded $100 million. The security incidents with losses in the range of $100,000 to $100,000, the incidents with losses in the range of $100,000 to $100,000, the attacks with losses exceeding $100,000, the attack mode of $100,000, the private key leakage chain platform and the blockchain game platform were attacked, and the hacker's address cast hundreds of millions of tokens worth $100,000, and then the negotiation with the hacker failed. The hacker cast hundreds of millions of tokens worth $100,000 and sent some funds to The coin moved to the token co-founder's billion-dollar attack mode, the private key leakage chain platform. On April, the co-founder said that his four wallets were hacked and stolen, totaling about billion dollars. The coin security team has successfully frozen the $10,000 attack mode, which was stolen by the attacker. The game platform based on the social engineering chain platform was attacked and lost about 10,000 dollars. It is suspected that the project party was attacked because it hired a North Korean hacker as a developer. After that, all the stolen funds have been returned by the hacker. The attack method, security structure, vulnerability chain platform, encrypted exchange suffered an attack loss of about USD 10,000. Hackers have transferred most of the stolen funds to the exchange, indicating that the attack was not committed by our employees, but an external attack caused by the vulnerability of our security structure. The attack method, contract vulnerability, access control vulnerability chain platform suffered an attack loss of about USD 10,000. The attack method, private key disclosure chain platform suffered an attack loss of about USD 10,000. Billion native tokens are worth $10,000, and the co-founder is worth $10,000. The attack mode of private key leakage chain platform lost about $10,000 due to private key leakage. For the first time, the game platform became the project type with the highest loss. The project type with the highest loss in this quarter was the game platform, which caused a total loss of $100 million, accounting for the loss of all attacks. For the first time, the game platform became the victim category with the highest loss. Two personal wallet thefts caused a loss of hundreds of millions of dollars, both of which were stolen by the co-founder of a well-known project, Lianchuang and Lianchuang hacking incidents. One incident occurred in the field, accounting for about 10,000 dollars, ranking third among all project types. Other attacked project types also included infrastructure, payment platform, music platform, etc. The chain with the highest loss amount and the largest number of attacks was the same as that of the year. It is still the public chain with the highest loss, and the attack on it caused a loss of $100 million, accounting for the total loss. The public chain with the second highest loss amount is from a co-founder wallet theft incident, and the public chain with the third highest loss amount is the attack on the secondary chain, which caused a total loss of $10,000. The loss amount of the chain ranks first among the major public chains, and only two major security incidents occurred in this quarter, resulting in a loss of about $10,000. Both the loss amount and the number of incidents are greatly reduced compared with last year. The amount comes from the private key leakage incident. In this quarter, there were several private key leakage incidents, which caused losses of $ billion, accounting for the same amount of total attack losses as in 2000. The losses caused by private key leakage incidents are still the first of all types of attacks. The private key leakage incidents that caused greater losses include $ billion, the co-founder of $ billion, and the co-founder of $ million. Engineering attacks and social engineering attacks caused losses of about $10,000. The top three vulnerabilities were algorithm defects of $10,000, access control vulnerabilities of $10,000 and business logic vulnerabilities of $10,000. The most frequent vulnerabilities were business logic vulnerabilities, contract vulnerabilities, and one of the attacks was business logic vulnerabilities to evade anti-money laundering analysis. Recently, a closed Hong Kong exchange began to transfer funds from its wallet to various decentralized exchanges and centralized platforms, allegedly for the purpose of Escape from anti-money laundering control Before it was discovered, the last known transaction involving the exchange wallet occurred in June and June, and before it closed down, it was one of the largest cryptocurrency exchanges in Hong Kong with more than 10,000 users. According to the analysis of the team, it was found that since June, the exchange began to transfer money from its exchange wallet, and the transfer funds were divided into three parts, namely, a sum of money was transferred to over 10,000 US dollars according to the current price. The ins and outs of the exchange incident were in cryptocurrency. Two days after the exchange filed for bankruptcy, it also stopped withdrawing money and cleared all social channels because of counterparty risk exposure. At first, the freeze was attributed to security measures against suspected malicious attacks. On April, the exchange issued a statement saying that its platform needed to be maintained, in addition to suspending withdrawal, derivatives would be automatically liquidated. After that, the platform operation and social media update stopped. The strange thing is that after the silence, the exchange wallet began to move, and a large amount of money began to be transferred to other addresses in an attempt to avoid the identification and monitoring of tools. The recent chain of exchange wallets by the anti-money laundering analysis platform. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。