比特币生态能否衍生出 Layer2 Summer

作者:Haotian,Twitter,@tmel0211

铭文市场火了之后,很多人对BTC L2投入了过多的期许,认为BTC 2层会像以太坊layer2一样辉煌?

然而事实是,比特币生态的“成功”可能很长时间会停滞在“资产发行”叙事阶段,要复刻以太坊的生态多样玩法,或许根本行不通。

Why?接下来分享几个技术逻辑:

逻辑一 可编程底层的差异

BTC和以太坊属于两个异族链种,前者是一条“无状态”链,后者则基于智能合约实现了复杂的可组合性金融业务逻辑。

要照搬以太坊上的DEX、Lending、Derivatives、Aggregator等多样金融玩法到比特币链上,关键得为比特币构建可编程的“状态+计算+验证”能力。

状态:目前比特币UTXO集合仅能计算出实时“余额”,历史余额,历史记录这些构成合约的基础状态根本就无法实现;

计算:可以把比特币ScriptPubkey脚本中的UTXO解锁条件当成它的核心计算能力,但这种计算能力非常受限,很难表达复杂业务逻辑;

验证:比特币网络全节点可以验证UTXO余额和脚本签名等信息,但仅限于这些基础验证本身,比特币网络甚至无法验证这些逻辑的具体执行效果。

总之,要想在比特币上实现复杂的金融应用,需要基于比特币上有限的“能力”来做延展,构建一套具备”状态+计算+验证“的可编程框架。

逻辑二 对比以太坊的扩容路线

我们回看以太坊扩容路线,分别经历了Plasma、Rollup、Validium等多条路线探索,最终选择了Rollup作为主流,而比特币的扩容最早出现的区块大小调整,SegWit隔离见证等早已落下帷幕,目前主要处在侧链Stacks、客户端验证RGB、状态通道验证Lightning Network的正统性纷争中。

由于Plasma的侧链没办法支持智能合约,Validium又过于独立,无法继承主网的安全性。Rollup路线能杀出重围恰恰因为其既能沿用以太坊DA的安全性,又足够灵活提升TPS的上限,关键是主网Rollup合约可由主网Validators做验证,Layer2的用户还有发起挑战撤回资金的权益。尽管在实际践行过程中部分环节不尽人意,但理论上Rollup方案也算获得了主流的市场共识。

参照之下,比特币侧链、客户端验证、状态通道验证目前发展各成一派:

侧链Stacks支持智能合约,应用类型也广泛,但属于比特币之外的独立共识,很难受大众一致认可;

客户端验证RGB沿用了主网UTXO模型,链下客户端可以处理更多复杂的交易,但其和比特币主网没有双向校验和约束能力,发展势头还不成气候;

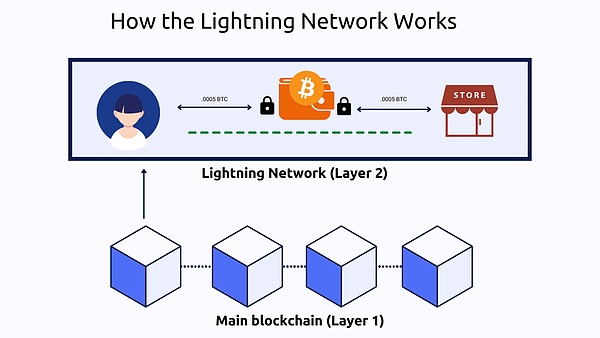

状态通道Lightning Network由于靠近bitcoin核心开发者,现阶段被视为相对正统的扩容赛道,但闪电网络发展太慢了,最近新出了个Taproot Assets结果还只是跑在主网上的资产,真正落地到闪电网络也还很难说。

如果以以太坊的范本来对照,一个成熟的layer2至少受主网安全保护,且扩容效果要明显,最关键是能跑智能合约有多元场景。以此为标准,侧链,客户端验证,状态通道似乎都达不到标准。

受主网保护:闪电网络>客户端验证>侧链;

扩容性效果:侧链>客户端验证>闪电网络;

合约性特征:侧链>客户端验证>闪电网络。

扩容路线的新教旨对比一下就很清楚了:如果安全是本位那铁定得等待闪电网络发展成规模,如果只追求扩容那别试图整改比特币了,一个合适的侧链可以解决一切问题,如果想同时兼顾三者,客户端验证RGB则是最优解。

逻辑三 BTC layer2的愿景方向

问题来了,到底哪条路线才值得托付比特币layer2的愿景呢?

1.侧链,虽然都可以做到,但这是一条独立共识链,和以太坊没啥两样,逻辑悖论出现了,我们已经有了以太坊这样的超级智能合约验证网络,为啥要搞一个全新的比特币侧链呢?让比特币守着其价值存储链的位置,其他以太坊类似的链来拓展开发想象空间,不更完美吗?非要开倒车意义何在?

2.客户端验证,和以太坊的Rollup类似,RGB客户端验证的综合性能更适合于做比特币主流扩容,这块市场和它的名字一样,目前还是一个“黑盒子”,能发展到什么程度还未知,还不能过早下定论;

3.状态通道,由于Lightning labs的正统性,闪电网络一度被给予扩容比特币的厚望。但Taproot Assets之后,闪电网络偏支付网络特性,会最终导向一个偏以太坊Plasma支付网络的侧链方案,恐怕也很难成为想象中可以承接多种金融玩法的二层。

本质上,试图把以太坊的多样金融玩法照搬到比特币,有些操之过急了。比特币生态的延展空间或许会很大,但未必会照搬以太坊。

试想,在以太坊上玩创新,也受其背后既定的原教旨主义影响,何况教旨和教义会更严苛的比特币呢?

以上。

VC驱动还是散户驱动,最终都要有价值沉淀

以太坊layer2局面繁荣,是因为其智能合约本身的可组合变成性可以无限组合叠乐高,整个过程最大的风险其实是共识过载,但在有效载荷内的多样玩法已经足以给开发者一片广阔的舞台。

而比特币layer2生态,由于其本身基础功能太薄弱了,可延展空间又过于丰富,奈何其本身安全共识又过于严苛。成也共识,败也共识,共识为比特币构建了绝对壁垒,但其也是生态创新受限的根本。

所以,混沌加矛盾,大部分资本、机构、主流用户群体,才会有看不懂的感觉。

比特币生态外VC们拿着巨资但却守在门外进不来,因为不知道比特币Build的叙事究竟该怎么讲才能逻辑Make Sense,而比特币生态内的开发者,在各个路线之间摇摆不定,缺乏统一的开发方向。

广大散户虽然群情fomo但大家都只关心铭文发币可能造就的财富神话,无人去问津Build的事。

太坊生态的资产发行路线虽然形式多样但终归围绕“价值捕获”的暗线,无论是VC驱动还是散户驱动,最终都要有价值沉淀。

比特币生态其实也一样,市场不可能永远停留在纯“资产发行”的繁荣阶段,终归要有技术持续突破,有人持续build,有项目持续发展。

这个市场不能全部都是MEME。

After the author's inscription that the market is on fire, many people expect that the layer will be as brilliant as Ethereum. However, the fact is that the success of Bitcoin ecology may be stagnant in the narrative stage of asset issuance for a long time. It may not be feasible to reproduce the ecological diversity of Ethereum. Next, share several technical logics-the difference between programmable bottom layer and Ethereum belongs to two alien chains. The former is a stateless chain, and the latter realizes complex composable financial business based on smart contracts. The key for logic to copy various financial games in the Ethereum to the bitcoin chain is to build a programmable state for bitcoin, calculate and verify the ability state. At present, the bitcoin collection can only calculate the real-time balance history, and these basic states that constitute the contract can not be calculated at all. The unlocking conditions in the bitcoin script can be regarded as its core computing power, but this computing power is very limited, and it is difficult to express complex business logic to verify the balance. And script signature, but it is limited to these basic verifications. Bitcoin network can't even verify the specific implementation effect of these logics. In short, to realize complex financial applications on Bitcoin, it is necessary to extend and build a set of programmable framework with state calculation verification. Logic II Compared with the expansion route of Ethereum, we look back and see that the expansion route of Ethereum has gone through several routes, and finally we chose it as the mainstream, and the expansion of Bitcoin first appeared. The block size adjustment, isolation witness and so on have already come to an end. At present, it is mainly in the orthodox dispute of side chain client verification status channel verification. Because the side chain can't support smart contracts and is too independent to inherit the security route of the main network, it can deus ex precisely because it can not only continue the security of Ethereum, but also be flexible enough to improve the upper limit. The key is that the users of the main network contract can be verified by the main network and have the right to challenge and withdraw funds, although some links are not in the actual practice. Satisfactory, but in theory, the scheme has won the mainstream market consensus. Under the reference, the verification of bitcoin side chain client authentication status channel is developing in different schools. The application types of side chain support smart contracts are also extensive, but the independent consensus outside Bitcoin is hard. The public unanimously agrees that the client authentication follows the main network model. Under the chain, the client can handle more complicated transactions, but it has no two-way checksum constraint ability with the bitcoin main network, and the development momentum of the climate status channel is not yet due to its proximity to the core. At present, the developer is regarded as a relatively orthodox expansion track, but the development of lightning network is too slow. Recently, a new result is that the assets running on the main network really land on the lightning network, and it is hard to say that if the model of Ethereum is compared with a mature model that is at least protected by the main network and the expansion effect is obvious, the most important thing is to be able to run smart contracts and have multiple scenarios as the standard. The side chain client verifies the status channel, and it seems that all the channels are not up to the standard. The lightning network client verifies the side chain protected by the main network. Expansion effect Side chain client verifies the contractual characteristics of lightning network. By comparison, it is clear that if safety is the standard, we must wait for the lightning network to develop into a scale. If we only pursue expansion, then don't try to rectify Bitcoin. A suitable side chain can solve all problems. If we want to take care of all three at the same time, client verification is the best solution. The vision direction of logic three is coming. Which route is worthy of entrusting Bitcoin's vision? Although the side chain can be done, it is an independent consensus chain, which is no different from Ethereum. A logical paradox has emerged. We already have a super-intelligent contract verification network like Ethereum. Why should we build a brand-new bitcoin side chain? Isn't it more perfect for other similar chains in Ethereum to expand the development imagination? What is the significance of driving backwards? The comprehensive performance of client verification and similar client verification in Ethereum is more suitable for the mainstream of bitcoin. Like its name, the expansion market is still a black box at present, and it is still unknown to what extent it can develop. It is too early to draw a conclusion about the state channel. Because of the legitimacy of the lightning network, it was once given high hopes to expand Bitcoin, but then the characteristics of the lightning network will eventually lead to a side chain scheme that is biased towards the payment network of Ethereum. I am afraid it is difficult to become an imaginary second-tier scheme that can undertake a variety of financial games. In essence, it is somewhat manipulative to try to copy the diversified financial games of Ethereum to Bitcoin. Too soon, there may be a lot of room for the extension of Bitcoin ecology, but it may not be copied from Ethereum. Imagine that playing innovation in Ethereum is also influenced by the established fundamentalism behind it, not to mention Bitcoin with stricter teachings and teachings. The above-mentioned drivers or retail drivers will eventually have value. The prosperity of Ethereum is due to the composability of its smart contracts. The biggest risk in the whole process is actually consensus overload, but the variety of gameplay within the payload is enough. In order to give developers a broad stage, but the bitcoin ecology is too weak in its basic function, and the extensible space is too rich. However, its own security consensus is too harsh, and the consensus has also failed. The consensus has built an absolute barrier for bitcoin, but it is also the root of the limited ecological innovation. Therefore, chaos and contradictions will make most mainstream users of capital institutions feel incomprehensible. Outside the bitcoin ecology, people are holding huge sums of money, but they can't get in because they don't know the narrative of Bitcoin. How to say it is logical, but the developers in the bitcoin ecosystem are vacillating between various routes and lack a unified development direction. Although the vast number of retail investors are in love, everyone only cares about the wealth myth that may be created by inscriptions and coins. Although the asset issuance routes of Taifang Ecology have various forms, they will eventually be valuable around the hidden line of value capture, whether driven by retail investors or driven by retail investors. In fact, the market cannot stay in the prosperous stage of pure asset issuance forever, and there must be continuous technological breakthroughs, continuous projects and sustainable development. This market cannot be all of them. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。