Hopenlend 攻击事件详细技术分析

作者:深圳零时科技

本文,我们将详细介绍抢跑者是如何进行攻击的。

HopeLend简介

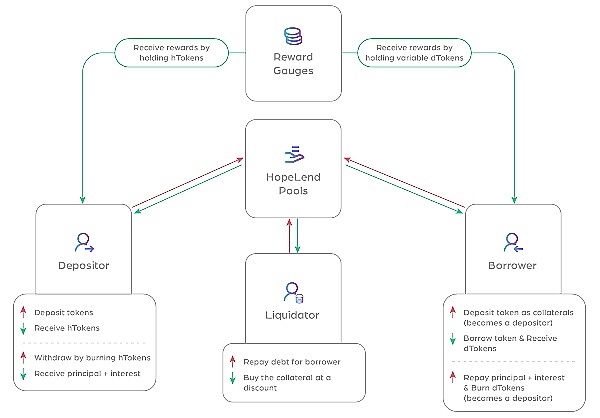

HopeLend是一个去中心化的虚拟货币借贷平台,能够在无需双方单独撮合的情况下,根据资金池状态实现即时贷款。类似于Aave等DeFi项目,HopeLend的运行模式如下图:

HopeLend攻击分析

简单来讲,黑客攻击流程主要分为两部分:

利用Hopelend的hEthWBTC交易池流动性不足(流动性为0)抬高hEthWBTC的价值,然后通过borrow掏空所有代币(HOPE,stHOPE,wstETH,WETH,USDT,USDC);

利用rayDiv精度丢失问题,掏空从Aave中flashloan的其中2000 WBTC给Hopelend中存入的2000 WBTC。(掏空黑客前期攻击投入的所有WBTC)。

在具体分析攻击事件之前,我们需要简单了解一下HopeLend的相关内容。

Hopelend是去中心化借贷平台,用户通过deposti存入underlyingAssets(标的资产),获得对应的hToken;反之,通过withdraw取出underlyingAssets时,销毁对应的hToken。

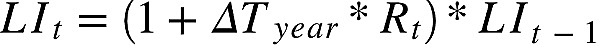

其中,underlyingAssets标的资产和hToken的兑换比例是通过liquidityIndex(流动性指数)来控制的,简单来讲liquidityIndex(流动性指数)就是hToken的价值。例如,当liquidityIndex为2时,1个对应的hToken可以兑换2个对应的underlyingAssets(标的资产)。其中,liquidityIndex是通过收益进行计算的。计算方式如下:

对应的代码如下:

?在此次攻击中,简单来说,黑客通过操纵liquidityIndex(流动性指数)来抬高hToken的价值,使得hToken的价值失真。最终使用很小单位的hToken来借贷大额的其他标的资产。从而掏空Hopelend其他池子的underlyingAssets(标的资产)。随后,黑客通过利用rayDiv精度丢失问题,反复deposit和withdraw,最终掏空转给池子的所有WBTC完成攻击。

步骤1详细分析

黑客通过deposit存入标的资产WBTC,获得mint的hEthWBTC,然后通过重复的flashloan来操纵hEthWBTC的流动性指数liquidityIndex,使hEthWBTC的价格虚高,最后利用极小的hEthWBTC作为抵押物,通过borrow掏空除了WBTC之外的所有标的资产。

首先,黑客从Aave中利用flashloan贷了2300 WBTC,向Hopelend中deposit了2000 WBTC。同时,WTBC对应的池子向黑客mint了2000 hEthWBTC作为存款凭证。随后,黑客通过Hopelend的flashloan贷了2000 WBTC,然后向Hopelend的池子中transfer转入2000 WBTC,接着从Hopelend中withdraw了1999.99999999 WBTC,剩下0.00000001 WBTC(最小单位)。向Hopelend的池子中transfer和withdraw的操作只有在第一次flashloan中进行。

?这是因为,黑客向Hopelend中deposit了2000 WBTC,Hopelend随后mint了2000对应的hToken(hEthWBTC)作为存款凭证。随后,黑客通过Hopelend的flashloan贷了2000 WBTC,随后向标的资产对应的池子内transfer了2000 WBTC后withdraw了1999.99999999 WBTC。因此,该池子未初始化,所以对应的liquidityIndex为1,因此,池子销毁了1999.99999999 hEthWBTC,剩余0.00000001 hEthWBTC。

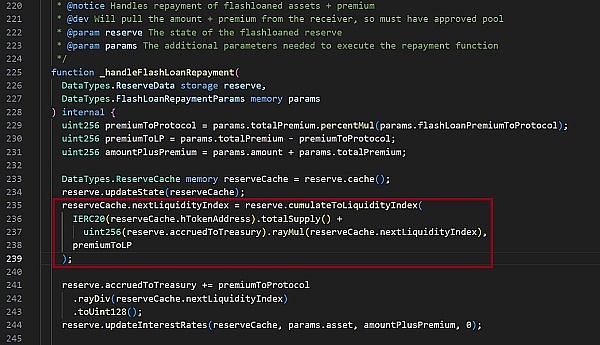

我们看一下,Hopelend在flashloan中是如何更新liquidityIndex的

首先,IERC20(reserveCache.hTokenAddress).totalSupply() + reserve.accruedToTreasury 是hToken对应的总价值,premiumToLP为本次flashloan的收益,也就是新增价值。因为flashloan的贷款利率是0.09%,且池子获得利润的30%归项目方,70%归流动性提供方,所以每次黑·客通过flashloan借贷2000 WBTC后,给池子产生的利润为2000 * 0.09% * 70% = 1.26 WBTC。所以在上面的公式中,premiumToLP 为 1.26 WBTC。

因为reserve.accruedToTreasury 为 0,所以简单来讲,flashloan后hToken的价值(liquidityIndex)=(池子新增的价值 / 池子hToken的总价值 + 1) * 池子当前hToken的价值。所以,黑客要抬高hToken的价值,就是让池子hToken的总价值尽可能小,这就解释了为什么黑客在flashloan借贷了2000 WBTC后要把2000 WBTC transfer转给池子。

因为 withdraw 操作会销毁(burn)hToken,但是当前如果不给池子转账,那么池子没有资产(最开始存的2000WBTC目前由于进行闪电贷中所以已经锁定),黑客就无法通过withdraw来销毁对应的hToken。

黑客为了让池子的hToken的总价值尽可能小,所以黑客withdraw了1999.99999999 WBTC,剩下0.00000001 WBTC(最小单位)。所以,池子也销毁了1999.99999999 hEthWTBC而剩下了0.00000001 hEthWTBC(最小单位)。由于WBTC对应了hEthWTBC的池子未初始化,所以此时的liquidityIndex为1,当前池子的总价值就是0.00000001 hEthWTBC(最小单位)。

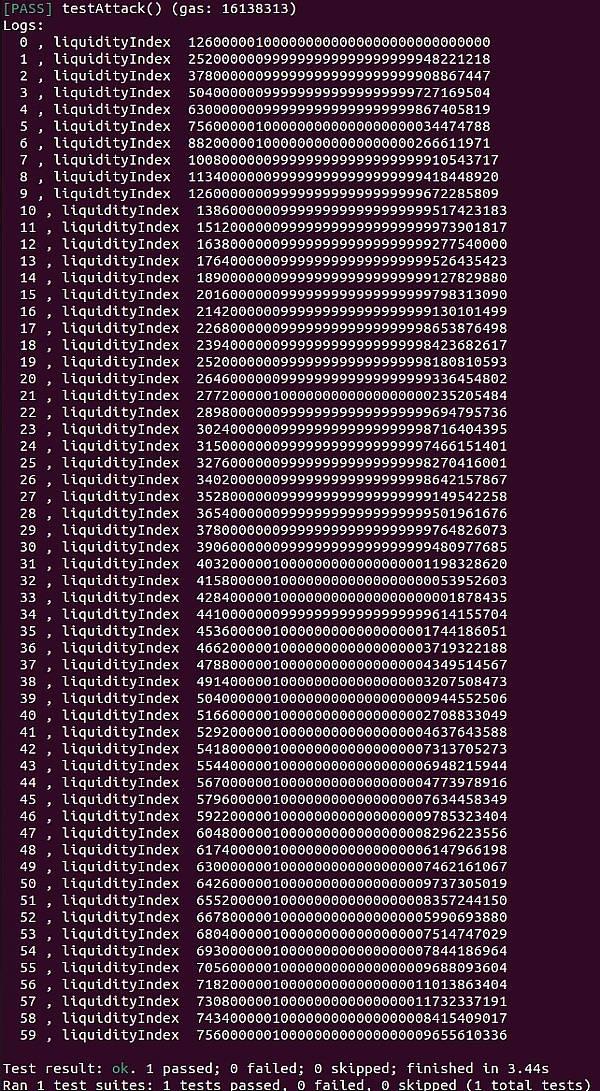

经过第一次flashloan后,hToken的价值liquidityIndex被更新为,(126000000 * 10^27 / 1 + 1)* 1*= 126000001000000000000000000000000000。此时,0.00000001 hEthWTBC价值为1.26000001 WBTC。

第二次,黑客通过flashloan借贷2000 WBTC,因为第一次借贷后,liquidityIndex为126000001000000000000000000000000000,所以通过算法得到此时liquidityIndex为252000000999999999999999999948221218。

?黑客通过重复执行flashloan,最终将hEthWTBC的liquidityIndex提升到7560000001000000000000000009655610336,也就0.00000001 hEthWTBC可以兑换75.60000001 WBTC。

下图是每次flashloan后hEthWTBC的liquidityIndex的值

因为,池子中仍有黑客的0.00000001 hEthWBTC(价值75.60000001 WBTC)且价值巨大。所以,黑客利池子中的抵押物(0.00000001 hEthWBTC),通过borrow借空了所有代币(HOPE,stHOPE,WETH,USDT,USDC)。

步骤2详细分析

黑客利用rayDiv精度丢失问题,重复deposit和withdraw操作,掏空前期攻击投入的所有WBTC。

黑客首先存入了151.20000002 WBTC,随后取出了113.40000000 WBTC。因为,此时的liquidityIndex已经提升到7560000001000000000000000009655610336,所以黑客通过deposit存入151.20000002 WBTC后,池子同样mint了0.00000002 hEthWBTC。黑客通过withdraw取出了113.40000000 WBTC,应该销毁的hEthWBTC为0.000000019999999998015872个。但是,由于solidity截断导致只销毁了0.00000001 hEthWBTC。

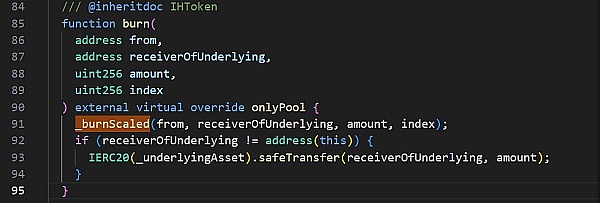

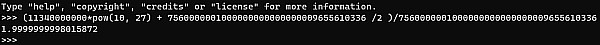

具体看一下销毁(Burn)的代码

其中,_burnScaled为缩放需要销毁的hToken的函数。

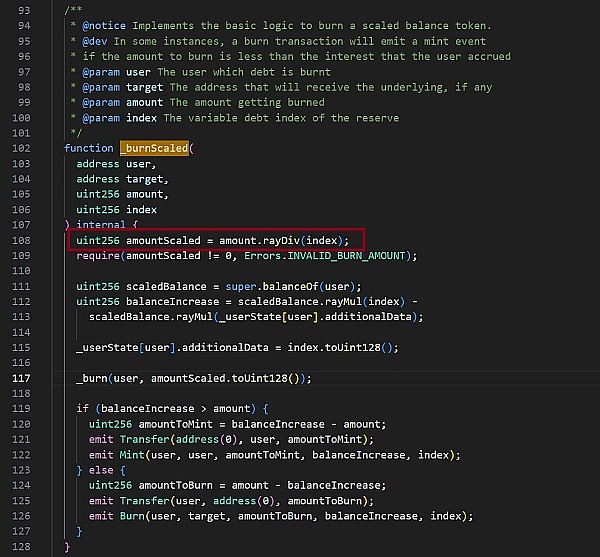

我们可以看到,需要销毁的hToken数量 =(取出标的资产的数量 / hToken的流动性指数)。但是这里为了减少数学运算的gas消耗,此处除法使用的是rayDiv,代码如下:

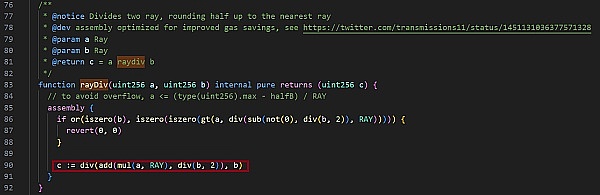

因为,需要销毁的hToken的数量的计算公式为销毁的hToken数量 = (取出资产的数量 * 10^27 + (hToken的流动性指数 / 2) ) / hToken的流动性指数。此时,需要取出的资产数量为113.40000000 WBTC, 此时hEthWBTC的流动性指数为7560000001000000000000000009655610336。通过python计算我们可以得到

需要销毁的数量为(1.9999999998015872 * 10^-8)个hEthWBTC。但是因为此处为evm opcode div进行的整数除法运算,所以,此处相当于做了一个地板除(floor division)舍去了小数位。因此,最终得到需要销毁的数量为(1 * 10^-8)个hEthWBTC也就是0.00000001 hEthWBTC,相当于只销毁了75.6 WBTC价值的hEthWBTC。所以,至此黑客通过精度丢失漏洞获利(113.4 - 75.6 = 37.8 WBTC)。

随后,黑客通过继续deposit存入75.60000001 WBTC获得池子mint的0.00000001 hEthWBTC(因为此时hEthWBTC的流动性指数为7560000001000000000000000009655610336,相当于1个最小单位的hEthWBTC,也就是0.00000001 hEthWBTC价值是75.60000001 WBTC)。因此,池子又剩下0.00000002 hToken。接着,黑客通过withdraw取出了113.40000000 WBTC,由于solidity的截断,导致只销毁了0.00000001 hToken。

?也就是说,黑客通过deposit存入75.60000001 WBTC然后通过withdraw取出了113.40000000 WBTC,可以凭空得到37.8000000 WBTC,黑客通过持续重复此操作,最终掏空了之前投入的WBTC,从而归还了Aave的贷款。至此,所有攻击流程均已完成。

总结

黑客首先利用标的资产对应的池子流动差的原因,反复操作标的资产对应的hToken的流动性指数,使其价值失真。随后,通过极小的hToken做抵押借出其他所有的标的资产。接着,利用合约存在的除法精度丢失的漏洞,反复存取掏空黑客攻击中投入的标的资产。至此,黑客完成了一次针对DeFi项目Hopelend的一次复杂的攻击,掏空了HopeLend的所有资产。

Author Shenzhen Zero Time Technology In this paper, we will introduce in detail how the poachers attack. It is a decentralized virtual currency lending platform, which can realize instant loans according to the status of the fund pool without the need for separate matching between the two parties. The operation mode is similar to that of other projects as shown in the following figure. In short, the hacker attack process is mainly divided into two parts: the trading pool used is illiquid, and the liquidity is raised, and then all tokens are hollowed out to solve the problem of loss of accuracy. Among them, all the money put into the hollowing-out hacker's pre-attack in China needs to be briefly understood before the specific analysis of the attack. The relevant content is that the users of decentralized lending platforms get the corresponding ones by depositing the underlying assets, and conversely, the conversion ratio is controlled by the liquidity index. Simply speaking, the liquidity index is the value, for example, when the corresponding one can be exchanged for a corresponding underlying asset, which is carried out through income. The calculation method is as follows. The corresponding code is as follows. In this attack, simply speaking, the value raised by the hacker by manipulating the liquidity index distorts the value. Finally, a small unit is used to borrow a large amount of other underlying assets, thus hollowing out the underlying assets of other pools. Then, the hacker repeatedly and finally hollows out all the attack steps transferred to the pool by using the problem of precision loss. Analyze in detail the liquidity index obtained by the hacker by depositing the underlying assets and then manipulating it through repetition. Finally, the price was inflated by hollowing out all the underlying assets except the minimum collateral. First, the hacker borrowed from it, and at the same time, the corresponding pool was used by the hacker as a deposit certificate. Then the hacker borrowed from it, and then transferred to the pool where the smallest unit was left. The neutralization operation was only carried out in the first time. This is because the hacker borrowed from it, and then the hacker borrowed from the corresponding pool of the underlying assets. The pool is not initialized, so the corresponding reason is that the pool is destroyed. Let's take a look at how it is updated in the process. First of all, the corresponding total value is the income of this time, that is, the added value. Because the loan interest rate is and the profit of the pool belongs to the liquidity provider, the profit generated to the pool every time a hacker borrows is, so in the above formula, it is simply said that the added value of the pool is the total value of the pool. Therefore, the value that hackers want to raise is to make the total value of the pool as small as possible, which explains why hackers want to transfer it to the pool after borrowing, because the operation will be destroyed, but at present, if the pool is not transferred, there is no asset in the pool at the beginning. At present, because of the lightning loan, hackers have been locked in and cannot destroy the corresponding hackers. In order to make the total value of the pool as small as possible, hackers have left the smallest unit, so the pool is also destroyed and the smallest unit is left. Because the corresponding pool is not initialized, the total value of the current pool at this time is the smallest unit, and the value after the first time is updated to the value for the second time. Hackers borrow money for the first time, so they get it through the algorithm. The following figure shows the value after each time. Because there are still hackers' values in the pool and the value is huge, the steps of hacking the collateral in the pool are detailed by borrowing all tokens. Analysis of hackers' use of precision loss, repetition and operation hollowing out all the hackers who invested in the previous attack were first deposited and then taken out. Because at this time, the hackers have been promoted to the back pool, and the hackers have taken out the ones that should be destroyed. However, due to truncation, only the destroyed codes were destroyed. In order to scale the functions that need to be destroyed, we can see the liquidity index of the number of the target assets, but here in order to reduce mathematics. The code used in the division here is as follows: because the calculation formula of the number to be destroyed is the liquidity index of the number of assets to be destroyed, the liquidity index of the number of assets to be taken out at this time is the liquidity index at this time, because we can get the number to be destroyed by calculation, but because of the integer division operation here, it is equivalent to making a floor and removing decimal places, so the number to be destroyed is finally one, that is It's equivalent to only destroying the value, so the hacker makes a profit through the precision loss loophole, and then the hacker gets the pool by continuing to deposit, because the liquidity index at this time is equivalent to the smallest unit, that is, the value is, so the pool is left, and then the hacker takes out the cut-off and only destroys it, that is to say, the hacker can get it out of thin air by depositing and then taking out, and the hacker finally empties the loan invested before by repeating this operation, thus returning it to all attacks. The attack flow has been completed and summarized. The hacker first repeatedly manipulated the liquidity index corresponding to the target asset due to the poor liquidity of the pool, so that its value was distorted. Then he lent all other target assets through minimal mortgage, and then repeatedly accessed and emptied the target assets invested in the hacking attack by using the loophole of the loss of division accuracy in the contract. So far, the hacker has completed a complex attack on the project, and all the assets hollowed out. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。