地缘政治下的加密市场 比特币不再是一种对冲工具

作者:Casey Wagner、David Canellis 来源:blockworks 翻译:善欧巴,比特币买卖交易网

数字黄金去向何方?

减半周是一个混乱的开始。

伊朗周六无人机袭击以色列后,由于地缘政治担忧日益加剧,加密货币在周末大幅波动。

周六晚上,比特币 ( BTC ) 暴跌至 62,000 美元以下,进一步扩大了周五开始的抛售,当时 BTC 在几个小时内从 70,000 美元跌至 66,000 美元。不过,到今天凌晨,情况已经相对稳定。 截至美国东部时间上午 11 点,比特币在过去 24 小时内下跌超过 2%,价格为 64,500 美元。

以太坊 ( ETH ) 和 Solana ( SOL ) 的反弹更加强劲。早些时候,ETH 当日上涨 7%,而 SOL 则上涨 9%。此后两者均略有回撤。值得注意的是,当周末爆发更广泛的地区战争的威胁迫在眉睫时,交易员会因股市休市而受到限制。

周五开始,人们纷纷涌向传统金融避风港——黄金,黄金上涨了 17%。上周油价触及10月以来的最高水平。

截至15日上午,油价有所回落,但黄金仍在上涨,现货期货又上涨了 0.3%。

周五,加密货币相关股票与比特币一起下跌。COIN 股价上周收盘下跌近 7%,但今天上午盘前交易上涨 0.6%。MicroStrategy 周五同样下跌 5%,并在今天开盘前下跌 0.6%。

展望未来,除了减半之外,分析师还关注油价,从历史上看,油价是经济衰退的先行指标。1973年、1980年和1990年的石油危机都导致天然气价格飙升+35%,而且每次都导致美国经济陷入衰退。

DataTrek Research 联合创始人尼古拉斯·科拉斯 (Nicholas Colas) 表示:“如果今年夏天油价飙升至足以让美国汽油价格达到 5.40 美元/加仑,那么晚些时候经济衰退的可能性确实存在。”

2023年第二次海湾战争期间,石油和天然气价格飙升,这是经济衰退规则的一个例外,但当时美联储已经处于降息周期两年了。与我们现在的情况截然不同。

两周多一点后,各国央行行长再次召开会议,降息预期继续减弱。芝商所期货数据显示下跌的可能性仅为 4.5%。

数据

代币化对冲基金 Ethena周末首次出现日净流出,总计损失 3158 万美元。

过去一周,流向第二层Arbitrum 和 Optimism 的净流量达到 2.78 亿美元。同期以太坊资金流出达到 2.89 亿美元。

在SEC 发出 Wells 通知后, Uniswap交易量并未放缓:仍约为每天 30 亿美元,而 2 月份约为 10 亿美元。

在过去的一个月、一周和一天中,比特币稳居 NFT 交易量第一的区块链,目前是第二名以太坊的两倍多。

Solana 的活跃地址在 3 月中旬触及 240 万的 30 个月高点后降至 100 万。

对冲状态仍悬而未决

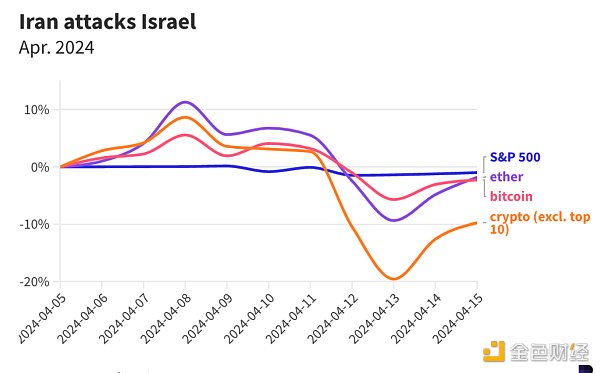

加密货币似乎对伊朗周末对以色列的袭击反应过度,大部分市场抛售高达 20%。

周一收盘前股市并未下跌。尽管如此,任何事情都有可能发生,但似乎无论加密货币投资者担心什么,股市人士并没有太在意。

在这种时候,如果比特币真的与股市不相关就好了。当世界摇摇欲坠时,人们可以购买比特币。对冲反乌托邦,长期以来一直是黄金的价值支柱。

在某些情况下,比特币确实是一种有用的对冲工具。在地缘政治高度紧张和市场不确定性的情况下,其与基准相反的时期。

随着时任总统唐纳德·特朗普 (Donald Trump) 于 2019 年 5 月加大与中国的贸易战力度,并计划将中国进口商品的关税从 10% 提高到 25%,比特币和以太坊上涨了 50% 以上。标准普尔 500 指数同期下跌超过 2.2%。

2021 年 1 月 6 日国会大厦骚乱前后,比特币飙升 40%,而标准普尔指数则下跌。以太坊和其他的加密货币市场的涨幅甚至超过了比特币。

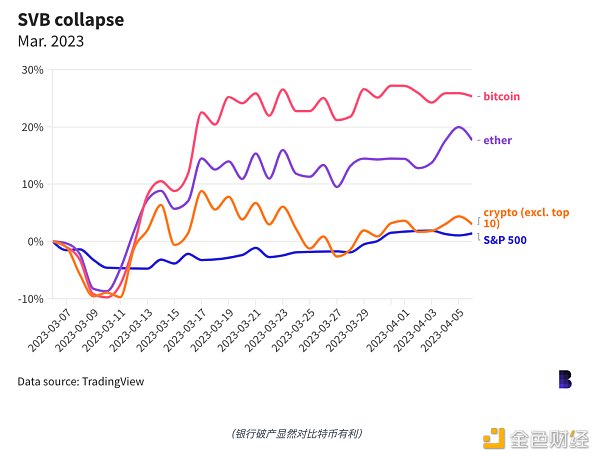

去年 3 月,随着硅谷银行破产,加密货币最初与标准普尔指数一起下跌,但随着美国政府出手整顿储户,比特币和以太坊的涨幅超过 20%。与此同时,标准普尔指数只是真正减少了损失。

10 月 7 日哈马斯袭击以色列后,比特币甚至飙升了四分之一以上。标准普尔 500 指数下跌约 5%。

然而在其他压力时期,加密货币的交易却与套期保值者的希望相反。2018 年 10 月贾迈勒·卡舒吉 (Jamal Khashoggi) 在沙特阿拉伯被暗杀后,比特币、以太坊和其他数字资产市场与标准普尔 500 指数一起崩盘。

有时,加密货币甚至可以像其他所有东西一样进行交易。当美国于 2021 年 9 月从阿富汗大幅撤军时,比特币和以太坊下跌超过 10%,标准普尔指数下跌 6%。

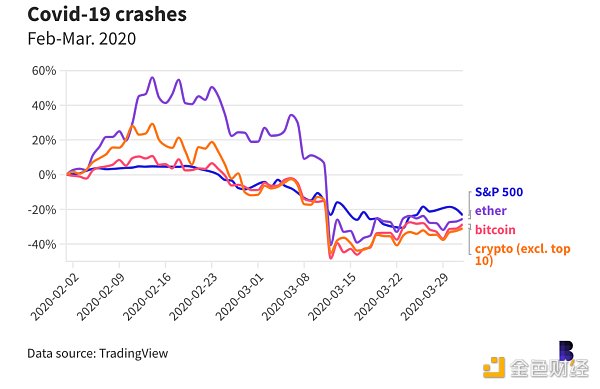

然后,在 2020 年第一季度 Covid-19 崩盘期间,比特币暴跌 50%,这与全球市场同步发生。尽管如此,也许我们正在走向一个比特币和加密货币充当避险资产的时代。

大事件

香港可能刚刚加入欧洲和美国的行列,因为它可能允许一些公司推出现货比特币 ETF。香港监管机构证券及期货事务监察委员会似乎也击败了美国证券交易委员会,同时批准了一些发行人推出现货以太坊 ETF。

华夏基金在一份声明中表示,正在与 OSL Digital Securities 和中银国际保诚合作。该公司声明的翻译版本称,该资产管理公司“计划发行可投资现货比特币和现货以太坊的 ETF 产品” 。

OSL 在另一份声明中确认“原则上批准并在香港推出首个现货比特币/以太坊 ETF”。

HashKey表示,它还与 Bosera International 一起获得了批准。两家公司计划联手“共同推动比特币和以太坊现货ETF的发行,为投资者提供安全、合规、便捷的直接参与这些市场的方式。”

由于上周晚些时候的报道,周一的消息足以提振比特币和以太币在经历了动荡的周末之后。以太坊上涨约 7%。

这是香港巩固其作为加密货币领域主要参与者的时刻。去年,特别行政区一直在制定新的法规并吸引加密货币公司。除此之外,这可能为亚洲的机构需求打开一扇大门。

在美国,现货比特币 ETF 的推出导致比特币创下历史新高,随着公司希望为自己及其客户获得投资机会,大量机构和散户买入新的 ETF。具体来说,以太坊 ETF的推出(如果在美国之前在香港执行)可以让整个市场了解如果或何时在美国推出 ETF,会发生什么,具体取决于你询问的对象。

The week is a chaotic beginning. After Iran's drone attack on Israel on Saturday, the cryptocurrency fluctuated sharply over the weekend due to increasing geopolitical concerns. Bitcoin plunged below the US dollar on Saturday night, further expanding the sell-off that began on Friday. At that time, it fell from the US dollar to the US dollar within a few hours, but by the early morning of this morning, the situation had been relatively stable. By the morning of Eastern Time, Bitcoin had fallen in the past hour. The rebound of Ethereum, which exceeded the price of US dollars, was stronger. Earlier, it rose on the same day, while it rose. After that, both of them retreated slightly. It is worth noting that when the threat of a wider regional war broke out over the weekend is imminent, traders will be restricted by the stock market closing. On Friday, people began to flock to the traditional financial haven. Gold rose, and the oil price hit the highest level since last week. As of the morning of March, the oil price fell, but the spot futures rose again. The stock closed down with bitcoin last week, but the stock price closed down nearly this morning, but the pre-market trading rose on Friday, and fell before the opening today. Looking forward to the future, in addition to halving, analysts also pay attention to oil prices. Historically, oil prices are the leading indicator of economic recession. The oil crises of 2000 and 2000 led to the soaring price of natural gas and the recession of the US economy every time. Co-founder Nicholas Colas said that if the oil price soared enough to make the price of gasoline in the United States reach this summer, The possibility of economic recession so late in the dollar gallon does exist. During the second Gulf War in, oil and gas prices soared, which was an exception to the economic recession rule. But at that time, the Federal Reserve had been in the interest rate reduction cycle for two years, which was completely different from our current situation. After a little more than two weeks, central bank governors met again to cut interest rates, and the expectation continued to weaken. The futures data of the Chicago Stock Exchange showed that the possibility of decline was only data token, and the hedge fund had its first daily net outflow at the weekend, with a total loss of 10,000. In the past week, the net flow of US dollars to the second floor reached US$ billion, while the outflow of funds from Ethereum reached US$ billion. After the notice was issued, the transaction volume remained at about US$ billion per day and about US$ billion per month. In the past month, the blockchain with the largest transaction volume in a week and a day, Bitcoin is now more than twice as active as the second Ethereum. After hitting a monthly high of 10,000 in the middle of the month, it fell to a hedging state of 10,000. It seems that the cryptocurrency attack on Iran and Israel over the weekend is still pending. Overreacting, most markets sold as high as Monday's close, and the stock market did not fall. Nevertheless, anything can happen, but it seems that no matter what cryptocurrency investors are worried about, the stock market people don't care too much. At this time, it would be nice if Bitcoin really has nothing to do with the stock market. When the world is crumbling, people can buy Bitcoin to hedge dystopia, which has long been the value pillar of gold. In some cases, Bitcoin is indeed a useful hedging tool at a geopolitical level. Under the condition of tension and market uncertainty, it was the opposite of the benchmark. With then President Donald Trump increasing his trade with China in and planning to increase the tariff on imported goods from China to Bitcoin and Ethereum, the S&P index fell over the same period, while Bitcoin soared before and after the riots in the Capitol on, while the S&P index fell. The increase of Ethereum and other cryptocurrency markets even exceeded that of Bitcoin with the bankruptcy of Silicon Valley banks last month. The cryptocurrency initially fell with the Standard & Poor's Index, but with the US government's efforts to rectify depositors, Bitcoin and Ethereum rose more than that, while the Standard & Poor's Index only really reduced the losses. After Hamas attacked Israel on April, Bitcoin even soared by more than a quarter, and the Standard & Poor's Index fell by about. However, in other stressful times, the cryptocurrency transactions were contrary to the hedgers' hopes. After Jamal Kachouqi was assassinated in Saudi Arabia, Bitcoin Ethereum and other figures. The asset market crashes with the Standard & Poor's Index, and sometimes cryptocurrencies can even be traded like everything else. When the United States withdrew its troops from Afghanistan in September, Bitcoin and Ethereum fell more than the Standard & Poor's Index, and then during the crash in the first quarter of 2008, Bitcoin plummeted, which happened simultaneously with the global market. Nevertheless, maybe we are heading for an era when Bitcoin and cryptocurrencies are safe-haven assets. Hong Kong may just join the ranks of Europe and the United States because. It may allow some companies to launch spot bitcoin. The Securities and Futures Commission, the Hong Kong regulator, seems to have defeated the US Securities and Exchange Commission and approved some issuers to launch spot ethereum. Huaxia Fund said in a statement that it is cooperating with BOC Prudential International. The translated version of the company's statement said that the asset management company plans to issue products that can invest in spot bitcoin and spot ethereum. In another statement, it confirmed that it approved in principle and launched the first one in Hong Kong. Spot Bitcoin Ethereum said that it has also been approved together. The two companies plan to jointly promote the issuance of bitcoin and Ethereum, providing investors with a safe, compliant and convenient way to directly participate in these markets. Due to reports late last week, Monday's news was enough to boost Bitcoin and Ethereum. After a turbulent weekend, Ethereum rose about. This is the moment for Hong Kong to consolidate its role as a major player in the cryptocurrency field. Last year, the Special Administrative Region has been formulating new regulations. And attract cryptocurrency companies. In addition, this may open a door for institutional needs in Asia. The launch of spot bitcoin in the United States has led to a record high in bitcoin. As the company hopes to obtain investment opportunities for itself and its customers, a large number of institutions and retail investors buy new ones, specifically, the launch of Ethereum in Hong Kong before the United States can let the whole market know what will happen if or when it is launched in the United States, depending on the object you ask. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。