全球虚拟货币交易所流量报告:美国第一,中国人均交易额高

加密货币熊市已来,犯愁的除了投资者,还有数字货币交易所。

The city of encrypt currency bears has arrived and there are digital currency exchanges in addition to investors.

交易量陷入低迷,市场竞争大幅增长,新鲜血液难以补充,再加上以Fcoin为代表的基于“交易即挖矿”模式的交易所,迅速搅动存量市场,一场用户流量的争夺战已经悄然开启。

The volume of transactions has been depressed, competition in the market has grown significantly and fresh blood has become difficult to supplement, coupled with the & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & Q & & & & & & & Q & & & & & & & & & & & & Q & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & # & & & & & & & & & & # # & & & & & & # # & & # # # & & & # & & & & # # # # # # # # # # & # & # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # # #

交易所流量从哪儿来?谁是主导流量走向的关键角色?区块链酋长(ID: cmcmbc)全球交易所流量报告,为你揭开交易所流量争夺战中不为人知的秘密。

Where does the exchange flow come from? Who is the key player in leading the flow? The Global Exchange Flow Report (ID:cmcmbc) reveals to you the hidden secrets of the exchange flow struggle.

01

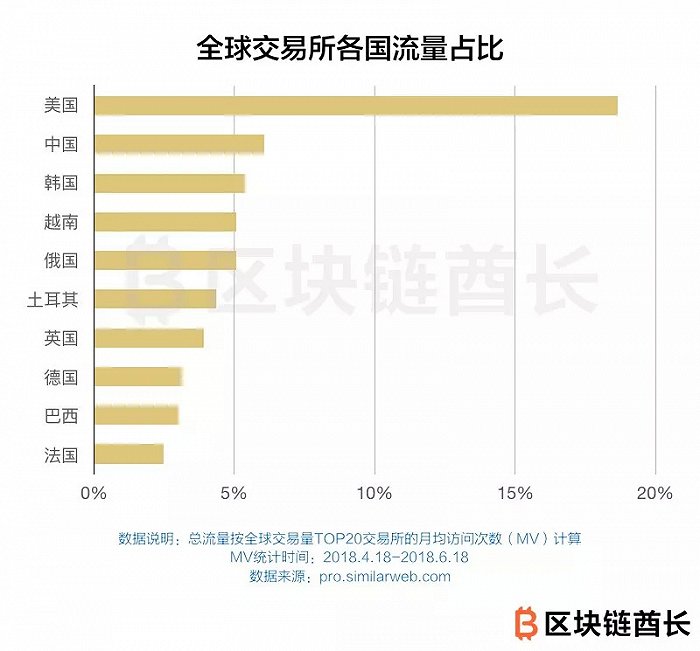

交易所流量主要来自美国,中国流量较分散

目前,全球交易量TOP20交易所24小时交易额已占全部交易额的90%。而在这20家交易所中,来自美国的月均访问次数(MV)占全部访问次数的18.66%,全球领先,中国次之,占6.07%。

Currently, the global trade volume TOP20 exchange accounts for 90% of all transactions. Of these 20 exchanges, the average monthly visits from the United States (MV) accounted for 18.66% of all visits, leading the world, followed by China, with 6.07%.

虽然主要流量来自美国,但在TOP20交易所中,第一流量来源国为中国的交易所却达到了10家,多于美国的7家。然而从下面的流量分布图中可以看出,以中国市场为主导的交易所访问量普遍偏低,人均访问次数也普遍低于以美国市场为主导的交易所。可见相比美国市场而言,中国市场的交易所流量可能较为分散。

Although the main flows are from the United States, the number of first-flow exchanges in the TOP20 exchange reached 10 in China, up from seven in the United States. However, as can be seen from the flow distribution chart below, the number of visits to exchanges dominated by the Chinese market is generally low, and the number of visits per capita is generally lower than the number of exchanges dominated by the United States market.

以美国市场为主导的交易所也在逐步蚕食地方市场的份额。以土耳其(Paribu+BTCTurk)、巴西(NegocieCoins)、越南(VNBIG)三国的本土交易所为例,其来自本地的流量,均与美国主导交易所来自本地的流量存在较大差距,甚至不敌币安一家。

Exchanges dominated by the US market are also gradually encroaching on the share of local markets. For example, local exchanges in Turkey (Paribu+BTCTurk), Brazil (Negocie Coins) and Viet Nam (VNBIG), where flows from local sources differ significantly from local flows from leading US exchanges, or even from foreign currencies.

02

第三方数据平台成交易所导量主力

在渠道上,交易所流量来源主要为网站引荐(Referral)、自然搜索(Organic Search)和社交网络(Social)。其中第三方网站引荐导量效果最佳,占总流量16.18%,是排名第二的自然搜索(8.79%)的2倍。

On the channel, the main sources of exchange flows are the website referral (Referral), Natural Search (OrganicSearch) and Social. Third-party sites are the most effective, accounting for 16.18 per cent of total traffic, twice the second-highest natural search (8.79 per cent).

在第三方网站中,数据平台的导量效果最为突出,如CoinMarketCap、非小号,此外交易所之间的互推也比较常见。交易所依赖第三方数据平台导量,说明交易所面对的潜在用户专业性较强,数据的说服力可能大于品牌效应。

Among third-party websites, data platforms have the most significant leverage, such as CoinMarketCap, non-small numbers, and exchanges are more common to interrogate. Exchanges rely on third-party data platforms for guidance, suggesting that potential users are more professional in dealings, and that data may be more persuasive than brand effects.

此外,由于交易所流量目前主要还是集中在PC端,因此搜索引擎的导量作用也不可忽视。

Moreover, since exchange flows are still mainly concentrated at the end of the PC, the conductivity of search engines cannot be ignored.

03

流量高并非绝对优势,但交易额也存在水分

手续费是目前交易所的主要盈利方式之一,因此关注流量的目的,最终都要归于对交易量的拉动,那么交易所流量与交易额之间存在怎样的关系呢?

Due to the fact that fees are one of the main ways in which the current exchange is profitable, attention to the purpose of the flow is ultimately attributed to the pull of the volume of the transaction, so what is the relationship between the exchange flow and the volume of the transaction?

首先单从交易额来看,除BitMex与Fcoin以外,当前全球数字货币交易所的日均交易额多数在10亿美元以下。BitMex与Fcoin交易量奇高有特殊原因,BitMex支持期货合约交易,杠杆高达100倍,其永续合约机制也吸引了大量短线投机;Fcoin则依靠二级市场投资+交易费返FT+佣金返利+持币分红,吸引用户不断进行交易挖取FT。如果排除这两个异常项,那么目前交易所日均交易量的天花板应该就在10亿美元左右。

First, in terms of the volume of transactions alone, the average daily turnover of the current global digital currency exchange, with the exception of BitMex and Fcoin, is mostly below $1 billion. BitMex and Fcoin trades are particularly high for a reason. BitMex supports futures contracts, with up to 100 times leverage, and its permanent contract regime attracts a large amount of short-line speculation; Fcoin relies on secondary market investment + transaction fees to return to FT+ commission + currency splits to attract users to keep trading for FT. If these two anomalies are excluded, the ceiling for the current average exchange volume should be in the range of $1 billion.

而从独立访问用户月均交易额来看,排除BitMex和Fcoin后,以中国市场为主导的交易所仍旧普遍高于以美国市场为主导的交易所。

In terms of the average monthly turnover of independent visitors, after excluding BitMex and Fcoin, exchanges dominated by the Chinese market remained generally higher than those dominated by the United States market.

从下面散点图中可以更清晰地看到,以美国市场为主导的交易所倾向于沿着纵轴分布,而中国主导的交易所则倾向于沿横轴分布,这说明后者人均交易额普遍高于前者。当然,这未必说明中国市场的“真实”人均交易量更高,正如前面提到的BitMex和Fcoin一样,诱发交易量虚高的因素还有很多。

As can be seen more clearly from the distribution chart below, US-led exchanges tend to follow a vertical axis, while Chinese-led exchanges tend to follow a horizontal axis, indicating that the latter generally have a higher per capita turnover than the former. This, of course, does not necessarily mean that the Chinese market & ldquo; real & rdquao; higher per capita turnover, as in the case of BitMex and Fcoin mentioned earlier, there are many other factors that induce a high volume of transactions.

此外,散点图也反映出,流量高的交易所,在人均交易额上未必占优势,如人气最高的几家交易所,币安、Coinbase Pro和Bithumb,人均交易量高于他们的也不在少数。

In addition, the breakout chart also shows that high-flow exchanges do not necessarily have an advantage in terms of per capita turnover, such as those with the highest levels of popularity, currency, Coinbase Pro and Bitimb, and that per capita turnover is not higher than they are.

总结

美国依然是目前全球数字货币交易的主导力量,而在中国,交易所虽然“遍地开花”,但流量分散,也存在诸多问题。不论是交易额数据,还是交易所之间的互推,人为操作的痕迹十分明显,整个市场的透明度、成熟度都有待进一步提高。

The United States continues to be the dominant player in global digital currency transactions, while in China the exchange, although & & & & & & & & & & & & ;, is fragmented, with many problems. Whether transactional data or exchange-to-exchange interchanges, the marks of man-made operations are clear, and the transparency and maturity of the market as a whole need to be further improved.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。