沉睡4年的11万枚比特币苏醒了,钱包主人是谁?

新谜题出现

加密货币从不缺乏神秘的色彩。最近,市场上又出现了一个新的谜题。

Encrypted money never lacks mystical colors. More recently, a new puzzle has emerged in the market.

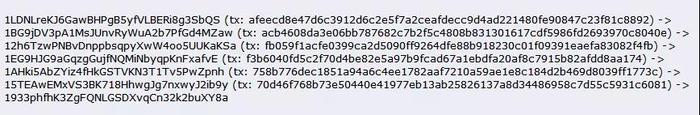

一个价值7.2亿美元的比特币钱包地址在沉睡4年之后被重新唤醒了。该比特币钱包在2014年3月10号之前曾拥有111114枚BTC,占比特币总供应量0.52%。8月下旬,从该钱包地址转出的资产中(转到多个子钱包),有价值1亿美元的比特币被转到了Bitfinex和币安交易所地址。

A $720 million bitcoin wallet address was woken up four years after sleeping. The Bitcoin wallet had 11,114 BTCs before March 10, 2014, accounting for 0.52% of the total Bitcoin supply. In late August, $100 million worth of assets transferred from the wallet address (to multiple wallets) were transferred to Bitfinex and the currency exchange.

这些巨量比特币突然流入市场,可能会对价格行为产生破坏性的影响。在Reddit论坛上,一位名为u/sick_silk(以下简称为silk)的用户对该钱包地址进行了分析,发布一系列详细跟踪其比特币交易的图表和数据,对该资产的归属做出了一些猜想。

The sudden influx of these large bitcoins into the market could have a devastating effect on price behaviour. At the Reddit forum, a user named u/sick_silk (hereinafter referred to as silk) analysed the wallet address, published a series of charts and data detailing its transactions in bitcoin, and made some assumptions about the attribution of the asset.

丝绸之路?

Silk Road?

今年8月31日,Silk发布了一篇帖子,指出该资产可能与现已消亡的暗网市场“丝绸之路”有关——“丝绸之路”曾处理过价值数十亿美元的违禁品交易,如处方药物、非法武器、色情内容、恶意软件、黑客服务、各种犯罪活动指南,以及其它黑市商品和服务。

On 31 August this year, Silk published an article stating that the asset may be linked to the now-defunct dark-net market &ldquao; the Silk Road & rdquao; related to — — &ldquao; the Silk Road & rdquao; and that it has dealt with several billion dollars worth of contraband transactions such as prescription drugs, illegal weapons, pornography, malicious software, hacker services, various criminal activity guides, and other black market goods and services.

silk在帖子中指出:该初始钱包地址曾拥有111114.62枚BTC和BCH,估价约为8.44亿美元(不计算其它比特币分叉币价值)。钱包已经沉睡了4年零6个月,2014年3月10日,这个疑似与“丝绸之路”相关的钱包地址曾将资产转移到多个子钱包地址,每个钱包的金额被拆分到1000 BTC以内。从8月下旬开始,这些子钱包地址开始活跃起来。

In the post, silk stated that the initial wallet had 11,1114.62 BTCs and BCHs, valued at approximately $844 million (not counting the value of other bitcoins fork). The wallet had been asleep for four years and six months, on 10 March 2014, and that it appeared to be &ldquao; Silk Road & rdquo; the related wallet addresses had transferred assets to multiple wallet addresses, each of which had been split up to 1,000 BTCs. Since late August, the wallet addresses had become active.

实际上,早在2013年10月14日,bitcointalk论坛上就有用户发布帖子分析了上述初始钱包地址的拥有者。

In fact, as early as 14 October 2013, the owner of the initial wallet address was analysed by a user at the Bitcointalk Forum.

该用户指出,以“1933phfh”开头的这个钱包地址上约有111114.60025818枚BTC。从“丝绸之路”披露的信息以及其创建者已将60万枚BTC安全锁定到冷钱包的消息来看,这两个钱包地址之间存在着一些联系。

The user noted that there were some links between the two wallet addresses, starting with “ 1933phfh” and about 11114.60025818 BTCs. From “ Silk Road & rdquo; the disclosed information and the information that its creator had safely locked 600,000 BTCs into cold wallets.

长话短说,以“1933phfh”开头的这个钱包地址的主人很可能是Ross Ulbricht。他用一系列障眼法打乱自己的比特币资产,但掩盖的效果并不是很理想——用最短路径算法可以找到通往最终目的地的路径。

To put it short, by &ldquao; 1933phfh&rdquao; the owner of the initial wallet address is probably Ross Ulbricht. He upsets his Bitcoin assets with a series of blindfolds, but the cover-up is not ideal — & mdash; the path to the final destination can be found using the shortest path algorithm.

Mt. Gox交易所或巨鲸账户?

尽管将资产转移与Ross Ulbricht联系起来的证据看起来很有趣,但是silk对此结论并不是十分确定。经过一周的调查后,他认为这些资金也可能来自Mt.Gox交易所被查封的(或仍归其控制的)钱包地址。

Although the evidence linking the transfer of assets to Ross Ulbricht seems interesting, silk is not very sure about this conclusion. After a week of investigation, he believes that the funds may also come from the closed (or still controlled) wallet address of the Mt.Gox Exchange.

当然,这也只是一种推测——2014年2月,Mt.Gox交易所申请破产。同年3月10日,该钱包资金有转账的活动;转账日期与Mt.Gox钱包地址之前丢失的200000枚BTC相关地址的转账时间非常类似(2014年3月7日)。比特币安全专家WizSec也对这一观点表示了赞同。

Of course, this is just a speculation & mdash; & mdash; February 2014 when the Mt.Gox Exchange applied for bankruptcy. On 10 March of the same year, the wallet money was transferred; the date of transfer was very similar to that of the 20,000 BTC-related addresses lost before the Mt.Gox wallet address (7 March 2014). This view was echoed by Bitcoin security expert WizSec.

还有一种可能,那就是它只是某个早期巨鲸用户的钱包地址,因为在这111111枚BTC中,有40954枚是在2011年6月2日处理的,属于非常古老的、早期采用者的钱包。

There is also the possibility that it is the wallet address of an early giant whale user, as 40954 of the 11111 BTC were processed on 2 June 2011 and belonged to a very old, early adopter.

不仅仅只是谜题

It's not just a puzzle.

该钱包的归属不仅只是一个有趣的谜团,它对现实世界也具有举足轻重的影响。silk认为,这些资金的流动可能是导致8月份比特币价格下跌的部分原因。

The wallet’s attribution is not only an interesting mystery, but it also has a significant impact on the real world. Silk argues that the flow of these funds may be part of the reason for the fall in Bitcoin prices in August.

无论真实情况如何,凭借这个占0.52%比特币总供应量的钱包地址,要操纵或破坏市场稳定都是绰绰有余的。事实上,自8月底至今,这笔资产已经缩水了大约8000万美元(BTC价格下跌)。

Regardless of the real situation, this wallet address, which accounts for 0.52% of the total supply of bitcoins, is more than enough to manipulate or destabilize the market. Indeed, since the end of August, the assets have shrunk by about $80 million (BTC prices have fallen).

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。