前Arbitrum技术大使解读Arbitrum的组件结构(下)

作者:罗奔奔,前Arbitrum技术大使,极客web3贡献者

导语:本文是Arbitrum前技术大使 及 智能合约自动化审计公司Goplus Security前联合创始人罗奔奔 对Arbitrum One的技术解读。

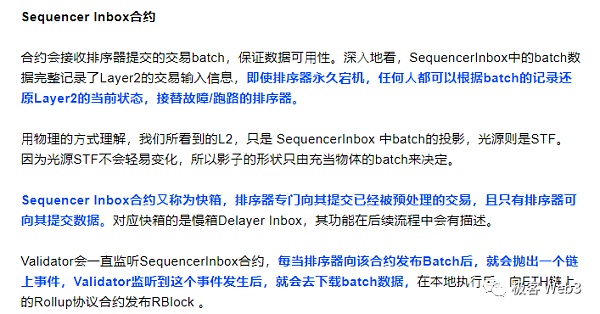

在上一篇文章《前Arbitrum技术大使解读Arbitrum的组件结构(上)》,我们介绍了Arbitrum核心组件中的 排序器、Validator、Sequencer Inbox合约、Rollup Block、非交互式欺诈证明的作用,而在今天的文章中,我们将重点讲解Arbitrum核心组件中与跨链消息传递及抗审查交易入口相关的组件。

正文:此前的文章中,我们曾提到,Sequencer Inbox合约专门在Layer1上接收排序器发布的交易数据包Batch。同时,我们指出,Sequencer Inbox又被称作快箱,与之相对的是慢箱Delayed Inbox(简称Inbox)。下面,我们将对Delayed Inbox等与跨链消息传递相关的组件进行细致解读。

跨链与桥接的原理

跨链交易可分为L1到L2(充值)与L2到L1(提现)。注意这⾥所说的充值和提现未必与资产跨链相关,可以是不直接附带资产的消息传递。所以这两个词仅仅表示跨链相关行为的两个⽅向。

跨链交易与纯L2交易相⽐,跨链交易在L1和L2这两个不同的系统中进⾏了信息互换,因此过程更复杂。

另外,通常我们说的跨链⾏为,是在两个毫不相关的⽹络上,⽤⻅证⼈模式的跨链桥进⾏的跨链,这种跨链的安全性取决于跨链桥的运营者,历史上基于见证人模式的跨链桥被盗事件频繁发生。

⽽在Rollup与ETH主⽹之间的跨链⾏为,与上述跨链有本质不同,因为Layer2的状态是由记录在Layer1上的数据决定的,只要你使⽤的是Rollup官⽅的跨链桥,其在运作结构上是绝对安全的。

这也凸显出Rollup的本质,它只是在⽤户角度看,像⼀条独立的链,但实际上所谓的“Layer2”只是Rollup对⽤户敞开的快速展示窗⼝,它的真实链式结构还是刻录在Layer1上。所以,我们可以认为L2算半条链,或者说是“在Layer1上创造出的一条链”。

可重试票据 Retryables

需要注意,跨链都是异步和非原子性的,它不可能像在一条链上一样做完一笔交易确认后就知道结果,也不能保证另一侧一定会在某个时间点发生某些事。因此跨链有可能因为一些软性问题而失败,但只要使用正确的手段,诸如可重试票据(Retryable Ticket),就不会发生资金卡住等硬性问题。

可重试票据是通过Arbitrum官方桥充值时,用到的基本工具,ETH和ERC20的充值都会使⽤到。其⽣命周期分为三步:

1. 在L1上提交票据。在Delayed Inbox合约中使用createRetryableTicket()方法创建充值票据,并提交。

2. L2上自动兑付。大部分情况下,排序器可以自动帮用户兑付票据,无需后续的手动操作。

3. L2上手动兑付。部分边缘情况,如L2上gas价格突然激增,票据上预付的gas不够,则无法自动兑付。此时需要用户手动操作。

注意,如果自动兑付失败,需要在7日内手动兑付票据,否则要么票据将会被删除(资金会永久损失),要么需要为票据的保存支付一定费用来续租。

另外,对于Arbitrum官方桥的提现流程,虽然和充值行为在流程上有一定对称相似性,但并没有Retryables这个概念,一方面可以从Rollup协议本身理解,另一方面我们可以从一些区别进行理解:

提现的过程中不存在自动兑付,因为EVM没有定时器或自动化,而L2上可以实现自动兑付,是排序器帮忙实现的,所以L1上用户要手动与Outbox合约交互,以Claim取回资产。

提现也不存在票据过期的问题,只要过了挑战期,可以在任意时间领取。

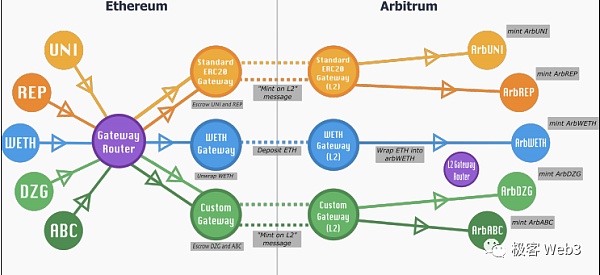

ERC-20资产跨链 Gateway

ERC-20资产的跨链是复杂的。我们可以思考几个问题:

一个在L1上部署的代币,它在L2上要如何部署?

它的L2对应合约需要预先手动部署,还是系统可以自动为跨过来的、但尚未部署合约的代币 自动部署资产合约?

L1上的ERC-20资产,在L2对应的合约地址是什么?是否该和L1一致?

在L2上原生发行的代币,如何跨链至L1?

拥有特殊功能的代币,如可调整数量的Rebase型代币,自增长生息代币,如何跨链?

我们不打算全部回答这些问题,因为展开太过复杂。这些问题仅是用来说明ERC20跨链的复杂性。

目前非常多扩容方案使用的都是白名单+手动清单的方案,来规避各种复杂的问题和边界情况。

Arbitrum使用了Gateway系统,解决了大部分ERC20跨链的痛点,具有以下特性:

Gateway组件在L1和L2成对出现。

Gateway Router负责维护Token L1<->Token L2之间的地址映射,以及some token<->some gateway之间的映射。

Gateway本身可分为StandardERC20 gateway,Generic-custom gateway,Custom gateway等等,用以解决不同类型的和功能ERC20的桥接问题。

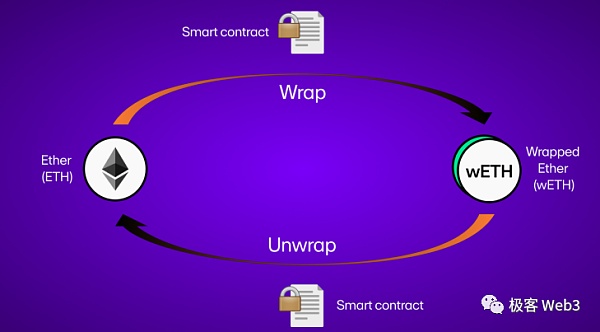

我们以比较简单的WETH跨链为例,来说明自定义gateway的必要性。

WETH是一种ETH的ERC20等价物。Ether作为主币,很多dApp中的复杂功能是无法实现的,因此需要一个ERC20的等价物。向WETH合约内转入一些ETH,它们会被锁在合约内,并生成出相同数量的WETH。

同理,也可以销毁WETH,取出ETH。显然,流通的WETH和锁仓的ETH数量永远是1:1的。

如果现在把WETH直接跨链到L2上,我们会发现一些奇怪的问题:

无法在L2上把WETH进行Unwrap变成ETH,因为L2上并没有锁仓对应的ETH。

Wrap功能可以使用,但这些新生成的WETH如果跨回到L1,也无法在L1上解封装为ETH,因为L1和L2上的WETH合约不是“对称的”。

显然这违反了WETH的设计原理。那么WETH在跨链时,不论是充值还是提现,都需要先Unwrap成ETH后,再跨到对面,然后Wrap成WETH。这个也就是WETH Gateway的作用。

其他有更复杂逻辑的代币同理,需要更复杂和精心设计的Gateway才能正常在跨链环境下工作。Arbitrum的自定义Gateway继承了普通Gateway的跨链通信逻辑,并允许开发者自定义与代币逻辑相关的跨链行为,可满足大部分需求。

慢收件箱Delayed Inbox

与快箱也即 SequencerInbox相对应的是慢箱 Inbox (全称Delayed Inbox)。为什么要有快慢之分呢?因为快箱是专⻔接收排序器发布的L2交易Batch的,所有未经排序器在L2网络内预处理的交易,都不该出现在快箱合约中。

慢箱的第⼀点作⽤是,处理L1到L2的充值⾏为。⽤户通过慢箱进⾏充值,排序器监听到后再反映在L2上,最终这笔充值记录会被排序器包含进L2的交易序列中,并提交⾄快箱合约Sequencer Inbox。

在这个例⼦中,⽤户直接向快箱提交充值交易是不合适的,因为提交到快箱Sequencer Inbox中的交易,会干扰到Layer2正常的交易排序,然后会影响到排序器的工作。

慢箱的第⼆个作⽤,是抗审查。用户直接提交⾄慢箱合约中的交易,排序器⼀般会在10分钟内归集到快箱中。但如果排序器恶意忽略你的请求,慢箱还有⼀个强制归集force inclusion功能:

如果交易被提交至Delayed Inbox中,经过24小时,慢箱中的交易仍未被排序器包含至交易序列中,用户可以在Layer1上手动触发force inclusion函数,把被排序器忽略掉的交易请求,强制归集到快箱Sequencer Inbox中,之后就会被全体Arbitrum One节点监听到,会被强制包含进Layer2交易序列里。

我们刚才提到过,快箱⾥的数据就是L2的历史数据实体。所以在被恶意审查的情况下,通过慢箱可以让交易指令最终包含进L2账本中,这涵盖了强制提款等逃离Layer2的场景。

由此可以看出,对任何⼀个⽅向和层次的交易,排序器最终都⽆法永久审查你。

慢箱Inbox的几个核心函数:

depositETH(),最简单的充值ETH的函数。

createRetryableTicket(),可用于ETH和ERC20以及消息的充值。相较depositETH()而言,有更高的灵活性,例如可指定充值后L2的收款地址等。

forceInclusion(),也即强制归集功能,任何⼈都可以调⽤。该函数会校验,提交至慢箱合约中的某笔交易,是否过了24小时还没被处理。如果条件满⾜,则将对消息进⾏强制归集。

不过需要注意,force Inclusion函数实际上位于快箱合约中,只是为了⽅便理解,我们将其放在慢箱这⾥⼀起讲解。

出站箱Outbox

出站箱Outbox只与提现有关,可以理解为提现行为的记录和管理系统:

我们知道,Arbitrum官方桥的提现需要等待约7天的挑战期结束, Rollup Block 最终敲定后,提款行为才可以实施。⽤户在挑战期结束后,向Layer1上的Outbox合约提交相应的Merkle Proof,它再与其他职能的合约通信(如解锁其他合约中锁定的资产),最终完成提现。

OutBox合约会记录哪些L2到L1的跨链消息已经被处理过,以防止有人反复提交执行过的提现请求。它通过

mapping(uint256 => bytes32) public spent,记录提现请求的spent Index与信息对应关系,如果mapping[spentIndex] != bytes32(0)则该请求已被提现过。原理类似于防止重放攻击的交易计数器Nonce。

下⾯我们将以ETH为例完整讲解充值与提现的流程。ERC20与之不同的仅仅是⾛了Gateway,就不再赘述。

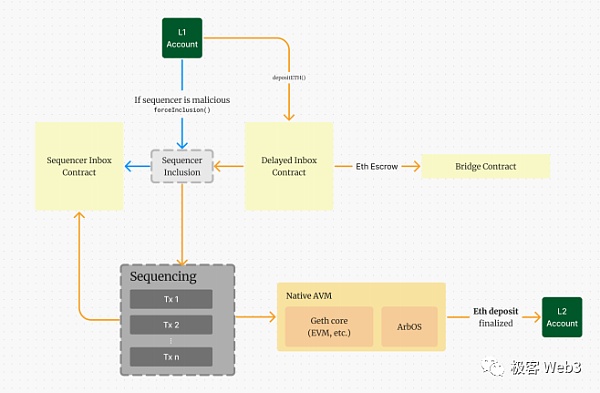

ETH充值

1. 用户调用慢箱的depositETH()函数。

2. 该函数会继续调用bridge.enqueueDelayedMessage(),在bridge合约中记录该消息,并将ETH发送往bridge合约。所有的ETH充值资金,都保管在bridge合约中,相当于一个充值地址。

3. 排序器监听到慢箱中的充值消息,将充值操作反映⾄L2数据库中,⽤户可以在L2网络看到自己充进来的资产。

4. 排序器将该笔充值记录包含进交易批次batch,提交给L1上的快箱合约。

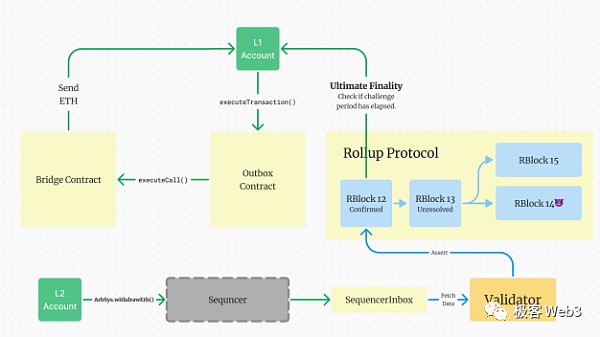

ETH提现

1. ⽤户在L2上调⽤ ArbSys合约的withdrawEth()函数 ,在L2上销毁相应数量的ETH。

2. 排序器将该提现请求发送⾄快箱。

3. Validator节点根据快箱中的交易序列,创建新的Rollup Block,其中会包含上述提款交易。

4. Rollup Block度过了挑战期并被确认后,⽤户可以在L1上调用Outbox.execute Transaction()函数,证明参数由前面提到的ArbSys合约给出。

5. Outbox 合约确认⽆误后,解锁bridge中相应数额的ETH发送给⽤户。

快速提现

使⽤乐观Rollup官方桥提现就会出现等待挑战期的问题。我们可以⽤私营的第三方跨链桥来规避这个问题:

原⼦锁交换。这种⽅式只是在双⽅在各⾃的链内进⾏了资产的互换,并且具有原⼦性,只要⼀⽅提供了Preimage,双⽅⼀定可以得到应有的资产。但问题是流动性⽐较稀缺,需要点对点地寻找对⼿⽅。

⻅证⼈跨链桥。⼀般类型的跨链桥都属于⻅证⼈桥。⽤户提交⾃⼰的提现请求,提现⽬的地指向第三方桥的运营者或流动性池。⻅证⼈发现跨链交易已提交到L1的快箱合约后,就可以直接在L1端向⽤户转账。这种⽅式本质上是⽤另⼀套共识系统来监视Layer2,并根据其已提交至Layer1上的数据进⾏操作。问题是,这种模式下的安全系数不如Rollup官方桥⾼。

强制提现

force Inclusion()强制归集功能用于对抗定序器的审查,任何L2本地交易、L1到L2交易和L2到L1交易,都可以使用该功能实现。定序器的恶意审查严重影响了交易体验,大部分情况下我们会选择提现离开L2,因此下面以强制提现为例介绍forceInclusion的用法。

回顾在ETH提现步骤中,只有步骤1、2是涉及到定序器审查的,所以只需要更改这两步:

调用L1上慢箱合约中的inbox.sendL2Message(),输入参数就是在L2上调用withdrawEth()时需要输入的参数。该消息会共享给L1上的bridge合约。

等待24小时的强制归集等待期后,调用快箱中的force Inclusion()进行强制归集,快箱合约会检视bridge中是否有对应消息。

最终用户可以在Outbox中提现,其余步骤由同正常的提现相同。

另外,arbitrum-tutorials中也有使用Arb SDK的详细教程去指导用户如何通过forceInclusion()去进行L2本地交易和L2到L1交易。

Author Luo Benben, former technical ambassador and geek contributor's introduction This article is the technical interpretation of Luo Benben, former technical ambassador and former co-founder of intelligent contract automation audit company. In the previous article, we introduced the role of non-interactive fraud proof of sorter contract in the core components, and in today's article, we will focus on the components related to cross-chain messaging and anti-censorship transaction portal in the core components. In the previous article, we mentioned that the contract is dedicated to receiving the transaction data packets released by the sorter, and at the same time, we pointed out that it is also called the fast box, which is opposite to the slow box abbreviation. Below, we will carefully interpret the components related to peer-to-peer and cross-chain messaging. Cross-chain transactions can be divided into recharge and cash withdrawal. The recharge and cash withdrawal mentioned here may not be related to asset cross-chain, but may not be the message delivery with assets directly attached, so these two words only mean cross-chain related lines. For the two-way cross-chain transaction and pure transaction, the cross-chain transaction has exchanged information in these two different systems, so the process is more complicated. In addition, what we usually call cross-chain is the cross-chain bridge in two unrelated Shanghai stock exchange modes. The safety of this cross-chain bridge depends on the operator of the cross-chain bridge. In the history, the cross-chain bridge based on witness mode has been stolen frequently, which is essentially different from the above-mentioned cross-chain because the state is determined by the data recorded on it. As long as you make the official cross-chain bridge, it is absolutely safe in operation structure, which also highlights the essence. It just looks like an independent chain from the perspective of users, but in fact, it is just a quick display window open to users. Its real chain structure is still burned on the table, so we can think that it is half a chain or a chain created on the table. It is necessary to pay attention to the fact that cross-chain is asynchronous and non-atomic, and it is impossible to know the result after completing a transaction as in a chain. There is no guarantee that something will happen on the other side at a certain time, so the cross-chain may fail because of some soft problems, but as long as the correct means are used, such as the retryable bill, there will be no hard problems such as fund stuck. Retryable bill is the basic tool used when recharging through the official bridge, and the recharge will make its life cycle divided into three steps. Submit the bill, use the method in the contract to create the recharge bill and automatically redeem it when submitting it. In most cases, the sorter can automatically help. There is no need for subsequent manual payment of bills. Some marginal conditions are as follows: the price suddenly surges, and the bills cannot be paid automatically. At this time, the user needs to manually pay the bills if the automatic payment fails, otherwise the bills will be deleted and the funds will be permanently lost, or a certain fee will be paid for the preservation of the bills to renew the lease. In addition, although there is a certain symmetrical similarity between the cash withdrawal process of the official bridge and the recharge behavior, there is no such thing. On the one hand, this concept can be understood from the agreement itself, on the other hand, we can understand from some differences that there is no automatic redemption in the process of cash withdrawal, because there is no timer or automation, and automatic redemption can be realized with the help of the sorter, so the user has to manually interact with the contract to retrieve the assets, and there is no problem of bill expiration. As long as the challenge period is over, assets can be collected at any time. Cross-chain assets are complicated, and we can think about several problems, one in the upper part. How does the token of the agency deploy its corresponding contract in advance, or can the system automatically deploy the assets on the asset contract for the tokens that have crossed over but have not yet deployed the contract? What is the corresponding contract address? Is it consistent with the original issue? How do the tokens cross the chain to the tokens with special functions, such as the adjustable number of tokens? How do the tokens cross the chain? We are not going to answer all these questions because the deployment is too complicated. These questions are only used for. Explain the complexity of cross-chain. At present, many expansion schemes use the white list manual list scheme to avoid all kinds of complex problems and boundary conditions. The system has solved most of the pain points of cross-chain. It has the following characteristics: the address mapping between components that appear in pairs and are responsible for maintenance, and the mapping itself can be divided into different types and functions to solve the bridge problem. We take a relatively simple cross-chain as an example to illustrate the necessity of customization, which is a kind of equivalent as the main one. The complex functions of many coins can't be realized, so we need a new equivalent to transfer some of them into the contract, and they will be locked in the contract and generate the same amount. Similarly, they can also be destroyed and taken out. Obviously, the number of circulating and locked warehouses will always be the same. If we cross the chain directly now, we will find that some strange problems can't be turned into because there is no corresponding function of locked warehouse in the world, but these newly generated ones can't be unpacked as the combination of reason and warehouse in the world if they cross back. Obviously, this is not symmetrical, which violates the design principle. So when crossing the chain, whether it is recharging or withdrawing money, it needs to be formed first, then crossed to the opposite side, and then this is the role. Similarly, other tokens with more complex logic need to be more complicated and carefully designed to work normally in the cross-chain environment. The customization inherits the common cross-chain communication logic and allows developers to customize the cross-chain behavior related to token logic, which can meet most needs. Slow inbox and express box are also the corresponding slow boxes. Why is the full name divided into fast and slow? Because the express box is designed to receive the transactions released by the sorter, all transactions that have not been preprocessed by the sorter in the network should not appear in the express box contract. The first point of the slow box is that the processed recharge record will be reflected in the transaction sequence that will be included in the sorter and submitted to the express box contract. In this case, it is not appropriate for the user to submit the recharge transaction directly to the express box. Transactions will interfere with the normal transaction sequencing and then affect the work of the sorter. The first action of the slow box is to resist censorship. The transaction sorter in the slow box contract will generally be collected into the express box within minutes, but if the sorter maliciously ignores your request, the slow box also has a forced collection function. If the transaction in the slow box is submitted to the middle hours, the user can manually trigger the function to forcibly collect the transaction request ignored by the sorter into the express box, and then it will be monitored by all nodes and will be forcibly included into the transaction sequence. We just mentioned that it is too fast. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。