代币经济学指南:识别优质项目的六大关键因素

作者:IGNAS | DEFI RESEARCH 翻译:善欧巴,比特币买卖交易网

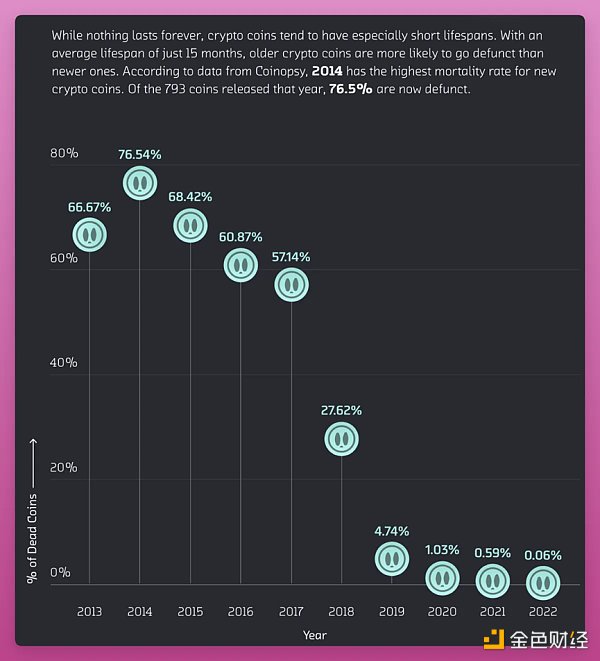

研究表明,2014 年加密货币崩盘中 91% 的代币现在已经死亡。据估计,十分之九的区块链项目也将失败,代币的平均寿命只有 15 个月。

成功率如此之低的情况下,我想分享我的想法,以识别可能存活并蓬勃发展的项目。

问题是 - 项目太多了,但我们的时间和精力是有限的。 花几天时间研究一个代币当然很棒,但加密货币发展迅速,因此要为决策节省一些精力。

这就是为什么我专注于真正重要的代币经济学部分。

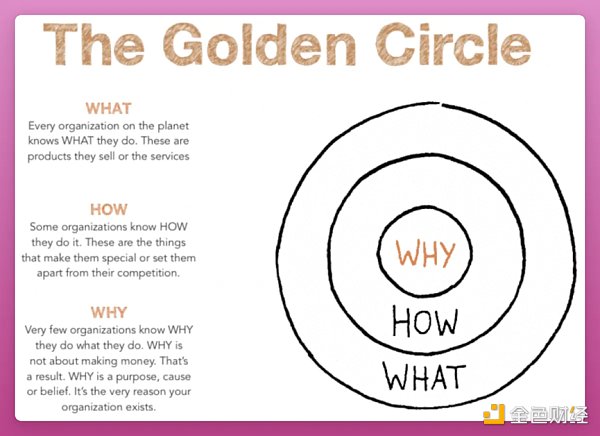

从“为什么”开始

根据西涅克的说法,“很少有人或公司能够清楚地阐明他们做某件事的原因。”

这更适用于加密项目及其代币。似乎项目每天都会根据当时的主导叙事而涌现。

我相信在投资代币之前,花一些时间了解项目为什么要发行代币是非常重要的。

这可以分解成三个问题:

1.项目为什么要发行代币?

2.它是如何运作的?

3.它有什么功能?

寻找代币存在的真正原因

实际上,我相信大多数项目根本不需要代币才能运行。想想以下项目是否真的需要代币才能运行?

DEX 和 DEX 聚合器

抵押稳定币

借贷协议

收益聚合器

钱包

例如,SushiSwap 的吸血鬼攻击可能迫使 Uniswap 发行他们自己的代币。$UNI 一段时间以来一直让人觉得麻烦,但多亏了潜在的收入共享终于启动,UNI 开始变得有意义。

无论如何,大多数项目都会发行代币。原因很明显:

筹款

建立社区

引导流动性

许多协议将代币仅仅视为筹款工具(显然,他们不会公开这么说)。

但伟大的项目是那些拥有更深层次代币存在理由的项目。 这些都是经过深思熟虑的功能,并不那么明显:

分配所有权和权力(谁决定哪个代币列入 Aave 或奖励在哪里/如何分配?)

风险管理(谁评估风险,如果协议资不抵债谁承担责任?)

未来效用选项(最初作为社区/筹款工具推出,但会添加功能以分散协议并以计划的方式将所有权移交给社区)。

在投资之前,先了解项目发行代币的真正原因,这不仅仅是为了筹款目标。

分析代币生态系统是如何运作的

“如何”的部分可能会很复杂,尤其是对于使用创新博弈论的项目而言。

每个项目都在其文档部分提供了代币经济学解释。 找到“如何”运作很容易,理解透彻则更具挑战性。

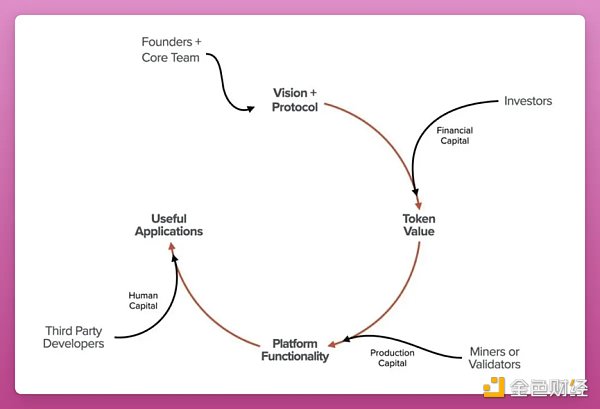

我相信最好的代币设计具有飞轮效应 - 一个推动代币的采用、使用和升值的良性循环。

这会创造一个正反馈循环,强化代币的生态系统。

Curve 的 veTokenomics 可能是最被复制的设计之一:veCRV 鼓励长期持有、激励流动性并吸引其他协议在 Curve 上进行建设。

但是,请记住,代币设计在复杂性方面各不相同,有些故意复杂化以欺骗投资者,而另一些则提供独特的创新并创造价值。

您的挑战在于区分两者。

毕竟,“如果你不知道收益来自哪里,那么你就是收益。”

质押可能是代币最简单且可以说最有用的功能。 如果项目设法奖励用户生态系统空投代币,那么这将是一个强有力的价值主张。 例如,考虑 Celestia 的 TIA 或 Cosmos 的 ATOM。

然而,有时会出现一种如此独特和不同的代币,以至于它改变了行业的轨迹。 代币经济学的原创性可以推动行业向前发展并开启新的牛市。

寻找对持有者有价值的代币

了解代币存在的根本原因以及其运作方式之后,现在是时候找出代币如何为投资者创造价值了。我们不想要没有任何用例的代币。

例子:

支付费用

收入共享

费用折扣

治理协议

用于流动性/风险管理

最流行的例子是协议费用收入共享。 或者一些项目已将代币集成到协议的核心功能中。

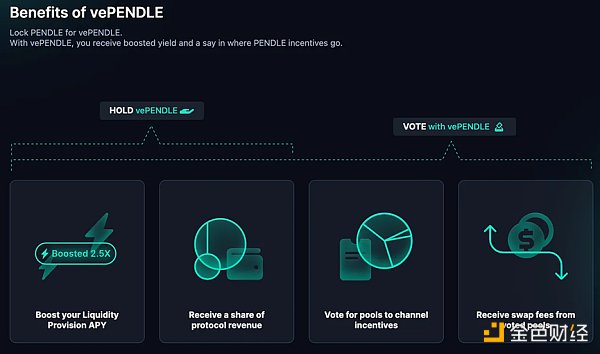

例如,Pendle 及其 vePendle 设计正处于上升期。vePENDLE 奖励用户提升的 LP APY 和部分协议收入。 并且由于 Pendle 成功将自己定位为 DeFi 的收益/积分挖矿中心,该代币受益于采用率/TVL 和其他指标的增长。

vePENDLE 还赋予用户投票权来决定激励分配。 总而言之,vePENDLE 的代币经济学设计简单,价值增长直接明了。

评估需求和供应机制

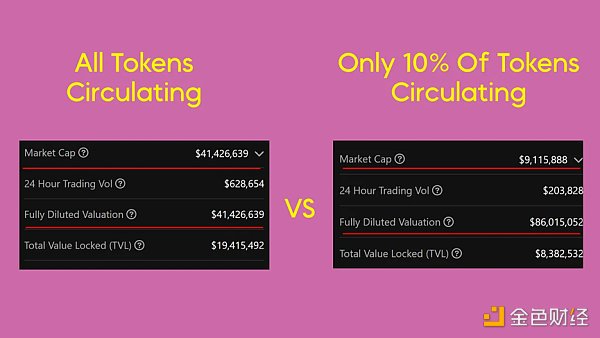

评估市值 (MC) 与完全稀释估值 (FDV) 的比率。

低的市值/完全稀释估值比率意味着将要向市场释放更多代币,从而对价格施向下行压力。

考虑谁会购买这些新发行的代币!

我同意短期内 FDV 就是个流行梗的说法。看看 Worldcoin 最近的暴涨就知道了!

但您可能不想在熊市来袭时持有这些代币。最终,真正的需求应该会抵消供应的增加。

我目前对这个周期的想法是短期到中期:只要主要解锁还有 6 个月或更长时间,市值比 FDV 更重要。

评估代币分配

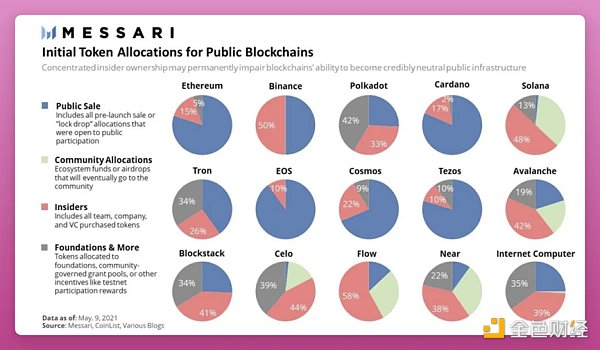

通过了解代币分配来评估代币的长期潜力。没有什么是最佳分配比率的简单答案。它因项目和当时占主导地位的叙事而异。

还记得那些团队分配 0% 的“公平启动”代币吗?

每个人都关注这个事实,团队分配太多会导致抛售。

然而,团队分配太少也存在问题:太少会削弱团队建设的财务动力。

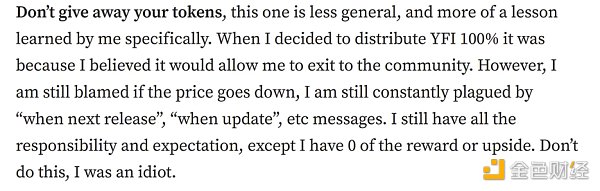

Andre Cronje 在他的博客文章“在 defi 中构建很糟糕(第 2 部分)”中写道,将 100% 的代币交给社区是一个错误。

除了责任和期望,我什么奖励或好处都没有。 不要这样做,我太蠢了。 - Andre Cronje

看来“公平启动”的趋势目前已经过时。最近的一次尝试是 BRC20 代币,但其中 99% 都迅速膨胀消失了…

长期持有与短期持有的方法

我专注于中长期持有,所以我寻找具有长期线性解锁时间表(没有大的悬崖解锁)和MC/FDV比率高于0.8的代币。团队和VC分配约30%。

如果你的重点是短期交易,你应该掌握代币分析工具:

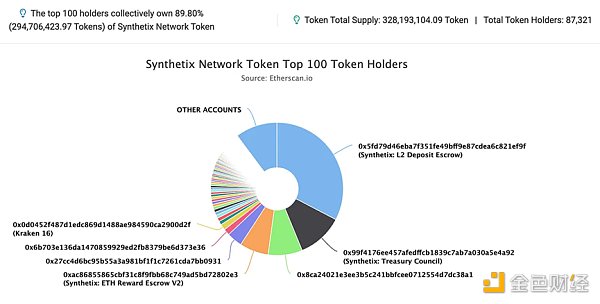

••Etherscan:检查鲸鱼持有代币的比例。你还应该检查代币是否被锁定在智能合约中或保存在单个钱包地址中。

(例子:前100持有者总共持有SNX 89%的股份,但实际上 32% 被锁定在质押中)

•Dune:用于专门的项目仪表板或社区构建仪表板,如DeFi Mochi所做的。

•Nansen:找出谁持有代币,它们流向哪里。

评估实际流动性

检查是否有对代币的真正需求,以及是否可以购买它。

不要仅仅依赖交易量,因为加密货币交易所因“清洗交易”而臭名昭著——从自己那里买卖代币,以创造一种需求幻觉。

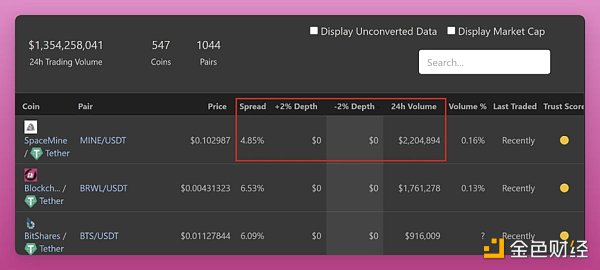

在Coingecko或Coinmarketcap上查看流动性深度,以评估真实的流动性。

有时会有独特的代币设计,但流动性较低,这意味着能够推高价格的大投资者无法进入。

代币的功能排在最后

“什么”部分很简单——它是代币的功能,比如投票、质押、VIP访问、应用内支付或每笔交易的销毁。

根据我的经验,不知道“为什么要这样做”的项目通常专注于提供尽可能多的功能。网站上到处都是复杂的图形和设计,吸引你立即购买。

然而,不要被简单的营销所迷惑——看看这些功能是如何支持协议的发展,并为代币持有者创造真正的价值的。

我喜欢Crypto Linn的这种简单方法,即投资于使用户富有的协议。一个简单而强大的框架。

你只需要一到三个杀手级用例。

简化方法

发现下一个优质代币可能是一项具有挑战性的任务,尤其是每天都有大量新代币涌现的情况下。

很难紧跟所有新项目并对每一个项目进行彻底研究。

这就是我让本指南简短易懂的原因 - 它可以用 6 个可操作的要点总结:

目标: 了解代币存在的理由以及它是否值得你投入时间。

功能: 检查飞轮效应和长期成功的潜力。

价值: 不要只看花哨的功能,而要关注代币持有者的实际价值。

动态: 考虑代币分配、市值/完全稀释估值比率、解锁和购买压力。

流动性: 检查流动性深度和需求以评估代币价值和增长。

分析: 掌握工具以便为投资和抛售做出明智决策。

The research of Shanouba Bitcoin Trading Network shows that the tokens in the cryptocurrency crash in 2000 are now dead. It is estimated that nine out of ten blockchain projects will also fail. The average life of tokens is only one month. With such a low success rate, I want to share my thoughts to identify projects that may survive and flourish. The problem is that there are too many projects, but our time and energy are limited. It is of course great to spend a few days studying a token, but cryptocurrency is developing rapidly, so we should save money for decision-making. Some energy. That's why I focus on the really important part of token economics. According to Sinek, few people or companies can clearly explain why they do something. This is more applicable to encryption projects and their tokens. It seems that projects emerge every day according to the dominant narrative at that time. I believe it is very important to spend some time to understand why the project should issue tokens before investing in tokens. This can be broken down into three questions: why should the project issue tokens? How does it work? What function does it have? In fact, I believe that most projects don't need tokens at all to run. Think about whether the following projects really need tokens to run and the aggregator mortgages the stable currency lending agreement. The vampire attack, for example, may force them to issue their own tokens, which has been troublesome for some time, but thanks to the potential revenue sharing, it has finally started to make sense. In any case, most projects will be issued. There are obvious reasons for raising money, establishing communities and guiding liquidity. Many agreements regard tokens as only fund-raising tools. Obviously, they will not say so publicly, but great projects are those with deeper reasons for the existence of tokens. These are well-thought-out functions, and it is not so obvious to allocate ownership and power. Who decides which tokens to include or where to reward, how to allocate risk management, who evaluates risks, and who bears the responsibility if the agreement is insolvent? The future utility option was originally used as community fund-raising. The tool is launched, but it will add functions to disperse the agreement and transfer the ownership to the community in a planned way. Before investing, it is necessary to understand the real reason for the project to issue tokens. This is not only for the purpose of fund-raising, but also to analyze how the token ecosystem works. It may be complicated, especially for projects that use innovative game theory. Each project provides an explanation of token economics in its document part, and it is more challenging to find out how to operate, which is easy to understand and thorough. Design has flywheel effect, a virtuous circle to promote the adoption, use and appreciation of tokens, which will create a positive feedback loop to strengthen the ecosystem of tokens. It may be one of the most replicated designs to encourage long-term holding of incentive liquidity and attract other agreements to build on it, but please remember that token designs are different in complexity, some are deliberately complicated to deceive investors, while others provide unique innovation and create value. After all, if you don't know, your challenge is to distinguish the two. Where does the income come from, then you are the pledge of income, which may be the simplest and most useful function of tokens. If the project tries to reward users for airdropping tokens in the ecosystem, it will be a strong value proposition, such as considering or, however, sometimes there will be a kind of token so unique and different that it changes the track of the industry. The originality of token economics can push the industry forward and open a new bull market to find tokens that are valuable to the holders and understand the root of the existence of tokens. After the reasons and how it works, it's time to find out how tokens create value for investors. We don't want examples of tokens without any use cases. The most popular examples of payment fees, income sharing fees and discount governance agreements for liquidity risk management are agreement fees, income sharing or some projects have integrated tokens into the core functions of the agreement, for example, their design is on the rise, rewarding users for their enhanced and partial agreement income and positioning themselves as income points due to success. The mining center benefits from the increase of adoption rate and other indicators, and also gives users the right to vote to decide the incentive distribution. In a word, the economic design of tokens is simple, and the value growth is straightforward. The ratio of evaluating demand and supply mechanism to evaluating market value and fully diluted valuation is low, which means that more tokens will be released to the market, thus putting downward pressure on prices. I agree that it will be a popular stalk in the short term. Look at the recent statement. But you may not want to hold these tokens when the bear market strikes. In the end, the real demand should offset the increase in supply. My current thinking about this cycle is that in the short to medium term, as long as the main unlocking is still a month or more, it is more important to evaluate the token allocation. By understanding the token allocation, we can evaluate the long-term potential of tokens. There is no simple answer to the optimal allocation ratio. It varies according to the project and the dominant narrative at that time. I still remember the fair start of team allocation. Everyone is concerned about the fact that too much team allocation will lead to selling, but too little team allocation will also lead to problems, which will weaken the financial motivation of team building. In the first part of his blog article, he wrote that it is a mistake to give the tokens to the community except for responsibility and expectation. Don't do this. I am stupid. It seems that the trend of fair start is out of date at present. The latest attempt is tokens, but all of them have rapidly expanded and disappeared for a long time. With the method of short-term holding, I focus on medium-and long-term holding, so I am looking for a token team and distribution contract with a long-term linear unlocking schedule without a big cliff unlocking and a higher ratio. If you focus on short-term trading, you should master token analysis tools to check the proportion of whales holding tokens. You should also check whether tokens are locked in smart contracts or kept in a single wallet address, for example, the shares held by the former holders in total are actually locked in pledge for special project instruments. Find out who holds the tokens and where they flow, assess the actual liquidity, check whether there is a real demand for tokens and whether it can be purchased. Don't just rely on the transaction volume, because cryptocurrency exchanges are notorious for cleaning transactions, buy and sell tokens from themselves to create an illusion of demand. Look at the depth of liquidity on or to assess the real liquidity, sometimes there are unique token designs, but the liquidity is low, which means that big investors who can push up the price can't enter the token. What part is the last? It is the function of tokens, such as voting pledge access. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。