USDe经济模型与潜在风险解析

作者:Bewater Giga-Brain 来源:X,@BeWaterOfficial

一、USDe界定:足额抵押的半中心化稳定币

稳定币有许多种分类方式,例如:

(1)足额抵押和非足额抵押

(2)中心化托管和非中心化托管

(3)链上发行与中心化机构发行

(4)需许可和无需许可

其中还会存在一些重叠和变化,例如过去我们认为AMPL、UST等算法稳定币供应和流通完全由算法节的稳定币。按照此定义,大部分稳定币属于非足额抵押稳定币,但也有例外,例如Lumiterra的LUAUSD,尽管其铸造和销毁价格是由算法调节,但协议金库提供了不少于LUAUSD锚定价值的抵押物(USDT&USDC),LUAUSD兼具算法稳定币和足额抵押稳定币两重属性。

另一个例子是DAI,当DAI的抵押物为100%的链上资产时,DAI属于非中心化托管稳定币,但引入RWA以后,部分抵押物事实上是由现实实体控制的,DAI转变为中心化和非中心化混合托管的稳定币。

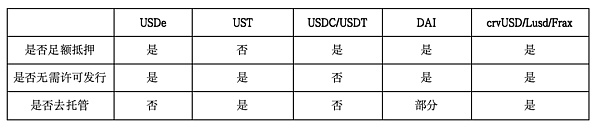

基于此,我们可以剥离掉过于复杂的分类,抽象成是否有足额抵押、是否无需许可发行、是否去托管三个核心指标。对比来看,USDe和其他常见稳定币在这三项属性上均有部分差异。如果我们认为【去中心化】需要同时满足【无需许可发行】和【去托管】两个条件,那么USDe是不符合的,因此将其归类为【足额抵押的半中心化稳定币】是合适的。

二、抵押物价值分析

第一个问题是USDe是否有足额抵押物,答案很显然是肯定的。正如项目文档所述,USDe的抵押物是加密资产和相应的空头期货头寸的合成资产作为抵押物。

合成资产价值=现货价值+空头期货头寸价值

初始状态下,现货价值=X,期货头寸价值=0,假设基差为Y

抵押物价值=X+0

假设一定时间后现货价格上涨a美元,而期货头寸价值上涨了b美元(a、b可以为负)头寸价值=X+a-b=X+(a-b),基差变为Y+ΔY,其中 ΔY =(a-b)可以看出,如果ΔY不变,那么头寸的内在价值不会变动,如果ΔΔY为正数,那么头寸的内在价值会上涨,反之则下跌。另外对于交割合约来说,基差初始状态下一般为负数,而到交割日时基差会逐步变为0(不考虑交易摩擦),这也就意味着AY必然是正数,因此如果合成的时候基差为Y,合成头寸在交割日时合成头寸价值会高于初始状态。

持有现货,做空期货的资产组合也被称作“期现套利”,这种套利结构本身是没有风险的(但有外部风险),按照当前数据,构造这种投资组合大约能够获取18%左右的低风险年化收益。

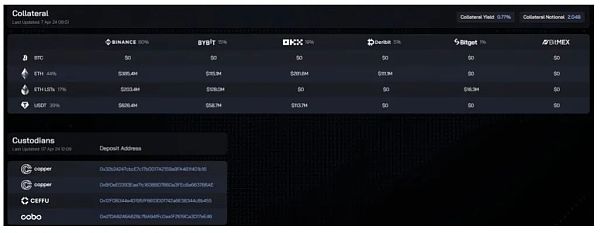

我们回到Ethena,关于是使用交割合约还是永续合约我并没有在官网找到准确界定(考虑到交易深度问题,永续合约的概率比较大),但公布了抵押物的链上地址和CEX分布。

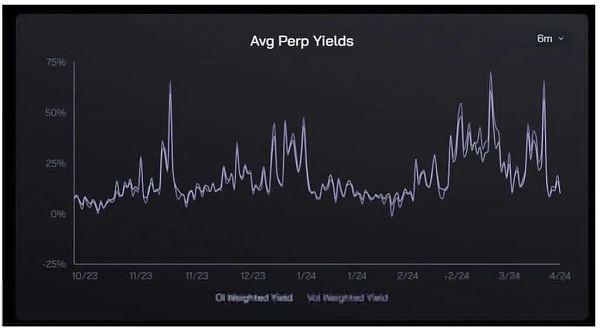

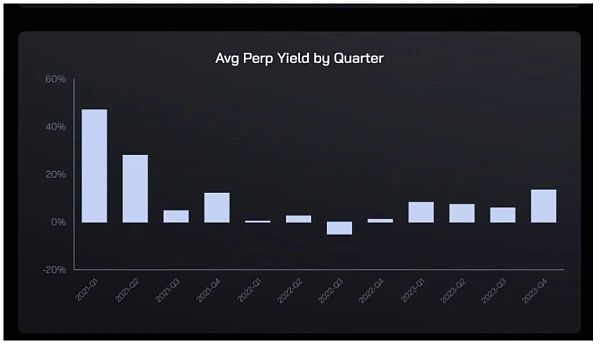

从短期来看,这两种方式会有一些差异,交割合约会提供一个更加“稳定且可预测”的收益率,且到期收益始终为正。而永续合约则是一个波动利率的产品,日利率在特定情况下也可能为负。但从经验来看,永续合约的套利历史回报会略高于交割合约,且二者都为正:

1)Delta中性的期货空投本质是出借资金,出借资金不可能长时间保持0利率或者负利率,而且这种头寸堆善了USDT风险、中心化交易所风险,所以必要收益率>美元的无风险收益率。

2)永续合约需要承受可变的到期收益率,需要支付额外的风险溢价。

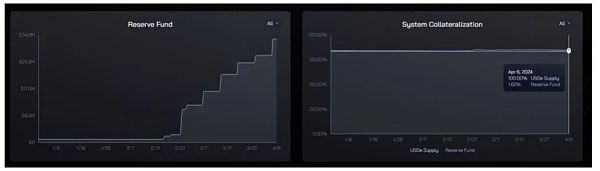

基于此,担心“USDe”资不抵债或者将USDe类比头UST是完全错误的。按照文章开始介绍的抵押物风险评估框架,USDe目前的核心/狭义抵押系数为101.62%,将ENA15.7亿美元的流通市值纳入考虑以后,广义抵押系数约可以达到178%。

【潜在负费率将导致USDe抵押物缩水】也不是大问题。依据大数定理,只要时间足够长,频率必然会收敛于概率,USDe抵押物长期会保持收敛于平均资金费率的增长率。

换个更加通俗的说法:你可以无限次地从扑克牌中抽一张,如果抽到大小王会损失1美元,抽到其他52张你可以赚1美元。在本金100美元的情况下,你需要担心因为抽到太多大小王破产吗?直接看数据更加直观,过去6个月中平均合约费率仅有两次处于0%以下水平,期现套利的历史胜率远高于抽扑克牌。

三、真正的风险在哪里?

1.市场容量风险

现在我们已经明确,抵押物风险并不值得担心。但这并不意味着没有其他风险。最值得关注的是合约市场容量对Ethena的潜在限制。

第一个风险是流动性风险。目前USDe的发行量约20.4亿美元,其中ETH和LST合计约12.4亿美元,这也就意味着完全对冲情况下需要开设12.4亿美元的空头头寸,所需的头寸规模于USDe的规模成正比

当前Binance的ETH永续合约持仓规模约30亿美元,Ethena USDT储备金中的78%存放在了Binance,假设资金的利用是均匀的,这意味着Ethena需要在Binance 开设 20.4亿*61%*78%=9.7亿名义价值的空头头寸,已经占到了持仓量的32.3%。

Ethena的持仓规模在Binance或者其他衍生品交易所占据过高的比例会产生很多负面影响,包括:

1)可能导致交易摩擦变大

2)无法应对短时间内的大规模赎回

3)USDe推高空头头寸的供给,导致费率的下降,影响收益率

尽管通过一些机制化的设计可能能够缓释风险,例如设置基于时间的铸造/销毁上限和动态费率(LUNA就引入了这一机制),但更好的方法还是不把自己至于危险之中。

按照这些数据,Binance+ETH交易对的组合能给Ethena提供的市场容量已经非常接近极限了。但还可以通过引入多币种、多交易所来突破这个极限。按照Tokeninsight数据,Binance占据了衍生品交易市场50.1%的份额,按照Coinglass数据,除ETH以以外,Top10币种在Binance的合约持仓总量约为ETH的三倍,按照这两个数据估算:

USDe市场容量理论上限=20.4(628/800)*60%/4/50.1%=128亿美元

坏消息是USDe是有容量上限的,好消息是离上限还有500%的增长空间。

基于这两个上限我们可以将USDe的规模增长分为三个阶段:

(1)0-20亿:通过Binance上ETH的市场达成这一规模

(2)20亿-128亿:需要将抵押品拓展到市场深度靠前的主流币+充分利用其他交易所的市场容量

(3)128亿以上:需要依靠Crypto市场本身的增长+引入额外的抵押物管理方式(例如RWA、借贷市场头寸)

需要注意的是,如果USDe希望真正Flip掉中心化稳定币,至少需要先超过USDC成为第二大稳定币,后者目前发行总量约346亿美元,是USDe第二阶段在容量上限的2.7倍,将会是一个比较大的挑战。

2.托管风险

Ethena另一个争议的点在于协议的资金由第三方机构托管。这是基于目前市场环境的妥协。Coinglass数据显示,dydx的BTC合约持仓总量为1.19亿美元仅有Binance的1.48%,Bybit的2.4%。所以通过中心化交易所管理头寸对Ethena来说是无法避免的。

但需要指出的是,Ethena采用了“Off-ExchangeSettlement”的托管方式。简单来说通过这种方式管理的资金不会真正进入交易所,而是被转移至一个专门地址进行管理,通常由委托人(即Ethena)、托管人(第三方托管机构)和交易所三方共管,同时交易所根据托管资金的规模,在交易所内生成对应的额度,这些资金只能用于交易,不能被转移;事后再根据损益情况进行结算。

这种机制最大的好处恰恰是【消除了中心化交易所的单点风险】,因为交易所始终没有真正掌控这笔资金,至少需要3方中的2方签名才可以转移。在托管机构可信的前提下,这种机制可以有效避免交易所Rug(如FTX)和项目方Rug。除了Ethena列出的Copper、Ceffu、Cobo以外,Sinohope、Fireblocks也提供了类似服务。

当然,托管机构也存在理论上的作恶可能性,但基于当前CEX仍然占据绝对主导+链上安全事件频发的背景下,这种半中心化是一种局部最优解,而非终局形态,但毕竟APY也不是免费的,关键在于为了收益和效率的提升是否应该去承担这些风险。

3.利率可持续风险

USDe需要质押才可以获取收益,由于质押率不会是100%,所以sUSDe的收益率是会高于衍生品费率的,目前合约中质押的USDe约4.7亿美元,质押率仅有23%左右,37.1%名义APY对应的底层资产APY为8.5%左右。

当前ETH质押收益率约为3%,而过去3年平均资金费率约为 6-7%,8.5%的底层资产APY是完全可以持续的,而37.1%的sUSDe APY能否持续还将取决于是否有足够多的应用常见承载USDe,以降低质押率,带来更高收益。

4.其他风险

包括合约风险、爆仓及ADL风险、操作风险、交易所风险等。

The author's source is a semi-centralized stable currency that defines full mortgage. There are many classification methods of stable currency, such as full mortgage and insufficient mortgage, centralized custody and decentralized custody chain issuance and centralized agency issuance with or without permission, and there will be some overlap and changes. For example, in the past, we thought that the supply and circulation of stable currency were completely controlled by the algorithm. According to this definition, most stable currencies belong to the stable currency with insufficient mortgage, but there are exceptions, such as despite its casting and circulation. The destruction price is regulated by the algorithm, but the collateral provided by the agreement vault is not less than the anchoring value, which has two attributes: the algorithmic stable currency and the fully mortgaged stable currency. Another example is that when the collateral is a chain asset, it belongs to the decentralized custody stable currency, but after the introduction, some collateral is actually controlled by the real entity and changed into the centralized and decentralized mixed custody stable currency. Based on this, we can strip off the complicated classification and abstract it into whether there is a fully mortgaged stable currency or not, and whether permission is not required. Compared with other common stable coins, there are some differences in these three attributes. If we think that decentralization needs to meet the two conditions of issuing without permission and trusteeship at the same time, it is not in conformity, so it is appropriate to classify it as a semi-centralized stable coin with full mortgage. The first question is whether there is sufficient collateral. The answer is obviously yes, as stated in the project document, the collateral is encrypted assets and corresponding empty space. Future positions's synthetic assets as collateral synthetic assets value spot value short future positions value in the initial state spot value future positions value hypothesis basis is collateral value. After a certain period of time, the spot price rises USD and future positions value rises USD, which can be negative position value basis. It can be seen that if it remains unchanged, the intrinsic value of the position will not change. If it is positive, the intrinsic value of the position will rise and vice versa. In addition, for delivery contracts, It is said that the basis is generally negative in the initial state, but the basis will gradually become without considering the transaction friction by the delivery date, which means that it must be positive. Therefore, if the basis is a synthetic position at the delivery date, the value of the synthetic position will be higher than that in the initial state. The asset portfolio holding spot short futures is also called current arbitrage. This arbitrage structure itself is risk-free, but there are external risks. According to the current data, we can obtain about low-risk annualized returns. Back to whether to use delivery contract or perpetual contract, I have not found an accurate definition in official website. Considering the depth of the transaction, the probability of perpetual contract is relatively high, but the chain address and distribution of collateral are announced. In the short term, there will be some differences between the two methods. Delivery contract will provide a more stable and predictable rate of return, while perpetual contract is a product with fluctuating interest rate, and the daily interest rate may also be negative under certain circumstances, but from the experience of perpetual contract. The historical return of arbitrage will be slightly higher than the delivery contract, and both of them are neutral futures airdrops. The essence is that lending funds can't keep interest rates or negative interest rates for a long time, and this position piles up the risk of risk-centered exchanges, so the risk-free rate of return of the necessary rate of return US dollars is subject to variable yield to maturity needs to pay an additional risk premium. Based on this, it is worried that it is insolvent or the analogy is completely wrong. According to the collateral risk assessment introduced at the beginning of the article, At present, the core narrow mortgage coefficient of the estimation framework is that the generalized mortgage coefficient can reach the potential negative rate after taking into account the circulation market value of $100 million, which will cause the collateral to shrink, and it is not a big problem. According to the law of large numbers, as long as the time is long enough, the frequency will inevitably converge to the probability, and the collateral will keep converging to the growth rate of the average capital rate for a long time. In other words, you can draw one card from the playing cards indefinitely. If you draw the big and small kings, you will lose dollars, and if you draw other cards, you can earn dollars. In the case of principal dollars, do you need to worry about bankruptcy because too many kings and kings are drawn? It is more intuitive to look at the data directly. In the past month, the average contract rate has only been below the level twice. The historical winning rate of arbitrage is much higher than that of playing cards. Now we have made it clear that the collateral risk is not worth worrying about, but this does not mean that there are no other risks. The most noteworthy is the potential limitation of the contract market capacity pair. The first risk is liquidity risk. The circulation is about $ billion, which means that the short position of $ billion needs to be opened under the condition of complete hedging is directly proportional to the scale. The current permanent contract position is about $ billion, and the reserve is deposited in the assumption that the utilization of funds is even, which means that the short position of $ billion needs to be opened, which has already accounted for the position. Or if the position size of other derivatives exchanges accounts for too high a proportion, it will have many negative effects. The response may lead to greater trading friction, unable to cope with large-scale redemption in a short period of time, pushing up the supply of short positions and affecting the rate of return. Although some institutionalized design may be able to mitigate risks, such as setting a time-based casting destruction upper limit and dynamic rate, this mechanism has been introduced, but a better way is not to put yourself in danger. According to the combination of these data trading pairs, the market capacity that can be provided is very close to the limit, but it can also be cited. Enter multi-currency and multi-exchange to break through this limit. According to the data, it occupies the share of derivatives trading market. According to the data divided by the total contract positions in other currencies, it is about three times. According to these two data, it is estimated that the theoretical upper limit of market capacity is $100 million. The bad news is that there is a capacity upper limit. The good news is that there is still room for growth from the upper limit. Based on these two upper limits, we can divide the scale growth into three stages. To achieve this scale, we need to expand the collateral to the market depth. The top mainstream currencies make full use of the market capacity of other exchanges of more than 100 million yuan, and need to rely on the growth of the market itself to introduce additional collateral management methods, such as lending market positions. It should be noted that if we want to truly decentralize stable currencies, we must at least surpass them to become the second largest stable currency, and the latter's current total issuance is about 100 million US dollars, which is twice the capacity limit in the second stage, which will be a relatively big challenge. Another controversial point is that the agreed funds are managed by a third-party institution, which is based on the compromise of the current market environment. Therefore, the total contractual positions shown by data are only 100 million 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。