观察|向上还是向下:比特币价格突破历史新高后剧烈回撤

比特币突破6.9万美元的历史新高后迅速暴跌。

Bitcoin broke the historic high of $69,000 and fell rapidly.

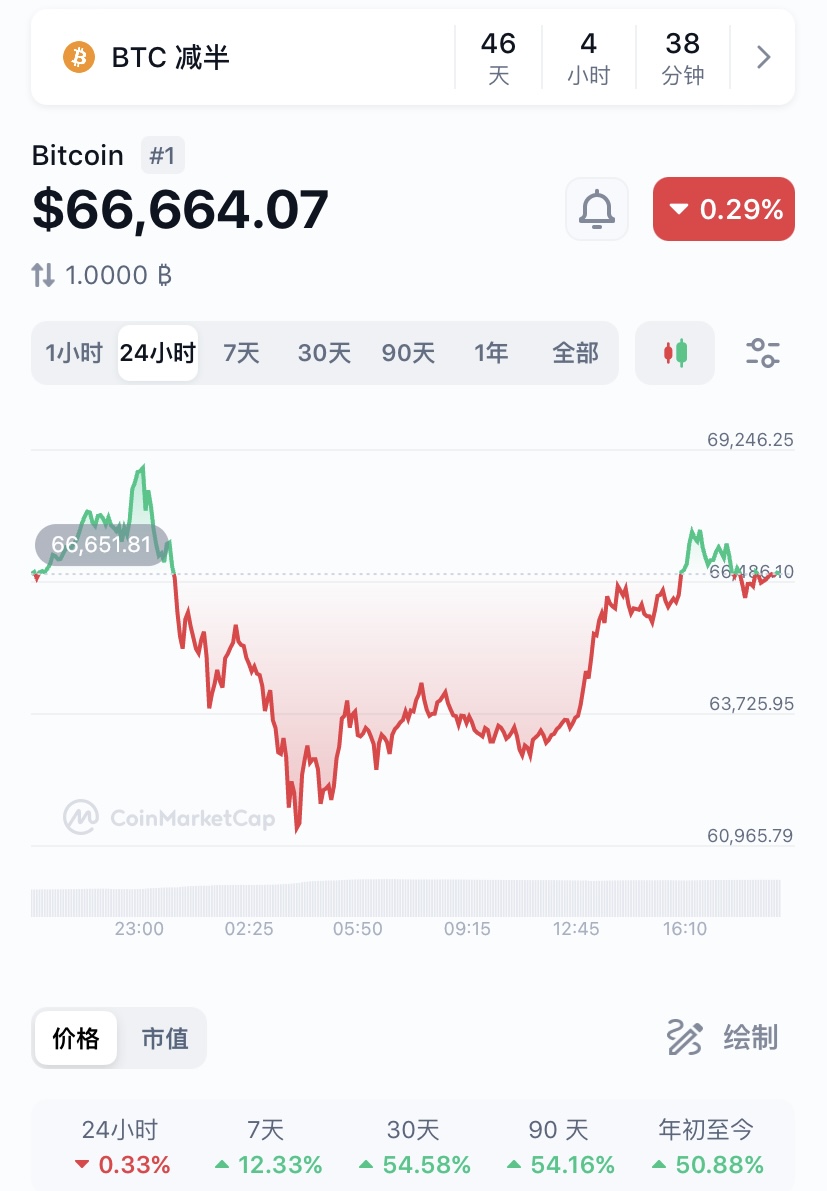

北京时间3月5日晚间,比特币价格一度突破6.9万美元,创下比特币历史以来新高,达到6.92万美元,总市值超过1.3万亿美元。然而,在到达历史最高点后比特币价格迅速回落,跌幅超过8%,一度跌破6.2万美元。截至发稿前,比特币价格徘徊在6.6万美元左右。

On the evening of 5 March Beijing time, Bitcoin prices broke by $69,000, reaching an all-time high of $692 million, with a total market value of more than $1.3 trillion. However, after reaching historical peaks, Bitcoins prices fell rapidly, by over 8 per cent, and fell by over $62,000. By the time of the release, Bitcoins prices had hovered around $66,000.

图片来自CoinMarketCap

比特币价格后续会否出现持续新高? 价格新高后剧烈回撤意味着什么?随着4月比特币减半事件发生,比特币走势可能会如何?

What does a sharp retreat after a new price rise mean? With the April halving of Bitcoin, what is the potential for bitcoin?

OKX研究院高级研究员赵伟向澎湃新闻(www.thepaper.cn)表示,从客观数据来看,比特币现货ETF获批提升了比特币的吸引力和可获得性,带来了大量机构等新增资金入场,成为推动比特币刷新历史记录的关键因素。据彭博ETF分析师James Seyffart在社交平台披露数据显示,昨日10只美国比特币现货ETF单日交易量达100亿美元,创下上市以来新历史记录。其中,IBIT、FBTC、BITB、ARKB均创单日最高交易记录。除了比特币现货ETF外,叠加全球经济趋势、市场情绪、监管体系建立与完善、比特币体系内技术创新、行业减半以及新叙事等系列利好因素,共同影响了比特币的价格走势和波动性。

According to data released on social platforms by James Seyffart, a senior researcher at the OKX Institute, 10 US-based current ETF single-day transactions amounted to $10 billion yesterday, a new record since it came to the market. Among these, IBIT, FBTC, BITB, ARKB, among other things, produced a single-day record of trading. added global economic trends, market sentiment, regulatory system building and improvements, technological innovation within the Bitcoin system, industry halving, and new narratives.

比特币价格是否还会再创新高

will the price of bitcoin be any higher

“后续比特币可能还会出现新高,这波由比特币ETF建仓的行情应该还没走完。”一位加密货币观察人士向澎湃新闻说道。

“The next bitcoin may have a new height, which should not have been done by the bitcoin ETF.” An encrypted currency observer told the news.

中国通信工业协会区块链专委会共同主席、香港区块链协会荣誉主席于佳宁向澎湃新闻分析称,比特币突破历史最高价这一里程碑事件,代表了数字资产市场的强劲势头和投资者对未来增长潜力的乐观预期。这种价格行为也反映了市场流动性的增强、资金的大规模进入,机构投资者参与度的提高以及广泛的零售兴趣。但考虑到比特币的高波动性和受宏观经济因素、政策变化、金融杠杆以及市场情绪等多种因素的影响,短期内价格可能会经历重大波动。从长期来看,随着数字资产市场的成熟和比特币在金融体系中角色的巩固,比特币的价格可能会继续攀升并创造新高。

The Co-Chair of the China Communications Industry Association’s District Chain Commission and Honorary President of the Hong Kong Block Chain Association, Jin Jia Ning, reported to the news that Bitcoin had broken through the milestone of historical peaks, representing the strong momentum of the digital asset market and investors’ optimism about future growth potential. Such price behaviour also reflected increased market liquidity, large-scale financial inflows, increased institutional investor participation, and widespread retail interest.

4月下旬将迎来比特币减半事件。据CoinMarketCap显示,截至北京时间3月6日,距离比特币减半还有47天。

In late April, Bitcoin will be halved. According to CoinMarketCap, by 6 March Beijing time, 47 days remained before Bitcoin was halved.

比特币挖矿公司Hashlabs Mining联合创始人兼首席策略师Jaran Mellerud向外媒表示,2020年5月发生的比特币减半事件推动了后续几个月的价格飙升。

Jaran Mellerud, a co-founder and chief strategist of the Bitcoin mining company Hashlabs Mining, stated to the foreign media that the halving of Bitcoin in May 2020 had contributed to soaring prices in the coming months.

如今,距离2024年预定的减半还有一个多月,比特币已经突破历史新高。

Today, more than a month before the scheduled reduction of half by 2024, Bitcoin has reached an all-time high.

上述加密货币观察人士向澎湃新闻表示,按照历史规律来说,一般比特币的“超级大牛市”发生在减半后的半年左右,减半利好兑现后会出现一波较大的回调,然后再进入“大牛市”。

The above-mentioned encrypt currency observers have indicated to the news that, according to historical patterns, the “super cow city” of Bitcoin usually takes place about half a year after halving, and that a larger wave of feedback will follow when the benefits of halving are realized and then enter the “big cow market”.

摩根大通在2月底的一份研究报告中指出,4月份减半事件后,比特币价格可能跌至4.2万美元。该行分析师解释称,一旦4月后比特币减半引发的乐观情绪消退,比特币价格就会趋向4.2万美元的预估水平。

In a study at the end of February, Morgan Chase noted that after the April halved incident, Bitcoin prices could fall to $42,000 . The Bank analyst explained that once the optimism generated by the halving of Bitcoins had subsided after April, Bitcoins would be at a projected level of $42,000.

今年的比特币产量减半将再次强化比特币的通货紧缩的特性。赵伟认为,随着比特币减半的到来,或导致矿工利润受到影响以及参与积极性降低、或推动低效矿工退出市场,从而影响比特币的整体算力和网络安全性。如何激励矿工保护比特币网络安全问题变得更加紧迫,不过这种残酷的减半机制也促进矿业技术革新。此外,随着比特币铭文以及可扩展性解决方案等创新叙事,激发了比特币网络生态的巨大潜力,与日俱增的网络交易费用正成为矿工的支柱收入。当前市场仍对4月减半事件所带来的影响以及未来市场趋势发展存在分歧,其价格并非由单一因素决定,而是以上提及因素的综合作用结果,因此不建议投资者按照此前减半单一叙事进行刻舟求剑式价格预测,应该充分理解加密市场的高波动性特征,并做好风险控制。

This year’s halving of Bitcoin production will once again reinforce the deflationary character of Bitcoin. Zhao Wei believes that, with the advent of the halving of Bitcoin, or the resulting erosion of profits for miners and their involvement in the reduction of incentives, or the promotion of the withdrawal of inefficient miners from the market, affecting the overall arithmetic and network security of Bitcoin. How to motivate miners to protect Bitcoin’s network security becomes more urgent, but this brutal halving mechanism also promotes innovation in mining technology. And, with innovations such as Bitcoin and scalable solutions, the enormous potential of Bitcoin’s network ecology has been raised, increasing network transaction costs are becoming the backbone of the miners’ income. The market is still divided about the impact of the April reduction and future market trends, the price of which is not determined by a single factor, but rather by the combined effect of the factors mentioned above.

于佳宁指出,虽然减半事件可能为比特币提供上行动力,但投资者应当警惕潜在的波动风险,对市场情绪和技术指标保持敏感,并在投资决策中考虑多种可能的市场情景。当前的宏观经济环境、全球政治事件、市场参与者的心理预期以及其他数字资产市场的动态都可能影响比特币的价格走势。

Yu Gianning pointed out that while halving events could provide action to Bitcoin, investors should be wary of potential volatility risks, be sensitive to market sentiment and technological indicators, and take into account a variety of possible market scenarios in investment decisions. The current macroeconomic environment of

比特币到达历史最高价后出现剧烈回撤,一路跌超8%

When Bitcoin reached the highest price in history, there was a sharp fall of over 8%.

昨夜,比特币在突破历史最高价后价格迅速回落,跌幅一度超过8%。截至3月6日晚间,币Coin统计数据显示,比特币24小时爆仓约1.89亿美元。

Last night, the price of Bitcoin fell rapidly after breaking its historical peak, a fall of over 8%. As of the evening of 6 March, the currency Coin statistics showed that bitcoin had exploded around $189 million in 24 hours.

上述加密货币观察人士表示,比特币超过新高后的剧烈震荡是很正常的,8%的波动对于比特币的波动率来说也属于正常范畴之内。

According to the encrypt currency observers mentioned above, it is normal for bitcoin to be more severe than the new height, and the 8 per cent fluctuation is within the normal range for bitcoin.

于佳宁认为,昨晚比特币达到历史最高点后的迅速回落,显示出数字资产市场的固有波动性特征,同时也凸显了市场参与者情绪的敏感性和多变性。根据过往表现显示,比特币在达到新高后通常会经历大幅波动,早期投资者往往选择获利了结,尤其是在如此关键的价格点位,获利了结的行为会更加密集,从而导致价格的快速回撤。此外,这种剧烈的价格变动也可能触发高杠杆交易的止损单,进一步加剧了波动的幅度。其次,机构参与者或做市商在关键价格位置的行动也是影响价格波动的重要因素。这些机构可能会在认为市场过热或存在回调风险时采取卖空策略,以对冲其持仓风险或寻求利润。

According to Janin, the rapid fall of Bitcoin last night, when it reached its highest point in history, revealed the inherent volatility of the digital asset market, while also highlighting the sensitivity and variability of the mood of market participants. Past performance showed that Bitcoin usually experienced large fluctuations when it reached a new height, and that early investors often opted for closure, especially at such a critical price position, and that profit-making by `strong' would become more intense, leading to a rapid reversal of prices.

赵伟表示,比特币冲高回调充分反映了加密市场的高波动性和高敏感特征。随着比特币价格创下年内新高,短期市场过热,杠杆率上升幅度较大,导致部分投资者风险偏好明显提升。在此背景下,不排除部分资金获利了结导致行情回落。此外,风险作为金融活动的内在属性,加密行业也不例外,当前仍面临宏观经济不确定性、系统性风险、黑天鹅,以及尚未明朗的监管政策等潜在利空因素。作为投资者,应该时刻保持理智和客观,充分做好市场环境、投资偏好、以及风险控制等评估,不要盲目跟风。

In this context, does not rule out partial financial gains leading to a fallback . Moreover, as risks are inherent in financial activity, the encryption industry is no exception, and

“对于投资者而言,这次剧烈的回撤应被视为对比特币投资固有风险的一个提醒,提示投资者应当对自己的投资组合进行多元化管理,同时要有良好的风险控制措施,以减少市场波动对投资组合的影响。”于佳宁说道。

“For investors, this dramatic retreat should be seen as a reminder of the inherent risk of a bitcoin investment, suggesting that investors should diversify their portfolios, with good risk control measures to reduce the impact of market volatility on the portfolios.” In Janning's words.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。