a16z:加密行业2024趋势“无缝用户体验”

对于互操作性的探索,正在从早期促进不同链、生态、应用的互联的探索,向获得更好的 UI/UX 方向转变,这也将是未来很长一段时间加密行业的叙事之一。

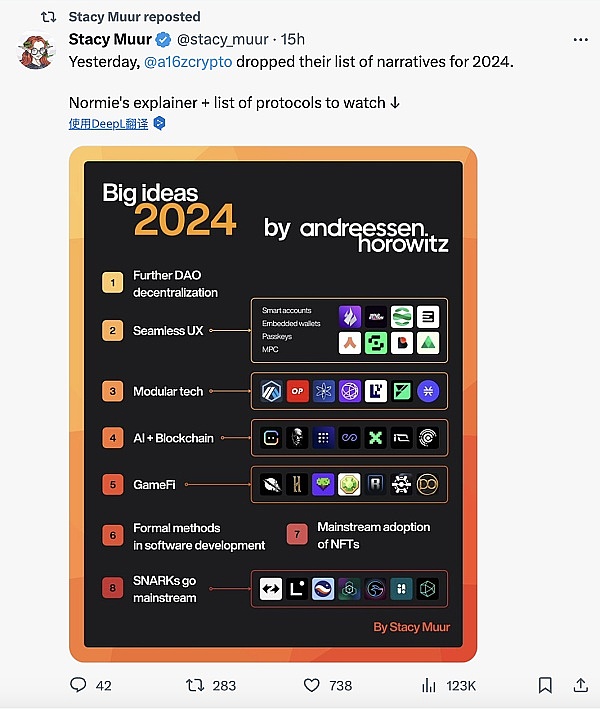

近日,知名加密投资机构a16z发布了“Big ideas 2024”,列出了加密行业在 2024 年几个具备趋势的“大想法”,其中 Seamless UX(无缝用户体验)赫然在列。

从最为直观的理解上,Seamless UX 是在强调用户在使用产品或服务时感到流畅、顺畅,没有令人困扰的阻碍或不连贯的体验。这通常包括直观的界面设计、高效的操作流程以及对用户需求的敏感性,以确保用户在整个交互过程中感到舒适和愉悦。

很显然,加密行业在可互操作性方向的探索中,始终没有很好的兼顾到用户交易体验,而随着行业对于 “Seamless UX ”的重视,也将对加密行业的发展产生十分深远的影响。

可互操作性的早期探索

多链化发展已经成为了链上世界的一个长期趋势,从早期 Layer1 赛道的爆发,到基于以太坊的 Layer2 赛道的增长,链上世界已经形成了上百个大大小小的生态。即便如此,多链化发展的趋势仍在加速,比如从 2023 年年初至今,包括 Mantle Network(alpha)、Base、Linea、 StarkNet、Scroll、Eclipse 等十几个 Layer2 网络陆续上线主网。随着技术的迭代,多链化趋势正在成为催生加密行业新一轮增长的重要力量。但新的问题在于,多链化趋势下,链与链之间却难以合理的建立互操作性。

在 Binance Research 的《Decoding Cross-Chain Interoperability》一文曾指出,不同的链底层在代码库、框架和设计等方面有着多样性的选择,这意味着几乎每两条链都是异构链,链上世界碎片化、割裂化正在加剧。

基于此,开发者们面临着非统一的工具化挑战,用户则要应对特定链上去中心化应用程序的限制,导致了流动性的碎片化和链上世界不够理想的 UI/UX(用户界面/用户体验)。所以无论是开发者还是用户,都具备将这些链链接的需求,那么如何建立合理的跨链互操作性正在成为加密行业讨论的重要议题。

最初以跨资产为目的跨链桥是被广泛采用的互操作方案,这类方案通常是以将资产锁定并在特定链上铸造新资产的方式实现跨链(最初 TVL 通常是主要衡量指标 ),它更专注于某一个方向比如资产专用型、链专用型、应用专用型等。

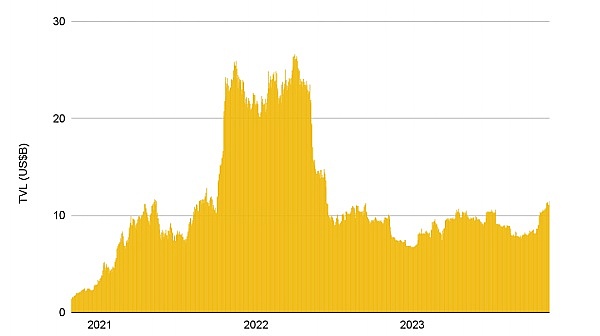

不过来自于 Binance Research 的数据显示,2021 年跨链协议的 TVL 经历了急剧增长,随后由于熊市和频发的安全事件,在 2022 年跨链板块的 TVL 则出现了急剧的回落。这意味着当跨链交互不活跃时风险较低,但随着跨链交互的增加,风险也会升级,跨链操作的安全性与其规模呈反比,这也反映出了跨链方案通常建立在牺牲安全的前提下实现。早期互操作性的探索曾引发了一系列安全事件,不仅引发了争议,并且很多人曾对此失去了信心。

Binance Research 《Decoding Cross-Chain Interoperability》 跨链板块 TVL 趋势

可见,跨链桥确实对行业的发展起到了十分重要的作用,但它仅仅是权益之计,一定不是跨链方案的最终状态。

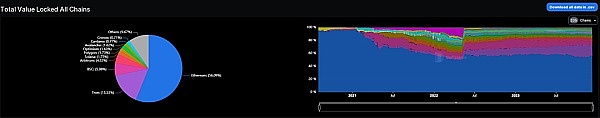

另一方面,多链趋势下,链上资源分布极其不均衡,我们看到以太坊、Tron、BNB Chain 等头部生态掌握着超 75% 的链上 TVL。而对于许多新兴生态因缺乏良好的互操作性方案,则在一轮又一轮的流量争夺战中,因难以向外捕获资金与用户而处于竞争的下峰,这也让新兴生态的启动与长期发展带来了挑战。一个很显而易见的例子是,一些用户对新兴 Layer2 的空投具备兴趣,但交互存在极高的成本与门槛。

数据来源:https://defillama.com/chains

所以在多链化趋势下,将不同的网络连接起来,对区块链的主流采用和价值捕获却至关重要,而如何在跨链互操作性中找到正确的平衡点,如何让用户更好的提升交易体验,也成为了行业的早期议题。

底层堆栈

在经历了早期跨链互操的探索后,跨链互操作领域迎来了全新的进展。Chainlink 、LayerZero、Axelar 等构建了一个全新的跨链互操作思路。它们通过构建一个分布式的底层堆栈,开发者可以直接基于这些平台建立具备跨链互操作特性的二级应用,底层堆栈来对通用性、可扩展性以及无须信任性。

图片来源:Binance Research

开发者通过这些堆栈,更容易获得跨链互操作的能力,以帮助不同的链间、应用间实现更好的链接,进而帮助 C 端用户更顺滑的进入到各个生态,同时能够兼顾安全性。底层堆栈通常主要面向 B 端用户即开发者,它们通常需要再通过应用层与 C 端用户进行传递与链接,但用户仍面临较高门槛和复杂操作。

所以,除了构建合理的跨链互操作性外,也需要对 UI/UX 实现质的改善,才能充分利用网络效应帮助不同的链上生态获得增长,但现阶段这类跨链互操作底层堆栈很难在“Seamless UX” 方向上起到直接的效果,这通常需要建立在开发者的理解之上。

以 “Web3 操作协议”为定位的 dappOS 在构建了一套“交易意图”框架,在实现合理的互操作性的同时,在 UI/UX 方面做到了极致,成为 Seamless UX 方向的示例生态。以此为基础,dappOS 也正在成为充分利用网络效应打通不同链上流量的典范生态。

Seamless UX 示例 dappOS:全新的流量分发端

dappOS 正在以更加“智能化”的方式建立跨链互操作性,它搭建了一套“交易意图”框架,包含统一账户以及 dappOS Network 两个部分。

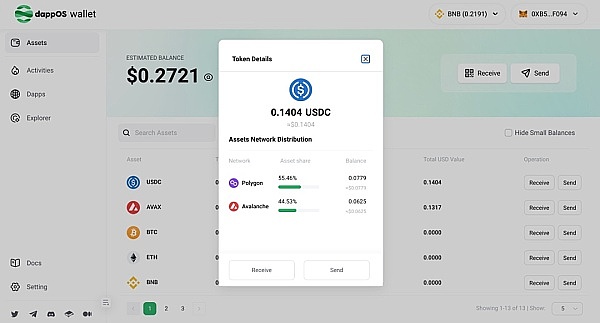

dappOS统一账通过链抽象,让用户无需关心资产分布在哪条链上以及手动切换网络,通过一次签名来一键实现与各个 Dapp 的无缝交互(由 dappOS Network 执行),其为自动化执行复杂的操作并可以在工作中组合成无缝流程。

dappOS Network 是一个由分布式节点组成的分布式执行网络,负责执行用户的一些交易需求指令,比如跨链交易、Gas 代付甚至一些较为复杂的交易动作,该网络正在帮助 dappOS 折叠链与链之间的隔阂来实现链抽象。

在账户抽象特性、链抽象的基础上,dappOS 系统充当了链接不同链生态的连接器,通过分布式的 dappOS Network 帮助所有接入系统的生态、应用间实现极低门槛的互联,并具备更完整的跨链互操作的能力,跨链交易可以直接在应用程序层进行。

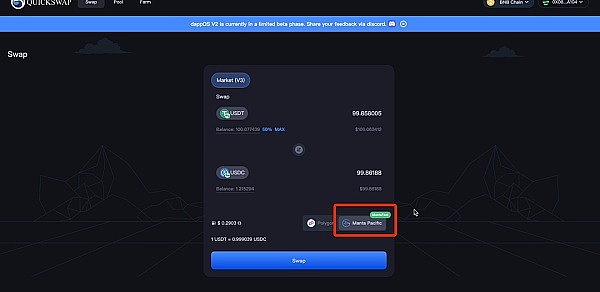

在 dappOS 全新的 v2 版本中,支持交易者通过统一账户对不同链上 Dapp 的交易功能进行组合,比如在 Avalanche 链上的 Benqi 中进行借贷后,直接将借贷的资金在 Perpetual 或者 QuickSwap 上无缝使用,并能够在任意链上归还 Benqi 借贷的资金。

这种以用户意图为核心的框架设计,正在改变用户的链上交易习惯。

有了 dappOS,用户只需要将资金存放在统一账户中,通过统一账户能够以类似于使用传统 APP 的方式来一键实现意图,而不再需要主动执行极为繁琐的链上交易步骤,极大降低了链上交互成本,提升了便利性。这也让 dappOS 正在成为成为极佳的链上交易、交互工具,用户可以无缝衔接应用和公链热点,并且生态具备极高的留存率与用户粘性。

dappOS 不仅在 UI/UX 方面实现了极大的改观,同时也能够很好的将用户保留在其 UI/UX 中,这也让 dappOS 正在成为全新的链上流量池。

为了更好的对生态流量体系进行引导,更好的发挥网络效应,dappOS v2 也在前不久推出了全新的奖励系统,通过与一些应用的合作为定向交互的用户发放空投激励。而通过这种定向的引导,dappOS 正在为新公链、应用生态迅速注入流量,实现高效生态增长。

自 dappOS v2 在今年 9 月上线以来,已经有包括 Perpetual、Benqi、QuickSwap、Stader 等几个用例进行了集成,并通过 dappOS 的流量分发体系获得了十分明显的增长效果。

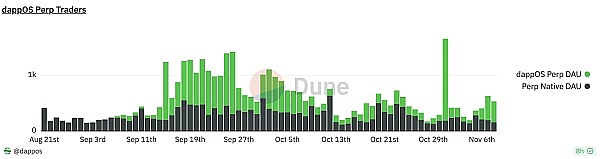

在 Perpetual Protocol 今年 10 月上线 dappOS v2 后,通过 dappOS 奖励系统上线了首个空投活动,已经为通过统一账户与 Perpetual Protocol 交互的用户发放了首批空投奖励,dappOS 生态的流量池也为 Perpetual Protocol 带来了切实的增长。

除了 Perpetual Protocol 外,dappOS支持用户从以太坊,Arbitrium, Avalanche等链无缝交互Manta网络dApp,无需手动跨链,整体费率下降85%。

同时交互也将被累计计入 dappOS v2 的奖励系统,具备获得多重空投的预期。

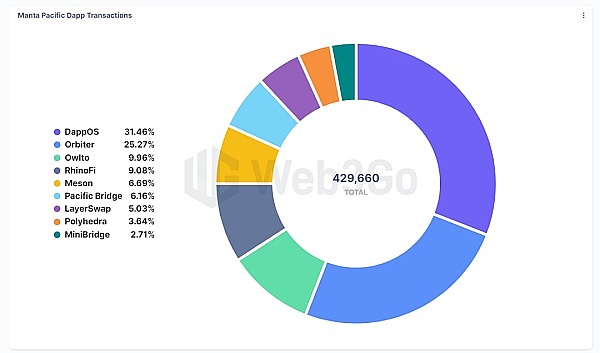

目前在 Manta Network 网络中,有超过 31% 的链上交易量来自于 dappOS 端,并且该比例目前仍在持续的上升,这不仅体现了 dappOS 对于链上 Dapp ,新公链生态增长所带来的增益,同时也反应出了功能抓手突出的 dappOS 在链上交互领域受欢迎的程度。

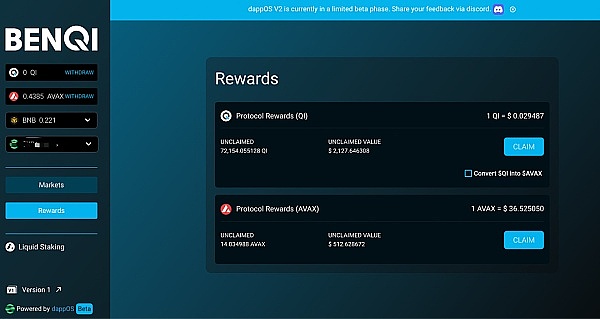

此外,近期加密市场整体向好的背景下,Avalanche 生态同样有着亮眼的表现,尤其是其头部借贷项目 Benqi 的生态代币 $QI 单日涨幅超 130%,进一步引发了 Benqi 上借贷以及质押热,以获得 $QI 资产的奖励。

dappOS 同样也成为了交易者使用 Benqi 的绝佳入口,通过 dappOS 统一账户,能够支持用户一键交互 Benqi,并能够从不同的链完成支付、质押等操作,无需手工跨链,奖励会以 $QI和 $AVAX 的形式直接发放到 dappOS v2 统一账户中。

截止至 12 月 12 日,根据 dappOS 公布的数据显示,BENQI 集成 dappOS 2 个月后,新增用户 4848 名,交易笔数 28,571 笔。新增 dappOS 用户存入资金达到 12,877,782 美元,USDT 和 USDC 存入资金分别占 BENQI 协议总数的 18.17% 和 16.62%。新增 dappOS 用户借贷金额达到 7,199,765 美元,WBTC 和 WETH 借出资金分别占 BENQI 协议总数的 80.57% 和 45.75%。这同样表明,dappOS 作为流量分发端对 Benqi 协议发展带来了明显的增益。

质押、借贷示例:

https://staking.benqi.dappos.com/liquidStaking

https://benqi.dappos.com/Markets

对于互操作性的探索,正在从早期促进不同链、生态、应用的互联的探索,向获得更好的 UI/UX 方向转变,这也将是未来很长一段时间加密行业的叙事之一。dappOS 作为“Seamless UX” 叙事方向早期的探索者,在成为链上世界主要的流量分发端,帮助新公链、应用生态捕获用户流量、实现高效增长赋能的同时,也正在对链上应用形态的演化提供着参照。

The exploration of interoperability is changing from the early exploration of promoting the interconnection of different chain ecological applications to getting a better direction, which will also be one of the narratives of the encryption industry for a long time to come. Recently, well-known encryption investment institutions have released several big ideas with trends in the encryption industry, among which seamless user experience is impressively listed. From the most intuitive understanding, the picture emphasizes that users feel smooth and smooth when using products or services, without disturbing obstacles or incoherence. This usually includes intuitive interface design, efficient operation process and sensitivity to users' needs to ensure that users feel comfortable and happy in the whole interaction process. Obviously, the encryption industry has never taken into account the user's transaction experience in the exploration of interoperability direction, and with the attention of the industry, it will have a very far-reaching impact on the development of the encryption industry. The early exploration of interoperability and multi-chain development has become a long-term trend in the chain world from the early track. With the outbreak of the Ethernet-based track, hundreds of large and small ecosystems have been formed in the world. Even so, the trend of chain development is still accelerating. For example, since the beginning of the year, more than a dozen networks have been online. With the iteration of technology, the trend of multi-chain is becoming an important force to promote a new round of growth in the encryption industry, but the new problem is that it is difficult to reasonably establish interoperability between chains under the trend of multi-chain. There are various choices in framework and design, which means that almost every two chains are heterogeneous, and the fragmentation of the world on the chain is intensifying. Based on this, developers are facing non-uniform instrumental challenges, and users have to deal with the restrictions of decentralized applications on specific chains, which leads to the fragmentation of liquidity and the unsatisfactory user experience of the world on the chain, so both developers and users have the need to link these chains. So how to establish reasonable cross-chain interoperability? Sex is becoming an important topic in the encryption industry. At first, cross-chain bridge is a widely used interoperability scheme. This kind of scheme is usually realized by locking assets and casting new assets on a specific chain. At first, it is usually the main measure. It focuses more on a certain direction, such as asset-specific chain, application-specific type, etc. However, the data from it shows that the cross-chain agreement has experienced a sharp growth in 2008, and then it crossed the chain board in 2008 due to bear market and frequent security incidents. The block has dropped sharply, which means that when the cross-chain interaction is inactive, the risk will be lower, but with the increase of cross-chain interaction, the security of cross-chain operation is inversely proportional to its scale, which also reflects that the cross-chain scheme is usually based on the premise of sacrificing security, and the exploration of early interoperability has triggered a series of security incidents, which not only caused controversy, but also caused many people to lose confidence. On the other hand, under the trend of multi-chain, the distribution of resources on the chain is extremely uneven. We see that the head ecology such as Ethereum holds the super-chain, while for many emerging ecosystems, due to the lack of good interoperability, it is difficult to capture funds and users in the round after round of traffic battles, which also brings challenges to the start and long-term development of emerging ecosystems. An obvious example is Some users are interested in emerging airdrops, but there is a high cost and threshold for interaction. Therefore, connecting different networks under the trend of multi-chain is very important for the mainstream adoption and value capture of blockchain. How to find the right balance in cross-chain interoperability and how to make users better improve the trading experience has also become an early topic in the industry. After the early exploration of cross-chain interoperability, the underlying stack has ushered in new progress in the cross-chain interoperability field. A brand-new idea of cross-chain interoperability is proposed. By building a distributed underlying stack, developers can directly build a secondary application underlying stack with cross-chain interoperability characteristics based on these platforms, which can improve the universality and scalability and avoid the need for trust. Through these stacks, developers can more easily obtain the ability of cross-chain interoperability, so as to help different inter-chain applications achieve better links, and then help end users enter various ecosystems more smoothly, while taking into account security. The bottom stack is usually mainly oriented to end users, that is, developers. They usually need to communicate and link with end users through the application layer, but users still face high thresholds and complex operations. Therefore, in addition to building reasonable cross-chain interoperability, we also need to improve the quality of implementation to make full use of network effects to help different chain ecosystems grow. However, at this stage, this kind of cross-chain interoperability bottom stack is difficult to play a direct role in the direction, which usually needs to be based on the understanding of developers to operate. For positioning, the protocol has built a set of transaction intention framework, while achieving reasonable interoperability, it has achieved the ultimate direction of the example ecology. Based on this, it is also becoming a model ecological example that makes full use of network effects to open up traffic on different chains. The brand-new traffic distribution is to establish cross-chain interoperability in a more intelligent way. It has built a set of transaction intention framework, including unified accounts and two parts of unified accounts, so that users do not need to care about asset distribution through chain abstraction. On which chain and manually switch the network to realize seamless interaction with each other with one click through one signature. By executing it, it performs complex operations for automation and can be combined into a seamless process at work. The picture is a distributed execution network composed of distributed nodes, which is responsible for executing some transaction demand instructions of users, such as cross-chain transaction payment and even some more complicated transaction actions. The network is helping to collapse the gap between chains to realize chain abstraction in account abstraction. On the basis of this, the system acts as a connector to link different chain ecosystems, helping all ecological applications accessing the system to achieve extremely low threshold interconnection through distribution, and having more complete cross-chain interoperability ability. Cross-chain transactions can be directly carried out at the application layer. In a brand-new version, traders can be supported to combine trading functions on different chains through a unified account, for example, after lending in a chain, the borrowed funds can be directly used seamlessly on or on any chain, and the framework design centered on the user's intention is changing the user's trading habits on the chain. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。