市场预期“宽松之夏” 比特币创两个月最佳单日表现

本文作者:Omkar Godbole,资讯来源:coindesk,中文翻译:善欧巴,金色财经。

重要内容摘要

-

周三,比特币(BTC)价格上涨超过7.5%,创下自3月20日以来的最佳表现。

-

美国经济数据疲软,增强了美联储在9月降息的可能性。

-

英国央行和欧洲央行可能会在6月降息。

由于美国经济数据疲软,提高了美联储在夏季降息的概率,比特币周三创下近两个月来的最大单日涨幅。根据TradingView和CoinDesk的数据,这一市值最大的加密货币上涨超过7.5%,达到66,250美元,这是自3月20日以来的最大百分比涨幅。像其他风险资产一样,比特币对主要央行货币政策立场的预期变化非常敏感,当预期法定货币借贷成本下降时,比特币往往会上涨。

美国劳工部周三发布的数据表明,4月份消费者价格指数(CPI)涨幅低于预期,显示出全球最大经济体的生活成本再次下滑。总体CPI上月上涨0.3%,而3月和2月的涨幅为0.4%。剔除食品和能源价格的核心CPI在4月份上涨了0.3%,3月份的涨幅为0.4%。

其他数据显示,4月份整体零售销售增长停滞,“控制组”类别的销售额(该类别数据纳入GDP计算)环比下降了0.3%。

因此,降息预期显著转变。联邦基金期货显示,交易员预计美联储将在9月进行首次25个基点的降息。(今年夏天将于6月20日开始,9月22日结束。)美联储最近表示,将从6月开始减少量化紧缩的步伐,这也是一种收紧流动性的工具。

不仅是美联储,市场预计英格兰银行和欧洲央行将在6月降息。瑞士国家银行(SNB)和瑞典央行(Riksbank)已经降低了基准借贷成本。

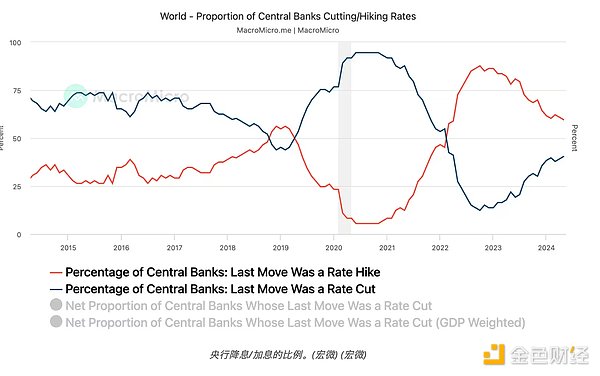

全球央行正在转向新的货币或流动性宽松政策,这对于包括加密货币在内的风险资产是一个积极信号,从数据追踪网站MacroMicro的图表中可以明显看出这一点。

最近一次加息的全球央行的比例正在迅速下降,而最近一次降息的央行比例在上升。换句话说,净降息央行的比例在上升。

MacroMicro在解释中指出:“比例越高,说明更多的央行在降息,这有助于改善市场流动性。比例越低,市场流动性越少。”

经纪公司Pepperstone表示,夏季流动性宽松的前景应该会支持股票市场,给投资者足够的信心“继续在风险曲线上前行”。

On Wednesday, the price of Bitcoin rose more than the best performance since March, and the weak US economic data enhanced the possibility of the Federal Reserve cutting interest rates in January. The Bank of England and the European Central Bank may cut interest rates in January because of the weak US economic data, which increased the probability of the Federal Reserve cutting interest rates in summer. Bitcoin hit its biggest one-day increase in the past two months on Wednesday. According to the sum data, the cryptocurrency with the largest market value rose more than. Like other risky assets, Bitcoin is very sensitive to the expected changes in the monetary policy stance of major central banks. When the borrowing cost of legal tender is expected to fall, Bitcoin tends to rise. The data released by the US Department of Labor on Wednesday showed that the increase in the consumer price index in January was lower than expected, showing that the cost of living in the world's largest economy fell again. Overall, last month, the monthly and monthly increases were excluding the core of food and energy prices. The increase in the month is other data showing that the overall retail sales growth stagnated in the month, controlling the sales of the group category. The data of this category has been included in the calculation, so the expectation of interest rate cuts has changed significantly. Federal funds futures show that traders expect the Fed to cut interest rates by 1 basis point for the first time in the month. This summer will start on the month and end on the month. The Fed recently said that it will reduce the pace of quantitative tightening from the month. This is not only a tool for tightening liquidity, but also a tool for the Fed market to expect the Bank of England and The European Central Bank will cut interest rates in January. The Swiss National Bank and the Swedish Central Bank have reduced the benchmark borrowing costs. Global central banks are turning to new monetary or liquidity easing policies, which is a positive signal for risky assets including cryptocurrencies. It can be clearly seen from the chart of the data tracking website that the proportion of global central banks that raised interest rates recently is rapidly declining, while the proportion of central banks that cut interest rates recently is rising. In other words, the proportion of central banks that cut interest rates net is rising. The higher the case, the more central banks are cutting interest rates, which will help improve the market liquidity. The lower the proportion, the less the market liquidity. Brokerage companies said that the prospect of loose liquidity in summer should support the stock market and give investors enough confidence to continue on the risk curve. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。