早期洗盘还是中期走熊?

作者:刘教链

星桥鹊驾,经年才见,想离情、别恨难穷。牵牛织女,莫是离中。甚霎儿晴,霎儿雨,霎儿风。

无论市场阴晴、风雨变幻,囤饼人心中只有BTC(比特币)。前日4.15文章《赢x5》,说到现在是wyckoff积累模式尾端洗盘。昨夜4.16教链内参《牛市早期大洗盘》,提到有诸研究机构认为目前是牛市早期阶段的洗盘,亦暗合4.15教链内参《香港批准BTC和ETH现货ETF》中的判断。

已故的投资大师芒格说过,看一个人智商高低,就要看他是否能容纳两套完全相反的观点在脑子里而仍能从容行事。我们也要时刻注意,保持开放心态,容许任何有益的、讲道理的反对观点进入自己的视线和脑海。网友Stockmoney Lizards就对当前的市场形势提出了一些别样的见解。

目前而言,从宏观角度,人们遑遑于相反的牛熊因素:三战,归零?BTC产量减半,上天?新高,开启牛市?美经济形势良好,继续加息,归零?…… 实在是冰火两重天。

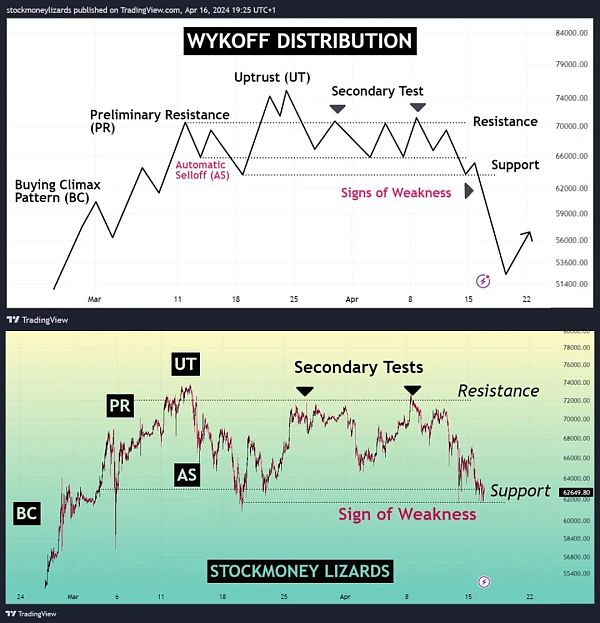

该网友的看法是,目前BTC正在走出一个wyckoff顶部派发模式。见下图:

技术图形总是后知后觉的 —— 只有当市场走完了这个形态,人们才能看清楚这是一个什么形态。

那么目前,BTC正处在悬崖边上:62k支撑一旦跌穿,三顶下跌可是够多头喝上一大壶的。

吓人吗?吓人。吓人就对了。这就叫“不战而屈人之兵”。

如果多头被吓到了,主动撤了杠杆。市场也就不会跌那么多。因为空头砸盘也是有代价的,最主要的代价就是砸下去被囤币党给捡了便宜,截胡了筹码。

但如果多头不愿意自己体面,仍然冒险放置高杠杆。那么市场也绝对不会客气,一定会帮多头体面。

总之,爆掉多头杠杆的收益,一定要比打折抛售损失筹码的代价要高,这才是一笔划算的买卖。

该网友随后分析了几个方面的因素:

首先,宏观经济方面:核心零售数据升高,显示通胀升高。美联储不想降息。人们担心美联储继续加息。这是看熊因素。

其次,地缘局势方面:伊打小以让市场紧张,担心局势升级。三战成为热搜。如果局势果真升级,市场可能会进一步回调。

第三,技术图形方面:(A)在历史上,当BTC突破“前高”之际,往往都会继续攀升。(B)产量减半后,BTC通常都会攀升。

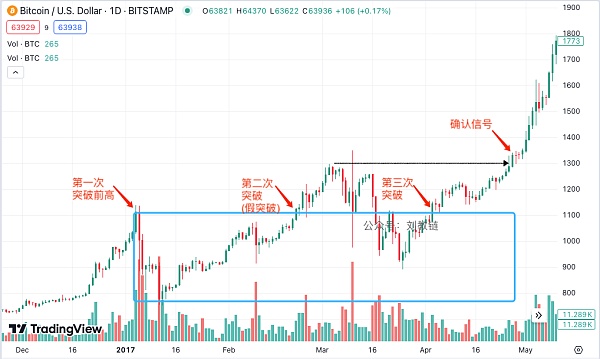

但是,教链提醒各位读者注意,他说的前一点其实并不准确。典型例子就是2017年1月突破2013年底“前高”1100刀之后,振荡洗盘了近4个月,才真正开启了2017年的牛市之旅。看一下当年的图表就很清楚了:

第一次突破前高后,立马来了个深度回调,回撤幅度近乎-30%。

而当前这次2024年3月初突破2021年“前高”之后,也才振荡了一个半月余,最大回撤仅-15%左右。

当然,2017年的回撤洗盘,其实总体趋势还是向上,而不是横盘或者下跌。而根据该网友的看法,“鉴于我们目前在宏观方面看到的一切,当前的图表形态遵循典型的wyckoff派发模式,表明我们肯定会看到另一次修正性下跌,更多负面消息可能会助长这种走势”,因此,他的结论是市场或将进入中期熊市。

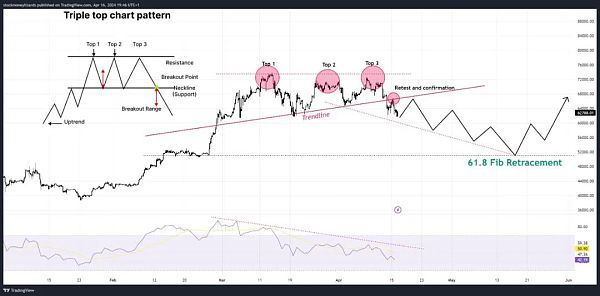

另外,他还从图表上找到了其他的一些“信号”,比如:三重顶;RSI显示正在衰减的动能;颈线的破位和重新测试,等。如下图所示:

还有艾略特波浪理论:

以及各种画线:

注意上面这个图是加密市场总市值,不是BTC的图线。对于这些,教链就不予置评了。

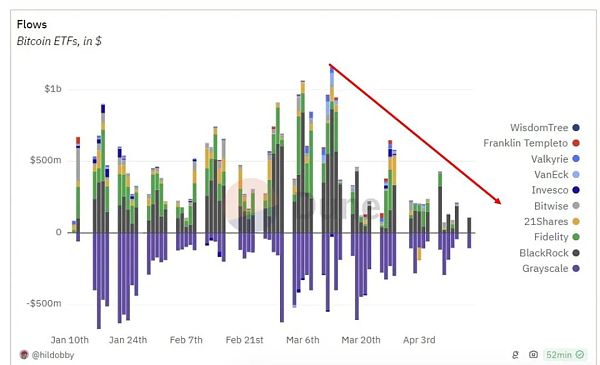

该网友还注意到了现货ETF方面。他说:大机构停止了买入。ETF流入大幅放缓。

教链此处又要更正一下。在3.19教链内参《加密瀑布,利空扑面而来》中就曾提到:「根据 Eric Balchunas 的数据,全球最大的资产管理公司贝莱德发行的 iShares 比特币信托基金(IBIT)每天平均有 25 万笔交易。平均交易规模为 326 股,约合 13,000 美元,这表明这些交易是由非专业投资者进行的。」

所以,并不是“大机构”停止了买入,而是“散户”停止了买入。对于散户而言,往往是买涨不买跌,就像房市也是类似。ETF买入放缓,是价格下跌的结果而非原因。

最后他提到,美股也在走出一个顶部下跌信号:圆顶,趋势线跌破。这可能也会对加密市场造成影响。

他最终的结论有两点:

第一,尽管有明显的看涨迹象(减半、新高),但有一些强烈的信号表明,我们可能会看到中期修正。根据新闻事件流,这可能会或多或少地突然发生。BTC 的主导地位将上升,山寨币将下降。

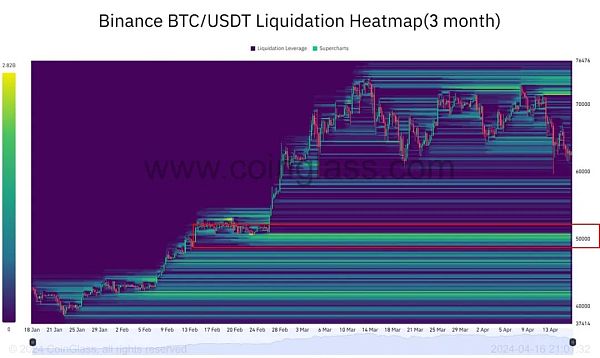

第二,尽管马上就要产量减半了,我们预计仍将继续调整。一个潜在的目标将是 61.8 斐波那契回调位(5万多美元的低点,那里有大量杠杆可以清算)。牛市没有结束。只是在休息。在经历了 1 年只涨不跌的走势后,这波回调也是可以接受的。

The author Liu Jiaolian Xingqiao Magpie has been driving for years before seeing her. She wants to leave her feelings. Don't hate it. It's hard to be poor. It's nothing but a moment of sunshine, a moment of rain and a moment of wind. No matter whether the market is sunny or rainy, the only thing in the heart of the cake hoarder is bitcoin. It is said that it is the end of the accumulation mode. Last night, the teaching chain was used to wash dishes in the early stage of the bull market. It was mentioned that some research institutions thought that it was the early stage of the bull market. It also coincided with the judgment of Hong Kong approval and spot in the teaching chain Whether he can hold two sets of completely opposite views in his mind and still act calmly, we should always keep an open mind and allow any beneficial and reasonable objections to enter our sight and mind. Netizens have put forward some different opinions on the current market situation. At present, from a macro perspective, people are obsessed with the opposite bull and bear factors, and the output will be halved after three wars, and the bull market will be opened to a new high. At present, we are going out of a top distribution mode. See the figure below. The technical graphics are always hindsight. Only when the market has finished this form can people see clearly what it is. So we are now on the edge of a cliff. Once we fall through three tops, it is scary enough for bulls to drink a big pot. Scary is right. This is called defeating the enemy without fighting. If bulls are scared and take the initiative to withdraw the leveraged market, they will not fall so much, because short selling is also costly. The main price is that The coin hoarding party took advantage of it and cut off the chips. However, if the bulls don't want to be decent and still risk putting high leverage, then the market will definitely be polite. In short, the income from exploding the leverage of the bulls must be higher than the cost of selling the lost chips at a discount. This is a good deal. The netizen then analyzed several factors. First, the increase in core retail data in macroeconomics shows that the Fed does not want to cut interest rates. People are worried that the Fed will continue to raise interest rates. It's the bear factor. Secondly, it's the geopolitical situation that makes the market nervous and worried about the escalation of the situation. If the situation really escalates, the market may be further adjusted. In the third technical graphic aspect, when it breaks through the previous high, it often continues to climb. However, the teaching chain reminds readers that the previous point he said is actually not accurate. A typical example is that it took nearly a month to really start the bull market trip in 2008 after breaking through the high knife before the end of the year. Looking at the chart of that year, it is clear that there was a deep callback immediately after the first breakthrough, and the retracement rate was almost the same. At present, the maximum retracement only oscillated for more than a month and a half after the breakthrough of the previous high at the beginning of the year. Of course, the overall trend of the retracement and dishwashing in 2008 is still upward rather than sideways or downward. According to the netizen's view, in view of everything we have seen in the macro aspect, the current chart pattern follows the typical distribution mode, which shows that we will definitely see another revision. More negative news may encourage this trend, so his conclusion is that the market will enter a mid-term bear market. In addition, he also found some other signals from the chart, such as the triple top showing the breaking and retesting of the decaying kinetic energy neckline, as shown in the following figure, as well as Elliott wave theory and various lines. Note that the above picture is the total market value of the encrypted market, but the line will not comment on these teaching chains. The netizen also noticed the spot aspect, and he said that large institutions stopped buying. The inflow slowed down sharply. Here, I have to correct it again. It was mentioned in the bad news of the encrypted waterfall in the teaching chain that according to the data, the bitcoin trust fund issued by BlackRock, the world's largest asset management company, has an average of 10,000 transactions every day, and the average transaction size is about US dollars. This shows that these transactions are carried out by non-professional investors, so it is not the big institutions that stop buying, but the retail investors often stop buying, just like the housing market. Finally, he mentioned that the US stock market is also coming out of a downward signal at the top, and the dome trend line falls below, which may also have an impact on the encryption market. His final conclusion has two points. First, although there are obvious bullish signs, there are some strong signals that we may see a mid-term correction, which may rise more or less suddenly according to the dominant position of news events. Second, although the output will be halved soon, we expect that. A potential target that will continue to adjust will be Fibonacci's pullback to a low of more than 10,000 dollars, where there is a lot of leverage to liquidate the bull market, which is not over but just resting. After experiencing the trend of only rising and not falling in 2008, this pullback is also acceptable. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。