加密市场十一月简报:第五轮牛市箭在弦上

作者:0xWeilan.eth,EMC Labs 来源:X@0xweilan

宏观市场

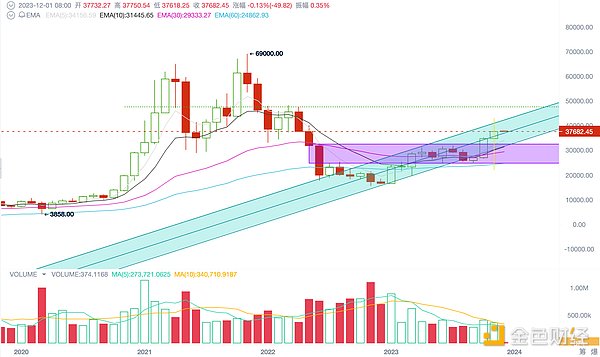

如EMC Labs在十月简报所预判,10月实现年度突破之后,BTC在11月继续沿上升通道震荡上行,将价格推进至38000美元一线。

10月、11月连续实现28.54%和8.88%的上涨之后,BTC持有者的盈利水平达到年内最高。锁定盈利的沽出和高位盘整的忧虑,使得BTC在上升通道中轨(大约37000美元)附近持续震荡,量能有所萎缩。

BTC月线走势

虽然本年度尚余一个月,但市场各方默认本轮加息周期已经结束。劳工就业数据开始下滑,美国经济温和衰退已经开始,各大投行开始预测降息周期的启动时间——2024年夏季或下半年。

在此背景下,美元指数录得全月下跌3%,表明宽松预期越来越强,资金开始抢先流入风险偏好更高的权益类资产。

宏观金融市场开始转涨。连续三个月下跌的纳指在10月均线附近大幅反弹,实现10.7%的月度涨幅。

Nasdaq月线走势

本月,全球规模最大、曾为产业发展发挥巨大促进作用,也因此对旧有体系形成挑战的中心化交易所币安,与美国司法部达成和解,以43亿美元的巨额罚单及创始人离任CEO为代价向野蛮生长的过去告别。对此市场整体态度偏向乐观,虽然并非所有的“黑天鹅”级不确定已经被清除,我们倾向于认为加密产业正在告别野蛮发展时期,未来几年打通传统世界合规发展将成为主流。

这是成人的阵痛,也是覆盖伤口的奖章。唯此,加密技术才能深入人类社会西部,加密市场才可能在未来数年内达到10万亿美元规模,成为人类最大的权益市场之一。

加密市场

11月,BTC开于34656美元,收于37732美元,全月实现上涨8.88%,振幅12.7%。

本月BTC取得的最大市场成就便是彻底告别困扰走势长达半年之久的震荡箱体(下图紫色区域)的束缚,全月在34000美元也就是10月突破后的高点之上运行,虽然量能有所萎缩,但仍在犹豫与暧昧中不断向上推进。

上升通道(下图绿色箱体)中轨也成为多空双方争夺的焦点,11月15/16日,20/21日多空双方在中轨附近发生硬刚式冲突。冲突日成交量均呈现放大之势,显示出大幅上涨之后松动筹码的沽出和新进场资金抢筹的决心都相当之大。

BTC日线走势

最终多军力量更胜一筹,在多项技术指标压制下,BTC价格依然保持强势创出反弹新高。

更积极的一面体现为L1板块对BTC月度涨幅的反超,ETH本月上涨13.08%跑赢BTC5500个基点,SOL、AVAX、OSMO等L1 Altcoin自10月启动迄今最高涨幅已达3倍,依稀呈现出场内资金从BTC向细分板块流入的趋势。

ETH涨幅持续超越BTC是牛市启动的表征之一,值得密切关注。

资金供给

通过技术分析,我们可以知晓静态市场中的趋势变化。但10月以来的行情主要推动力量是场外资金的加速入场。对后市做研判,我们必须深入这个主要因素做分析。

继10月流入转正,11月稳定币继续净流入,且流入规模放大至35亿美元,是10月规模的3.5倍。EMC Labs在十月简报《EMC Labs十月簡報:如期突破!後市BTC大概率沿通道震蕩上行》中指出:“ 10月流出趋势逆转,稳定币实现单月净流入。稳定币开始走出熊市。”

11月,这一判断继续被实现。BTC年初走出熊市,稳定币10月走出熊市,加密资产的整体牛市已越来越近!

本月,稳定币加快了流入速度,EMC Labs认为如果12月稳定币继续保持流入状态,那么稳定币将确认进入牛市状态。配合早已走出熊市的BTC,在最乐观的估计中,最快在1月市场将会进入第五次加密资产牛市的早期阶段。

虽然稳定币的整体供给要到今年10月才转正,但早在2022年12月之后,USDT的供给便由流出转为流入状态,并在10月创出历史供给新高。这股先行流入的资金连同场内资金一起抄了比特币历史上的第四次大底,并促成了比特币在前11个月所实现的130%的强势反弹。

相比10月整体净流入,本月稳定币市场取得的最大成就便是USDC也结束了流出状态,开始实现净流入。这意味着使用这两类稳定币的交易者都开始看好后市,开始着手增大自己的仓位。

供应趋势

伴随10、11月的持续上涨,比特币的整体供应越来越乐观。这是资金净流入之外,我们必须持续关注的内部因素。

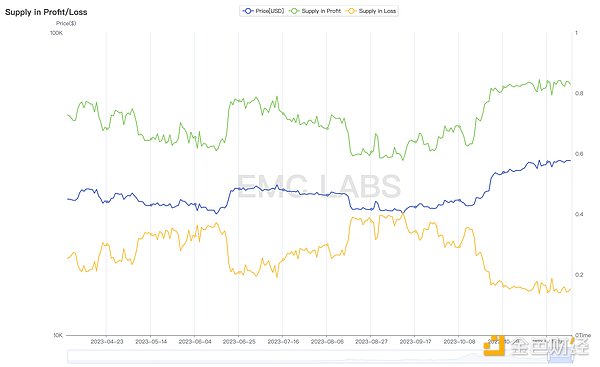

截止月底,比特币总供应的87%已处于盈利状态,这一方面得益于BTC价格的上涨,另一方面也得益于磨底期和修复期所发生的大规模投降和抄底。

BTC整体供给盈亏分布

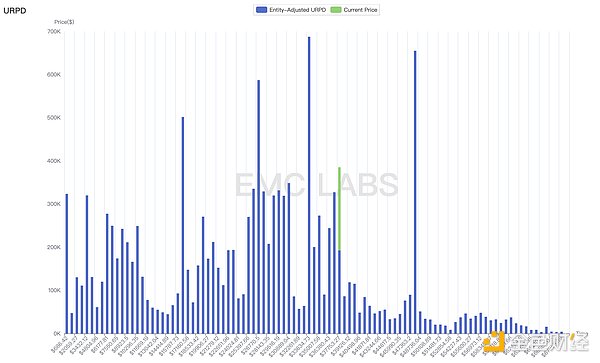

与之对应,BTC的成本结构也发生了巨大变化——

BTC整体供给成本分布

33634美元成为最大的筹码堆积区,这些筹码大部分是在10月份建仓的。这也是我们在10月简报中判断11月市场不会回调而是持续上行的原因之一。

再往上便是48000美元,这是上轮熊市下跌中形成的堆积区域,也是我们判断修复期的高点所在。这个高点或许就在12月或1月被触及。判断价格几乎毫无意义,但如果实现,12月将会有一轮两位数的大涨。

长短博弈

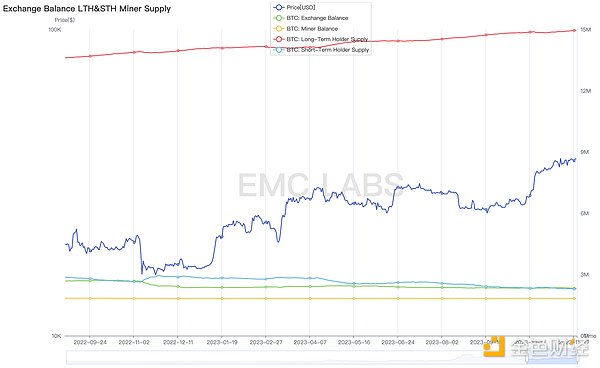

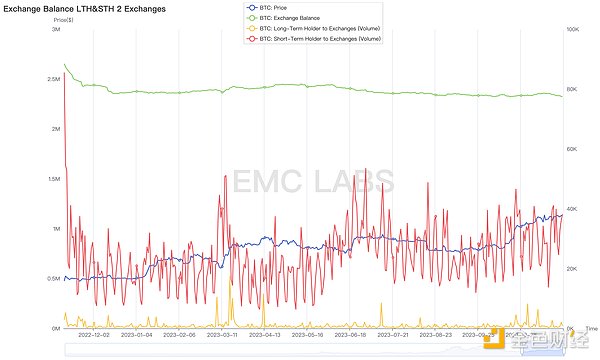

审视长短手及交易所的持仓,整个11月——

市场各方BTC持仓规模

长手:+11万枚,至1496万枚;

短手:-7万枚,至229万枚;

交易所:-4万枚,至232万枚

长手仍在收集筹码,而短手仍在交出筹码。这一表现符合修复期“流动性持续丧失”的收敛趋势。这一趋势的持续使得短期市场很难实现大幅下跌。

再来看长短手的浮盈状况,长手浮盈达到了81%,短手达到了21%。与10月相比较,长手浮盈继续堆高,短手浮盈略降1%,也维持在短手水平的高位。

长短手持仓浮盈状况

在修复期,盈利水平会逐渐恢复,同时随着修复期的进行与对未来趋势的逐步乐观,市场各方的浮盈阈值会逐步提升。

继续查看盈利锁定情况:沽出长手的盈利水平在30~70%之间,沽出短手的盈利水平在0~3%之间。

从长手的盈利水平来看,那些长手中的弱手在卖出(他们的盈利水平低于长手整体盈利水平)。

从短手的盈利水平来看,那些短手中的强手选择持币待涨(卖出者的盈利水平远远低于短手整体盈利水平)。

目前市场处于修复期的末期。在这一时期,长手的盈利预期越来越高(进入上升期亦即牛市之后,他们的预期会达到数倍之多),而短手的盈利预期也在逐步提高。同时短手中的弱手和长手中的弱手成为最后的“清除”对象,本月长手收集的筹码即来自这一部分市场参与者。

再审视11月长短手的沽出规模——

长手在11月2、10、21、28日出现较大规模的抛售,4个交易日沽出21653枚。

短手在11月7、21、22、24日出现较大较大规模抛售,4个交易日沽出161839枚。

这是长短手群体中的弱手售出状况。相较本年度的其他月份,整体沽出水平处于下降状态,这同样表明市场各方对后市整体上保持乐观预期。

长短手沽出规模统计

综上,对市场最重要的长短手博弈来说,EMC Labs维持此前的判断:市场仍然处于修复期,筹码继续“由短入长”,流动性进一步丧失。虽然长短手的浮盈都创下本轮修复期的历史最高记录,但沽出规模并没有放大。市场已经进入修复期的末期,再往前就是隐隐若现的上升期亦即“牛市”。

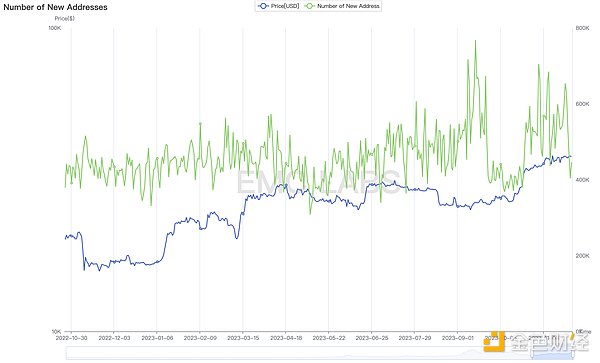

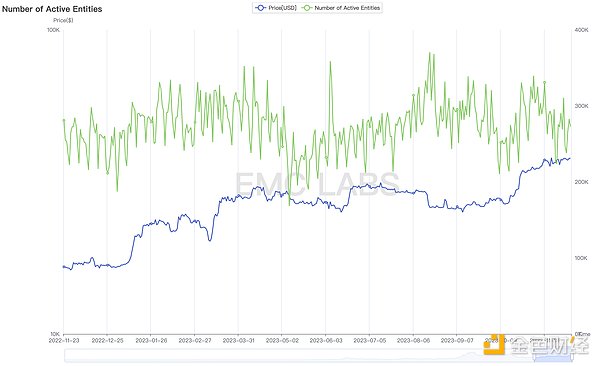

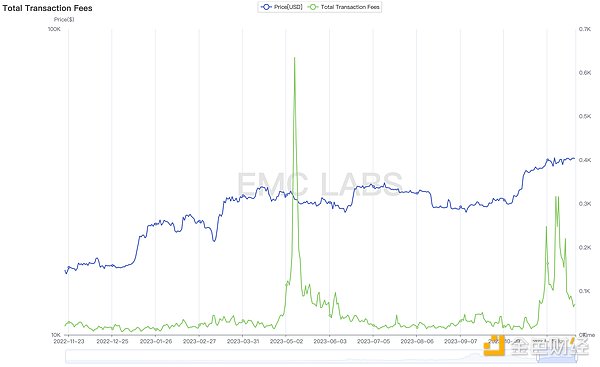

链上数据

链上数据是BTC价格的稳定器,有链上数据支撑的价格上行更可持续,与链上数据背离的上行或下行必然不可持续。

在10月,我们观测到新增地址数、日活跃实体、Transaction规模和矿工收入都出现了大幅下跌。这种背离在11月得到了有效修复。

比特网络新增地址

比特网络活跃实体

比特网络矿工Gas收益

自今年4月,Ordinals资产尤其是BRC-20 MEME代币兴起之后,有超过3万枚BTC作为新增“消费类型”Gas进入矿工们的钱包。这些代币会否成为一类新型资产还存在较大争议,但4月和11月的两拨热潮所引发的Transaction激增的确令“污染”了数据。所以,11月的链上数据修复,我们应该客观看待。

随着BRC-20 MEME热潮速冷,我们需要在12月进一步观察,基于积累和沽出的链上行为的“转牛”趋势。

关于牛市

依EMC Labs开发的Emergence Engine来看,目前修复期指数顶格100的时间已经接近一个月。历史上,如果这个时间达到两个月,市场将进入牛市。

EMC Labs修复期指数综合了多维度的链上数据,体现的是市场的内因。而外因亦即资金流入情况也非常乐观,10月本年度首次实现净流入,11月流入规模达到10月的3.5倍,如果12月继续加速流入,那么流入时间将达到3个月。而三个月时间用于判断中长期趋势是较为充分的。

2023年的最后一个月非常重要,它是审视加密资产市场内外因的双重焦点。这个焦点所绽放的光芒,所照亮的就是下一轮牛市。

这是EMC Labs依据比热网络客观数据所得出的结论。

困扰依然存在——

比如美国温和衰退刚刚开启,权益市场接下来可能会向下调整,甚至可能会影响稳定币的流入?

2024年1月是美国BTC ETF申请的最后回复时间,如果申请被拒,加密市场可能进入调整。

币安之后,其他交易所甚至公链、稳定币发行方会否被美国司法部、SEC起诉追责?

FTX破产后资产处置方正在向市场抛售数以十亿计的代币,单一实体的大幅抛售会否打乱市场的节奏?

面对内外因的已然促动,我们做最积极的仓位准备;面对不确定性,我们应该在策略上控制风险。若此,这个“不确定”便不再重要。

我们热切期待12月的到来,并准备在下一期月度简报中与大家分享我们对于牛市的条件判定与主赛道猜想。

结语

11月是重要的一月。

我们收获了链上数据的修复,也乐见BTC价格的持续上攻,看到弱手群体的小规模离场,也看到长短手群体浮盈阈值的不断抬升。

加密资产市场以天价罚单迎来石头落地,USDC结束背离,稳定币供给全月大规模流入。

12月是更重要的一个月。

在暧昧与忐忑中,加密资产市场的“内感”、“外应”都将逼近临近点。

漫长的修复期行将结束,上行期(牛市)呼之欲出!

The author's source macro market, if it is predicted that the annual breakthrough will be achieved in October, will continue to fluctuate upward along the rising channel and push the price to the US dollar in January. After the continuous realization and monthly increase, the profit level of the holders will reach the highest locked profit in the year, and the worry of selling out and high consolidation will make the continuous fluctuation around the US dollar in the rising channel shrink. The encrypted market will be shocked by the fifth round of bull market in November, although there is still one month left this year. However, all parties in the market acquiesced that the current interest rate hike cycle has ended, and the labor employment data began to decline. The moderate recession of the US economy has begun, and major investment banks have begun to predict the start time of the interest rate cut cycle. In this context, the US dollar index recorded a full-month decline, indicating that loose expectations are getting stronger and stronger, and funds are beginning to flow into equity assets with higher risk appetite first. The macro-financial market began to turn up, and the Nasdaq, which fell for three consecutive months, rebounded sharply near the monthly moving average to realize the monthly increase encryption market eleven. In the monthly briefing, the fifth round of bull market is on the line, and the trend of the monthly line is on the line. This month, the largest centralized exchange in the world, which played a great role in promoting the industrial development, thus challenged the old system, reached a settlement with the US Department of Justice, and bid farewell to the barbaric development at the expense of a huge fine of US$ 100 million and the departure of its founder. Although not all the black swan uncertainties in this market have been cleared, we tend to think that the encryption industry is bidding farewell to barbaric development. In the next few years, it will become the mainstream to break through the traditional world. This is a pain for adults and a medal covering wounds. Only in this way can encryption technology penetrate into the encryption market in the western part of human society and become one of the largest rights and interests markets of mankind in the next few years. The biggest market achievement this month is to completely bid farewell to the shock box that has been plagued for half a year. The purple area below is bound by the whole month. Running above the US dollar, that is, the high point after the monthly breakthrough, although the volume can shrink, it is still pushing upward in hesitation and ambiguity. Below, the middle rail of the green box has also become the focus of contention between long and short sides. On the day of the month, the long and short sides clashed hard and rigid near the middle rail, and the daily turnover showed an enlarged trend. After the sharp rise, the determination to sell loose chips and grab new funds was quite large. The fifth round of bull market briefing in November should be on the line. In the end, the trend of the line was even better. Under the suppression of many technical indicators, the price remained strong and hit a new high. The more positive aspect was that the plate overtook the monthly increase, and this month's increase outperformed by one basis point. Since the start of the month, the highest increase has doubled, which vaguely shows the trend of the inflow of funds from the segmented plate in the field. The continuous increase is one of the characteristics of the bull market start, which deserves close attention. Through technical analysis, we can know the trend changes in the static market, but since last month, The main driving force of the market is the accelerated admission of OTC funds to judge the market outlook. We must analyze this main factor deeply. After the monthly inflow turned positive, the stable currency continued to flow in net, and the inflow scale was enlarged to billion dollars, which was twice the monthly scale. In October, the briefing broke through the market outlook as scheduled, and it was pointed out that the monthly outflow trend reversed, and the stable currency realized a net inflow in a single month. The judgment that the stable currency began to walk out of the bear market at the beginning of the year continued to be realized. The overall bull market of crypto-assets has been getting closer and closer this month, and the inflow rate of stable currency has been accelerated. It is believed that if the stable currency continues to flow in this month, it will definitely enter the bull market and cooperate with the market that has already stepped out of the bear market. In the most optimistic estimation, the market will enter the early stage of the fifth bull market of crypto-assets at the earliest in January. Although the overall supply of stable currency will not turn positive until this month, the supply will change from outflow to inflow as early as June, and this first inflow will hit a historical high in January. Together with the on-site funds, the funds copied the fourth big bottom in the history of Bitcoin and contributed to the strong rebound of Bitcoin in the previous month. Compared with the overall net inflow in the previous month, the biggest achievement made by the stable currency market this month is that it has also ended the outflow state and started to realize the net inflow, which means that traders who use these two types of stable currencies are beginning to be optimistic about the market outlook and start to increase their position supply trend. With the continuous increase in the month, the overall supply of Bitcoin is becoming more and more optimistic, which is the net inflow of funds. The internal factors that we must continue to pay attention to are that by the end of the month, the total supply of bitcoin has been in a profitable state. On the one hand, it has benefited from the price increase, on the other hand, it has benefited from the large-scale surrender and bargain-hunting during the grinding period and the repair period. In November, the briefing of the encryption market, the overall supply profit and loss distribution of the fifth bull market was on the string, and the corresponding cost structure has also changed greatly. For the biggest chip accumulation area, most of these chips were built in January, which is one of the reasons why we judged in the monthly briefing that the monthly market will not be adjusted back but will continue to rise. Further up is the US dollar, which is the accumulation area formed in the last round of bear market decline and the high point where we judge the repair period. This high point may be touched in June or June, and it is almost meaningless to judge the price. However, if the month is realized, there will be a round of double-digit ups and downs, and the positions of long and short hands and exchanges will increase throughout the month. In November, the briefing of the secret market was informed by internal factors and external factors. The fifth round of bull market was on the line. The positions held by all parties in the market ranged from 10,000 to 10,000 short hands to 10,000 exchanges. The performance that the long hand is still collecting chips and the short hand is still handing over chips conforms to the convergence trend of continuous loss of liquidity during the repair period. The continuation of this trend makes it difficult for the short-term market to achieve a sharp decline. Let's look at the floating profit situation of the long hand and the short hand. The floating profit of the long hand has reached a longer level than that of the month. The decline is also maintained at the level of short-hand, and the high-level encryption market is briefed in November. The external factors should be the fifth round of bull market. The floating profit situation of long and short positions will gradually recover during the repair period. At the same time, with the progress of the repair period and the gradual optimism about the future trend, the floating profit threshold of all parties in the market will gradually increase. Continue to check the profit lock-up situation and sell the profit level of long hands between them. From the profit level of long hands, those weak hands are selling, and their profit level is lower than that of short hands. From the overall profit level of short hands, those strong hands choose. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。