2024年Q1 关健监管和合规事件分析(二)

点击阅读:2024年Q1 Web3区块链安全态势、反洗钱分析回顾(一)

Elven的报告将重点关注两个关键主题,提供对主要司法管辖区近期监管发展的全面见解,并为实施有效的内部控制以管理金融领域的数字资产提供实用指导。

首先,该报告将探讨欧洲、迪拜、新加坡和香港等著名金融中心 2024 年第一季度的关键监管和合规事件,提供有关数字资产监管环境不断发展的见解。

其次,该报告将从财务视角对加密货币内部控制框架进行全面审查,强调实施强大的内部控制和对账流程的重要性,以有效管理数字资产、降低风险并保障利润。

欧洲、迪拜、新加坡和香港等著名金融中心 2024 年第一季度的关键监管和合规事件

*本文篇幅有限,清晰版请见完整报告。

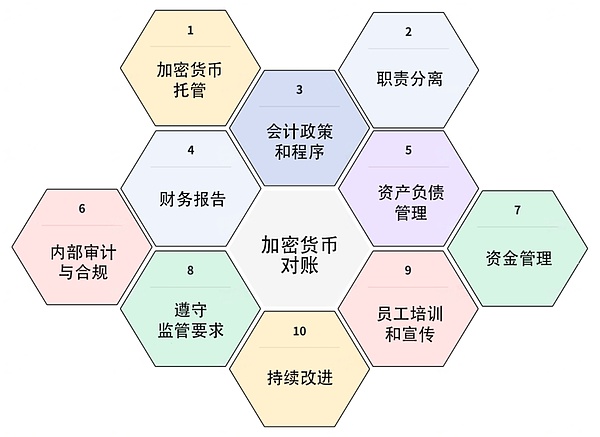

加密货币内部控制框架(财务视角)和对账

从财务视角来看,加密实体的内部控制框架侧重于确保财务报告和交易的准确性、可靠性和完整性。加密货币对账仍然是该框架的核心部分。

加密货币内部控制框架(财务视角)

1. 加密货币托管:

- 必须单独存储私钥及其备份,并保护它们免受内部和外部威胁。

- 强有力的措施已经实施,以在整个生命周期内保护私钥及其备份。

- 应制定书面程序,概述主钱包丢失时应采取的步骤,以用于备份和恢复目的。

- 在合约终止的情况下,必须制定协议来解决有权访问钱包和/或私钥的个人被解雇的情况。

2. 职责分离:

- 交易、财务管理、会计和对账等不同职能之间的职责明确划分,以防止利益冲突和欺诈。

- 金融交易的授权和批准流程,包括对进行交易的权限的限制。

根据普华永道《加密货币托管:审计师视角下的风险与控制》,<<加密实体应确保只有经过授权或批准的员工才能发起加密货币的销售——至少必须应用双重控制原则>>

3. 会计政策和程序:

- 明确的会计政策和程序,用于管理与交易、存款、取款、收费和佣金相关的金融交易的记录、分类和报告。

根据安永《加密资产持有者应用国际财务报告准则会计》,<<加密资产具有不同的条款和条件。持有加密资产的目的在不同实体之间也有所不同,甚至在持有加密资产的同一实体内的商业模式之间也是不同的。因此,会计处理将取决于特定的事实和情况,相关分析可能会很复杂>>

- 根据美国公认会计原则(GAAP)或其他适用的会计标准准确、及时地记录交易。

根据 FASB 发布的会计准则更新 2023 年 8 月—无形资产—商誉及其他—加密资产(子主题 350-60):加密资产的会计处理和披露,

<<对于年度报告期,本更新中的修订要求实体披露以下信息:

·汇总报告期内加密资产持有量的活动变动,包括增加(及导致增加的活动描述)、处置、盈亏。

·对于报告期内任何加密资产的处置,处置价格与成本基础之间的差异以及导致处置的活动描述

·如果盈亏未单独呈现,则需指出收益表中认可这些盈亏的项目。

·加密资产成本基础的确定方法>>

4. 财务报告:

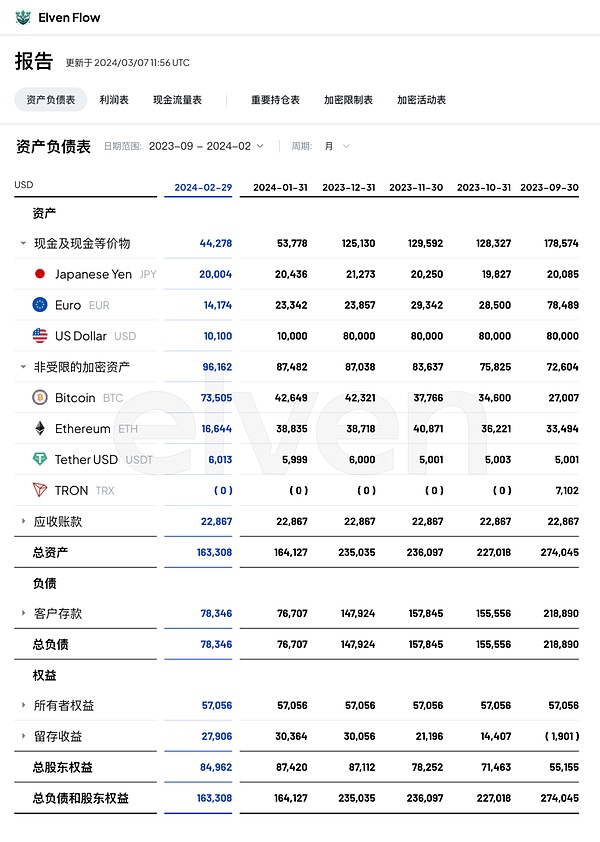

- 定期准备财务报表,包括资产负债表、损益表和现金流量表,以提供透明度并深入了解交易所的财务业绩。

- 对财务数据进行独立验证和对账,确保准确性和完整性。

- 遵守监管报告要求,包括向有关当局提交财务报告。

Elven专业加密会计软件生成的资产负债表页面

Elven专业加密会计软件生成的重大持有页面

5. 资产负债管理:

- 监控和管理资产和负债,以保持流动性和偿付能力。

- 定期核对资产和负债余额,包括客户资金、交易准备金和运营资金。

- 风险评估和管理策略,以减轻市场波动、信用风险和运营失败可能造成的潜在损失。

根据国际证监会组织《加密货币和数字资产市场政策建议最终报告》,

<<加密实体应当:

1)将客户资产托管或以其他方式与自有资产分离。

2)向客户用清晰、简洁且非技术性语言披露相关信息:

·客户资产的持有方式,以及保护这些资产及/或其私钥的安排;

·是否使用独立托管人、子托管人或关联方托管人(如有);

·客户资产在综合客户账户中汇总或汇集的程度、个人客户对汇总或汇集资产的权利以及任何汇集或汇总活动产生的损失风险;

·加密实体直接或间接(例如通过跨链桥)处理或移动客户资产而产生的风险;以及

·关于加密实体使用客户资产及私钥的义务和责任的完整准确信息,包括偿还条款以及涉及的风险。

3)拥有自身的系统、政策和程序,在适当的独立保证下对客户资产进行定期和频繁的对账。

4)采用适当的系统、政策和程序,以降低客户资产丢失、被盗或无法访问的风险。>>

6. 内部审计与合规:

- 内部审计功能,以评估内部控制的有效性,识别缺陷,并推荐改进措施。

- 合规监控,以确保遵守监管要求、行业标准和内部政策。

- 由独立审计师进行的外部审计,以向利益相关者和监管机构提供有关财务报告可靠性和内部控制的保证。

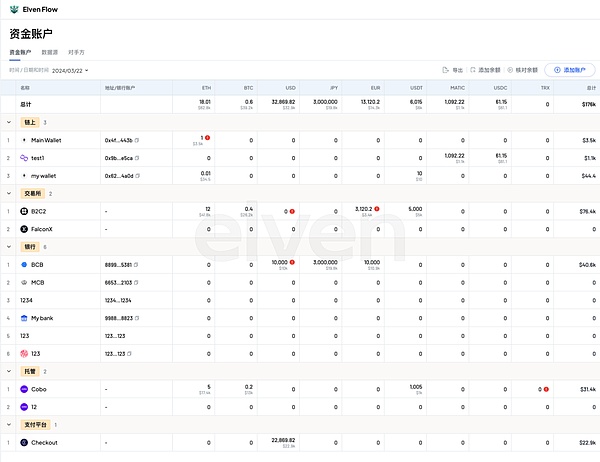

7. 资金管理:

- 有效管理现金流,包括从交易活动收到的资金、客户存款和取款请求。

- 管理现金储备和超额资金的投资政策和指南。

- 控制资金转移和支付,以防止未经授权的交易和欺诈。

Elven专业加密记账软件生成的资金管理页面

8. 遵守监管要求:

- 遵守适用的金融法规,包括反洗钱 (AML)、了解你的客户 (KYC) 和消费者保护法。

- 定期监控和更新,以确保符合监管要求和行业最佳实践的变化。

9. 员工培训和宣传:

- 开展培训项目,旨在教育员工了解财务控制、合规要求和伦理标准。

- 开展宣传活动,促进组织内的诚信、透明和负责任文化。

10. 持续改进:

- 持续审查和评估财务控制和流程,以确定需要加强和优化的领域。

- 建立反馈机制,收集员工、审计师、监管机构和其他利益相关者的意见,以实现持续改进。

该框架旨在促进金融稳定、透明度和对加密货币实体的信任,从而增强投资者的信心和市场诚信。

在新加坡金融管理局 (MAS) 要求

数字支付代币服务提供商对客户资产

进行日常对账的背景下,

探索加密货币对账(框架的核心)

1. 什么是加密货币对账?

加密货币对账是指比较和验证来自多个来源的交易数据,以识别差异或缺失交易的过程。由于管理各种钱包、交易所、链和代币的复杂性,这项任务尤其具有挑战性。它可能涉及匹配交易金额、日期、地址和其他相关细节,以确保所有交易都被正确记账。

2. 如何进行加密货币对账?

Web3 公司通常使用能生成每日对账报告的加密货币会计软件。

Elven专业加密会计软件生成的加密货币对账报告

3. 为什么加密货币对账很重要?

-持牌方的监管要求

《关于数字支付代币服务拟议监管措施的咨询文件》(2023 年 11 月)

新加坡金融管理局(MAS)要求数字支付代币服务提供商对客户资产进行日常核对并保留交易记录,并为每位客户维护分开的账簿和记录,随时详细记录客户资产的详细信息。

-财务记录的准确性

对于加密货币交易所和金融机构来说,提供透明和准确的交易记录可以建立客户信任。对账体现了对责任和诚信的承诺,增强了服务提供商的声誉。

根据《关于保护客户资产的建议》,<<原则1 - 中介机构应保存准确和最新的客户资产记录和账目,以便随时确定客户资产的确切性质、数额、位置和所有权状况,以及客户资产是为哪些客户持有的。保存记录的方式还应使其可用作审计线索。>>

-维护与利益相关者的信任,以吸引投资者投资

确保交易记录的准确性是财务诚信的基础。对账有助于验证所有交易都已正确记录和核算,减少错误或差异的风险。

References

1. ESMA75-453128700-52 MiCA Consultation Paper - Guidelines on the qualification of crypto-assets as financial instruments

https://www.esma.europa.eu/sites/default/files/2024-01/ESMA75-453128700-52_MiCA_Consultation_Paper_-_Guidelines_on_the_qualification_of_crypto-assets_as_financial_instruments.pdf

2. DIFC Announces Enactment of New Digital Assets Law, New Law of Security, and Related Amendments to Select Legislation

https://www.difc.ae/whats-on/news/difc-announces-enactment-of-new-digital-assets-law---new-law-of-security-and-related-amendments

3. Explanatory Brief: The Financial Institutions (Miscellaneous Amendments) Bill 2024

https://www.mas.gov.sg/news/speeches/2024/explanatory-brief-the-financial-institutions-miscellaneous-amendments-bill-2024

4. SFC warns public of suspicious crypto-related products “Floki Staking Program” and “TokenFi Staking Program”

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR12

5. SFC and Police warn public of Aramex and DIFX for suspected virtual asset-related frauds

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR6

6. SFC warns public of suspicious crypto-related product “Yieldnodes.com masternode pool”

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR34

7. SFC urges investors to check regulatory status of virtual asset trading platforms as transition period will end soon

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR14

8. SFC warns public of suspicious websites for impersonation and suspected virtual asset-related fraud

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR50

9. SFC warns public against unlicensed virtual asset trading platform MEXC

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR48

10. SFC warns public against unlicensed virtual asset trading platform Bybit

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR47

11. SFC warns public of BitForex for suspected virtual asset-related fraud

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR40

12. SFC warns public of suspicious websites impersonating licensed virtual asset trading platforms

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR39

13. SFC reminds public VATP application period has ended under transitional arrangements

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR37

14. Stablecoin Issuer Sandbox

https://www.hkma.gov.hk/eng/news-and-media/insight/2024/03/20240312/

15. Crypto custody: risks and controls from an auditor's perspective

https://www.pwc.ch/en/insights/digital/crypto-custody-risks-and-controls-from-an-auditors-perspective.html

16. Accounting by holders ofcrypto assets

https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/ifrs/ey-apply-ifrs-crypto-assets-update-october2021.pdf

17. Intangibles—Goodwill and Other—Crypto Assets (Subtopic 350-60)

https://www.fasb.org/page/ShowPdf?path=ASU%202023-08.pdf&title=ACCOUNTING%20STANDARDS%20UPDATE%202023-08—Intangibles—Goodwill%20and%20Other—Crypto%20Assets%20(Subtopic%20350-60)

18. Policy Recommendations for Crypto and Digital Asset MarketsFinal Report

https://www.iosco.org/library/pubdocs/pdf/IOSCOPD747.pdf

19. Consultation Paper on Proposed Regulatory Measures for Digital Payment Token Services

https://www.mas.gov.sg/publications/consultations/2022/consultation-paper-on-proposed-regulatory-measures-for-digital-payment-token-services

20. Recommendations Regarding the Protection of ClientAssetsFinal Report

https://www.iosco.org/library/pubdocs/pdf/IOSCOPD436.pdf

Click to read the analysis of blockchain security situation and anti-money laundering in 2001. The first report will focus on two key topics, provide a comprehensive view of the recent regulatory development in major jurisdictions and provide practical guidance for implementing effective internal control to manage digital assets in the financial sector. First, the report will discuss the key regulatory and compliance events in the first quarter of 2001 in famous financial centers such as Europe, Dubai, Singapore and Hong Kong, and provide insights on the continuous development of the regulatory environment for digital assets. Second, the report will be based on financial resources. A comprehensive review of the internal control framework of cryptocurrency from the perspective of business affairs emphasizes the importance of implementing a strong internal control and reconciliation process to effectively manage digital assets, reduce risks and guarantee profits. The key regulatory and compliance events in the first quarter of 2008 in famous financial centers such as Dubai, Singapore and Hong Kong in Europe are limited in space. Please see the full report on the internal control framework of cryptocurrency from the financial perspective and reconciliation. From the financial perspective, the internal control framework of cryptoentities focuses on ensuring financial reporting and submission. Easy accuracy, reliability and completeness Cryptographic currency reconciliation is still the core part of the framework. Cryptographic currency internal control framework financial perspective Cryptographic currency custody must store private keys and their backups separately and protect them from internal and external threats. Strong measures have been implemented to protect private keys and their backups throughout the life cycle. Written procedures should be formulated to outline the steps that should be taken when the main wallet is lost for backup and recovery purposes. In the case of contract termination, an agreement must be made to solve it. The situation that the individual who has access to wallet and or private key is dismissed, and the responsibilities are separated. The responsibilities between different functions such as financial management, accounting and reconciliation are clearly divided to prevent conflicts of interest and fraud. The authorization and approval process of financial transactions includes restrictions on the authority to conduct transactions. According to the risk and control from the perspective of PwC cryptocurrency custodian auditors, the crypto entity should ensure that only authorized or approved employees can initiate the sale of cryptocurrency, and at least the principle of double control accounting must be applied. Clear accounting policies and procedures are used to manage the records, classification and reports of financial transactions related to withdrawal fees and commissions in transaction deposits. According to Ernst & Young's application of international financial reporting standards, accounting for encrypted assets has different terms and conditions, and the purpose of holding encrypted assets is different among different entities, even among business models in the same entity holding encrypted assets. Therefore, accounting treatment will depend on specific facts and circumstances. The analysis may be complicated. Record transactions accurately and timely according to US GAAP or other applicable accounting standards. Update the monthly intangible assets goodwill and other encrypted assets according to the published accounting standards. Accounting treatment and disclosure of encrypted assets. For the annual reporting period, the amendments in this update require entities to disclose the following information. Summarize the changes in the holdings of encrypted assets during the reporting period, including the increase and description of the activities that led to the increase. Disposal of profits and losses for any encrypted assets during the reporting period Dispose of the difference between the disposal price and the cost basis and the description of the activities leading to the disposal. If the profit and loss are not presented separately, it is necessary to point out the items in the income statement that recognize these gains and losses, and the method for determining the cost basis of encrypted assets. Financial reports are prepared regularly, including the balance sheet income statement and cash flow statement to provide transparency and in-depth understanding of the financial performance of the exchange. Independent verification and reconciliation of financial data to ensure accuracy and completeness, compliance with regulatory reporting requirements, including to relevant authorities. Submit financial reports, balance sheet pages generated by professional encryption accounting software, major holding pages generated by professional encryption accounting software, asset and liability management, monitor and manage assets and liabilities to maintain liquidity and solvency, and regularly check the balance of assets and liabilities, including customer capital trading reserve and working capital risk assessment and management strategies to mitigate market fluctuations, credit risk and potential losses caused by operational failure. According to the policy of the International Securities Regulatory Commission on organizing cryptocurrency and digital assets market, It is suggested that the final report encryption entity should keep the client assets in custody or separate them from its own assets in other ways, and disclose relevant information to the client in clear, concise and non-technical language, as well as whether the arrangement for protecting these assets and or their private keys uses independent custody, the extent to which the client assets are aggregated or aggregated in the comprehensive client account, the rights of individual clients to aggregate or aggregate assets and the losses caused by any aggregation or aggregation activities. Risk: The risks directly or indirectly generated by the encryption entity, such as handling or moving the customer's assets across the chain bridge, and the complete and accurate information about the obligations and responsibilities of the encryption entity in using the customer's assets and private keys, including the repayment terms and the risks involved. It has its own system policies and procedures to conduct regular and frequent reconciliation of the customer's assets under the appropriate independent guarantee, and adopts appropriate system policies and procedures to reduce the risk of loss, theft or inaccessible of the customer's assets. The audit function of the Ministry is to evaluate the effectiveness of internal control, identify defects and recommend improvement measures. Compliance monitoring ensures compliance with regulatory requirements, industry standards and internal policies. The external audit conducted by independent auditors provides stakeholders and regulatory agencies with assurance about the reliability of financial reports and internal control. Fund management effectively manages cash flow, including capital received from trading activities, customer deposits and withdrawal requests, investment policies and guidelines for managing cash reserves and excess funds, and controls capital transfer and Pay to prevent unauthorized transactions and fraud. The fund management page generated by professional encryption accounting software complies with regulatory requirements and applicable financial regulations, including anti-money laundering. Know your customer and consumer protection laws. Regularly monitor and update them to ensure compliance with regulatory requirements and changes in industry best practices. Staff training and publicity are carried out. Training programs are aimed at educating employees about financial control compliance requirements and ethical standards, and conducting publicity activities to promote the continuous improvement of integrity, transparency and responsible culture within the organization. Continuously review and evaluate financial controls and processes to determine areas that need to be strengthened and optimized, establish a feedback mechanism to collect opinions from employees, auditors, regulators and other stakeholders to achieve continuous improvement. This framework aims to promote financial stability, transparency and trust in cryptocurrency entities, thereby enhancing investors' confidence and market integrity. In the context of monetary authority of singapore's request for digital payment token service providers to conduct daily reconciliation of customer assets, explore the core of cryptocurrency reconciliation framework. What is cryptocurrency reconciliation? Cryptcurrency reconciliation refers to comparing and verifying transaction data from multiple sources to identify. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。