PayPal 稳定币对加密市场的连锁反应

作者:Victoria Chynoweth,cointelegraph 翻译:善欧巴,比特币买卖交易网

PayPal推出的原生稳定币PayPal USD(PYUSD)引发了加密货币行业内部的激烈讨论,关于PayPal推出的原生稳定币PayPal USD(PYUSD)引发了加密货币行业内部的激烈讨论,关于其可能对支付和更广泛的加密货币采用产生的影响。

虽然这一举措似乎是朝着接受常规金融中的加密货币迈出了一大步,但一些行业观察家建议谨慎行事。他们强调可能会阻碍更广泛采用的障碍和限制。

什么是PYUSD?

该倡议旨在为消费者、商家和开发者弥合法定货币和数字货币领域之间的鸿沟。PayPal首席执行官丹·舒尔曼强调了对稳定数字-法定渠道的需求。PYUSD促进了各种交易,包括付款、PayPal与兼容外部钱包之间的资金转移以及加密货币兑换。

“向数字货币的转变需要一种稳定的工具,该工具既是数字原生的,又可以轻松与美元等法定货币连接。我们对负责任的创新和合规性的承诺,以及我们为客户提供新体验的记录,为通过 PayPal USD 推动数字支付的增长提供了必要的基础。”

该代币旨在减轻虚拟环境中的支付摩擦,加快价值转移,并通过成为大多数加密货币波动性的更安全替代品来简化数字资产参与。

PYUSD 是以太坊区块链上的 ERC-20 代币,旨在与流行的交易所、钱包和 Web3 应用程序兼容,并计划将其可用性扩展到 Venmo。

虽然该货币是缩小传统金融生态系统与数字金融生态系统之间差距的一步,但 PYUSD 在 PayPal 200 个市场的庞大用户群中的广泛采用仍有待观察。

PYUSD 的监管由纽约州金融服务部提供,Paxos 将于 2023 年 9 月起发布月度储备报告和储备资产价值的第三方证明,以提高透明度。

除了 PYUSD 之外,PayPal 还继续致力于加强消费者和商家的数字货币教育和理解,补充其允许客户以选定的加密货币进行交易的现有服务。

对行业的影响

“PayPal推出PYUSD确实标志着迄今为止最大的支付公司以一种新的标准和产品本身的新水平采用区块链技术,”沃尔特·赫瑟特在美国银行家播客上指出。赫瑟特是全球区块链基础设施公司Paxos的策略主管。

“当PayPal进入这个领域并推出稳定币时,他们向其他支付公司、全球数千万商家以及数亿使用其应用程序的消费者传达了一个信息,即稳定币是一个真正的产品,”他补充道。

PYUSD的推出传递了一个信息:稳定币已经进入主流,将区块链技术的好处扩展到日常交易中。

赫瑟特的观点取决于PayPal作为更广泛接受加密货币的推动者的能力。数字资产通常受限于自身的有限系统,受到监管框架的限制。在这种背景下,作为一种连接传统货币和数字货币的桥梁的稳定币具有强大的吸引力。

其他人则被 PayPal 跨多个系统的稳定币的可能性所吸引,认为这将带来更多用例的引入。

VUCA Digital 首席执行官 Pan Lorattawut 告诉 Cointelegraph,“如果 PayPal 的稳定币能够集成到跨生态系统、交易所和钱包中,它将增加许多数字资产、代币和加密货币的用例,并使其成为能够弥合许多数字资产、代币和加密货币的金融领导者。”用户进入加密世界。”

她断言,可以轻松交易、转移和转换为其他加密货币或法定货币的稳定币的存在将使它们更加通用,并受到加密货币原住民和新用户的欢迎。

然而,Lorattawut 并非没有意识到相关的风险。她表示:“尽管稳定币和加密货币仍然是金融体系的一小部分,但如果稳定币规模扩大并对经济构成系统性风险,人们对监管稳定币的兴趣就会增加。”

但她还补充说,尽管长期面临监管和合规挑战,但 PayPal 进入加密领域可以成为加密驱动支付系统的催化剂,并且有利于加密市场的更广泛采用。

一些人认为,PayPal 进入稳定币领域可以为其他金融科技公司效仿打开大门。PayPal 的举动可以为企业积极主动地进行 Web3 创新开创先例。

其他人则更加矛盾,比如 Twitter 加密货币影响者 The Wolf Of Crypto Streets。

在稳定币推出后不久,监管机构就向银行发出警告,要求其停止与 PayPal 开展业务,这也降低了人们的关注度。美国监管机构最近对促进货币代币化的科技企业提起了几起诉讼。

监管和合规挑战

PayPal 进入这个世界就像一把双面刀片。一方面,它可以成为加密支付系统的火花,帮助更多人使用数字资产。另一方面,PayPal 的规模和影响力可能会吸引更强的规则关注,导致更严格的检查和规则需求。

监管机构已经严阵以待。众议院金融服务委员会民主党领袖 Maxine Waters 对 PayPal 推出自己的稳定币表示担忧。

“我对 PayPal 选择推出自己的稳定币深感担忧,而这些资产仍然没有监管、监督和认可的联邦框架,”Maxine 在稳定币发布后不久写道。

强烈的规则焦点可能会扼杀新的想法,并夺走加密货币市场对那些看重其自由且在很大程度上不受监管的性质的人的同情。

DeFi 为无银行账户人群提供服务的潜力

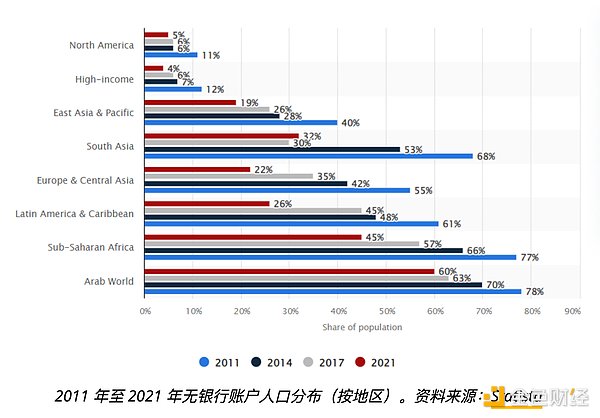

据世界银行称,全球约有 17 亿人没有银行账户,从而错过了重要的货币服务。传统银行系统的封锁损害了它们参与全球货币游戏的能力。

通过提供贷款、储蓄和投资机会,DeFi 可以为无银行账户和银行服务不足的人群提供权力,让他们能够访问加密货币,从而访问全球金融体系。

尽管关于 DeFi 如何改变多个无银行账户国家命运的文章已经有很多,但这仍然是一个未实现的梦想。仍然存在多个瓶颈,其中监管问题是首要问题。

但如果监管变得更加符合现代思维,并且 DeFi 变得更容易被接受,那么 PayPal 的稳定币能否利用 PayPal 的熟悉程度来促进从传统到 DeFi 的过渡?

目前来看,PYUSD 具有很强的中心化根基,尚未跨入 DeFi 领域。虽然它仍然存在更加开放并冒险进入去中心化领域的可能性,但就目前而言,这似乎过于鲁莽,无法接受。

加密货币人群正在努力思考 PayPal 稳定币可能存在的优点和缺点。

虽然它有可能弥合旧金融和数字资产之间的差距,但真正的担忧仍然是坚持使用 Web2 系统,因为没有银行和监管审查,人们就无法访问该系统。

还有一个收养问题。CoinMarketCap 显示该代币在撰写本文时排名第 242。尽管该代币已被列入 4,452 个观察名单,但人们仍然对它感到担忧,许多人举起了看跌旗帜。

这表明,要使 PYUSD 在区块链领域成为家喻户晓的名字,还有很多工作要做。在那之前,只能猜测它对金融生态系统的影响有多大。

The introduction of the original stable currency by Shanouba Bitcoin Trading Network has triggered a heated discussion in the cryptocurrency industry. The introduction of the original stable currency has triggered a heated discussion in the cryptocurrency industry about its possible impact on payment and wider adoption of cryptocurrency. Although this move seems to be a big step towards accepting cryptocurrency in conventional finance, some industry observers suggest caution, and they emphasize the obstacles and limitations that may hinder wider adoption. What is this initiative aimed at bridging the gap between legal tender and digital currency for consumers, businesses and developers? CEO Dan Shulman emphasized the need for stable digital legal channels, which promoted various transactions, including the transfer of funds between payment and compatible external wallets, and the transformation of cryptocurrency exchange to digital currency. We need a stable tool, which is both digital native and easily connected with legal tender such as the US dollar. We are committed to responsible innovation and compliance. Novo and our record of providing customers with new experiences provide the necessary foundation for promoting the growth of digital payment. The token aims to reduce the payment friction in the virtual environment, speed up the value transfer and simplify the participation of digital assets by becoming a safer substitute for the volatility of most cryptocurrencies. The token on the Ethereum blockchain aims to be compatible with popular exchange wallets and applications, and plans to expand its usability to although the currency is to shrink the traditional financial ecosystem and digital finance. A step in the gap between ecosystems, but its wide adoption among the huge user groups in this market remains to be seen. The supervision provided by the New York State Department of Financial Services will release the monthly reserve report and the third-party proof of the value of the reserve assets from January to improve transparency. In addition, it will continue to devote itself to strengthening the digital currency education and understanding of consumers and businesses, and supplement the impact of its existing services that allow customers to trade in the selected cryptocurrency on the industry. The launch really marks the biggest impact on the industry so far. Payment companies adopt blockchain technology with a new standard and the new level of products themselves. Walter Hershet pointed out in the American banker podcast that Hershet is the strategic director of global blockchain infrastructure companies. When they entered this field and launched stable coins, they sent a message to other payment companies, tens of millions of businesses around the world and hundreds of millions of consumers who used their applications, that is, stable coins are a real product. He added that the launch conveyed a message that stable coins have entered the mainstream. Extending the benefits of blockchain technology to daily transactions, Hershet's point of view depends on the ability to promote the wider acceptance of cryptocurrency. Digital assets are usually limited by their own limited systems and limited by the regulatory framework. In this context, as a bridge between traditional currencies and digital currency, the stable currency has strong attraction. Others are attracted by the possibility of stable currency across multiple systems, thinking that this will bring more use cases. The CEO told them that if it is stable, Coin can be integrated into cross-ecosystem exchanges and wallets, which will increase the use cases of many digital assets tokens and cryptocurrencies and make it a financial leader who can bridge many digital assets tokens and cryptocurrencies. Users enter the cryptocurrency world, and she asserts that the existence of stable coins that can be easily traded, transferred and converted into other cryptocurrencies or legal tender will make them more universal and welcome by cryptocurrency aborigines and new users, but they are not unaware of the related risks, she said. Stable currency and cryptocurrency are still a small part of the financial system, but if the scale of stable currency expands and poses systematic risks to the economy, people's interest in supervising stable currency will increase, but she added that despite the long-term challenges of supervision and compliance, entering the encryption field can become a catalyst for encryption-driven payment systems and be conducive to the wider adoption of the encryption market. Some people think that entering the stable currency field can open the door for other financial technology companies to follow suit and accumulate for enterprises. Take the initiative to innovate and set a precedent. Others are even more contradictory. For example, the influencers of cryptocurrency issued a warning to banks to stop and start their business soon after the launch of stable currency, which also reduced people's attention. Recently, the US regulators filed several lawsuits against technology companies that promoted currency token, and the regulatory and compliance challenges entered the world like a double-sided blade. On the one hand, it can become the spark of encrypted payment system, and on the other hand, it can help more people use digital assets. The scale and influence of the market may attract more attention to the rules, leading to stricter inspection and demand for rules. Regulators have been waiting for the House Financial Services Committee. Democratic leaders are worried about launching their own stable currency. I am deeply worried about choosing to launch their own stable currency, and these assets still have no regulatory supervision and recognition. The federal framework wrote shortly after the release of the stable currency that a strong focus on rules may stifle new ideas and take away the cryptocurrency market from those who value themselves. According to the World Bank, about 100 million people in the world do not have bank accounts and thus miss important monetary services. The blockade of the traditional banking system has damaged their ability to participate in the global currency game. By providing loan savings and investment opportunities, people without bank accounts and under-served banks can be provided with power to access cryptocurrencies and thus the global financial system. There have been many articles on how to change the fate of many countries without bank accounts, but this is still an unfulfilled dream, and there are still many bottlenecks, among which supervision is the primary issue. However, if supervision becomes more in line with modern thinking and more acceptable, can a stable currency use its familiarity to promote the transition from tradition to decentralization? At present, it has a strong centralized foundation and has not yet entered the field. Although it still has the possibility of being more open and venturing into the decentralized field, At present, it seems too reckless to accept cryptocurrency. People are trying to think about the possible advantages and disadvantages of stable currency. Although it may bridge the gap between old financial and digital assets, the real concern is still to insist on using the system, because people can't access the system without banking and regulatory review. There is also an adoption problem that shows that the token ranks first at the time of writing. Although it has been included in a watch list, people are still worried about it. Many people have raised the bearish flag, which shows that there is still a lot of work to be done to make it a household name in the blockchain field. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。