市值一夜涨出一个阿里,只因Meta元宇宙和大模型都要?

一夜之间,众神归位,硅谷的天又亮起来了。

In one night, the gods will come to power, and the day of Silicon Valley will come to light again.

继微软在两周前刷新历史成为第二家市值突破3万亿的上市公司之后,Meta也迎来了2024年的第一个高光时刻。截止2月2日收盘时,Meta股价单日暴涨逾20%,市值飙升2000亿美元,重回万亿俱乐部,更创下美股历史最高单日涨幅纪录。扎克伯格本人的总资产值也达到1400亿美元,一天之内激增约280亿。

Following Microsoft’s rejuvenation of its history two weeks ago as the second listed company with a market value of $3 trillion, Meta also reached its first high-light moment in 2024. By the close of the round on February 2, Meta’s stock stock stock bill had soared by more than 20% a day, its market value had soared at $200 billion, and it had returned to the trillion-dollar club, making it a record record of America’s highest single-time stock increase.

将时间轴拉长一些,Meta的股价在过去12个月里共上涨了168%,反弹异常凶猛。去年这个时候,外界还在讨论字节跳动超越Meta,张一鸣反杀扎克伯格的可能性。一年之后,字节CEO梁汝波在内部讲话中连续提到“危机感”,Meta这边则洋溢着欢庆气息,忙着派息分红,命运的齿轮不经意间完成了又一次轮转。

At this point last year, the possibility of a byte beating beyond Meta and a resonance to Zuckerberg was discussed. One year later, the byte CEO Liang-Po consistently referred to the “crisis feeling” in his internal speech, while Meta's side was ecstatic, busy with the cleavage, and the gear of fate had done yet another turn without care.

强劲的涨势背后,Meta确实度过了不平凡的一年:业绩明显复苏,广告业务依旧充当集团最稳定的现金牛;元宇宙之路历经波折,扎克伯格始终不愿放弃,仍在寻找各种新方向;搭上AI快车,憧憬着超算中心、AI芯片等更多新赛道。

Behind the strong upswing, Meta has indeed spent a remarkable year: a marked recovery in performance, with advertising still serving as the group’s most stable cash cow; the windfall of the Woncosmos road, with Zuckerberg still refusing to give up and looking for new directions; and getting on the AI Express, hoping for more new paths, such as the Centre for Supercounting, the AI chip, etc.

扎克伯格曾在接受福布斯杂志采访时表示,“决定命运的不是你的敌人,是自己的行动”。过去一年的Meta,用实际行动践行了这条准则——互联网巨头想要逆天改命,终究只能靠自己。

Zuckerberg, in an interview with Forbes magazine, said, “It is not your enemy who determines destiny, it is his own initiative.” The Meta of the past year has practiced this norm with practical action — the Internet giants, who want to change their lives against the sky, on their own.

(图片来自UNsplash)

(photo from UNsplash)

增收又增利,业绩助推Meta股价腾飞

Increases in revenue and gains, and performance boosts Meta's share price hikes.

2月2日收盘后,大多数分析师将股价暴涨的导火索指向Meta的一项新决策——派息分红。

Following the closing of the round on 2 February, most analysts pointed the spark of a sharp increase in equity prices to a new decision by Meta — the distribution of dividends.

扎克伯格为首的管理层在四季度财报电话会上表示,将从今年3月开始按季度向A/B类普通股股东派发50美分/股现金股息,这也是Meta上市以来首次派息。机构测算显示,光是扎克伯格本人,就能从本轮派息中拿到超过7亿美元的税前收入。

The Zuckerberg-led management indicated at the four-quarterly treasury telephone conference that 50 cents/shares of cash would be distributed quarterly to A/B general equity shareholders starting in March of this year, the first time since Meta was listed. The agency estimates that Zuckerberg alone would receive more than $700 million in pre-tax revenue from the current round.

多家投行也表示,大手笔派息表明董事局对企业经营状况感到满意,Meta过去一个财年肯定超预期完成了业绩指标。向外释放这种积极信号,也有利于刺激资金流入、稳定股东信心。比如高盛、巴克莱、花旗等投行就第一时间更新研报,将Meta目标价上调到500美元以上。

A number of investors have also indicated that the board of directors is satisfied with business performance, and Meta must have over-expected performance indicators in the past fiscal year. Exploiting this positive signal would also help to stimulate capital inflows and stabilize shareholder confidence.

不过派息终究只是其中一条导火索。支撑投资者信心的,始终是业绩。回顾Meta过去一年的各项财务指标,进步是显而易见的,一切都在朝着良好的方向发展。

It is always performance that underpins investors’ confidence. Looking back at Meta’s financial indicators over the past year, progress is clear, and everything is moving in the right direction.

首先,营收保持增长,且增速不断提高,下一季度的业绩指引更是远超市场预期。

First, revenue growth has been sustained and increasing, with performance guidance for the next quarter far exceeding market expectations.

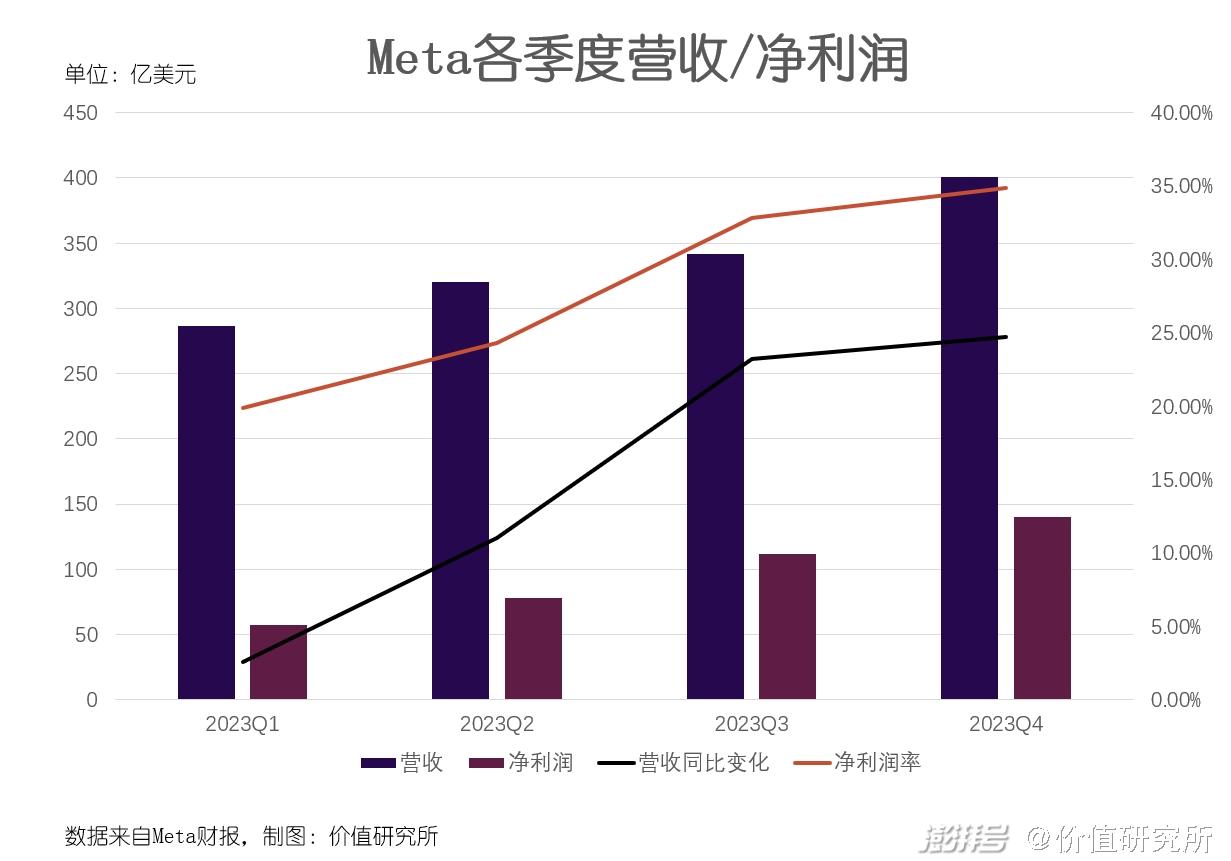

财报显示,Meta过去四个季度的营收分别录得286.5亿、320亿、341.5亿和401.1亿美元,同比分别增长2.6%、11%、23.2%和24.7%,下半年后劲十足。对于2024财年的业绩,Meta高层信心十足,将一季度收入指引设定为345亿-370亿美元,高于分析师此前预期的336亿美元,对应的增速在20%-27%之间,远高于去年同期的表现。

For the second half of the financial year 2024, the financial statements showed that the income of Meta recorded in the last four quarters was $28.65 billion, $32.00 billion, $34.15 billion and $40.11 billion, respectively, an increase of 2.6 per cent, 11 per cent, 23.2 per cent and 24.7 per cent, respectively, which was strong. For the second half of the year, the high-level confidence of Meta was strong, setting a quarterly income guideline of $34.5-37 billion, higher than the amount of $33.6 billion previously anticipated by analysts, and a corresponding increase of between 20 and 27 per cent, much higher than it was during the same period last year.

需要注意的是,去年下半年投行已经大幅调高Meta营收预期,但最终的成绩仍高出预测一截。以刚公布的四季度业绩为例,市场预期为390.8亿美元,增速21.5%,分别比最终的成绩低了10亿美元、3.2%。

It should be noted that, in the second half of last year, the campaign had substantially increased its expectations for the Meta camp, but the final performance was still above the forecast. For example, the market was expected to be $39.98 billion, or 21.5 per cent, less than the final performance of $1 billion and 3.2 per cent respectively.

其次,利润得到修复,下季度支出指引小幅上修,但整体可控。

Second, profits have been repaired and the next quarter's expenditure guidelines have been slightly revised, but the whole is manageable.

财报显示,Meta去年四个季度的净利润分别录得57.1亿、77.9亿、112.1亿和140.2亿,对应的净利率分别录得19.9%、24.3%、32.8%和34.9%,后面三个季度全面超过市场预期。除了净利润之外,每股收益、毛利率等指标也得到明显改善,企业的经营已经重回正轨。

The financial statements show that Meta recorded net profits of $5.71 billion, $7.79 billion, $11.21 billion and $14.02 billion in the last four quarters of the year, corresponding net interest rates of 19.9 per cent, 24.3 per cent, 32.8 per cent, and 34.9 per cent, respectively. In addition to net profits, indicators such as returns per share, Māori rates, etc. have improved significantly, and businesses are back on track.

利润上涨,自然得益于有效的成本控制。数据显示,Meta上一财年的总支出约为1062亿美元,符合此前的支出指引。其中,几场轰轰烈烈的大裁员下来,Meta共减少了约2万名员工,成功削减了人力、福利方面的支出。不过由于对AI等创新业务的投入在下半年逐渐上升,研发费用在也重回增长态势。

The data show that Meta’s total expenditure in the previous fiscal year was approximately $106.2 billion, in line with previous spending guidelines. Among these, several high-profile layoffs resulted in a reduction of about 20,000 workers, and successful cuts in human and welfare spending.

面向2024年,管理层制定了一个尚算积极的支出计划,预计全年总开支940-990亿美元,资本支出300-370亿美元。而在此之前,外界普遍预期其资本支出会控制在320亿美元以内。

Towards 2024, management developed a still-positive expenditure plan, with a total projected expenditure of $94-99 billion and capital expenditure of $30-37 billion for the year as a whole, prior to which capital expenditure was generally expected to remain within $32 billion.

由此可以看出,Meta的降本增效基本告一段落。接下来,是时候积极扩张了。

So, we can see that Meta's downside efficiency is largely over. And then it's time to expand.

广告复苏的秘密:大环境回暖,平台努力创新

The Secret of Advertising Revival: Large Environments Warm Back and Platforms Working for Innovation

正如上文所说,Meta能花一年时间完成自我救赎,大环境回暖是一个原因,但最重要的还是自己的努力。逆袭的秘密,要回到业务上,回到过去一年行动线上。

As stated above, Meta can take a year to redeem itself, and the warming of the environment is a cause, but the most important one is its own effort. The secret of the backlash is going back to business and back to the line of action of the past year.

在Meta的业务版图里,广告无疑是最核心的一环,这么多年从未改变。财报显示,过去四个季度Meta广告业务的收入分别为281亿、315亿、336亿和387亿美元,同比分别增长4.1%、11.9%、23.5%和23.8%,同样是下半年渐入佳境,增速节节走高。

In Meta's business map, advertising is undoubtedly the most central and has remained unchanged for so many years. The financial statements show that revenue from Meta's advertising business has increased by 4.1 per cent, 11.9 per cent, 23.5 per cent and 23.8 per cent in the past four quarters, with higher rates of growth.

去年下半年,美国互联网广告市场的复苏是肉眼可见的,谷歌、亚马逊等大厂的业绩也证明了这一点。GroupM的报告指出,2023年全年美国互联网广告市场规模同比增长约5.1%,并将在今年保持相近的增幅。

In the second half of last year, the recovery of the US Internet advertising market was visible, as evidenced by the performance of major companies such as Google and Amazon. The GroupM report states that the size of the US Internet advertising market increased by about 5.1 per cent year-on-year in 2023 and will remain similar this year.

Meta之所以能比谷歌、亚马逊们吃到更多复苏红利,就在于其实现了更高的用户增长。

Meta was able to eat more of the recovery dividend than Google and Amazonians were able to achieve higher user growth.

根据Meltwater发布的最新统计,截止今年1月底,Facebook和Instagram的用户规模总计达到38.4亿,是全球用户量最高的两个社交应用。其中,Instagram在过去一年表现更为突出,Facebook的MAU增速反倒落后于平均水平,WhatsApp也取得了不错的增长效果。

According to the latest statistics released by Meltwater, by the end of January, Facebook and Instagram had a total of 3.84 billion users, the two largest social applications in the world. Instagram has performed more prominently over the past year, its MAU growth has fallen short of average, and WhatsApp has achieved positive growth.

Instagram、WhatsApp取得的进步,很大程度上归功于团队的学习能力:尤其是向TikTok偷师,向短视频、生活服务甚至购物等领域渗透。

Much of the progress made by Instagram and WhatsApp is due to the team's ability to learn: in particular, they steal teachers from TikTok and infiltrate into short videos, life services and even shopping.

去年9月,Meta宣布对WhatsApp进行更新,扎克伯格本人亲自在2023 Meta全球商业信息会议上宣布了这个消息。令扎克伯格感到兴奋的新变化,主要有以下几个:新增WhatsApp flows功能,向企业用户开放付费认证服务,向印度、巴西等更多地区推广商家付款功能。

Last September, Meta announced an update of WhatsApp, a message that Zuckerberg himself announced at the 2023 Meta Global Business Information Conference. The new changes that excites Zuckerberg are the following: the addition of the WhatsApplows function, the opening of payment certification services to business users, and the extension of the business payment function to more regions, such as India and Brazil.

这当中,WhatsApp flows的效果立竿见影。该功能类似于微信、支付宝等应用的小程序模式,Meta鼓励企业通过这个新场景进行投放,根据会话量抽取分成,等于为WhatsApp增加了一个创收途径。而完善商家认证和交易功能,也是为了方便商家、用户,提高转化率。

In this case, the effect of WhatsApp follows quickly. This function is similar to that of micro-procedures for micro-letters, payment treasures, etc. Meta encourages companies to project through this new scene, which is divided according to the size of the session, thus adding an income-generating route to WhatsApp.

Instagram则在短视频化的路上大获成功,甚至有了反客为主,正面迎击TikTok的底气。

Instagram, on the path of short videoization, has achieved great success, even with anti-prisoners, who face TikTok face-to-face.

早在2021年6月,Instagram就上线了短视频板块“Reels”,并于2022年面向全球用户开放,但初期一直处于不温不火的状态。

As early as June 2021, Instagram went on line with a short video plate, “Reels”, which was opened to global users in 2022, but which was initially in a quiet state.

不过Meta没有灰心,坚持投入大量资源。不仅在Instagram站内提供最多的曝光量,还通过Facebook等应用进行导流,甚至不惜顶着广大用户的质疑声对Instagram进行改版,将Reels入口提前,以及不断加大对短视频内容的流量倾斜力度。

Meta is not discouraged, however, and insists on investing a lot of resources. Not only is it the most exposed at the Instagram station, but it is also channeled through applications such as Facebook, even by adapting Instagram to the user’s doubts, by keeping the Reels portal ahead, and by increasing the flow of short video content.

长期投入的确有效果,用户也慢慢接受了Instagram的短视频化,接受了Reels的存在。Laterblog社交媒体经理在近期接受采访时透露,自上线Reels频道以来,其账号的用户互动量上涨了280%。而根据扎克伯格在去年三季度的财报电话会上的说法,Reels驱动的用户时长增长超过40%。

Long-term investment has been effective, and users have slowly accepted the short videoization of Instagram and the presence of Reels. Laterblog’s social media manager, in a recent interview, has revealed that the number of user interactions has increased by 280% since his online channel Reels.

在广告这个行业,有用户就有流量,有流量就能赚钱。摩根士丹利的统计显示,过去一年Meta广告业务是量价齐飞,用户增长带来了更高的展现次数,也让平台有底气上调收费标准。其中,二季度和三季度的广告展示量同比分别增长34%和31%,是2021年二季度以来的最佳表现。

In the advertising industry, there is a flow of users, and there is a flow of money. Morgan Stanley’s statistics show that in the past year, Meta’s advertising business has been price-effective, with the growth of users leading to a higher number of performances and a bottom line for the platform.

都说硅谷巨头走向衰落在所难免,Meta用行动证明,只要实力经得起考验,触底反弹就不是梦。

It is said that the fall of the Silicon Valley giants is inevitable, and Meta has demonstrated by its actions that it is not a dream to hit the bottom as long as its strength can stand the test.

元宇宙与大模型都要,Meta天花板更高了?

The dollar universe and the big model. The Meta ceiling's even taller?

当然,Meta也不是每一次尝试都能收到好的结果。

Of course, Meta doesn't get good results in every attempt.

去年7月,Meta推出了对标Twitter的社交应用Threads,创下上线当天用户数破600万、5天破亿等一系列纪录,远胜上半年红透半边天的ChatGPT。但这一系列令人瞠目结舌的数据,是靠着和Instagram账号的深度绑定,靠铺天盖地的宣传攻势达成的,根本无法延续。

In July last year, Meta launched Threads, a social application to Twitter, to create a series of records of 6 million people and five billion people on the line on a daily basis, far more than the ChatGPT, half a day in red for the first half of the year. This series of obnoxious data is tied to the depth of Instagram’s account, and it is achieved by a campaign of propaganda that has been spread thinly.

Sensor Tower的统计显示,到去年7月17日当周,Threads的用户使用时间平均减少了50%,在部分地区的DAU也出现了下滑。用户留存都成了大问题,更不用说之后的创收了。Threads能不能摆脱出道即巅峰,火一把就歇菜的命运,还是未知。

Sensor Tower's statistics show that, by the week of July 17, Threads' user time had been reduced by an average of 50 per cent, and in some parts of the region the DAU had fallen. User retention had become a major problem, let alone income generation.

这个案例也给Meta敲响警钟:即便重回扩张状态了,也要保持谨慎,不能再盲目上马新项目了。否则,很可能又要承受新一轮降本增效的阵痛。而在各项需要投钱的新业务中,元宇宙和AI,是Meta现在,也是未来的重点。

The case also sounded a wake-up call for Meta: even if expansion is back, be careful not to go blind to new projects. Otherwise, it is likely to bear the brunt of a new wave of efficiency gains.

先来看元宇宙的状况。无论团队怎么变,明眼人都看得出来,扎克伯格从未放弃自己的元宇宙梦想。哪怕在上半年业绩复苏势头还没有那么强劲的时候,他也不忘财报电话会上强调会保持对元宇宙的投入。不过现在的策略变得务实了一些,降低了对高成本的硬件业务投入,转而发力内容、软件。

First, look at the state of the meta-cosm. No matter how the team changes, it can be seen that Zuckerberg never gave up his dream of the meta-cosmos.

Meta全球事务负责人Nick Clegg在去年年初就表示,Meta的元宇宙业务未来会通过广告、电商等多种形式变现,弱化了对硬件的依赖程度。与此同时,他还鼓励更多开发者、创作者加入共创行列,提供更丰富的内容。

Meta’s head of global affairs, Nick Clegg, said in early last year that Meta’s meta-cosm business will become less dependent on hardware in the future, through advertising, electricity, etc. At the same time, he encouraged more developers, creators, and more content.

接着看扎克伯格同样十分重视的AI业务状况。从过去一年的动态看,Meta发力点主要有两个:一是面向用户的AI应用,二是能提高算力的芯片、超算中心等配套。

And look at the AI business that Zuckerberg also attaches great importance to. From the dynamics of the past year, Meta’s power points are mainly two: a user-oriented AI application, and a combination of numeracy-enhancing chips, super-calculators, etc.

Meta对AI算力的要求,一直是极高的。根据扎克伯格的说法,Meta会在今年年底前部署超过35万块英伟达H100用做训练大模型。而根据Omdia的统计,过去一年Meta购置的H100数量是除微软外科技企业的至少三倍。

Meta’s demand for AI computing has been extremely high. According to Zuckerberg, Meta will deploy more than 350,000 British Wetland H100 training models by the end of this year.

不过比起依赖英伟达,Meta显然想加强自研实力,把命运掌握在自己手里。去年5月,扎克伯格就透露Meta正在建设一个全新的人工智能数据中心,并投入大量资金研发AI推理芯片。今年1月底,Meta官方发言人对外透露,第二代自研AI芯片Artemis将于今年内投产。

Last May, Zuckerberg revealed that Meta was building a brand-new data centre for artificial intelligence, and invested a lot of money in the development of AI reasoning chips. At the end of January, Meta’s official spokesperson revealed that the second generation of AI chip Artemis would be working this year.

目前还没有关于Artemis的更多消息流出,但据悉上一代产品MTIA V1采用的是台积电7nm先进制程工艺,运行频率800MHz,二代产品性能肯定会在此基础上有大幅提高。

No further information has yet been received on Artemis, but it is known that the previous generation's MTIA V1 was based on an advanced 7nm process, with an operational frequency of 800 MHz, on which the performance of the second-generation product is bound to increase significantly.

值得一提的是,根据Meta方面的构想,算力的提升,不仅为大模型服务,也能助力元宇宙、广告等事业。扎克伯格就曾表示,会借助自研芯片和超算中心开发新一代生成式AI编码助手,继而为元宇宙软件开发、社区运营提供支持。此外,在AI辅助推广下,Meta广告投放的支出回报率提升了32%,成本降低了17%。

It is worth mentioning that, according to Meta’s vision, the increase in computing not only serves large models, but also contributes to the universe, advertising, etc. Zuckerberg said that a new generation of generation AI code assistants would be developed through self-research chips and super-counting centres, which in turn would support the development of meta-cosm software and community operations. Moreover, under AI-assisted promotion, the return on expenditure on Meta advertising increased by 32%, with a 17% reduction in cost.

未来一段日子,广告、元宇宙、AI这几个业务之间的联动肯定会更加紧密,Meta不愿意放弃任何一个赚钱机会。虽然20%的暴涨神话很难复制,但只要配合得当,这些业务的前景仍是值得期待的。

In the coming days, the connection between advertising, the meta-cosmos, and AI is bound to become even closer, and Meta is reluctant to give up any opportunity to make money. While 20% of the surge myths are hard to replicate, the prospects for these operations are still to be expected as long as they work together properly.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。