地缘政治危机中的牛市:BTC的表现与避险情绪

作者:BloFin 来源:medium 翻译:善欧巴,比特币买卖交易网

全球不确定性上升是近期加密市场流动性水平持续改善的主要原因之一,也是近期BTC表现强劲的重要原因。

由于缺乏避险属性,非BTC加密货币的表现更多取决于宏观流动性的变化和场内资金的博弈状况。

山寨币在与 ETH 的流动性竞争中取得了一定的优势,这对 ETH 的表现产生了进一步的不利影响。

地缘政治危机中的牛市

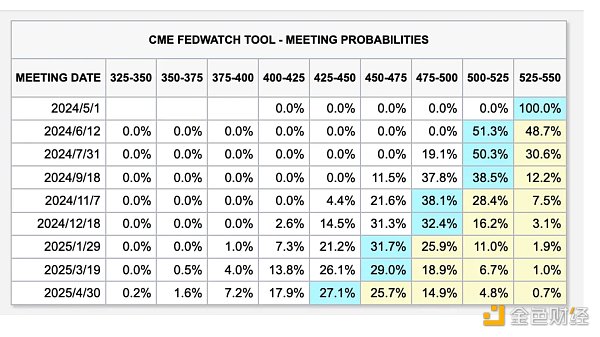

上周非农数据和就业数据公布后,“低于预期的降息”似乎已逐渐被投资者接受并消化。

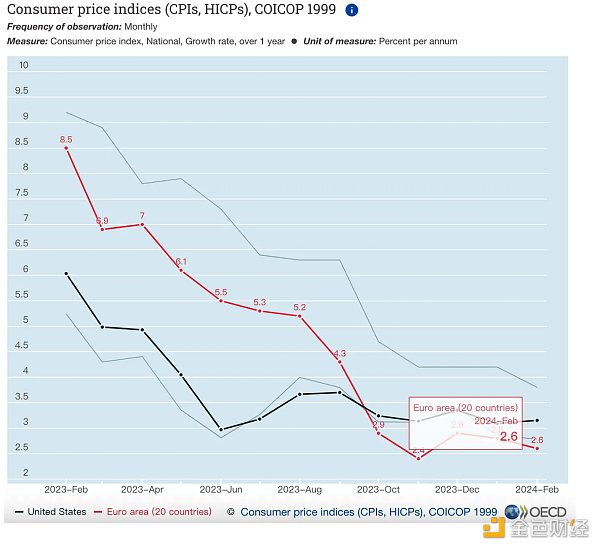

本周,以欧洲央行为首的多国央行也将公布最新利率决定。尽管欧洲在通胀方面的表现远好于美国,欧洲央行也表现出较高的降息预期,但考虑到欧洲央行的影响力相比美联储相对较弱,可以确定全球现金流动性的速度未来风险资产市场回归速度将会放缓。对于加密市场来说,牛市可能会更加“温和而漫长”。

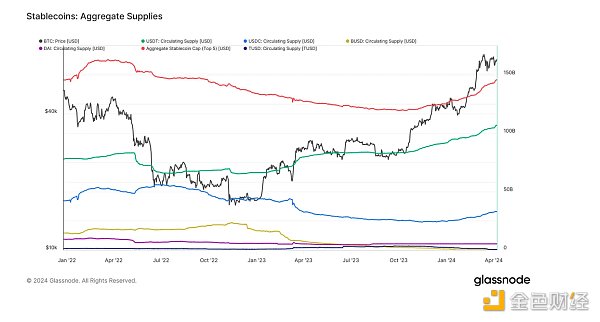

然而,情况似乎并非如此。4月初以来,加密市场内部现金流动性回流速度明显加快。过去一周,整个加密市场获得了近30亿美元的现金流动性,整体现金流动性规模也恢复到2022年Q3同期水平。受上述情况影响,BTC、ETH价格上涨、山寨币均获得强劲支撑,市场情绪也明显恢复。是什么原因导致现金流动性出现异常变化?

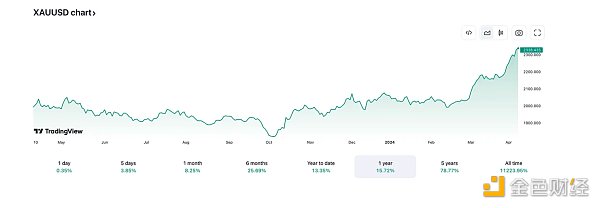

我们一起来看看其他资产的表现。在BTC创下历史新高的同时,金价6个月内上涨超过25%,也突破历史新高。与此同时,白银和铜的价格也达到了近一年来的最高点。金价上涨通常与避险情绪有关。作为一种长期存在的“硬通货”,当宏观不确定性上升时,尤其是地缘政治紧张时期,黄金是重要的对冲手段。

然而,当我们观察白银和铜的价格趋势时,事情就变得有趣了。白银和铜是重要的军事战略物资,与武器生产和国防工业密切相关。因此,从某种程度上来说,银铜价格的快速上涨是地缘政治冲突和宏观不确定性风险的额外体现。

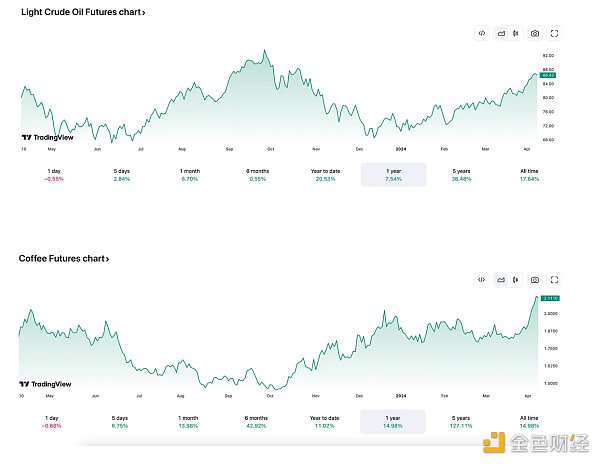

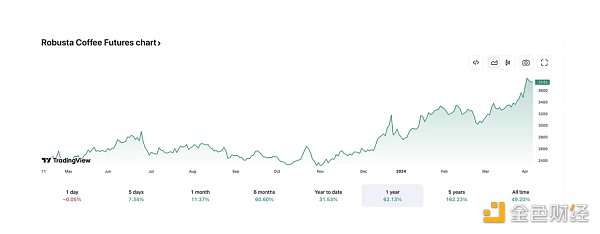

那么,还有更多类似的线索吗?当然!2024年初以来,原油价格上涨超过20%,咖啡等具有战略意义的大宗商品价格因地缘政治危机引发的需求增加和供应链紧张而飙升。

避险情绪从来不仅仅反映在一项资产上;当不确定性来临时,人们会用现金换取“安全的硬通货”或物资,这是黄金、原油、咖啡等大宗商品价格上涨的重要原因,当然也是股市上涨的原因之一。比特币等加密货币的价格上涨。

BTC:继续上涨?

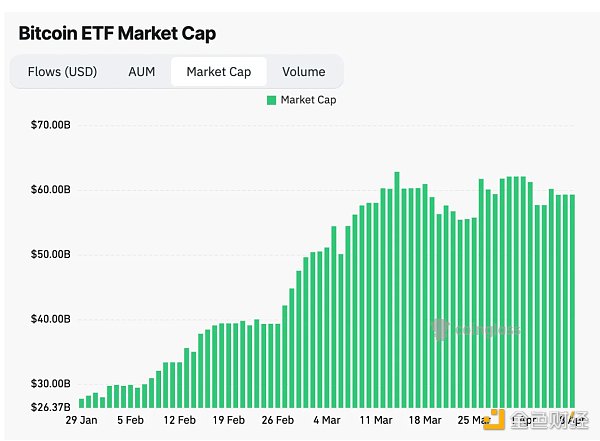

考虑到中东、东欧地缘政治紧张局势不断升级,全球投资者的避险需求短期内难以得到有效缓解。因此,避险情绪将有力支撑BTC的需求。与此同时,尽管流动性回流速度预计放缓,但流动性收紧的情况不太可能再次发生。因此,“锁定”现货BTC ETF的流动性规模将保持相对稳定。长期来看,未来流动性的回归也将推动BTC价格稳步上涨。

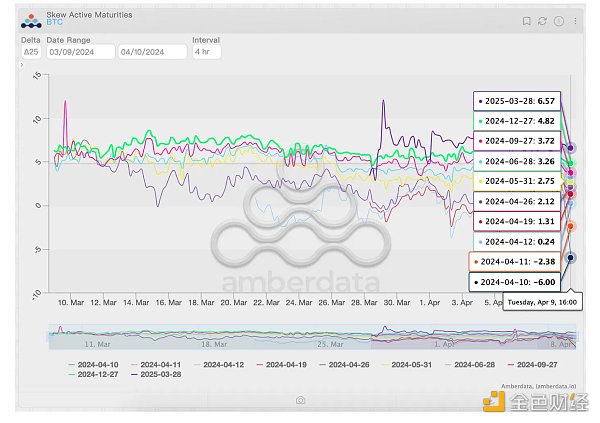

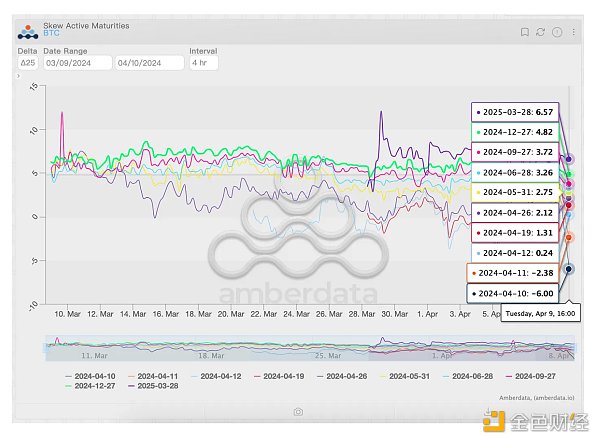

期权市场的交易员也持有类似的观点。尽管投资者盘中看涨情绪因短期波动而减弱,但投资者对 BTC 的看涨情绪在近月和远月均保持稳定并占据主导地位。不过,投资者对BTC中长期表现的预期较3月同期略有下降,降息预期减弱可能是原因之一。

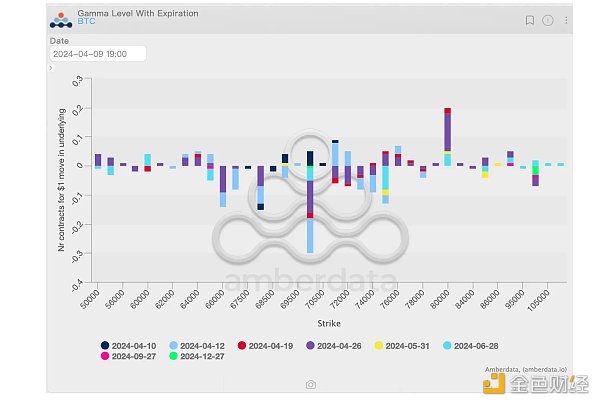

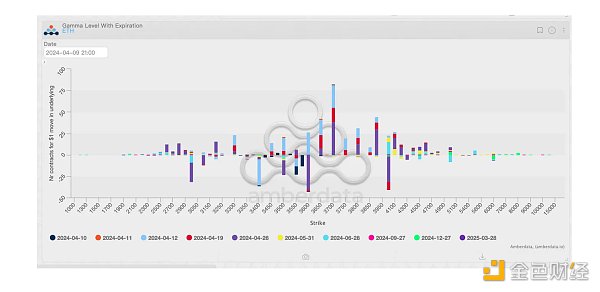

从最新的伽玛暴露分布来看,随着“资产配置期”的结束,BTC的价格似乎出现了一些企稳的迹象。BTC 的价格可以在 63k-65k 美元左右获得一些支撑。不过,如果BTC价格进一步上涨,将会在74k美元附近遇到一些阻力,该阻力位会随着价格的上涨而显着增加。

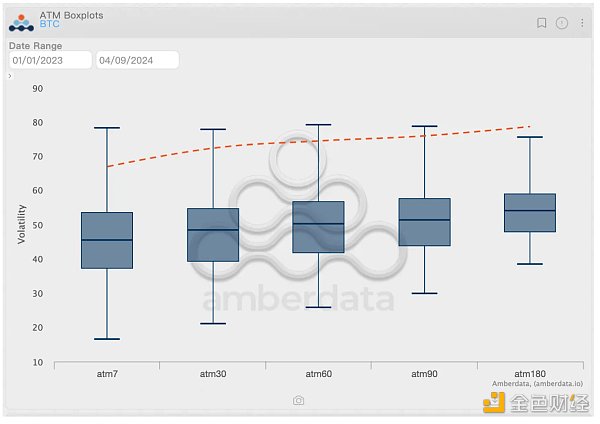

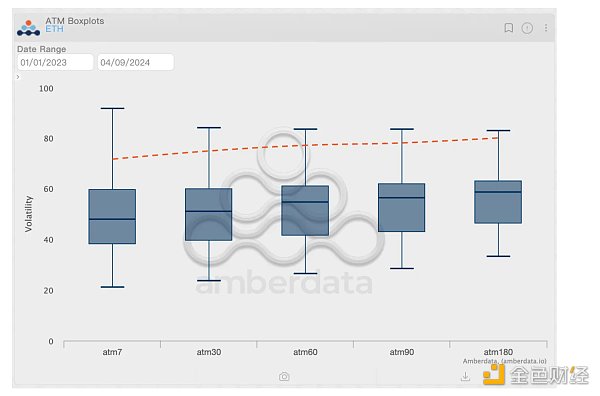

值得注意的是,最新的隐含波动率数据显示,交易者对BTC的价格表现仍保持相对谨慎的态度。面对即将到来的BTC减半,虽然宏观不确定性水平相对较低,尾部风险水平的定价也有所下降,但交易者仍然预计BTC价格7日价格变动幅度可能达到9.27%,30日价格移动幅度可达20.74%。

考虑到投资者看涨情绪依然高涨,理想情况下BTC价格仍有突破8万美元的潜力。然而,波动从来都不是单向的;我们不能忽视 BTC 跌破 6.5 万美元的可能性。

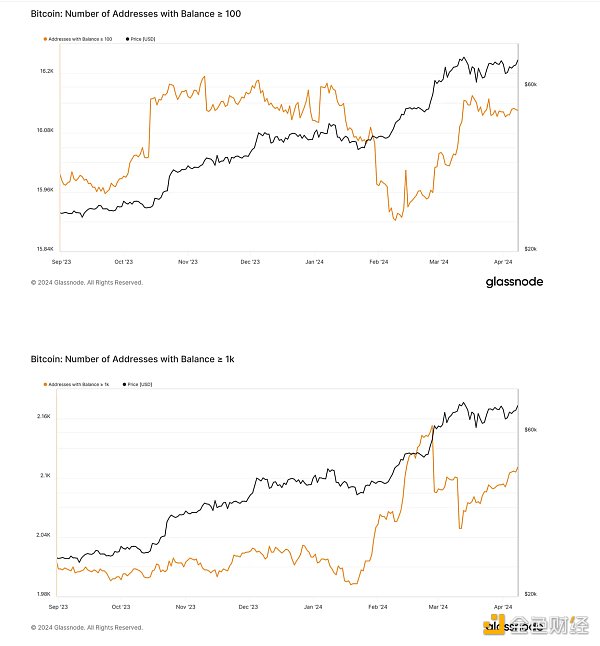

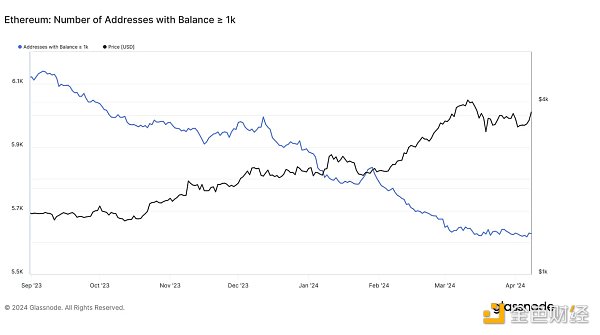

交易员的谨慎似乎是有道理的。现货市场上,虽然持有1k BTC以上的鲸鱼数量仍在增加,但总体而言,持有100 BTC以上的鲸鱼增长停滞,这意味着购买力正在减弱。总体来看,虽然中长期来看持有BTC仍是较好的选择,但随着“资产配置期”的暂时结束,BTC的价格涨幅可能会逐渐企稳。

非 BTC 加密货币:内部游戏

与BTC相比,ETH就没那么幸运了。现货ETH ETF通过的概率逐渐变小。即使是最乐观的 ETH 投资者也逐渐接受了围绕现货 ETF 的谈判和博弈将是长期的。ETH的表现更多地取决于加密市场内部流动性的重新分配以及加密市场内部宏观流动性水平的变化。

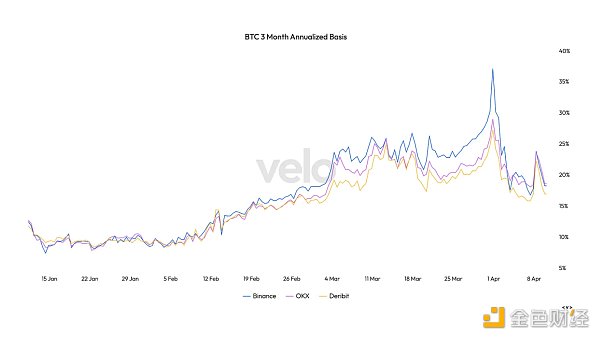

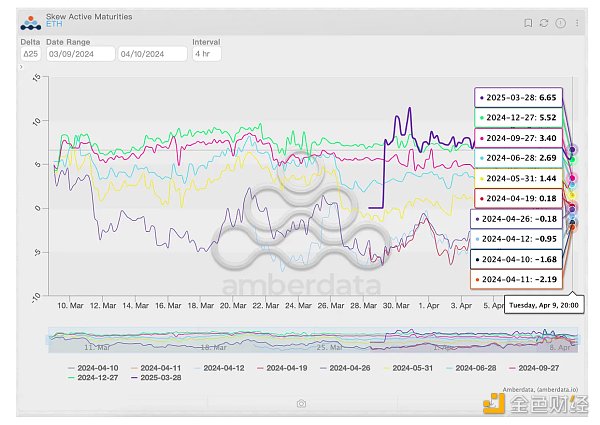

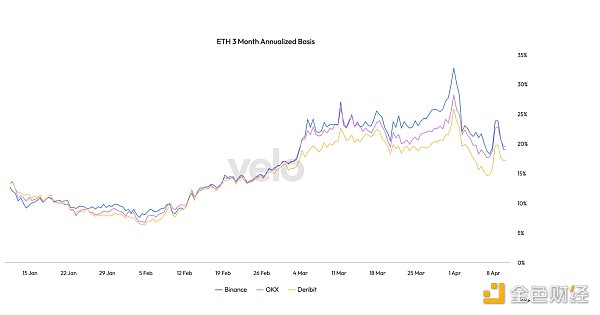

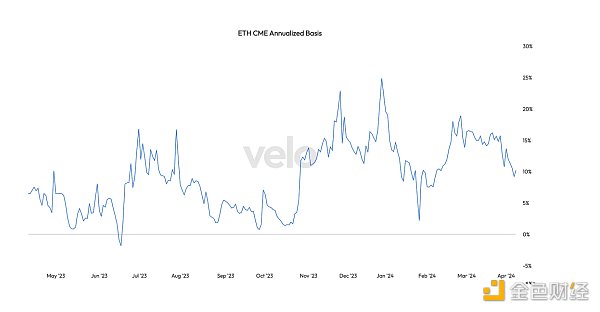

从宏观角度来看,受益于降息预期,交易者对ETH长期表现依然保持看多态度。但与BTC类似,降息预期的减弱也对ETH未来的业绩预期产生了负面影响,这体现在ETH期货年化溢价的变化上。

尽管投资者对 ETH 的价格变动定价相对较高(9.94%/7 天、21.5%/30 天),但从最新的伽马分布来看,投资者更可能担心的是价格下跌带来的波动,而不是价格下跌带来的波动。通过上涨。如果ETH价格呈现下跌趋势,只有跌至3300美元附近后才能获得一定支撑。

与此同时,与上行区间的阻力相比,下行路径上的支撑显得“微不足道”。除非在当前基于“流动性重新配置”的市场运行模式下出现足够多的利好事件,否则做市商的对冲行为将导致ETH价格难以突破并稳定在3700美元上方。

幸运的是,ETH巨鲸似乎已经放慢了现货的抛售速度。在Ethena等项目的影响下,质押现货盈利成为相对更赚钱的业务,而传统的Covered Call策略也随着价格上涨放缓而再次受到青睐。然而,这仅意味着鲸鱼在价格游戏中暂时保持“中立”。

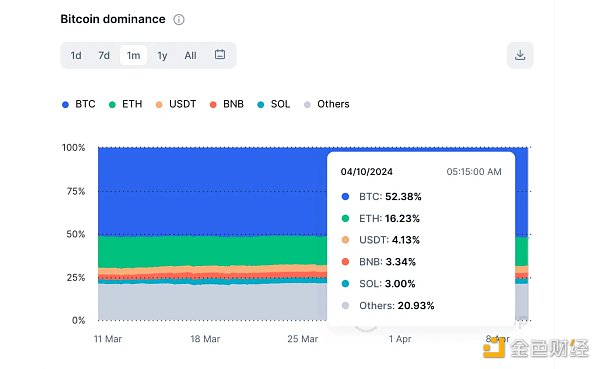

对于投机者来说,在 ETH 价格疲软的情况下,投资其他更具增长潜力的币似乎更为合适,这对 ETH 的表现产生了进一步的不利影响。ETH市场份额一度跌破16%;虽然最近有所回升,但与上个月相比,ETH的市场份额仍然大幅缩水。考虑到过去一个月BTC的市场份额没有明显变化,显然山寨币在与ETH的流动性竞争中占据了一定的优势。

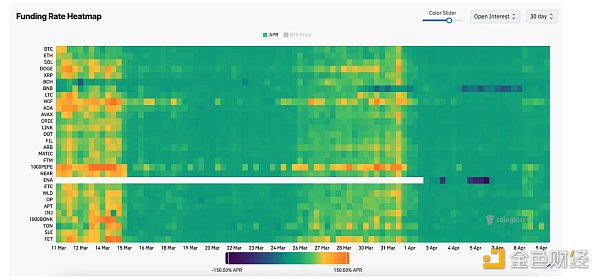

总体而言,持有 ETH 并不是一个“糟糕的策略”;对于巨鲸来说,ETH丰富的生息渠道仍然可以带来相对稳定和可观的回报。然而,对于寻求突破性回报的勇士来说,考虑到目前的杠杆水平以及资金费率所体现的山寨币投机情绪相对较低的情况,跟随加密市场流动性重新配置的步伐似乎是更合适的选择。

The rising global uncertainty of Shanouba Bitcoin Trading Network is one of the main reasons for the continuous improvement of the liquidity level in the encryption market in recent years, and it is also an important reason for the strong performance in the near future. Due to the lack of safe-haven properties, the performance of non-encrypted currency depends more on the changes in macro liquidity and the game situation of funds in the market. Shanouba Bitcoin has gained certain advantages in the liquidity competition with China, which has further adversely affected its performance. Bull market in geopolitical crisis last week, the number of non-agricultural products. According to the release of employment data, the lower-than-expected interest rate cut seems to have been gradually accepted and digested by investors. This week, many central banks headed by the European Central Bank will also announce the latest interest rate decisions. Although Europe's performance in inflation is far better than that of the United States, the European Central Bank also shows a higher interest rate cut expectation, but considering that the influence of the European Central Bank is relatively weak compared with that of the Federal Reserve, it can be determined that the speed of global cash liquidity will slow down in the future, and the bull market may be even more for the encryption market. Warm and long, but it seems that this is not the case. Since the beginning of the month, the return speed of cash liquidity in the encryption market has obviously accelerated. In the past week, the entire encryption market has obtained nearly 100 million US dollars in cash liquidity, and the overall cash liquidity scale has also recovered to the same level as that of the same period of last year. Affected by the above situation, the prices of counterfeit coins have all gained strong support, and the market sentiment has also obviously recovered. What caused the abnormal changes in cash liquidity? Let's take a look at the performance of other assets, which are at record highs. At the same time, the price of silver and copper has reached the highest point in the past year. As a long-standing hard currency, gold is an important hedging means when macro-uncertainty rises, especially in the period of geopolitical tension. However, when we observe the price trend of silver and copper, things become interesting. Silver and copper are important military strategic materials and are closely related to weapons production and national defense industry. To some extent, the rapid rise in the price of silver and copper is an additional manifestation of geopolitical conflicts and macro-uncertainty risks. So are there more similar clues? Of course, since the beginning of the year, the price of crude oil has risen more than that of coffee and other strategic commodities, and the price of commodities has soared due to the increased demand caused by the geopolitical crisis and the tight supply chain. Risk aversion has never only been reflected in an asset. When uncertainty comes, people will exchange cash for safe hard currency or materials. This is gold crude oil. An important reason for the rise in the price of coffee and other commodities is of course one of the reasons for the rise in the stock market. The price of cryptocurrencies such as bitcoin continues to rise. Considering the escalating geopolitical tensions in the Middle East and Eastern Europe, the demand for safe haven of global investors will be difficult to be effectively alleviated in the short term, so the demand for risk aversion will be strongly supported. At the same time, although the liquidity return rate is expected to slow down, the liquidity tightening situation is unlikely to happen again, so the liquidity scale of locking in the spot will remain relatively. Stability in the long run, the return of liquidity in the future will also push the price to rise steadily. Traders in the options market also hold similar views. Although investors' intraday bullish sentiment has weakened due to short-term fluctuations, investors' bullish sentiment has remained stable and dominated in recent months and far months. However, investors' expectations for medium and long-term performance have slightly decreased compared with the same period of last month, and the weakening of interest rate cut expectations may be one of the reasons. From the latest gamma exposure distribution, prices seem to appear with the end of the asset allocation period. With some signs of stabilization, the price can get some support around the US dollar, but if the price rises further, it will encounter some resistance near the US dollar, which will increase significantly with the price increase. It is worth noting that the latest implied volatility data shows that traders are still relatively cautious about the price performance of the company, and face the upcoming halving. Although the macro uncertainty level is relatively low and the pricing of the tail risk level has also declined, traders still expect the daily price of the price. The fluctuation range of the grid may reach the daily price movement range. Considering that investors' bullish sentiment is still high, the price still has the potential to exceed $10,000 under ideal circumstances. However, the fluctuation is never one-way. We can't ignore the possibility of falling below $10,000. The caution of traders seems to be reasonable. Although the number of whales holding above is still increasing in the spot market, the overall growth of whales holding above is stagnant, which means that the purchasing power is weakening. A better choice, but with the temporary end of the asset allocation period, the price increase may gradually stabilize. Compared with it, the internal game of non-encrypted currency is not so lucky. The probability of spot passing gradually decreases, and even the most optimistic investors gradually accept the negotiation and game around the spot. The long-term performance will depend more on the redistribution of liquidity in the encryption market and the changes in the macro liquidity level in the encryption market. From a macro perspective, it is expected that traders will benefit from interest rate cuts. However, the weakening of similar interest rate cut expectations has also had a negative impact on the future performance expectations, which is reflected in the change of the annualized premium of futures. Although investors price the price changes relatively high every day, from the latest gamma distribution, investors are more likely to worry about the fluctuations caused by the price drop than the fluctuations caused by the price drop. If the price shows a downward trend, it will only get some support after falling to around the US dollar, and at the same time, it will go up. The resistance of the interval is insignificant compared with the support on the downward path. Unless there are enough favorable events in the current market operation mode based on liquidity reconfiguration, the hedging behavior of market makers will make it difficult for the price to break through and stabilize above the dollar. Fortunately, the whale seems to have slowed down the selling speed of the spot. Under the influence of other projects, the pledge of spot profit has become a relatively more profitable business, and the traditional strategy has been favored again with the slowdown of price increase. However, this only means It seems more appropriate for speculators to temporarily remain neutral in the price game and invest in other currencies with more growth potential when the price is weak, which has further adversely affected their performance. Although the market share once fell below that of last month, it still shrank sharply. Considering that the market share of the past month has not changed significantly, it is obvious that it is not a bad strategy to hold counterfeit coins in the competition with liquidity. However, for giant whales, rich interest-earning channels can still bring relative stability and considerable returns. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。