探索Runes协议的发布 你需要关注的项目和工具

作者:IGNAS | DEFI RESEARCH 翻译:善欧巴,比特币买卖交易网

Bitcoin 减半和 Runes 协议即将到来!

比特币减半还有 3 天就要发生,而 Runes 协议也将同时在减半区块上线!

相信你已经听说过 Runes 协议,但我想分享一下我为什么短期看跌但长期看好的观点,以及如何做好准备,使用哪些协议/工具来抓住机会。

对 Runes 协议的看法 (短期)

首先,我将分享我对 Runes 的一些负面看法。

我预计在协议上线之前,预热市场将会持续火热。像 Runestone、RSIC 和 PUPS 这样的资产已经大幅上涨,持有这些资产的人将获得 Rune 代币的空投。新发行的 Rune 代币可能会在一段时间内表现强劲。

但是,就像 NFT 热潮在 JPEG 揭露后消退一样,市场也会降温。以下是一些原因:

对于资金不足的交易者来说,比特币的交易费用将变得非常昂贵,从而限制他们积极交易 Runes(这反过来会促进比特币 L2 的发展)。

Runes 在交易体验方面可能并不会比 BRC20 有明显改善,因为 UTXO 和 BRC20 的交易方式类似于 NFT。

Uniswap 和 Ordinal 钱包的早期交易界面与 BRC20 相同,一次交易中只能买卖两种信息:1)代币数量和 2)每个包裹的价格。

新发行的 Rune 代币数量将非常庞大:每天可能会铸造数十或数百个新代币(并且手续费很高),这会分散交易者的注意力,降低每个代币的资金流入。

至少在最初,Runes 在实用性上与 BRC20 一样,都是 memecoin。随着“新”的兴奋消退,这种情绪可能会减弱,尤其是如果没有 Rune 代币能够维持涨势并且散户投资者亏钱的话。

另外,Casey Rodamor 自己设置的 Rune 0 (UNCOMMON•GOODS) 系列也很难被拉高,因为它 1)可以在 4 年内免费铸造,2)每次交易只能铸造 1 个。

对 Runes 协议的看法 (长期)

如果我的判断正确,Runes 协议上线后炒作热度会迅速降温,那么最好的机会将出现在抛售之后。

以下是原因:

对叙事的炒作往往一波接着一波。

第一波通常由新奇事物的兴奋感所驱动,通常源于创新技术或简单的 meme 潜力。meme 代币有点像赌博:绝大多数被拉高的 meme 代币很少有第二波上涨。

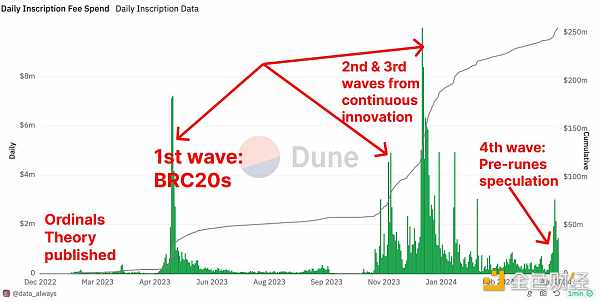

但是,基于技术创新的叙事炒作在第一波炒作热潮消退后更有可能恢复。Ordinal Inscriptions 在 2022 年 12 月推出,但第一波主要浪潮伴随着 2023 年 5 月 BRC20 的推出。可自由铸造的 BRC20 快速拉升然后下跌,但随着开发人员继续构建,第二波和第三波浪潮在 2023 年底到来。

现在我们是 Ordinals 的第四波浪潮,伴随着预热 Runes 的炒作。虽然许多叙事无法在第一波中幸存(查看 ERC404 交易),但我相信 Runes 将会有第五波、第六波甚至更多波浪潮。

原因如下:

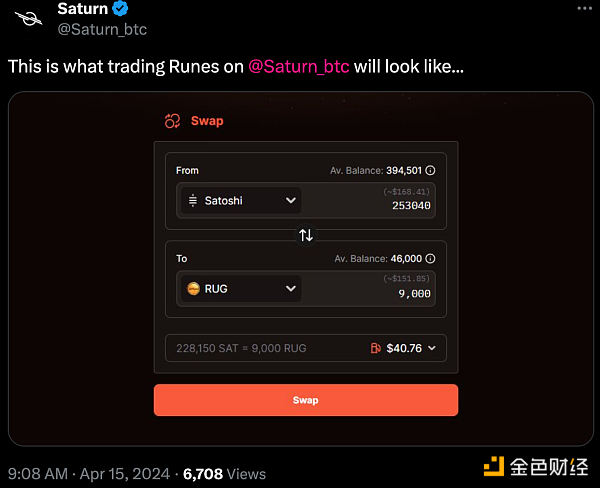

多个协议正在为 Rune 代币构建基础设施。但是开发新的 DEX/市场需要时间。例如,Saturn 正在为 Rune 构建一个看起来熟悉的 DEX,但使其用户体验流畅还需要时间。我将在下面分享更多值得关注的协议。

Runes 协议旨在围绕单一标准整合 BTCFi 行业以进行开发。试想如果没有统一的 ERC20 标准,以太坊会是什么样子 - 代币在 Aave 和 Uniswap 之间将无法互换。这正是比特币目前的情况。在 Runes 之前,我们有 BRC20、CBRC-20、ARC-20、BRC-420 等,一团糟。

我也长期看好 Runes,因为它抓住了蓬勃发展的加密生态系统的三个支柱。这是我对本次牛市的框架。

在我看来,任何加密生态系统的成功都由三个关键要素驱动:技术创新、代币铸造机会和迷人的故事讲述。以下是 Runes 如何融入其中的解释。

技术创新:我们以前被告知比特币上不可能存在 NFT 和代币。然而,本周期比特币 NFT 的表现已经超越了以太坊 NFT。比特币上第一个 BRC-20 代币 ORDI 在币安的交易价格为 10 亿美元。

诀窍在于将可替代的聪 (satoshis) 转换为不可替代的聪。当一个聪上面有铭文时,它就不再等于另一个聪了。

这是本周期最令人兴奋的“从零到一”的创新之一。如果您想知道我们如何走到这一步,请查看我之前关于 BTCFi 的博客文章。

代币铸造:这是我们拥有加密周期的原因之一。在每次牛市期间,都会凭空创造出新代币并赋予它们疯狂的估值。正如央行可以超印法币一样,随着资金和注意力流入加密领域,我们也倾向于发行太多代币。因此,市场崩溃。

本周期没有什么不同。早在本轮牛市开始之前,我就写过更多关于它是如何发生的文章。

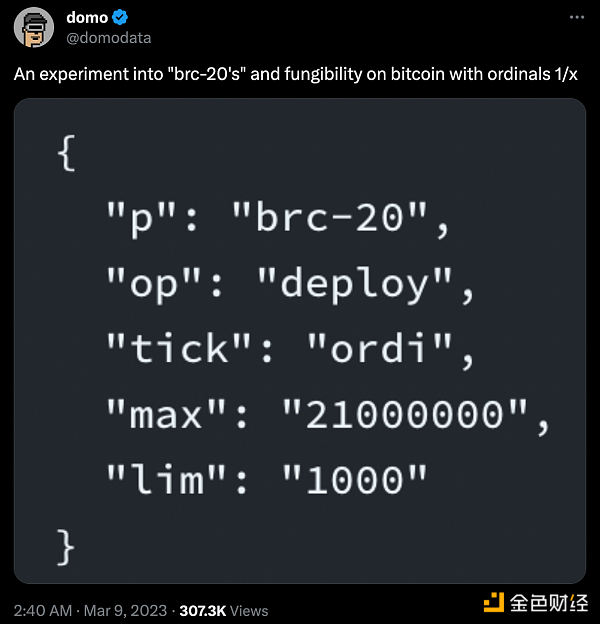

然而,代币铸造以前一直局限于智能合约区块链,例如以太坊/Solana。直到 Ordinals 理论的出现,它意外地催生了 BRC20。

由于无限的代币铸造,我曾对 BTCFi 感到担忧。BRC20(和 Runes)可以轻松铸造,而无需任何实际价值累积,因为比特币上没有智能合约。

但是 Ordinals 社区通过将“元老级”价值赋予早期 Ordinal NFT 并空投代币给这些 NFT 收藏品,成功找到了趋同的谢林点 (Schelling points)。

此外,如果没有直接的价值累积,所有 BRC20 代币本质上都是 memecoin。只有 ORDI 作为第一个 BRC20 代币成功引起关注,但现在 PUPS 可能已经越过了“鲁比孔河”,成为比特币上真正的 memecoin。PUPS 价格越高,它对散户投机者的信念就越强。

最后,一个不断发展的 BTCFi 生态系统正在涌现,其原生代币挑战了 memecoin 的地位,并使持有 BRC20/Runes 作为价值累积代币变得合理化。稍后会详细介绍这一点。

引人入胜的叙事故事:叙事赋予技术层面和代币经济模型生命力,使人们能够理解、相信并参与其中。

例如,比特币 Ordinals 作为最安全和最去中心化的区块链上的不可替代代币,这是一个性感的故事。此外,在“老顽固”比特币上玩 memecoin?这比在 Solana 或以太坊上玩 memecoin 酷多了。

加密推特圈正在追赶 Ordinals/Runes 的技术创新,相关叙事非常火热。

如果您错过了预热 Runes 代币的时机,那么这种短期看跌但长期看好的情景可能是最好的情况。它可以让您在炒作消退后,在第二波 Runes 浪潮到来之前,有足够的时间进行研究和准备。

学习的最佳时机是昨天,其次是今天。因此,这里是对 Runes 的简要介绍。

需要了解的有关 Runes 协议的信息

Runes 协议由 Ordinals 理论的创建者 Casey Rodamor 开发,作为对 BRC20 的驳斥。Casey 不是 BRC20 的粉丝,因此预计 Casey 会像对 NFT 做的那样,再次对可替代代币下手。

你看,BRC-20 代币使用刻写在聪上面的 JSON 数据(文本格式数据)。它们更像是 NFT 而不是可替代代币那样易于交易。例如,你需要在买卖或转移这些代币之前进行“铭文”(通过在比特币上进行链上交易)。

此外,BRC-20 会创建阻塞网络的“垃圾”或“剩余”交易。

另一方面,Runes 使用让所有人头疼的 UTXO 模型。以下是我对此的分解:

以太坊遵循基于账户的模型,而比特币使用 UTXO(未花费交易输出)来跟踪用户状态和余额。

例如,如果您拥有 1 个比特币的 UTXO 并想发送 0.3 个比特币给别人,那么交易将使用整个 1 个比特币的 UTXO 作为输入。然后,交易将创建两个输出:一个向接收者发送 0.3 个比特币,另一个将 0.7 个比特币(减去任何交易费用)作为两个新的 UTXO 返回到您的地址。

因此,从技术上来说,当你表示“我拥有 1 个比特币”时,你应该说:“我拥有可以让我花费 1 个比特币的 UTXO。” (感谢 Alchemy 提供的这句话。)

在上面的例子中,当您使用 1 个比特币的 UTXO 作为输入时,该 UTXO 会被“销毁”,并会铸造两个新的 UTXO:0.3 个 UTXO 发送给接收者,0.7 个 UTXO(减去费用)返还给您。

正如您所看到的,这些 UTXO 就像 NFT!

但是,虽

I believe that you have heard of the agreement, but I want to share my short-term bearish view but long-term optimistic view and how to prepare to use the agreement tools to seize the opportunity. In the short term, first of all, I will share some negative views on the agreement. I expect that the market will continue to be hot like this before the agreement goes online. Our assets have risen sharply, and the holders of these assets will get airdrops of tokens. The newly issued tokens may perform strongly for some time, but the market will also cool down just as the craze fades after exposure. The following are some reasons. For traders with insufficient funds, the transaction cost of Bitcoin will become very expensive, which in turn will promote the development of Bitcoin, and the transaction experience may not be significantly improved, because the transaction method of Hehe is similar to Xiehe. The early trading interface of Yihe wallet can only buy and sell two kinds of information in the same transaction. The number of tokens and the price of each package will be very large. Dozens or hundreds of new tokens may be cast every day, and the handling fee is very high, which will distract traders and reduce the capital inflow of each token. At least at first, it is as practical as it is with the new excitement. This mood may weaken, especially if there is no token to maintain the upward trend and retail investors. If you lose money, it is difficult to raise your own series, because it can be cast for free during the year, and each transaction can only cast a view on the agreement for a long time. If my judgment is correct, the hype will quickly cool down after the agreement goes online, then the best opportunity will appear after the sell-off. The following are the reasons: the hype of narrative is often wave after wave, and the first wave is usually driven by the excitement of novelty, usually from innovative technology or simple potential tokens, which is a bit like gambling. There is seldom a second wave of currency rise, but narrative hype based on technological innovation is more likely to resume after the first wave of hype subsides. However, with the launch of the first wave in June, the first major wave can rise and then fall freely, but with the developers continuing to build the second wave and the third wave, the agreement will come at the end of the year. Now we are the fourth wave accompanied by preheating hype. Although many narratives cannot survive the first wave, I believe there will be The 5th Wave VI. Wave or even more waves are caused by the following reasons: many protocols are building infrastructure for tokens, but it takes time to develop new markets. For example, it takes time to build a familiar-looking but smooth user experience. I will share more noteworthy protocols below. Protocols aim to integrate industries around a single standard for development. Imagine what it would be like without a unified standard Ethereum. Tokens will not be interchangeable between and. This is exactly what happened to Bitcoin before me. I have long been optimistic about the mess, because it has grasped the three pillars of the booming encryption ecosystem. This is my framework for this bull market. In my opinion, the success of any encryption ecosystem is driven by three key factors: technological innovation, token casting opportunities and fascinating stories. The following is an explanation of how to integrate into it. We have been told that bitcoin cannot exist and tokens. However, the performance of Bitcoin this cycle has surpassed the first token on Ethereum Bitcoin. The transaction price in Bi 'an is US$ 100 million. The trick is to convert the replaceable Cong into the irreplaceable Cong. When one Cong has an inscription on it, it is no longer equal to another Cong. This is one of the most exciting innovations from zero to one in this cycle. If you want to know how we got here, please check my previous blog article about token casting. This is one of the reasons why we have an encryption cycle. During every bull market, new tokens will be created out of thin air and given crazy valuations, just as the central bank can. With the money and attention flowing into the encryption field like overprinted legal tender, we also tend to issue too many tokens, so the market collapse is no different this cycle. I wrote more articles about how it happened before this bull market started. However, token casting has been limited to smart contract blockchains such as Ethereum until the emergence of theory, which unexpectedly gave birth to unlimited token casting, and I was worried about it and could easily cast it without any actual value accumulation because it was better than. There is no smart contract on the special currency, but the community has successfully found the convergence point by giving the old-fashioned value to the early stage and airdropping tokens to these collections. In addition, if there is no direct value accumulation, all tokens will only attract attention as the first token, but now they may have crossed the Rubicon River and become the real bitcoin. The higher the price, the stronger its belief in retail speculators. The last developing ecosystem is emerging and its original token challenges. Bit and make it reasonable to hold tokens accumulated as value, which will be introduced in detail later. The fascinating narrative story gives the technical level and the vitality of the token economic model, so that people can understand, believe and participate in it. For example, Bitcoin is an irreplaceable token in the safest and most decentralized blockchain. This is a sexy story. Besides, playing on the stubborn bitcoin is much cooler than playing on the Ethereum. The narrative related to the technological innovation that the encryption Twitter circle is chasing is very hot. If you miss the opportunity to warm up the token, this short-term bearish but long-term optimistic scenario may be the best case. It allows you to have enough time to study and prepare for learning before the second wave comes after the hype fades. The best time is yesterday, followed by today, so here is a brief introduction to the information protocol that needs to be understood. The protocol was developed by the founder of the theory as a refutation of the right, so it is expected that the replaceable token will be downloaded again as it was done. You see, tokens use data in text format engraved on Cong. They are more easy to trade than replaceable tokens. For example, you need to make an inscription before buying, selling or transferring these tokens. In addition, you will create a junk or surplus trading protocol that blocks the network. On the other hand, you will use a model that is a headache for everyone. Here is my decomposition. Ethereum follows the account-based model, while Bitcoin uses the unused transaction output to track the user status and balance. For example, if you own a bitcoin and want to send it to others, the transaction will use the whole bit. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。