深入探讨Avalanche区块链交易创历史新高的关键指标和推动因素

作者:Pedro M. Negron,IntoTheBlock 翻译:善欧巴,比特币买卖交易网

Avalanche 是 EVM 生态系统的关键参与者,长期以来一直在促进新的创新领域的发展方面发挥着重要作用。目前,就总锁定价值 (TVL) 而言,Avalanche 排名第七,其总锁定价值 (TVL) 为 6.5 亿美元,支持超过 30 个去中心化应用程序 (dApp),每个应用程序的总锁定价值都超过 100 万美元。Avalanche 相对于以太坊的主要优势之一是其低成本的交易费用,使用户能够参与去中心化金融(DeFi)生态系统,而不会产生过高的 Gas 成本。

在宣布与摩根大通和花旗合作后,Avalanche 最近经历了价格飙升。两家金融巨头都在尝试使用 Avalanche 的技术进行现实世界资产 (RWA) 代币化。RWA 代币化是加密货币领域的下一个重大突破。它本质上需要将黄金、大宗商品、国债和房地产等传统资产数字化,并在区块链上表示它们。7 月,Avalanche 基金会推出了Avalanche Vista,这是一项价值 5000 万美元的计划,旨在投资 RWA 的代币化。

摩根大通的 Onyx 平台正在利用 Avalanche 子网将投资组合与 WisdomTree 提供的代币化资产链接起来。这一概念验证展示了区块链、智能合约和代币化在简化投资组合管理方面的功能。这对于传统上难以交易和管理的另类资产尤其重要。传统金融重量级人物涌入该生态系统预计将对其增长做出重大贡献。相信这些蓝筹机构带来的业务将产生连锁效应,惠及生态系统的各个方面。

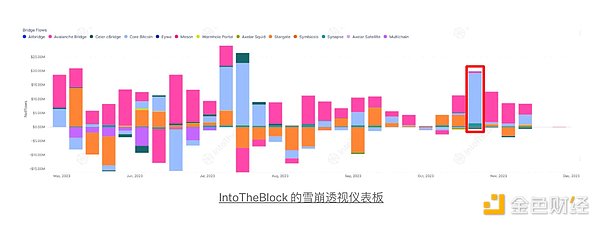

围绕这些发展的兴奋可能已经开始变得明显。10 月 23 日这一周,通过桥梁流入 Avalanche 的资金达到了六个月来最高水平,总流入额达到 1,924 万美元。此外,今年最后两个季度流入 Avalanche 的资金显着增加。第三季度的净流入总额为 7900 万美元,而第四季度(仅 11 月最后一周)的净流入就已经达到 5600 万美元。与第一季度和第二季度分别记录的 6600 万美元和 6200 万美元相比,这一趋势显着上升。

此外,资金流入的激增并不是 Avalanche 生态系统最近的唯一发展。还有其他重大进步和活动促进了其发展。最近,Avalanche 的铭文交易量激增,反映了之前影响比特币、莱特币和狗狗币的序数趋势。11月20日,Avalanche C链交易量再创新高,预计交易总量达到307万笔。

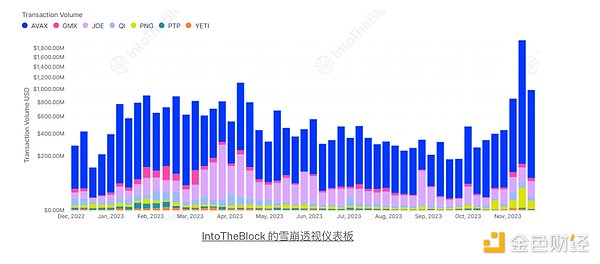

因此,整个链上的交易量也受到了影响,在 2023 年 11 月 13 日当周,交易量达到了 20 亿美元的年度新高。在此期间,区块最终确定时间保持稳定在大约一秒。此外,Gas 价格保持在 80 AVAX 左右,导致每笔交易的平均成本为 0.05 美元。

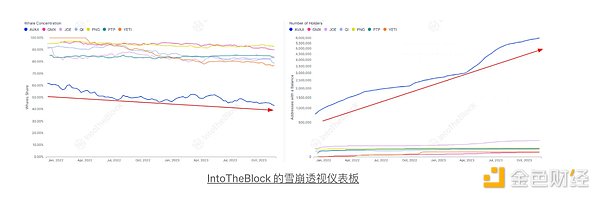

Avalanche 生态系统的 AVAX 代币也显示出成熟的迹象。这很明显,因为鲸鱼的集中度一直在下降,而持有者的数量却在增加。

Avalanche 生态系统中鲸鱼饲养者的集中度显着降低,从两年前的 62% 下降到目前的 43%,这标志着过去两年发生了显着变化。高比例的鲸鱼持有者有时可以被解释为一个令人担忧的迹象,因为这可能表明对代币价格稳定性的潜在威胁。同样,这种情况下的持有人数量也显着增加,在过去两年中从 776,000 人增加到 600 万人。这两项统计数据表明持有者的分布更加分散,加上鲸鱼的集中度较低,有效地凸显了生态系统的成熟和成长。

Avalanche 生态系统一直在经历增长和创新,最近与摩根大通和花旗等主要金融机构在现实世界资产代币化方面的合作凸显了这一点。这导致桥梁流入量显着增加。此外,网络中创纪录的交易数量表明对 ASC-20 铸币交易的需求不断增长。最后,鲸鱼集中度的下降和 AVAX 持有者数量的大幅增加表明了显着的成熟和去中心化。这些发展不仅凸显了 Avalanche 在加密货币领域不断扩大的影响力,也标志着传统金融和区块链技术的日益融合。

Shanouba Bitcoin Trading Network is a key participant in the ecosystem and has been playing an important role in promoting the development of new innovation fields for a long time. At present, it ranks seventh in terms of total locked value, with a total locked value of $100 million. It supports more than 10,000 decentralized applications, and the total locked value of each application exceeds $10,000. One of the main advantages of Ethereum is that its low transaction cost enables users to participate in the decentralized financial ecosystem without. After announcing the cooperation with JPMorgan Chase and Citigroup, it has recently experienced soaring prices. Both financial giants are trying to use the technology to token real-world assets. Tokenization is the next major breakthrough in the field of cryptocurrency. It essentially needs to digitize traditional assets such as gold commodities, national debt and real estate, and indicates on the blockchain that their monthly foundation has launched a plan worth 10,000 US dollars. The platform of JPMorgan Chase is using subnets. The proof of concept of linking the portfolio with the provided token assets shows the functions of blockchain intelligent contract and token in simplifying portfolio management, which is especially important for alternative assets that are traditionally difficult to trade and manage. The influx of traditional financial heavyweights into the ecosystem is expected to make a significant contribution to its growth. It is believed that the business brought by these blue-chip institutions will have a chain effect and benefit all aspects of the ecosystem. The excitement around these developments may have begun to become. Obviously, the inflow of funds through the bridge reached the highest level in six months in the week of March, and the total inflow reached $10,000. In addition, the inflow of funds in the last two quarters of this year increased significantly, and the total net inflow in the third quarter reached $10,000, while in the fourth quarter, the net inflow in the last week of the month alone reached $10,000. Compared with the $10,000 and $10,000 recorded in the first and second quarters respectively, this trend has increased significantly. In addition, the surge of capital inflow is not the only development of the ecosystem Significant progress and activities have promoted its development. The recent surge in inscription trading volume reflects the ordinal trend that affected Bitcoin, Litecoin and dogecoin before, and the monthly daily chain trading volume has reached a new high. It is estimated that the total trading volume will reach 10,000, so the trading volume of the whole chain has also been affected. In the week of October, the trading volume reached an annual high of US$ 100 million. During this period, the final determination time of the block remained stable at about one second, and the price remained around, resulting in the average cost of each transaction being the generation of the US dollar ecosystem. Coins also show signs of maturity, which is obvious because the concentration of whales has been declining while the number of holders is increasing. The concentration of whale breeders in the ecosystem has decreased significantly from two years ago to the present, which indicates that there has been a significant change in the past two years. A high proportion of whale holders can sometimes be interpreted as a worrying sign because it may indicate a potential threat to the price stability of tokens. Similarly, the number of holders in this case has also increased significantly in the past two years. These two statistics show that the distribution of holders is more dispersed and the concentration of whales is lower, which effectively highlights the maturity and growth of the ecosystem, which has been experiencing growth and innovation. Recently, the cooperation with major financial institutions such as JPMorgan Chase and Citigroup in real-world asset tokenization has highlighted this point, which has led to a significant increase in the inflow of bridges. In addition, the record number of transactions in the network shows the growing demand for coin trading, and finally the concentration of whales 3. The decline in the number of holders and the substantial increase in the number of holders show remarkable maturity and decentralization. These developments not only highlight the expanding influence in the field of cryptocurrency, but also mark the increasing integration of traditional finance and blockchain technology. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。