即将上线币安的Ethena (ENA)项目的分析及优势介绍

币安将于 2024 年 04 月 02 日 16:00(东八区时间)上市 Ethena (ENA),并开通 ENA/BTC、ENA/USDT、ENA/BNB、ENA/FDUSD 和 ENA/TRY 交易市场。今天我们就来客观分析一下 Ethena(ENA)的项目背景、融资、业务等情况,并对即将上线的 ENA 代币价格做个预测,供大家参考。

The currency will be on the market at 1600 hours (East 8th District Time) in 2024 and will open the Ethena (ENA) and ENA/BTC, ENA/USDT, ENA/BNB, ENA/FDUSD and ENA/TRY trading markets. Today we will analyse objectively the project background, financing, operations, etc. of Ethena (ENA) and make a forecast for you of the forthcoming ENA proxy prices.

通过币安KOL/队长邀请链接(新用户注册通道),注册并交易100U以上的新用户,前三千名每人50枚$ENA,三千名以后瓜分5万$ENA!老用户可以通过币安Launchpool通过质押BNB或FDUSDT参考一下。

By inviting links ( to a new user registration channel ), the first 3,000 new users over 100 U were registered and traded at $50 per person ($ENA) and then at $50,000 after 3,000. The older users were able to pledge BNB or FDUSDT via Launchpool.

币安Launchpool上线Ethena(ENA)并非意料之外。早在2月19日,Ethen Labs向公众开放其合成美元稳定币存款时,Ethena(ENA)就成为了Crypto Twitter上几乎所有人都在关心讨论的热门话题。

As early as February 19, Ethen Ethena (ENA) became Crypto when Labs opened its deposit to the public for a US dollar-stabilized currency; almost everyone on Twitter was interested in the topic under discussion.

3月初,BitMEX创始人Arthur Hayes也曾发文赞赏Ethena(ENA):我相信Ethena可以超越 Tether 成为最大的稳定币。可见这次多人看好的项目,让我们拭目以待。

At the beginning of March, Arthur Hayes, founder of BitMEX, also sent a message of appreciation to Ethena: I believe that Ethena can move beyond Tether to become the biggest stabilizer. So let's see how many people watch this project.

Ethena 是一个建立在以太坊上的合成美元(synthetic dollars)协议,将为不依赖传统银行系统基础设施的货币提供一种加密原生解决方案,同时提供一个全球可访问的以美元计价的储蓄工具?—— "互联网债券"(Internet Bond)。

& mdash; — &quat; Internet bonds &quat; Internet Bond.

Ethena Labs 当前的主要产品为 Delta 中性的合成美元(Synthetic Dollars)USDe,该产品的创意灵感来自于 BitMEX 的创始人 Arthur Hayes, 2023 年 3 月,Arthur 曾撰写了一篇名为《Dust on Crust》的文章 ,文中谈到了其对新一代稳定币"中本聪美元"的构想,即创建一个由等量 BTC 现货多头和期货空头共同支撑的稳定币。

The current main product of Ethena Labs is Synthetic Dollars (Synthetic Dollars) USDE, inspired by the creative ideas of the founder of BitMEX, Arthur Hayes, in March 2023, who wrote an article entitled " Dust on Crust ", in which he talked about his new generation of stable coins &quat; medium-size dollar & quot; and the idea of creating a stable currency supported by an equivalent BTC on the spot and futures empty.

Ethena Labs 落地了 Hayes 的想法,但以 ETH 作为底层资产标的,USDe 基于等量的现货 ETH 以及期货 ETH 空头抵押构成,二者对冲成为一项 Delta 中性的稳定资产,Delta 中性意味着 USDe 的抵押铸造仓位基本上不受 ETH 价格变动的影响,从而保证资产的可靠性。

Ethena Labs landed on Hayes'idea, but with ETH as the bottom asset, ETH based on the equivalent of spot ETH and futures ETH empty mortgages, both of which were hedged into a stable asset of Delta neutrality, which meant that ETH’s mortgage-making warehouse was largely unaffected by changes in ETH prices, thereby guaranteeing the reliability of the asset.

另一方面,确保了资产稳定性后,Ethena 通过两种途径为 #USDe 生息:

On the other hand, after ensuring the stability of the asset, Ethena makes a living for #USDe in two ways:

现货仓位的质押收益。Ethena Labs 支持将现货 ETH 通过 Lido 等 LSD 协议进行质押,从而获得 3%?-?5% 的年化收益。

Ethena Labs supports the pledge of off-the-shelf ETHs through LSD agreements such as Lido, thereby reaping 3% - 5% annual gains.

空头的资金费率收益。虽资金费率波动性较大,但长期而言空头是资金费正收入的一方,Ethena 通过该途径获得较高但波动较大的收益,目前这一收益大约在 5–20% 之间。

Funds rate gains. While the rates are highly volatile, in the long term they are on the positive side of the cost of the funds, Ethena receives higher but more volatile returns through this route, which currently range between 5&ndash and 20%.

Ethena 的合成美元 USDe,在链上完全透明地支持,并可在 DeFi 中自由组合。Ethena 的建立是为了解决加密领域最大、最明显的直接需求。

Ethena's synthetic dollar, USDe, is fully transparent in the chain and can be freely combined in DeFi. Ethena was created to address the greatest and most obvious direct need in the field of encryption.

Ethena(ENA)是一个提供价值 13 亿美元 USDe 代币的开放式对冲基金,使用流动性质押ETH代币作为抵押品,做空等量的ETH,以创建一个delta为0的投资组合,这种配置确保了Ethena(ENA)所持资产的净值不随其资产基础价值的变化而波动,同时可以从ETH质押和其空头头寸的融资支付中获取收益。

Ethena (ENA) is an open hedge fund that provides $1.3 billion worth of USDE tokens, uses mobile ETH tokens as collateral to create an investment portfolio of Delta zero, which ensures that the net value of the assets held by Ethena (ENA) does not fluctuate in line with changes in the underlying value of its assets, while at the same time generating gains from the ETH pledge and the financing payments of its empty positions.

为了保护用户的抵押品,Ethena(ENA)利用场外结算(OES)解决方案,由信誉良好的第三方托管机构持有资金,仅将账户余额映射到CEX以提供交易保证金,确保资金永远不会存入中心化交易所。

In order to protect the collateral of users, Ethena (ENA) uses the off-site settlement (OES) solution, where funds are held by a reputable third-party hosting institution, merely map account balances to CEX to provide a trading bond to ensure that funds will never be deposited into a centralized exchange.

由于质押ETH可以用等值名义价值的空头头寸完美对冲,USDe可以以1:1的抵押比率铸造,使Ethena(ENA)的资本效率与美元资产支持的稳定币(如USDC和USDT)相当,同时还规避了对从传统金融市场获取资产的依赖,而传统金融市场中资产发行人须遵守实体世界的规定。

Since the pledge of ETH can be perfected against empty positions of nominal value of equivalent value, the USDE can be forged at a collateral ratio of 1:1 so that the capital efficiency of Ethena (ENA) is comparable to that of stable currencies supported by United States dollar assets (e.g. USDC and USDT), while avoiding reliance on the acquisition of assets from traditional financial markets, where asset issuers are subject to entity-world requirements.

虽然Ethena(ENA)当前模式只使用质押ETH作为抵押品,但该协议可能会进一步将BTC作为抵押品以实现更大规模的扩展,但这样做可能会稀释USDe的收益,因为BTC抵押品不会产生质押收益。

While the current Ethena (ENA) model uses only the pledge of ETH as collateral, the agreement may further use BTC as collateral to achieve a larger expansion, but this may dilute the gain for USDE, as the BTC collateral does not generate the pledge proceeds.

Ethena Labs是USDe的创造者,这是一个基于以太坊构建的合成美元协议。该计划解决了加密原生空间内需要稳定、可扩展的货币形式,而不依赖传统银行系统的需求

Ethena Labs is the creator of USDe, a synthetic dollar agreement based on the Taiwan. The plan addresses the need for stable, scalable currency in encrypted primary space, rather than relying on traditional banking systems.

ENA是Ethena的原生实用代币,并用于以下功能:

ENA is Ethena's original practical token and is used for the following functions:

治理:ENA代币持有人可以对协议治理决策进行投票

Governance: ENA currency holders can vote on agreement governance decisions

截至2024年3月29日,ENA的总供应量为150,000,000,000,上市时的初始流通供应量将为1,425,000,000(约占总代币供应量的9.5%)

As of 29 March 2024, the total supply of ENA was 150,000,000,000, and the initial supply of circulation at the time of listing would be 1,425,000,000 (approximately 9.5 per cent of the total supply in currencies)

关键指标: (截至 2024 年 3 月 29 日)

Key indicators: (as of 29 March 2024)

代币名称 token name | ENA |

代币种类 tokens | ERC-20 |

初始代币流通量 Initial currency circulation | 1,425,000,000 (代币总量的9.50%) 1,425,000,000 (9.50 per cent of the total currency) |

总量和最大代币供应量 total and maximum supply of money | 15,000,000,000 |

币安 Launchpool 额度 Launchpool Amount | 300,000,000 (代币总量的2.00%) 300,000,000 (2.00 per cent of total currency) |

币安 Launchpool 开始日期 | 2024 年 3 月 30 日 30 March 2024 |

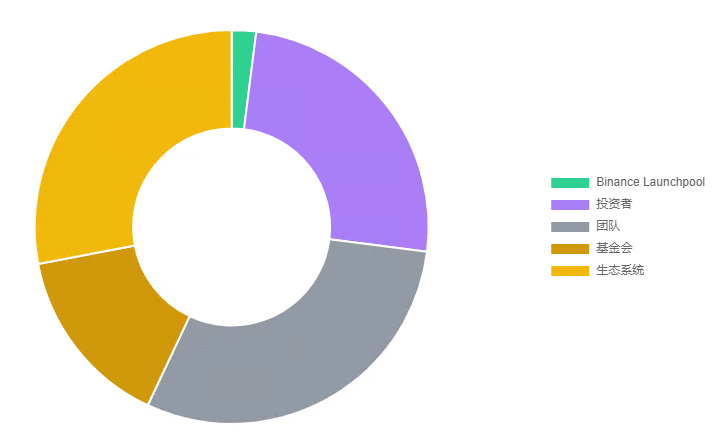

代币分配

token distribution

代币名称 token name | ENA |

币安 Launchpool CurrencyAnn Launchpool | 代币总量的 2.00% 2.00 per cent of total tokens |

投资者 Investors | 代币总量的 25.00% 25.00 per cent of total currency |

团队 Team | 代币总量的 30.00% 30.00 per cent of total currency |

基金会 Foundation | 代币总量的 15.00% 15.00 per cent of total currency |

生态系统 Ecosystems | 代币总量的 28.00% 28.00 per cent of total currency |

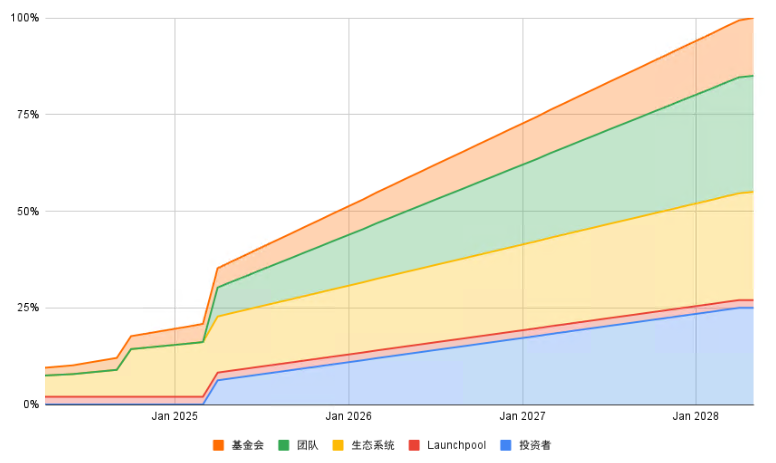

代币发行时间表

Democracy Distribution Schedule

Ethena 是一种综合支持的法定加密货币美元。

Ethena is a consolidated, legal encrypt currency in United States dollars.

USDe是Ethena发行的稳定币,旨在与美元1:1挂钩。

The USDE is a stable currency issued by Ethena and is intended to be linked to the dollar of 1:1.

Ethena 加入了各种授权参与者 (AP)。 AP 可以按照 1:1 美元的比例铸造和销毁 USDe。

Ethena has joined various authorized participants (AP). AP can cast and destroy USDE at a scale of 1:1.

目前,接受 stETH Lido、Mantle mETH、Binance WBETH 和 ETH。 然后,Ethena 自动出售 ETH/USD 永续掉期以锁定 ETH 或 ETH LSD 的美元价值。 然后,该协议铸造等量的 USDe,与空头永久对冲的美元价值相匹配。

Currently, there is acceptance of stETH Lido, Mantle mETH, Binance WBETH, and ETH. Then, Ethena sells ETH/USD automatically for a lifetime to lock in the dollar value of ETH or ETH LSD. Then, the USDE of the agreement, which creates the equivalent, matches the dollar value of the permanent hedge over the empty head.

AP 存入 1 stETH,价值 10,000 美元。

AP deposited 1 stETH, valued at $10,000.

Ethena 每份掉期合约出售 10,000 ETH/美元=10,000 美元/1 美元合约价值。

Ethena sells 10,000 ETH/US$ = US$ 10,000/US$ 1 contract value per swap.

AP 收到 10,000 USDe,因为 Ethena 卖出了每份掉期合约 10,000 ETH/USD。

AP received 10,000 USDE because Ethena sold each swap contract 10,000 ETH/USD.

为了销毁 USDe,AP 将 USDe 存入 Ethena。 然后,Ethena 自动回补其空头 ETH/美元永久掉期头寸的一部分,从而解锁一定数量的美元价值。 然后,协议将销毁 USDe,并根据解锁的美元价值减去执行费用的总金额返还一定数量的 ETH 或 ETH LSD。

Then Ethena automatically returns part of its empty ETH/US$ permanent swap position, thereby unlocking a certain amount of the dollar value. The agreement will then destroy the U.S.DE and return a certain amount of ETH or ETH LSD based on the dollar value of the unlocked less the total cost of implementation.

AP 存入 10,000 USDe。

AP deposited in 10,000 USDe.

Ethena 每份掉期合约回购 10,000 ETH/美元=10,000 美元 / 1 美元合约价值

Ethena buys back 10,000 ETH/US$ = $10,000/US$ 1 contract value

AP 收到 1 stETH=10,000 * $1 / $10,000 stETH/USD 减去执行费用

AP Received 1 stETH=10,000 * $1 / $10,000 stETH/USD minus implementation costs

(1)可扩展性

(1) Extendable

通过利用衍生品实现可扩展性,这允许USDe以资本效率扩展。由于质押的ETH可以通过等值的空头头寸完美对冲,合成美元只需要1:1的抵押。

This allows USDe to expand capital efficiency by using derivatives. Since the pledged ETH can be perfectly hedged in an equivalent empty position, the synthetic dollar requires only 1:1 collateral.

(2)稳定性

通过在发行后立即对转移资产执行对冲来提供稳定性,确保了在所有市场条件下USDe背后的合成美元价值。

The stability provided by the hedging of transferred assets immediately after issuance ensures the synthetic dollar value behind the USDE under all market conditions.

(3)抗审查

(3) Resistance

通过将支持资产与银行系统分离并将无信任的支持资产存储在链上、透明、全天候可审计、程序化的托管账户解决方案外的去中心化流动性场所中,来抵抗审查。

Resistance to censorship is achieved through decentralized liquidity sites outside the chain, transparent, auditable, procedural hosting account solution that supports the separation of assets from the banking system and the storage of untrusted support assets.

(1)抵押品脱钩风险

(1) collateral decoupling risk

Ethena的主要风险是混合使用LST抵押品和普通的以太币空头。虽然这种对ETH基差交易的优化有助于协议最大化其收益持续能力,但却增加了风险!

The main risk for Ethena is a combination of LST collaterals and ordinary TTs. While this optimization of the ETH base trade helps the agreement maximize its revenue sustainability, it increases the risk!

如果Ethena的LST抵押品与ETH脱钩,Ethena的ETH空头将无法捕捉到波动,从而使协议蒙受账面损失。

If Ethena's LST collateral was decoupled from ETH, Ethena's ETH head would not be able to capture fluctuations, thereby causing book losses to the agreement.

虽然LST的交易通常接近其挂钩,但我们已经目睹了这些代币的多种脱钩情况,例如2022年的年中3AC(三箭资本)的黑天鹅清算事件期间,Lido的stETH价格大打折扣,逼近8%!

Although LST transactions are usually close to their linkage, we have witnessed multiple decouplings of these tokens, such as the black swan settlement of 3AC (three arrow capital) in mid-2022, where Lido's stETH prices were significantly reduced to nearly 8%!

2023年4月Shapella升级启用了以太坊质押提款功能,这使得3AC清算可能创造了我们在蓝筹股LST中看到的最广泛的脱钩,但事实仍然是,任何未来的脱钩事件都将给Ethena的保证金要求(必须部署到交易所的资金数量,以保持其对冲敞口,避免其头寸被清算)带来压力。

The upgrade of Shapela in April 2023, which introduced the Etheria pledge withdrawal function, may have created the most extensive decoupling we have seen in Blue Equity LST, but the fact remains that any future decoupling event will put pressure on Ethena's bond requirements (the amount of funds that must be deployed to the exchange to keep its hedge open and avoid the liquidation of its positions).

一旦达到清算阈值,Ethena将被迫实现亏损。

Ethena would be forced to realize a loss once the liquidation threshold had been reached.

(2)融资利率风险

(2) Financing interest rate risk

尽管从一开始Ethena的收益可能看起来很惊人,但重要的是要注意到,之前曾有两个协议试图扩大合成美元稳定币的规模,但因为出现了收益率倒挂,都以失败告终。

While Ethena's earnings may have looked amazing from the outset, it is important to note that two previous agreements had attempted to expand the size of the synthetic dollar to stabilize the currency, but both failed because of the reversal of the rate of return.

为了对抗负融资收益,Ethena使用质押ETH作为抵押品,这一策略将USDe在三年数据回测中产生负收益率的天数从20.5%降低至10.8%。

In order to counter negative financing gains, Ethena used the pledge of ETH as collateral, a strategy that reduced the negative rate of return from 20.5 per cent to 10.8 per cent in the three-year data recovery by USDE.

虽然可以100%确定在某一点上融资利率会出现倒挂,但加密市场的自然状态是期货溢价交易,给融资利率施加上行压力,并为Ethena进行基差交易提供有利环境。

While 100 per cent of financing interest rates can be determined to be reversed at a given point, the natural state of the cryptomarket is , putting upward pressure on financing interest rates and providing an enabling environment for Ethena to conduct base trading.

(3)交易对手风险

(3) counterparty risk

许多不熟悉Ethena设计的人认为,将用户抵押品部署到中心化交易所是一个主要风险,但使用上述OES托管账户大大减轻了这一风险。

Many people who are not familiar with the design of Ethena consider the deployment of user collateral to a centralized exchange to be a major risk, but the use of the above-mentioned OES hosting account significantly mitigates this risk.

虽然针对破产交易所进行的未结算对冲利润可能会带来亏损,但Ethena至少每天都进行PnL(盈亏)结算,以减少对交易所的资本敞口。

While open hedge profits for insolvency transactions may result in losses, Ethena carries out the PnL (loss and loss) settlement at least daily to reduce capital exposure to the exchange.

如果Ethena的一家交易所破产,该协议可能会被迫对其他交易所的头寸使用杠杆,使其投资组合delta变得中性,直到未平仓头寸得以结算,受影响的OES账户的托管人可以释放资金。

In the event of the bankruptcy of an Ethena exchange, the agreement may be forced to leverage the positions of other exchanges to make its portfolio delta neutral until unsettled positions are settled, and the trustee of the affected OES account may release the funds.

此外,如果Ethena的OES账户的托管人之一破产,资金获取可能会被推迟,这就需要在其他账户上使用杠杆来对冲投资组合。

In addition, if one of the trustees of Ethena's OES accounts were to fail, access to funds could be delayed, which would require the use of leverage against other accounts to hedge the portfolio.

(4)一般加密风险

(4) General encryption risk

与许多早期加密协议的情况一样,重要的是要切记,Ethena的存款人面临着协议团队骗取用户资金的风险,因为项目密钥的所有权目前还没有实现去中心化。

As in the case of many early encryption agreements, it is important to bear in mind that Ethena's depositors face the risk that the agreement team will fraudulently access user funds, as ownership of the project key has not yet been decentralized.

虽然绝大多数加密项目在其智能合约中的潜在漏洞方面面临大量的黑客攻击风险,但Ethena使用OES托管账户通过消除使用复杂智能合约逻辑的需要减轻了这种风险。

While the vast majority of encryption projects face significant risk of hacking in connection with potential loopholes in their smart contracts, Ethena's use of OES hosting accounts mitigates this risk by eliminating the need to use the logic of complex smart contracts.

2 月 16 日,Ethena Labs 宣布以 3 亿美元估值完成了 1,400 万美元的战略轮融资,Dragonfly 和 BitMEX 创始人 Arthur Hayes 家族办公室 Maelstrom 联合领投。

On 16 February, Ethena Labs announced that it had completed $14 million in strategic rotation financing with a $300 million valuation, and that Dragonfly and the family office of the BitMEX founder, Arthur Hayes, were co-directed by Maelstrom.

L2 衍生品交易平台Aevo曾在社交媒体指出Ethena(ENA)的估值可达45亿美元。3. 2000亿美元

L2 Derivative trading platform Aevo pointed out in social media that Ethena's valuation could reach $4.5 billion.

BitMEX 创始人 Arthur Hayes则认为估值不仅于此。

The founder of BitMEX, Arthur Hayes, considered the valuation to be more than that.

Arthur Hayes 认为:预计长期分割将是协议生成的收益的 80% 归入质押的 USDe (sUSDe),而生成的收益的 20% 归入 Ethena 协议。

According to Arthur Hayes, the expected long-term partition would be 80 per cent of the proceeds generated by the agreement and 20 per cent of the proceeds generated would be included in the Ethena Agreement.

Ethena协议年收入=总收益 * (1–80% * (1 — sUSDe 供应量 / USDe 供应量))

Ethena agreement annual income = total income * (1– 80% * (1 & mdash; sUSDE supply / USDE supply))

如果 100% 的 USDe 被质押,即 sUSDe 供应=USDe 供应:

If 100% USDE is pledged, that is, sUSDE supply=USDE supply:

Ethena协议年收入=总收益 * 20%

Ethena's annual income = total gain * 20%

总收益率=USDe 供应 *(ETH 质押收益率 + ETH Perp 掉期资金)

Total rate of return = USDE supply * (ETH pledge rate + ETH Perp swap funds)

ETH 质押收益率和 ETH Perp Swap 资金均为可变利率。

The ETH pledge rate and ETH Perp Swap funds are variable interest rates.

ETH 质押收益率——假设 PA 收益率为 4%。

ETH pledge rate & mdash; & mdash; assumed PA return rate of 4%.

ETH Perp Swap 资金——假设 PA 为 20%。

ETH Perp Swap funds & mdash; & mdash; assuming 20% PA.

该模型的关键部分是应使用收入倍数的全稀释估值 (FDV)。

The key part of the model is the fully diluted valuation (FDV) using multiple income figures. & nbsp;

使用这些倍数作为指导,创建了以下潜在的 Ethena FDV。

Using these multiples as a guide, the following potential Ethena FDV was created.

3月初时,Ethena 8.2亿美元资产产生了67%的收益率。 假设 sUSDe 与 USDe 的供应比率为 50%,则推断一年后,Ethena的年化收入约为 3 亿美元。 使用类似 Ondo 的估值得出的 FDV 为 1,890 亿美元。 这是否意味着 Ethena 的 FDV 在推出时将接近 2000 亿美元?

At the beginning of March, Ethena’s $820 million asset generated a 67% return. Assuming a 50% supply ratio between sUSDE and USDE, it is assumed that Ethena’s annualized income would be about $300 billion a year later.

本周三,Ethena(ENA)公布了空投计划,将在 4 月 2 日正式向用户空投代币。Ethena(ENA)计划空投 7.5 亿个 ENA 代币,占总供应量的 5%。 赚取“碎片”的活动将于 4 月 1 日结束,该活动使用户有资格获得代币空投。在此日期之前取消质押、解锁或出售所有 USDe 的人将没有资格获得空投。

On Wednesday, Ethena (ENA) announced its air drop plan, which will officially be dropped on the user by air on April 2. Ethena (ENA) plans to drop 750 million ENAs, or 5 per cent of the total supply. earned “ debris & rdquo; the event will end on April 1, and the event will qualify the user to airdrop. Anyone who cancels the pledge, unlocks or sells all USDEs before that date will not be eligible for air drops.

用户将能够从第二天开始领取代币,届时 ENA 将在中心化交易所上市。 空投结束后,Ethena(ENA)将启动一项活动,为下一阶段的空投提供新的激励措施。

After the drop, Ethena (ENA) will launch an activity to provide new incentives for the next stage of the drop.

24 年 2 月 16 日,Ethena Labs 以 3 亿美元估值完成 1400 万美元战略轮融资,Dragonfly、Brevan Howard Digital 和 BitMEX 创始人 Arthur Hayes 的家族办公室 Maelstrom 共同领投,PayPal Ventures、富兰克林邓普顿、Avon Ventures、Binance Labs、Deribit、Gemini 和 Kraken 等参投,本轮融资采用了未来股权简单协议与代币认股权证的结构。

24 On February 16th, Ethena Labs completed a US$ 14 million strategic round of financing with a valuation of US$ 300 million, with the participation of Dragonfly, Brevan Howard Digital and the family office of Arthur Hayes, founder of BitMEX, with the participation of Maelstrom, PayPal Ventures, Franklin Templeton, Avon Ventures, Binance Labs, Deribit, Gemini and Kraken, which adopted the structure of a simple future equity agreement and intergenerational title.

23 年 7 月 17 日,加密初创公司 Ethena 完成 600 万美元种子轮融资,Dragonfly 领投,并得到 Deribit,Bybit,OKX,Gemini 和 Huobi 等交易平台以及 BitMEX 创始人 Arthur Hayes 及其家族办公室的支持。

On July 17, 2007, the encryption start-up company Ethena completed $6 million in seed rotation finance, led by Dragonfly and supported by trading platforms such as Deribit, Bybit, OKX, Gemini and Huobi, as well as by the founder of BitMEX, Arthur Hayes, and his family's office.

去年 10 月,哥伦比亚商学院教授、Zero Knowledge Consulting 创始人兼管理合伙人 Austin Campbell 曾发文拆解了 USDe 的设计结构。Austin 在文中指出,其更愿意将 USDe 称为一个"结构性票据",而非稳定币,并剖析了 USDe 的四层潜在风险:

Last October, Austin Campbell, a professor at Columbia Business School and founder and management partner of Zero Knowledge Consulting, wrote to dismantle the design structure of USDE. Austin stated that he preferred to refer to USDE as a &quat; structural notes &quat; rather than a stable currency, and analysed the four layers of potential USDE risk:

一是质押层面的安全风险,质押节点的安全性及可持续性是否可得以保证;

The first is the security risk at the pledge level, whether the security and sustainability of the pledge node are guaranteed;

二是期货合约开设平台的安全风险,无论是 DEX 还是 CEX 均存在黑客攻击风险;

The second is the security risk of futures contracts opening platforms, with both DEX and CEX risk of hacking;

三是合约可用性风险,有些时候可能根本没有足够的流动性来进行做空;

The third is the risk of contractual availability, which in some cases may not have sufficient liquidity to carry out the exercise;

四是资金费率风险,虽然空头头寸的资金费率大多数时候为正,但也存在转负的可能性,如果在加权质押收益之后的综合收益率为负,对于"稳定币"而言是相当致命的。

The fourth is the risk of a financial rate, which is mostly positive in empty positions, but there is also the possibility of a reversal if the combined rate of return after the weighted pledge proceeds is negative for & quot; stable currency & quot; and is quite lethal.

而根据往期币安 Launchpool 新矿的 #BNB 池进行计算,前十期的平均年化收益率为 123% ,假设本次挖矿的年化收益率也是 123% ,按照挖矿 3 天计算,则ENA代币的价格为 0.45 USDT,按照 AI 的最低收益率 0.18% 计算,保底价格为 0.18 USDT。

The average annualized rate of return for the first ten periods, calculated on the basis of the #BNB pool of the new mine in the previous period, was 123 per cent, assuming that the annualized rate of return for the mine was also 123 per cent, and the value of the ENA indemnity was 0.45 USDT, calculated on the basis of 3 days of mining, and 0.18 per cent of the minimum rate of return for AI, which was 0.18 USDT.

按照 150 亿的代币总量计算,当价格达 0.45 USDT 时,FDV 为 67.5 亿美元。而当前盘前交易市场 Aevo 对ENA给出了更高的价格约 0.65 USDT,对应 FDV 高达 97.5 亿美元。

The FDV is $6.75 billion when the price amounts to 0.45 USDT, based on the sum of $15 billion. Aevo has given ENA a higher price of about 0.65 USDT, corresponding to $9.75 billion in FDV.

此外,随着 BNB 价格的一路快速上升,新矿收益率难以维持此前的高水平, #ETHFI? 更是创下了近十期的最低收益率,但在初始筹码抛售之后,ETHFI 曾迎来了一波快速剧烈的上涨。

In addition, with BNB prices rising rapidly, the rate of return for new mines could not be sustained at its previous high levels, #ETHFI?, the lowest rate of return in almost 10 years, but after the initial chips were sold, ETHFI experienced a wave of rapid and dramatic increases.

也正是基于ETHFI先抑后扬的强劲走势,目前场外社区中相对激进的投资专家普遍对 ENA 中期走势持乐观态度,甚至给出了2 USDT 的较高预估价格,因此大家不妨适当持有筹码,不忙抛售。

It is also on the basis of the strong trend of ETHFI before and after, that relatively radical investment experts in the off-site community are generally optimistic about the medium-term evolution of the ENA, even giving a higher pre-value of 2 USDT, so that you may have the right leverage and not be busy selling it.

展望未来,除了刚刚完成的 1400 万美元融资之外,围绕着 Ethena Labs 还有其他几件关键事项需要关注。

Looking ahead, in addition to the US$ 14 million financing that has just been completed, there are several other key issues that need attention around Ethena Labs.

其一自然是产品的公开发布,以及相关代币经济模型的披露。

One is naturally public publication of the product and disclosure of the economic model of the relevant currency.

二是 Lido 此前的对外"门面"、扩展负责人 Seraphim 已跳槽至 Ethena Labs 担任增长负责人,或有助于推动 Ethena Labs 的产品集成。

Second, Lido’s former external & quot; front & quot; and Serraphim, who is responsible for expansion, has jumped to Ethena Labs as the head of growth or has helped to promote Ethena Labs’ product integration.

三则是 Binance Labs 已将 Ethena Labs 列入 Incubation Season 6 的首批孵化项目,这或许也会成为 Ethena Labs 加速增长的一大助力。

Three, Binance Labs has included Ethena Labs in the first incubation project of Information Season 6, which may also be a major contribution to the accelerated growth of Ethena Labs.

稳定币赛道的挑战者们来了又去,希望这次,Ethena Labs 和 USDe 会带来不一样的故事。

The challengers of stabilizing the currency race have come and gone and hope that this time, Ethena Labs and USDE will bring different stories.

币安发布公告称,币安 Launchpool 上的第50个项目为 Ethena(ENA),这是一种合成美元协议。该网页预计在 Launchpool 启动前 5 小时内可用。

The currency announcement states that the 50th project on the currency Launchpool is Ethena (ENA), a synthetic dollar agreement. The web page is expected to be available within 5 hours of Launchpool’s launch. & nbsp;

用户将能够将其BNB 和 FDUSD放入单独的池中 ,在三天内挖矿ENA 代币,挖矿从 2024 年 3 月 30 日 00:00(UTC)开始。

Users will be able to put their BNB and FDUSD in a separate pool & nbsp; in three days, dig the ENA token and dig the mine from 30 March 2024 at 00:00 (UTC).

币安将于2024 年 4 月 2 日 8:00(UTC)上线 ENA ,并开通 ENA/BTC、ENA/USDT、ENA/BNB、ENA/FDUSD 和 ENA/TRY 交易对。

Currency security will be on line ENA at 8:00 (UTC) on April 2, 2024 and will open ENA/BTC, ENA/USDT, ENA/BNB, ENA/FDUSD and ENA/TRY transaction pairs.

1、白皮书:

1. White Paper:

https://ethena-labs.gitbook.io/ethena-labs

2、官网:

2. Network of officials:

3、官推:

Three. Officer-in-charge:

https://twitter.com/ethena_labs

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。