Equation 链上永续合约协议

本文是针对链上永续合约产品equation的调研分析。以下先从DeFi我最喜欢的两个协议谈起。

Uniswap让我认识到,真正好的DeFi产品不需要发币也能很好的运营下去。真正满足用户需求,就会有实际收益。它开启的是一个真实收益的叙事。

Yearn也在无币模式下运行了很久,满足了很多用户解决资产自动化收益的需求。当它发布代币时,市场FOMO了,因为它开创了Fair Launch(公平启动)模式。

真实收益+公平启动

为什么真实收益很重要?

不管是web2还是web3的产品,满足用户需求并能赚钱至关重要。一个产品不可能仅靠VC的融资或者用户的资助长期存活下去。

有真实收益的产品,说明它一方面找到了PMF的市场平衡。另一方面可以依靠产品收益持续的运营下去,不用卖B或者不断融资。

在加密市场,真正能赚钱的产品并不多,大多还是依靠VC的融资或者卖币为生。

Blur在Opensea拥有绝对市场领导地位的情况下,依靠独特的代币激励机制迎头赶上,甚至有稳坐赛道第一的趋势。这其中代币在项目启动过程的模式设计至关重要,明牌让用户能真正的获得好处。

对于一个能真实满足用户需求的产品,在验证产品逻辑正确的前提下,代币机制的合理使用,是冷启动最有效的方法,也是能给用户带来最大好处的方式。

在众多经济模型设计中,公平启动是最让用户喜欢的模式,这里没有VC和项目方预留份额,所有人通过公开方式公平的获得项目代币,这也是最近很多BRC20 MEME火爆的一个底层逻辑。

Equation的经济模型

Equation的经济模型主打公平启动,通过公平启动方式,参与项目的所有人共同获取项目代币EQU的分发

全部代币通过持仓挖矿、流动性挖矿和推荐挖矿产出,100%归社区所有,无VC和项目方份额。

项目代币EQU总量1000万,每日产出1w代币全部通过挖矿的方式分发。目前项目启动20多天,分发了26万多EQU。

用户还可以将赚取的EQU进行质押,赚取协议的收益的25%,进而分享项目成长红利。

这里或许用户会有个疑问,项目方不拿币,如何赚钱?

这就是该项目的一大亮点,项目方只通过赚取协议收益分成来维持运营,不通过任何销售代币的行为赚钱。

打个比方,就类似uniswap项目方不拿任何代币,而只收取一定比例手续费。用户通过交易和提供流动性赚取项目代币,通过质押代币分享项目红利。

产品功能和运行机制

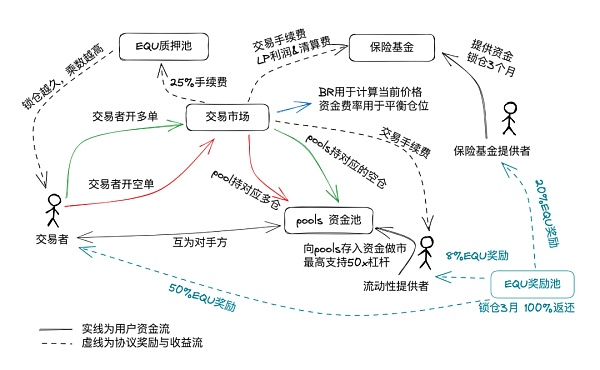

上图为equation的用户与协议功能关系图,下面将从用户资金流和协议收益流两个角度来进行分析。

永续合约产品通常存在两大类角色,交易者和做市商。Equation的做市采用的是资金池模式,类似GMX,而没有采用dydx的订单薄模式。

对于采用订单薄模式的协议,标的定价主要取决于目前的订单情况,由订单出价产生。

对于资金池模式,equation所有做市商将资金存入pool中,不主动挂单,而是被动的与交易者进行对手盘交易。

当交易者开多单时,pool对应的开空单。当交易者开空单时,pool对应的开多单。也就是说pool是交易者的对手盘。

如果交易者多空力量均衡,这是最理想的情况,pool不额外开任何方向订单,坐收手续费。

但如果某一方订单数过多,会导致pool处于单边开仓中,这有可能导致pool的亏损。

BRMM定价模型

为了避免pool单边风险可能造成的亏损,equation采用了BRMM定价模型。该模型关键由执行价、指数价和资金费率构成。

简单说,就是当pool中某一方向开仓偏移时,执行价格就向这个方向偏移,开仓量偏差越大,偏移价格就越大。同时资金费率也越高。

举例来说,比如ETH当前指数价格为2000,pool中目前净空仓占比为0.5%,这说明当前交易者做多的仓位多,导致pool中空仓比例过高(理想情况是多空平衡)。

根据协议的执行价格计算公式,大致计算当前的ETH执行价为2001.2,也就是比指数价格要高。同时,资金费率也会为正。

这种设计机制,是为了保护pool中资金的平衡,避免单边仓位过大导致资金损失,同时也可以利用价格吸引套利者将pool中仓位配平。

保险基金

保险基金的主要用途,是当pool中LP遭受损失时,首先承担LP的所有临时损失,直到基金余额耗尽。

因此,作为对保险基金的资金补偿,保险基金的资金来源包括了:

用户在开仓、平仓或被清算时支付的一部分交易手续费

pool中LP产生利润的一部分

当LP被清算时,资金直接进入保险基金

简单说,当协议亏钱时,先从保险基金支付。当保险基金用光后,再从高杠杆的LP中开始清算。

交易功能与各项费用

使用链上永续合约产品,作为交易者通常关心的是保证金比率、手续费和开关仓滑点、持仓规模等体验。

Equation部署在Arbitrum链上,与dydx不同的是,它采用即时交易的方式,无需将资金提前存入。

协议并不限制交易者的持仓规模,可以保持最低0.25%的保证金率。在手续费方面,开关仓均为0.05%,同时需要一笔链上交互费用。

Equation多空均采用USDT作为保证金,支持限价单和市价直接成交模式,同时也支持多空双开。

为提高资金利用率,做市商向pool中提供做市资金,最高支持50x杠杆。

挖矿奖励与质押收益

参与Equation挖矿的收益主要来源于两部分:EQU挖矿奖励和质押收益

挖矿获得项目代币EQU的方式包括:

交易&持仓(每日产量50%),平均APR 300%+

做LP(每日产量的8%),平均APR 40%+

保险基金质押(每日产量20%),平均APR 300%+

其余22%分发给NFT持有者(按交易量和LP持仓的总比例分发)

Equation的主要收益来源为交易手续费,其中25%的手续费将奖励给EQU质押者。

目前质押EQU的平均年化为20%+,收益直接以USDT方式发放。采用ve模型,锁仓3个月可以获得最大乘数加速。

同时,也支持EQU/ETH的LP质押模式,相对APR会更高些。

总结

Equation是Arbitrum上新的永续合约协议,主打叙事:真实收益+公平启动。

对于交易者,Equation拥有更方便的操作体验、更低的手续费、更高的杠杆和资金利用率,在交易的同时还可以赚取协议代币。

对于做市商,Equation的pool最高支持50x杠杆,有效提升资金效率,有保险基金保护,且没有对LP的锁仓限制,做市进出更加灵活。

以上观点,仅为个人对产品的分析研究,不作为任何投资建议。如要参与,还需要进行个人的研究和测试。

This paper is aimed at the investigation and analysis of perpetual contract products on the chain. Let me start with two of my favorite agreements, which makes me realize that really good products can operate well without issuing coins, and really meet the needs of users, and there will be real benefits. It opens a narrative of real benefits, and it has also been running for a long time in the cashless mode, which has met the needs of many users to solve the automatic benefits of assets. When it issues tokens, the market has come into being because it has created a fair start mode. Why does the real benefits start fairly? Real income is very important, no matter whether it is a product that meets the needs of users and can make money, it is very important that a product can't survive for a long time only by financing or the support of users. The products with real income show that it has found a market balance on the one hand, and can continue to operate on the other hand without selling or constantly financing. There are not many products that can really make money in the encryption market, and most of them still rely on financing or selling money for a living under the condition of absolute market leadership. Relying on the unique token incentive mechanism to catch up and even have a tendency to sit firmly on the track first. Among them, the pattern design of tokens in the project start-up process is very important. winning numbers allows users to really benefit. For a product that can truly meet users' needs, the rational use of token mechanism is the most effective method for cold start and the way to bring the greatest benefits to users. Among many economic model designs, fair start-up is the most popular mode for users. Everyone who reserves shares with the project side gets the project tokens fairly in an open way, which is also a popular economic model of the underlying logic recently. The economic model focuses on fair start, and all the people who participate in the project jointly get the distribution of the project tokens through fair start. All the tokens are owned by the community through position mining, liquidity mining and recommended mining output. The total amount of project tokens is 10,000, and all the tokens are distributed through mining for many days. After distributing more than 10,000 users, they can also share the project growth bonus by pledging the income earned from the agreement. Perhaps users will have a question here. This is one of the highlights of the project. The project only maintains its operation by sharing the income from the agreement, and does not make money by selling any tokens. For example, the project only charges a certain percentage of handling fees. Users earn project tokens by trading and providing liquidity. The function and operation mechanism of the bonus product of the currency sharing project, as shown in the figure above, will be analyzed from the perspectives of user capital flow and agreement income flow. There are usually two types of roles for perpetual contract products. Traders and market makers use the similar fund pool model but do not use the order book model. The pricing of the agreement subject using the order book model mainly depends on the current order situation, and the order bid is generated. For the fund pool model, all market makers will put funds. In the deposit process, you don't take the initiative to hold orders but passively trade with the traders. When the traders open multiple orders, the corresponding open orders, that is to say, when the traders open multiple orders, are the traders' opponent's orders. If the traders' long and short positions are balanced, this is the ideal situation. Do not open additional orders in any direction, but if one party has too many orders, it will lead to losses that may be caused by unilateral opening. The pricing model is adopted to avoid the losses that may be caused by unilateral risks. Price model The key of this model consists of the execution price index price and the capital rate. Simply speaking, the execution price will shift to this direction when the opening position in a certain direction deviates. The greater the deviation of the opening position, the greater the deviation price and the higher the capital rate. For example, if the current index price is medium, the current net empty position ratio indicates that the current trader's long positions lead to the high proportion of empty positions. The ideal situation is the long-short balance. According to the calculation formula of the execution price of the agreement, the current execution price is roughly calculated as follows That is, it is higher than the index price and the capital rate will be positive. This design mechanism is to protect the balance of funds in China and avoid the loss of funds caused by excessive unilateral positions. At the same time, it can also use the price to attract arbitrageurs to balance the positions in China. The main purpose of insurance funds is to bear all temporary losses first when they suffer losses until the fund balance is exhausted. Therefore, as a fund compensation for insurance funds, the source of funds includes users' payment when they open positions or are liquidated. A part of the transaction fee generates a part of the profits. When it is liquidated, the funds directly enter the insurance fund. Simply put, when the agreement loses money, it will be paid from the insurance fund first, and then it will be liquidated from the highly leveraged fund. The trading function and various expenses are used in the chain. As a trader, what he usually cares about is the margin ratio, the handling fee and the size of the sliding position of the switch warehouse. The difference is that it adopts the way of real-time trading without depositing the funds into the agreement in advance. There is no limit to the size of traders' positions, and the minimum margin rate can be maintained. In terms of handling fees, both the switch positions need a chain interactive fee. Both long and short positions are used as margin to support the limit order and the market price direct transaction mode. At the same time, it also supports the long and short double opening to improve the utilization rate of funds. Market makers provide the highest support for market-making funds, leverage mining incentives and pledge income. The income from participating in mining mainly comes from two parts: mining incentives and pledge income. The ways of mining to obtain project tokens include delivery. The average daily output of easy positions is the average daily output of insurance fund pledge, and the rest is distributed to holders according to the total proportion of trading volume and positions. The main source of income distributed is transaction fee, which will be rewarded to the pledgee. The average annual pledge of the current pledge will be paid directly as income, and the maximum multiplier can be obtained by using the model to lock the warehouse for one month, and the pledge model supported at the same time will be relatively higher. The summary is that the new perpetual contract agreement is the main narrative of real income fairness. Start-up has more convenient operation experience for traders, lower handling fee, higher leverage and capital utilization rate. At the same time, you can also earn agreement tokens. For the highest support leverage of market makers, you can effectively improve capital efficiency. There is insurance fund protection and no right lock-up restrictions, making market entry and exit more flexible. The above views are only personal analysis and research of products, not as any investment advice. If you want to participate, you need to conduct personal research and testing. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。