比特幣在2021年底前至少達到10萬美元

加密投資一直追求的是引人入勝的敘事,而不是“基本面”,而且在短期內,這種情況也不太可能改變。

encryption investment has been about winning narratives, not "fundamentals," and this is unlikely to change in the short term.

好消息是,從未有比今天更好的敘事環境了,甚至可能有一些引入註目的“基本面”來支持這些敘事,我非常看好加密市場在2021年的前景。樂觀情緒並沒有超出共識,我認為接下來的牛市將是“大牛市”,比特幣的價格在2021年之前至少達到10萬美元,而在這次週期的最高點,加密貨幣市場的總市值將衝擊3萬億美元。

The good news is that there's never been a better environment than today, and there may even be some “fundamentals” introduced to support these things, and I very much appreciate the prospect of an encrypted market in 2021. The optimism is not beyond common understanding. I think that the next cow market will be the Great Bull City, and the price of Bitcoins will reach at least $100,000 before 2021, and at the peak of this week the total market value of the encrypted currency market will hit $3 trillion.

以下是我認為將推動這次牛市的十大敘事。實際上,我認為它們也是未來十年的長期趨勢。

1 “藍籌股”:真實價值與相對價值

1

2017年ICO熱潮中最讓人沮喪的是,那麼多聰明人對一種想法非常著迷,他們認為幾十種加密貨幣最終可能成為可行的投資。如此多的代幣可以賺取豐厚的貨幣溢價,這完全是胡說八道,我們從第一天起就爭辯說,“貨幣”是贏家通吃的市場,在這個市場上,即使是競爭失敗者也需要提供差異化的特徵來贏得長尾市場份額。另一方面,“功能性”代幣要么找到一種捕獲網絡費用的方法,要么隨著產生現金的網絡資產的出現,而逐漸消失。

the most frustrating of the 2017 ICO booms was that so many intelligent people were fascinated by the idea that a few dozen encrypted currencies might eventually become viable investments. So many of these coins could make a huge overflow of currency, which we argued from day one that the “currency” was a win-win market, where even the competitor’s failure would need to provide a different sign to win the long tail market. On the other hand, the “functional” currency would either find a way to capture the Internet’s costs, or disappear as a result of the creation of a cash-producing network.

這一論點被印證了,並且由於我們看到了實際使用情況,因此在相對和基本面驅動的基礎上考慮資產變得更加容易。界限是模糊的,但我們通常以六個類別來劃分加密資產:1、貨幣(主要是工作量證明貨幣,例如BTC),2、智能合約平台代幣(ETH和它的朋友們),3、加密美元(穩定幣),4、DeFi代幣,5、錨定&合成資產,6、Web3/NFT資產。

the argument is confirmed, and because we see actual usage, it is easier to consider assets on the basis of relative and fundamental driving. The boundaries are blurred, but we usually divide encrypted assets by six categories: 1, currency (mainly workload proof currency, e.g. BTC), 2, smart platform currency (ETH and its friends), 3, encrypted dollar (stabilized currency), 4, deFi currency, 5, anchored & synthetic capital, 6, Web3/NFT, .

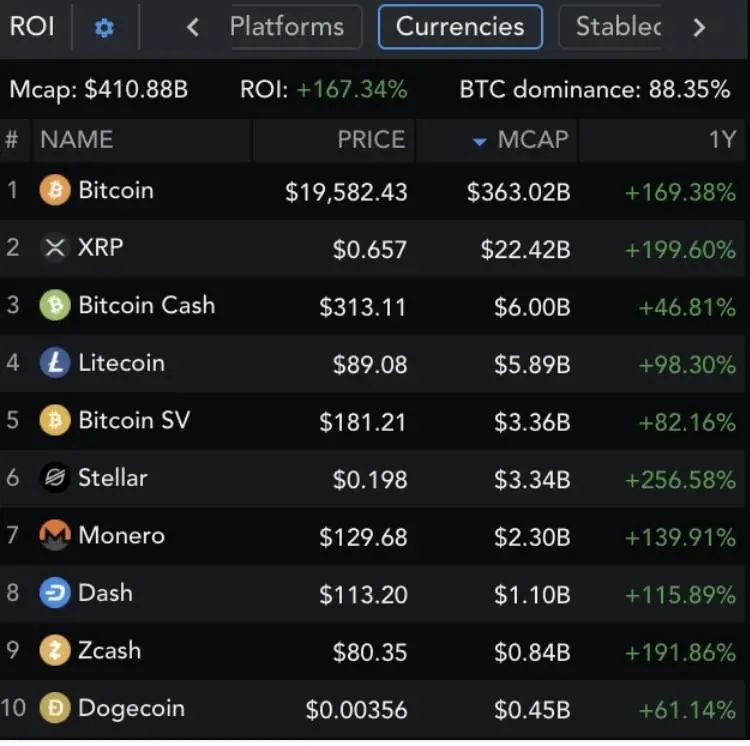

如果你把比特幣和其他PoW貨幣相比較,你會發現比特幣的市場佔有率大約是90%。如果將ETH與其他智能合約平台代幣相比,那ETH的佔有率接近70%。很可能會有一大群人會認為“ETH就是貨幣”,但我個人認為,比特幣這樣的純貨幣和ETH這樣的平台代幣是不同的(之後會講到)。

If you compare bitcoins to other PoWs, you'll find that bitcoins have a market of about 90%. If you compare ETHs to other smart contract platforms, ETHs will probably have a rate of nearly 70%. A large group of people will probably think that “ETH is currency, but I personally think that bitcoins and platform coins like ETHs are different.

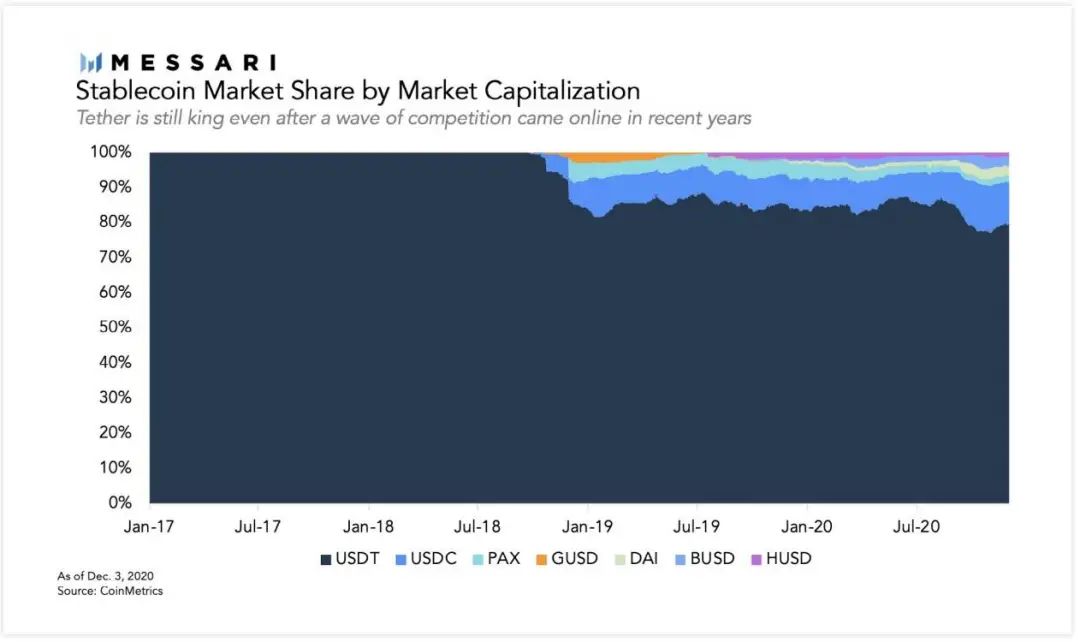

對於穩定幣來說,市場的“支配地位”可能不會影響VC投注,但它可以幫助你監控系統性風險,截止目前,Tether仍佔據了美元錨定幣市場75%的市場份額。

The market's “dominant position” may not affect VC's exposure to currency stability, but it can help you monitor systemic risks. To date, Tether still accounts for 75% of the market value of the dollar's fixed currency market.

DeFi和Web3/NFT,以及合成資產具有更多定制的價值驅動因素。

DeFi and Web3/NFT, and synthetics have more customized value drivers.

這很有道理!這些資產的估值,可以從它們的市場所產生的基本費用,或它們所代表的“真實”數字或金融資產中得出。即使大多數加密資產都具有相關性,但我們已經開始看到,隨著時間的推移,具有真實經濟模型的資產,在隨著時間的推移,與其他資產之間形成了分離。

領域隔離不僅僅是相對估值分析的一種練習,它有助於我們確定特定領域的關鍵KPI指標。我們可能關心通貨膨脹率和貨幣的鏈上流動性,平台代幣的staking收益以及網絡費用,以及DeFi網絡代幣的調整/費用驅動收益。我們仍在弄清楚哪些因素對整個交易至關重要,可能需要很長時間才能就加密新型資產定價模型達成一致。

Field isolation is not just a practice of relative valuation analysis, which helps us to identify key KPI indicators for particular domains. We may be concerned about inflation rates and chain movements of currency, platform surrogates' stagking and network fees, and DeFi network infusion/fee drives. We are still trying to figure out what factors are important for the entire transaction, and it may take a long time to agree on the encryption of new asset pricing models.

2濫發的貨幣與數字黃金(BTC)

2

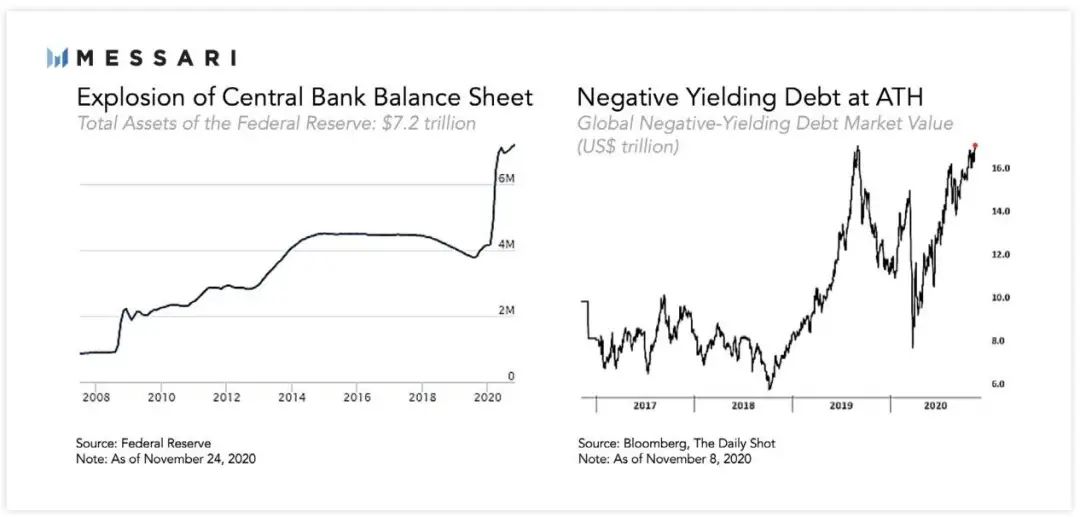

回顧2020年,在新冠疫情和隨後的封鎖混亂中,我們看到了比特幣的真實故事:各國央行在其資產負債表上增加了數万億美元,主權債務貨幣化達到了創紀錄的水平,並將實際收益率推低至創紀錄水平(永久性影響)。

Looking back to 2020, in the wake of the new crown epidemic and the ensuing blockade, we saw the true story of Bitcoins: central banks increased their asset debt statements by trillions of dollars, the principal debt dollar was converted to record levels, and the real rate of return was pushed down to record levels (permanent impact).

簡而言之,現代貨幣理論(認為國家用於赤字支出和債務貨幣化的能力基本上是無限的)不僅已被規範化,而且在2020年成為了政策。當權者甚至不再假裝限制支出,而美國分裂的政府,可能會造成極大的影響。如果民主黨在今年1月喬治亞州的決選中大獲全勝,這將改善無節制的財政刺激方案的前景,並為圍繞比特幣和其他金融及硬資產的投機火上澆油。如果國會仍然分裂,印鈔機將繼續大肆印錢。

In short, the modern currency theory (which considers the state's ability to use deficit spending and debt monetization to be essentially unlimited) has not only been regulated, but has become a policy in 2020. The authorities will not even pretend to limit spending, while the US government is divided, could have a huge impact. If the Democratic Party wins the Georgian elections in January this year, this will improve the prospects for an uncontrolled fiscal stimulus and fuel the oil boom around the Bitcoins and other financial and hard capital. If the country remains divided, the printing machine will continue to print money.

今天與幾年前的不同之處在於,比特幣在宏觀談話中的重要性變大了,以及它作為黃金替代品的敘事也變強了。

The difference today and a few years ago is that bitcoins have become more important in grand discourse and that they have become stronger as a gold substitute.

保羅·都鐸·瓊斯(Paul Tudor Jones)將比特幣稱為“最快的馬”;斯坦利·德魯肯米勒(Stanley Druckenmiller)表示,比特幣押注可能比黃金更有效;Chamath Palihapitiya認為,每個人都應將其資產的1%用於投資比特幣;Bill Miller則強烈推薦投資者擁有比特幣敞口;摩根大通寫道,家族理財辦公室可能會將比特幣視為黃金的替代品; Raoul Pal表示,比特幣是一個超大的黑洞;

Paul Tudor Jones called Bitcoins the fastest horse; Stanley Druckenmiller said that bitcoins might be more effective than gold; Shamath Palihapitiya argued that everyone should use 1% of their assets to invest bitcoins; Bill Miller strongly recommended investors to have bitcoins; Morgan Chase wrote that family finance offices might treat bitcoins as a substitute for gold; Raoul Pal said that bitcoins were a superb black hole;

這不僅僅意味著這些特定投資者的資本流入,這還代表的一種趨勢。

not only means the inflow of capital of these particular investors, but it also represents a trend.

全球頂尖的機構資金管理者終於參與了進來,通過消除與加密投資相關的風險,他們已經像馬克·安德森(a16z)和弗雷德·威爾遜(Fred Wilson)(USV)在2013年為加密風險投資所做的那樣,在2021年打開機構配置加密資產的閘門。

The world's top institutional fund managers are finally involved, and by eliminating the risks associated with an investment in encryption, they have opened up the encryption doors in 2021, as Mark Anderson and Fred Wilson (USV) did in 2013 to invest in encryption risks.

如果你在這裡停止閱讀,那就追隨領頭者,並將你的部分投資組合分配給比特幣,那你可能會擁有一個繁榮的2021年。

If you stop reading here, follow the leader and allocate a portion of your investment to bitcoins, then you may have a great 2021. 3以太坊:萬物市場 3 Etheria:

由於以太坊,今年有很多新穎的金融服務和應用找到了適合市場的產品,這是令人難以置信的。一些憤世嫉俗的人將新項目視為泡沫或玩具(或兩者皆有),但我敢冒險猜測,其中幾乎沒有人實際測試過這些產品。

它們是真實的,而且非常壯觀。

在以太坊(以及更廣泛的智能合約)領域,有太多內容需要討論,你會發現關於以太坊應用的內容,幾乎遍布本報告的每個部分。

in the Etheria (and more extensive intellectual contracts) domain, there's too much to discuss, and you'll find content about Ether's applications, almost everywhere in this report.

由於比特幣的宏觀定位,比特幣可能會迎來一個重要的一年,但以太坊(Ethereum)已經成為加密技術最重要的平台,這是一個可推動一個全新的金融系統和一個更開放、更具彈性的互聯網的平台。

As a bitcoin's ambition is likely to be an important year, but Etheeum has become the most important platform for encryption, a new financial system and a more open and dynamic Internet.

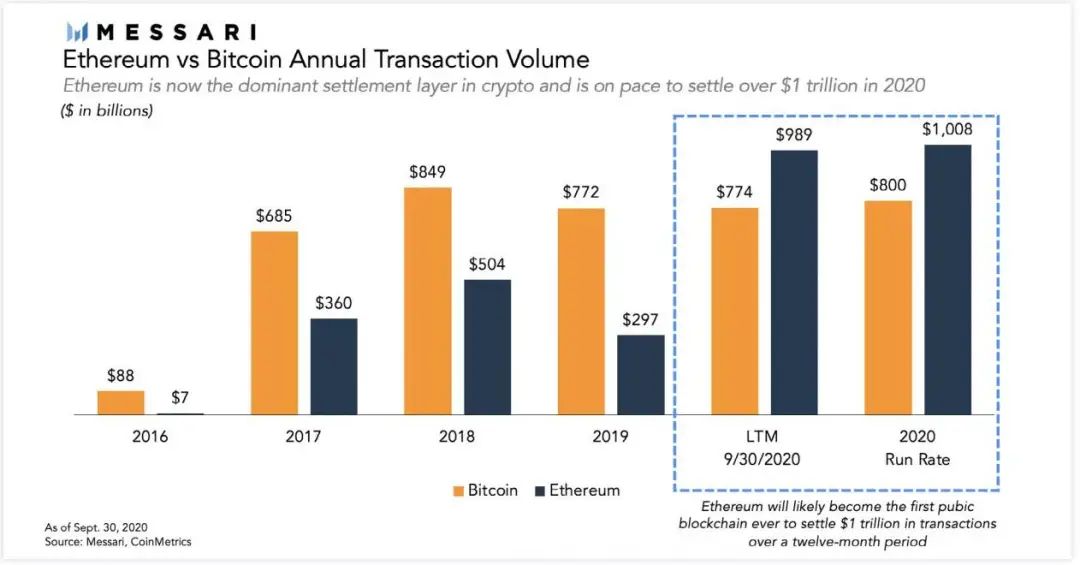

就網絡發生的交易經濟價值而言,在2021年,以太坊甚至會一直超過比特幣。

In terms of the economic value of the transactions that took place on the Internet, in 2021, Ethio would have been even above bitcoin.

在今年,以太坊平台處理了超過1萬億美元的實際價值轉移,這一數字已經超過了PayPal。以太坊面臨著挑戰,但其活力不可否認,它將繼續成為2021年值得關注的平台。

This year, over $1 trillion in real value has been processed on the Taiwan platform, a number that exceeds PayPal. There is a challenge on the table, but its vitality is undeniable, and it will continue to be a noteworthy platform in 2021.

4 DeFi: 無銀行的未來

4假設你想從頭開始創建一個全新的金融體系:支付、借貸、保險、資產發行以及交易所,你首先要意識到的是,從今天聯邦存款保險公司(FDIC)保險的金融系統和etrade賬戶到加密等價物,需要有大量的工作。

if you want to start from the beginning to create a new financial system: payments, loans, insurance, equity and exchange, first of all, you realize that there is a lot of work to do from today's Federal Deposit Insurance (FIDC) insurance financial systems and etrade accounts to encryption. 然而在今年的過程中,加密市場出現了這樣的構建塊。 一個平行的金融系統首先需要一種合成美元,資產的創建和管理,需要基本的借貸設施和參考數據基礎設施來維持資產的掛鉤。擴大規模,並使利率和利差與中心化解決方案相競爭,需要對資本提供者提供強有力的激勵。如果你弄清楚這些市場是如何運作的,你將不得不面對缺乏斷路器和退款的問題,你必須保護存款免受“銀行擠兌”和黑客攻擊,你還需要精明的風險經理設置協議默認值、防止應用耗盡攻擊的防禦措施以及針對技術錯誤的低成本保險。 A parallel financial system requires, first and foremost, a synthetic dollar, capital creation and management, basic lending and reference data infrastructure to sustain asset hooks. Broadening the scale, and competing interest rates and spreads with centralised solutions, requires strong incentives for capital providers. If you know how these markets operate, you will have to face the lack of circuit breakers and refunds, you will have to protect deposits from “bank squeezes” and hacker attacks, and you will also need clear risk management of silent recognition, anti-exploitation precautions and low-cost insurance against technical errors. 聽起來很有趣嗎?好吧,有了Maker(加密美元)、Uniswap(自動做市商)、Compound(流動性挖礦)、Balancer(動態流動性池再平衡)、YFI(智能資產管理)、Aave (閃電貸)、 ChainLink(數據預言機)、SushiSwap(防禦對策)、CVP(代理聚合)以及bZx(去中心化漏洞獎勵協議),我們有了一些構建一個完全去中心化和算法化的金融系統所需的構建塊例子。 sounds interesting? Okay, with Maker (encrypted dollar), Uniswap (auto-marketer), Compound (fluent mining), Balancer (motivated pool rebalancing), YFI (smart asset management), Aave (blitz lending), ChainLink (digital predictor), SushiSwap (advocacy), CVP (agent fusion) and bZx (decentralization gap incentive agreement), we have some examples of building blocks for a completely decentralized and numeric financial system . DeFi被炒作是有道理的,而我唯一看到的,能夠放慢該行業發展勢頭的事情,將是對頂級市場項目的先例性監管鎮壓(我不是在賭監管者會這樣做)。 The only thing I see that slows down the growth of the industry will be precedental surveillance of top market projects. 5穩定幣:吞噬加密市場 5 >/span style=font-size: medium;" >Stable currency: swallows an encrypted market 有時候,數字就能說明很多事情。今年,穩定幣的規模和用途經歷了爆炸式的增長。今天,超過200億美元的“加密美元”穩定幣供應,促進了數千億美元的交易流。具有諷刺意味的是,美元仍然是加密貨幣的儲備貨幣,隨著越來越多的加密美元應用上線,以及各國推出自己的央行數字貨幣計劃,穩定幣的增長趨勢沒有減弱的跡象。 the numbers sometimes explain a lot of things. This year, the size and use of the stable currency have experienced explosive growth. Today, more than $20 billion of “encrypted dollars” have stabilized the supply of the currency, driving up hundreds of billions of dollars of transactions. Ironically, the dollar remains the reserve of the encrypted currency, with more encrypted dollar applications going online, and with the introduction of its own central bank digital currency scheme, there is no sign of a weakening of the steady growth of the currency. 儘管人們擔心Tether可能會遭到監管打擊,但這一領先的穩定幣仍在繼續增長,並主導著其細分市場(以及大多數國際加密貨幣交易所的結算)。在沒有穩定幣激增的情況下,今年DeFi的爆炸性增長可能不會發生,並且以太坊平台上擁有110億美元的USDT,就存儲在以太坊區塊鏈上的經濟價值而言,Tether僅次於ETH本身。 Although people fear that Tether might be hit by surveillance, this first steady currency continues to grow, and leads to its fine market (and most of the international encrypted currency exchange is finished). Without steady currency surges, DeFi's explosive growth this year may not occur, and there's $11 billion worth of USDT on the Tether platform, which is second only to the ETH itself in terms of the economic value stored in the Tethan chain. 比特幣將無限期地保持為最有價值的數字貨幣(無論是加密貨幣還是穩定幣),但以太坊及其同類產品未必如此。智能合約平台上的美元穩定幣,以及由國家發行的央行數字貨幣(CBDC)將在2-3年內超過平台幣本身的市值。這對智能合約平台的安全性而言意味著什麼,目前還不清楚。 bit currency will remain indefinitely as the most valuable digit currency (encrypted or stable), but not necessarily in Ether and its peers. US dollar stability on a smart contract platform, and the country-issued central bank digit currency (CBDC) will exceed its own market value within two to three years. It is not clear what this means for the security of a smart contract platform. 6加密信貸:鎖定價值 6encrypt credit: lock value

過去一年中,加密貨幣最大的福音是加密貨幣信貸市場的爆炸式增長。面向散戶的中心化服務商,例如BlockFi,面向機構借貸者的Genesis、BitGo以及Galaxy,以及像Compound、Aave以及Maker這樣的DeFi借貸協議都經歷了很多年,並為高波動性的加密貨幣市場帶來了更大的流動性和穩定性(長期!)。

The biggest Gospel of encryption currency in the past year has been the explosive growth of the encrypt currency market. Centralised service providers, such as BlockFi, Genesis, Bitgo and Galaxy of institutional borrowers, as well as DeFi loan agreements such as Comboud, Aave and Maker, have gone through many years and have brought greater fluidity and stability (long term!) to the highly volatile market for encrypted currency.

同時,它們幫助推動了新應用的使用,這些新應用需要穩定的基礎貨幣以及更低的交易價差。更重要的是,信貸使資產鎖定在加密經濟中,並遠離稅務員。

and they help to promote the use of new applications that require stable base currency and lower transaction prices. More importantly, lenders are locked in an encrypted economy and far away from tax agents.

在過去,如果你有一筆主要的支出,如新房子的首付或學生貸款償還,你想用加密收益來支付這筆款項,你會遭受巨大的資本利得稅打擊,並錯過基礎投資組合的上行機會。但在今天,情況就不同了,你可以接受超額抵押貸款,以支付像新房這樣的一次性開支。

''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' ''''''''''''''''''''''''''''' ''''''''''''''' '''''''''''''' '' ''' '''''''' '''' '' '' '' ''''' ''''''' '' '' ''' '' '''''''''''' '' '' ''''''''''''' '' '' '' '' '' '' '' ''''' '' ''''''' ''''' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' '' ''

在DeFi和中心化服務中,鏈上抵押信貸的可用性可能會大大降低下一個上升市場的拋售壓力。無論是散戶投資者還是機構投資者,都是如此。而引發一連串清算的衝擊,雖是世界末日的情景,但這似乎更像是周期後期而非早期的風險。加密信貸市場的成熟,更有可能造就一場流動性最強的牛市。

In DeFi and in centralized services, the availability of mortgages on the chain may significantly reduce the pressure on the next upmarket to sell. This is true for both investors in the diaspora and institutional investors. And triggering a series of liquidations, though world-end scenarios, seems more like a post-cycle rather than an early risk. The maturity of encrypted credit markets is more likely to create one of the most dynamic cattle markets.

7合成資產:可訪問性

7synthetic assets: visiting

灰度交易、比特幣ETF、DeFi財富前線、封裝資產(Wrapped Assets)、預測市場、加密交易“證券”、鏈上指數基金、DAO、可編程金融資產……

Grey trading, Bitcoin ETF, DeFi wealth front, sealing property (Wrapped Assets), predicting the market, crypto-trading “certificates”, chain pointing funds, DAO, programmable financial assets

你能想到的每一種金融資產,總有一天會和加密(crypto)聯繫起來,而合成技術則證明了這種轉變會比我們所理解的更早發生。我不想預先破壞這一部分,但如果你是在“區塊鏈而不是比特幣”的陣營,這就是紫色藥丸部分,它會使千禧一代讀者感到興奮。

every kind of financial asset you can think of will be linked to encryption one day, and synthetic technology will prove that this change will happen sooner than we understand. I don't want to destroy this part of it in advance, but if you're in the camp of "a chain rather than a bitcoin," that's the purple part of the pill, and it will excite the millennium readers.

8基礎設施:與大型加密交易所解綁

8base application: untie with large encryption exchange

交易所是加密市場最達800磅的大猩猩,它們賺了所有的錢,它們接觸了所有用戶,它們也參與了幾乎所有業務,包括交易、託管、借貸、Staking、研究、數據、治理以及VC 。這似乎讓很多人懷疑加密經濟到底是不是去中心化的。但用戶擁有的力量,其實遠比人們想像的要更多。將資金撤出大型交易所可能會產生轉換成本,但這仍然很普遍。

the exchange is the most 800-pound gorilla in the crypto market, and they make all the money, they reach all the users, and they are involved in almost all the businesses, including transactions, trustees, loans, Staking, research, data, governance, and VC. This seems to make many people wonder if the encryption economy is not centralized. But users have far more power than people think.

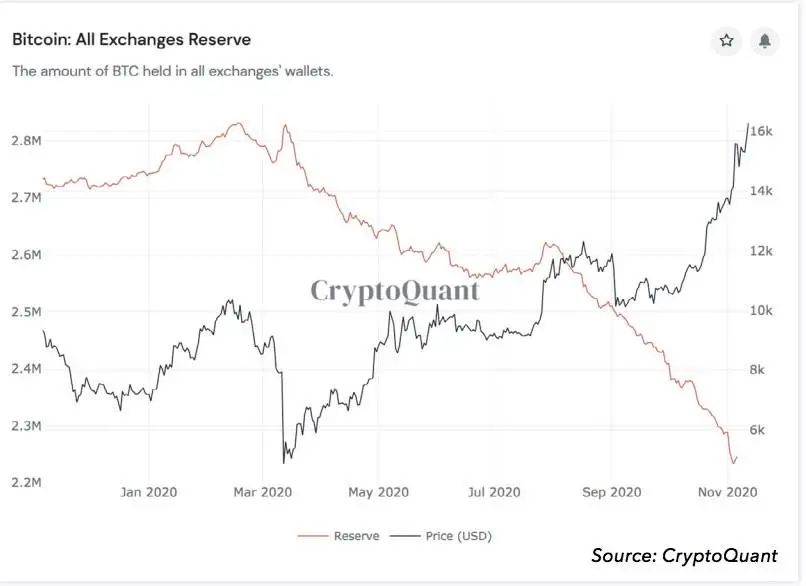

而且這要比換銀行容易得多!近幾個月來,由於對監管的擔憂,資本從BitMEX、OKEx、幣安等大型交易所撤離的情況非常常見。 2020年,資金從中心化交易所轉移到了合規託管方、基金經理以及移動錢包當中,而交易量則從中心化交易所轉移到主要的經濟商和DeFi市場。

and it's much easier to change banks! In recent months, capital has been withdrawn from large exchanges such as BitMEX, OKEx, and Money Ann, due to concerns about supervision. In 2020, funds were transferred from centralized exchanges to sub-contractors, fund managers, and mobile wallets, while turnover moved from centralized exchanges to major economics and the DeFi market.

隨著它們的價差和費用收緊,加密市場已開始(非常緩慢地)解除對交易巨頭的捆綁。與更廣泛的加密經濟相關的可信接口,將繼續比深度訂單和100倍槓桿賭場更重要。

As their prices and charges tighten, the encryption market has begun to untie (very slowly) the trading giants. A credible interface with the wider encryption economy will continue to be more important than a deep order and a 100-fold casino.

關於這些,看看Poloniex和Bittrex就行了。

我們將密切關注交易所存款在整個加密貨幣市場市值中所占到的百分比,以表明其不斷上升還是不斷減弱的趨勢。

we will keep an eye on the percentage of exchange deposits in the market value of the entire encrypt currency market to indicate whether it continues to rise or weaken.

別誤會我的意思,我不是在賭它們會衰落,相反,我預計它們在無機擴張方面會變得更加積極。

I'm not betting that they will fall, but rather that they will become more active in the growth of the drone.

9 Web3和NFT:數字資源經濟

今年秋天,(儘管在最後時刻出現了一些問題)我們終於迎來了期待已久的去中心化存儲網絡Filecoin的發布。此後,其它存儲解決方案(Sia,Storj,Arweave)也得到了推動,諸如Orchid (VPN)、Livepeer(視頻轉碼)以及Helium(IoT設備網絡)等去中心化網絡工具也出現了。這些去中心化的硬件市場,可以說是確保網絡在未來幾年保持開放所需的最重要的基礎架構網絡。

This autumn, we finally got the long-awaited release of the decentralised storage network Filecoin. Other storage solutions, such as Orchid (VPN), Livepeer (video transfer) and Helium (Iot installation network), have also been pushed forward. These centralized hardware markets can be described as the most important building blocks needed to make sure that the Internet remains open in the coming years.

區塊鏈不僅僅是貨幣和DeFi,Web3平台打開了通往新的數字化原生資產的大門,例如虛擬現實中的遊戲產品和數字藝術,新的內容和數據許可證以及不可審查的DNS等。

District Chains are not just currency and DeFi, Web3 platforms that open the door to new digital prototypings, such as virtual reality games and digital art, new content and data licensing and non-censorshipable DNS.

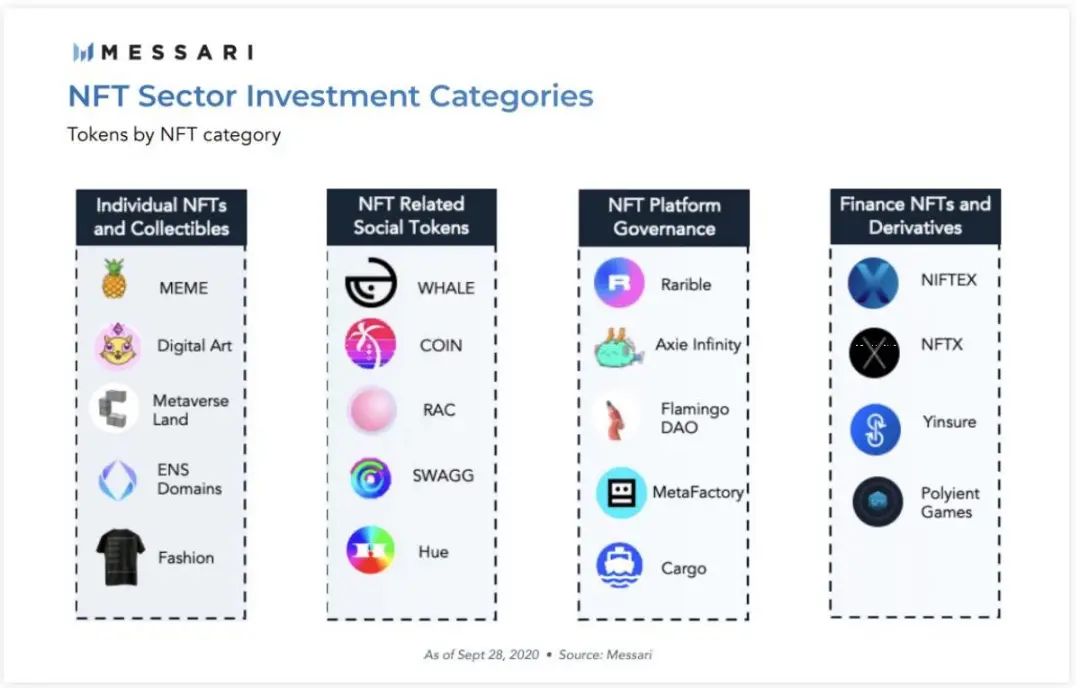

我贊成這樣一個論點:“迄今為止,幾乎所有類型的NFT都可能最終受到青睞,” 並且Web3平台打開了原生數字未來的大門,比特幣和智能合約平台主要是去中心化金融系統的火車頭,但Web3網絡和NFT是更開放的互聯網的真正關鍵組成部分。

I agree with the argument that: “To date, almost all types of NFTs are likely to end up in the sun.” And the Web3 platform opens the door to the future of original numbers, and the Bitcoins and smart contracts platform are primarily the train head of the centralised financial system, but Web3 and NFT are the real key components of a more open network.

10最終Boss

10

由於比特幣的波動性,監管方多年來一直仁慈地讓我們獨處。

每一個高峰和低谷的市場週期都是一個假象,比特幣的崩潰讓監管者認為這種逝去的時尚最終會死亡,不值得監管。 Every peak and valley market period is an illusion, and the collapse of bitcoins has led supervisors to believe that the passing fashion will end up dead and not worthy of supervision. 現在,市值已達5000億美元的加密市場,以及每年數万億美元的交易額,實在讓人難以忽視。幸運的是,較大的投資者、遊說實體,甚至是監管者(現在是參議員!)在美國內部都已開始使用該系統。我已將其稱為“比特幣叛亂”,當他們在華盛頓特區(以及布魯塞爾,東京和全球其他權力中心)發揮自己的魔力時,我們當中的一些人將開始思考最終的通道:how to rebuild a crypto-inspired nation-state。 Now, it's hard to lose sight of the encrypted market, which is worth $500 billion, and the hundreds of billions of dollars a year. Fortunately, larger investors, lobbyists, and even supervisors (now senators!) are already using the system inside the United States. I have called it the “bit currency rebellion”, and some of us will begin to think about the ultimate path when they do their magic in Washington, D.C. (and in Brussels, Tokyo, and other global power centres): How to restore a crypto-inspired national status . 你說,這是瘋了? 噓。

注册有任何问题请添加

微信:MVIP619

拉你进入群

打开微信扫一扫 添加客服 进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。