为什么比特币在土耳其、埃及、尼日利亚和阿根廷创下了历史新高?

作者:Nancy Lubale,cointelegraph 翻译:善欧巴,比特币买卖交易网

比特币近期表现强劲,再次刷新多国历史最高价格,证明了其作为通胀对冲工具和价值储存手段的价值。

然而,尽管表现令人瞩目,比特币相对于美元的价格仍比 2021 年 11 月创下的历史新高低 39%。

另一方面,比特币继续在阿根廷、土耳其、埃及、尼日利亚、黎巴嫩和巴基斯坦创下新的历史高点。根据 X 社交平台用户 Tahini 于 12 月 13 日发布的帖子,12 月 12 日某个时候,单个比特币相对于阿根廷比索触及历史新高 15,176,100.12 ARS。BTC 的价值分别为 1,202,109.40 土耳其里拉 (TRY)、32,703,517.06 尼日利亚奈拉 (NGN) 和 1,280,955.47 埃及镑 (EGP)。

图表还显示,BTC 已经分别相对于黎巴嫩镑和巴基斯坦卢比创下历史新高,分别达到 622,548,74.67 黎巴嫩镑和 11,736,063.26 巴基斯坦卢比。

值得一提的是,这些数字相当于比特币当前的价格,这些国家加密货币的飙升是由于高通胀压力导致其各自货币贬值所致。

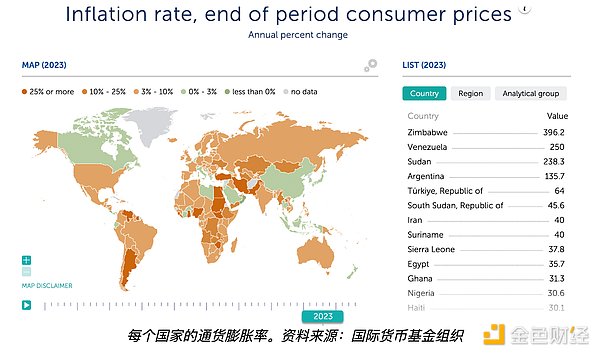

国际货币基金组织 (IMF) 的数据对各国通货膨胀率的年度百分比变化和期末消费者价格进行排名。

根据上图,津巴布韦元目前以 396% 的年通货膨胀率位居榜首,其次是委内瑞拉玻利瓦尔 (250%)、苏丹磅 (238%) 和阿根廷比索 (135%)。 国际货币基金组织的数据显示,土耳其里拉和尼日利亚奈拉分别以 64% 和 30% 的年通货膨胀率位居第五和第十二位。

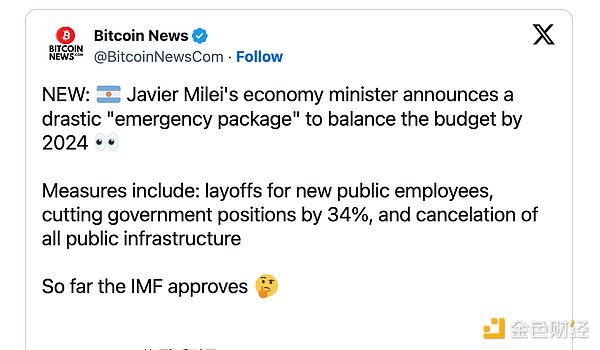

对于这些国家的许多加密货币投资者来说,比特币已经成为一种可靠的价值储存手段和抗击高通胀的避风港。 尽管本国货币持续贬值,许多国家,包括尼日利亚和阿根廷,都积极拥抱加密货币。 根据 Chainalysis 9 月 12 日的一份报告,尼日利亚、土耳其和阿根廷是全球加密货币采用率第二高、第十二高和第十五高的国家。 随着亲比特币候选人 Javier Milei 在 11 月 19 日总统选举决选中获胜,阿根廷的比特币采用预计将进一步增长。 Milei 于 12 月 10 日就任后,任命 Luis Caputo 为经济部长,后者于 12 月 12 日宣布,阿根廷将比索贬值超过 50%,至每美元 800 比索,作为“紧急方案”旨在到 2024 年平衡预算。这一举措似乎得到了国际货币基金组织的认可。 国际货币基金组织称这些措施“大胆”,并补充称它们将“以保护社会最脆弱群体并加强汇率制度的方式,大幅改善公共财政”。 在竞选期间,Milei 曾表示,如果他当选总统,将废除阿根廷央行。

比特币的表现优于科技公司

在2022年漫长的熊市期间,比特币与科技股一起持续下跌。根据美国加密货币对冲基金 Pantera Capital 的一封评论信,比特币的表现优于所有其他基金,只有 Meta 除外,Meta 的年初至今涨幅超过 172%,而 BTC 的涨幅为 162%。

Pantera 表示,由于“绝大多数重大事件”都是“好消息”,比特币在 2023 年反弹,“区块链行业取得了有意义的、必要的进展”。

这家加密货币对冲公司列出了许多此类事件,包括机构采用率的提高,这得益于“由传统金融领域的知名企业(如贝莱德和富达)以及区块链 ETF 的领导者 Bitwise 赞助的现货比特币 ETF。” 比特币交易所交易基金的潜在批准 为传统资本作为“数字黄金”注入比特币开辟了新渠道。

信中还指出,市场依赖美国法院系统公平的能力一直“令人放心”,并引用了法官阿娜丽莎·托雷斯(Analisa Torres)的裁决,即 XRP不是证券,Grayscale 在 针对 BTC ETF 申请向美国证券交易委员会提起的诉讼中获胜。报告指出,这些都表明美国的加密货币监管环境有利,从而使进一步的创新能够在国内发生。

除此之外,即将到来的2024 年比特币减半事件也加剧了人们对这一旗舰加密货币的普遍乐观情绪。

The author translated Shanouba Bitcoin Trading Network's recent strong performance has once again refreshed the history of many countries. The highest price has proved its value as an inflation hedging tool and a means of value storage. However, despite its remarkable performance, the price of Bitcoin relative to the US dollar is still higher than the historical high set in June. On the other hand, Bitcoin continues to hit new historical highs in Argentina, Turkey, Egypt, Nigeria, Lebanon and Pakistan. According to a post posted by social platform users on June, sometime. The value of a single bitcoin hit a record high relative to the Argentine peso, namely, Turkish lira, Nigerian naira and Egyptian pound. The chart also shows that it has reached a record high relative to the Lebanese pound and Pakistani rupee, reaching the Lebanese pound and Pakistani rupee respectively. It is worth mentioning that these figures are equivalent to the current price of bitcoin. The surge of cryptocurrencies in these countries is due to the depreciation of their respective currencies caused by high inflationary pressure. The data of the International Monetary Fund are against the currencies of various countries. According to the above figure, Zimbabwe dollar ranks first with the annual inflation rate, followed by Venezuela's Bolivarian Sultan pound and Argentina's peso. According to the data of the International Monetary Fund, Turkish lira and Nigeria's Naira rank fifth and twelfth with the annual inflation rate of and respectively. For many cryptocurrency investors in these countries, Bitcoin has become a reliable means of storing value and fighting against high inflation. A safe haven for inflation, although their currencies continue to depreciate, many countries, including Nigeria and Argentina, are actively embracing cryptocurrencies. According to a report on May, Nigeria, Turkey and Argentina are the countries with the second highest cryptocurrency adoption rate, the twelfth highest and the fifteenth highest in the world. With the pro-Bitcoin candidate winning the presidential election on May, Argentina's bitcoin adoption is expected to further increase. After taking office on May, he was appointed as the Minister of Economy. The latter announced on May that Argentina would devalue the peso. As an emergency plan, the goal of balancing the budget by 2008 seems to have been recognized by the International Monetary Fund, which called these measures bold and added that they would greatly improve public finances by protecting the most vulnerable groups in society and strengthening the exchange rate system. During the election campaign, they said that if he was elected president, the Argentine central bank would abolish Bitcoin, which performed better than technology companies. During the long bear market in 2008, Bitcoin continued to fall together with technology stocks, according to the United States. A comment letter from China Cryptographic Currency Hedge Fund shows that Bitcoin has outperformed all other funds except for the year-to-date increase, which means that Bitcoin rebounded in 2000 because most major events are good news, and the blockchain industry has made meaningful and necessary progress. This cryptocurrency hedge company listed many such events, including the increase in institutional adoption rate, which benefited from the sponsorship of well-known enterprises in the traditional financial field, such as BlackRock and Fidelity, and blockchain leaders. The potential approval of the spot bitcoin bitcoin exchange trading fund has opened up a new channel for traditional capital to be injected into bitcoin as digital gold. The letter also pointed out that the market's ability to rely on the fairness of the US court system has always been reassuring, and quoted the ruling of judge Analisa Torres that the securities did not win the lawsuit filed with the US Securities and Exchange Commission against the application. The report pointed out that all these indicate that the regulatory environment of cryptocurrency in the United States is favorable, so that further innovation can take place in China. In addition, the upcoming annual halving of bitcoin has also aggravated people's general optimism about this flagship cryptocurrency. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。