Messari创始人:2024年加密行业值得关注的赛道、人物和项目

作者:Ryan Selkis,Messari创始人兼CEO;翻译:比特币买卖交易网xiaozou

近日Messari发表了Messari Crypto Thesis 2024报告。下面是报告要点,我对2024年加密行业的24个看法。

1、当你存有疑问时,着眼大局。

加密货币是不可避免的,当你质疑加密货币的长期发展时,把镜头拉远,看看我们已经走了多远,会很有帮助。

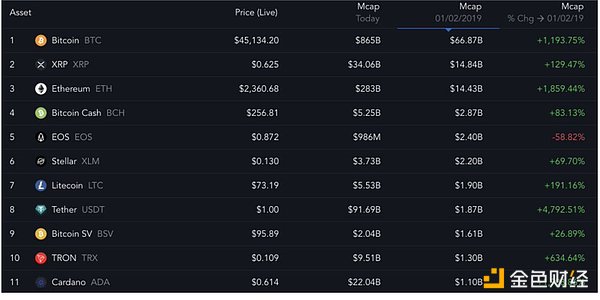

下图是加密货币最近5年的表现:

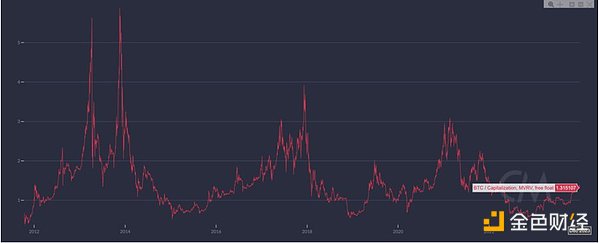

2、尽管最近有所上涨,但BTC仍是金融领域的哥斯拉。

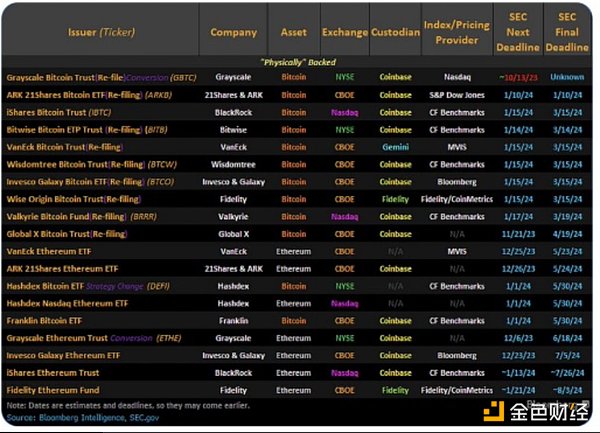

ETF即将到来,机构采用,加之地缘政治影响,与历史周期相比,还远未过热。再看市场价值与已实现价值之比,现在是1.3。等达到2.0以上之后再做评估。

3、我曾在11月下旬写过“ETH陷入停滞状态”。比特币是一种更好的数字黄金,Solan等在“集成”网络上有更好、更快、成本更低的执行表现。这看起来好像很有道理,但由于均值回归(如果没有其他因素的话)理论,ETH现在应该暴涨了。

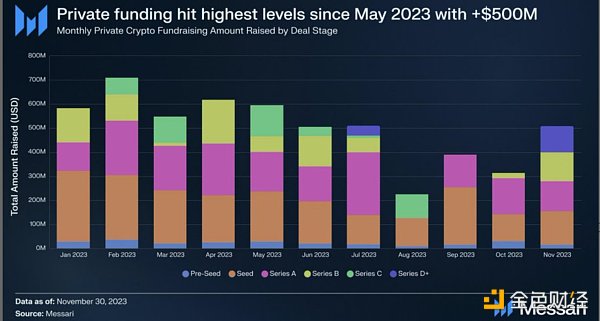

4、私募资金将跟随公开代币价格趋势。在加密风投活动方面,2024年将碾压2023年,成长型公司仍将继续吸引投资。

最大受益者:

+ DePIN(存储、计算、无线)

+ Rollup & 集成网络生态系统

+ 任何加密x AI项目

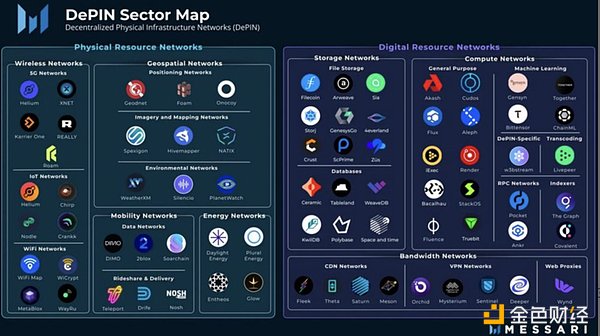

5、DePIN将在2024年爆炸式增长。

6、以下10个对象值得关注:

ETF团队(Cathie Wood、Larry Fink、Sonnenshein), Circle团队(最有可能的IPO候选人),政策领袖(Kristin Smith、Mike Carcaise),我们的死敌Satan(Elizabeth Warren), RWA领头羊,以及DeSoc和DeFi支持者。

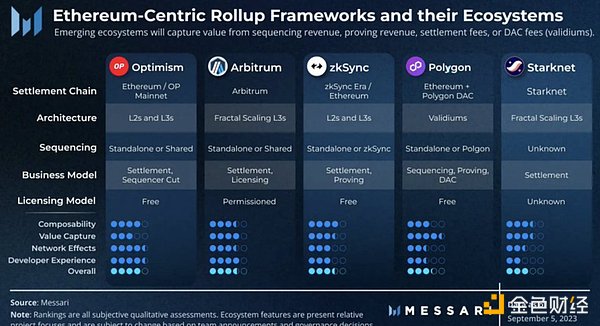

7、10类值得关注的加密项目:

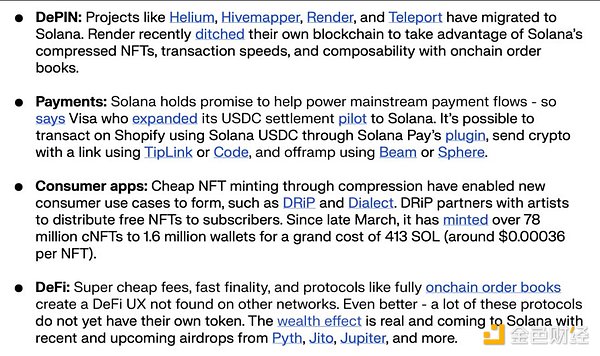

(1)Tron上的USDT

(2)Base上的应用程序

(3)Celestia

(4)Jupiter & Solana DeFi

(5)Farcaster / Lens

(6)GBTC

(7)Lido & LSTs

(8)CCIP vs. Pyth

(9)Blur & Blast

(10)Project Guardian

8、比特币的安全模型依赖于Ordinals。比特币网络在中期需要通过以下方式确保安全:

(1)收费应用程序。

(2)引入永久性低通胀。

(3)向权益证明迁移。

否则,比特币最终会(慢慢地)失败。

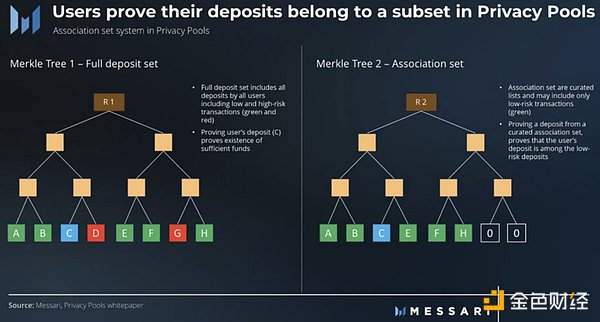

9、我最感兴趣的隐私保护项目是Privacy Pools、Silent Protocol,还有ZCash。

我们需要链上隐私,这是一场保护我们链上隐私权的全面战争。

10、对Tether的担忧是微不足道的

美国政府喜欢USDT(可监控的欧洲美元),虽然他们私下里假装讨厌它。对USDC持续的敌意将继续给我们造成伤害,除非白宫换一个新总统。

11、如果民主党人同时控制参议院和白宫,加密货币在美国就没有未来。

我们需要摆脱Sherrod Brown、Jon Tester、Katie Porter和其他几个敌对的参议员候选人,否则你就应该转移到海外,选择另一个行业。

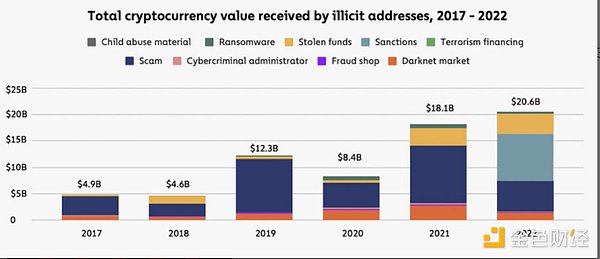

12、我们的政治对手所说的关于我们的一切几乎都是谎言。

非法加密货币的使用占交易量和市值的百分比接近历史最低点,我们一半的“非法融资”是因为世界上一半的国家(印度+中国+其他国家)甚至没有意识到制裁。

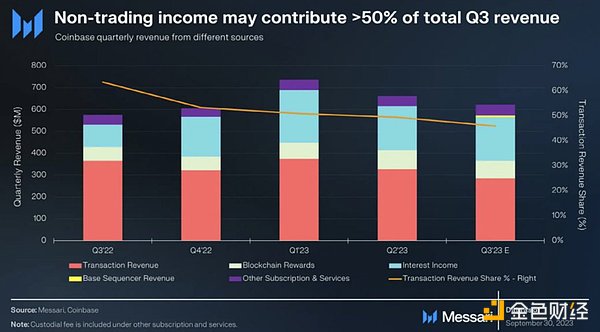

13、Coinbase是一大巨头,并将继续如此。

该团队在各个方面的卓越表现将推动加密领域发展。我预计他们将在2024年通过并购实现增长。他们现在的盈利途径有存款、交易量和链上活动。

14、你还没有看到比特币ETF的潜力。

+华尔街现在对加密货币很感兴趣。

+他们都必须砸大量的市场营销资金相互激烈竞争。

+ 先是ETH,然后是其他。

这是一场海啸(地震、微小的修正、然后是无情的资金藩篱)。

15、DCG和Gemini等公司相互之间、与他们的客户、SEC(美国证券监管委员会)和NYAG(纽约总检察长办公室)进行清算。

+最低的民事处罚。

+大多数债权人以美元结算,而非加密货币。

+所涉人员不用坐牢。

如果你有异议,很抱歉,一切已经结束了。

16、我们的季度报告包含了数十个L0/L1/L2网络。但是,“fat protocol”观点仍然存在,并将在2024年继续存在,即使从长远来看仍然有些荒谬。不要与潮流或meme对抗。

17、以太坊未来将仍然以rollup为中心,今年反弹的大部分经济价值将归于那些rollup链的代币与ETH。价差交易轻而易举。

18、Solana是今年加密行业的返场选手,它仍然有空间对抗ETH作为顶级集成网络。如果比特币是哥斯拉,那么Solana就是吃豆人,可一次吃掉所有杀手级加密应用。

19、加密支付在以太坊、Tron和Solana上蓬勃发展。就是不在比特币的Lightning闪电网络上。Solana将继续获得市场份额,Tron将与Tether同行或同死,以太坊将依靠其上的rollup来进行支付结算。而Lightning则会安静坐在角落里。

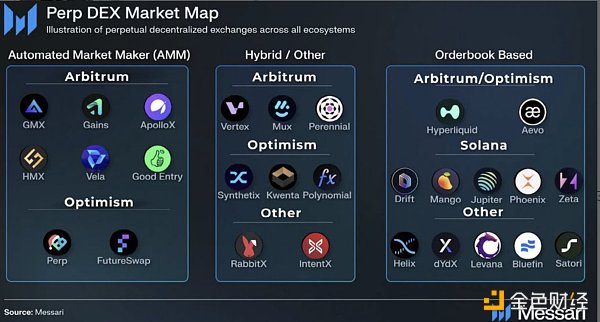

20、目前,现货DEX交易量约为现货CEX交易量的15-20%,但Perp DEX交易量的市场份额要低一个数量级。这一差距将在2024年大幅缩小。

以下是潜在的DeFi佼佼者:

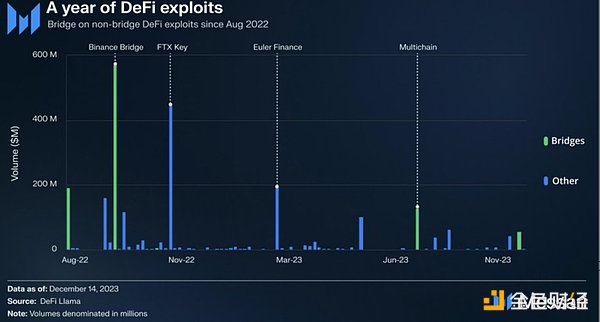

21、Bridge(桥)将继续是我们生存的祸根。如今,大多数非法加密货币都来自于链上黑客攻击和糟糕的安全性。攻击者使用不同程度的复杂操作,但不安全的桥是并将继续是攻击的主要来源。

22、Elon为我们争取了时间,但我们需要一个平行的社交媒体生态系统。俱乐部里的领头羊是Lens、Farcaster,还有friend.tech。这些协议规模很大,牵涉到很多资金。

23、随着美国总统大选的到来,预测加密市场今年可能会上涨50倍,但最可持续的高加密投注机会是在博彩领域。加密货币在灰色市场和监管不明晰的环境下表现出色,全球对博彩投注需求巨大。

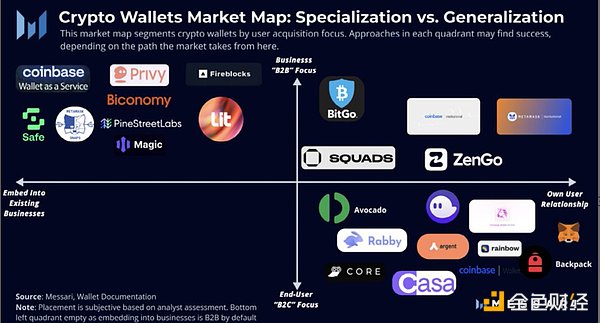

24、钱包之战是加密货币领域最有趣、风险最高、却最少被提及的战争。随之而来的竞争将在2024年将加密货币从一种投机性资产升级为一种更安全、更容易的主流消费技术。

The author, founder and translator Bitcoin Trading Network recently published a report. The following are the main points of the report. My views on the encryption industry in 2008 are as follows: When you are in doubt, it is inevitable to focus on the overall situation. When you question the long-term development of cryptocurrency, it will be helpful to zoom in and see how far we have come. The following picture shows the performance of cryptocurrency in recent years, although it has risen recently, it is still Godzilla in the financial field. Combined with the geopolitical impact, compared with the historical cycle. It's far from overheating, so let's look at the ratio of market value to realized value. Now it's time to make an evaluation after reaching the above. I wrote in late June that Bitcoin is a better digital gold with better, faster and lower cost performance on the integrated network. This seems reasonable, but due to the regression of mean value, if there are no other factors, the theory should skyrocket now. Private equity will follow the trend of public token prices and crush the annual growth companies in encrypted venture capital activities. Will continue to attract the biggest beneficiaries of investment, storage and computing, wireless integrated network ecosystem, and any encryption project will explode in. The following objects are worthy of attention: team, most likely candidate, policy leader, our sworn enemy leader and supporters. The security model of Bitcoin depends on the Bitcoin network. In the medium term, it is necessary to ensure that the security charging application will introduce permanent low inflation and migrate to the equity certificate in the following ways. Then bitcoin will eventually fail slowly. The privacy protection project I am most interested in is that we need online privacy. This is a full-scale war to protect our online privacy. The concern is negligible. The US government likes the monitorable Eurodollar, although they pretend to hate it privately, and their continued hostility will continue to hurt us unless the White House is replaced by a new president. If Democrats control both the Senate and the White House, cryptocurrency will have no future in the United States. We need to get rid of it. He is a few rival Senate candidates, otherwise you should move overseas and choose another industry. Everything our political opponents say about us is almost a lie. The percentage of illegal cryptocurrency in transaction volume and market value is close to the lowest point in history. Half of our illegal financing is because half of the countries in the world, India, China and other countries don't even realize that sanctions are a giant and will continue to be so. The outstanding performance of this team in all aspects will promote the development of encryption. It is expected that they will achieve growth through mergers and acquisitions in 2006. Their current profit channels are deposit trading volume and online activities. You have not seen the potential of bitcoin. Wall Street is now very interested in cryptocurrency. They all have to spend a lot of marketing funds to compete fiercely with each other. First, it is a tsunami and earthquake, and then it is a ruthless fund fence. And companies have the lowest liquidation with their customers, the US Securities Regulatory Commission and the new york Attorney General's Office. Most creditors settle in dollars instead of cryptocurrency, and the people involved don't have to go to jail. If you have any objection, I'm sorry that everything has ended. But our quarterly report contains dozens of networks, but the views still exist and will continue to exist in 2008, even if it is still absurd in the long run. Don't go against the trend or fight against Ethereum. In the future, we will still think that most of the economic value of the center's rebound this year will be attributed to those chains of tokens and spread trading, which is easily a comeback for the encryption industry this year. If bitcoin is Godzilla, it is Pac-Man who can eat all killer encryption applications at once. Encrypted payment is booming in Ethereum and Internet, but it will continue to gain market share on Bitcoin's lightning network. Ethereum will rely on it to pay and settle accounts, but it will sit quietly in the corner. At present, the spot trading volume is about the spot trading volume, but the market share of trading volume is one order of magnitude lower. It will be greatly reduced in 2008. The following are the potential leaders. Bridges will continue to be the bane of our survival. Nowadays, most illegal cryptocurrencies come from hacker attacks on the chain and poor security. Attackers use different levels of complex operations, but unsafe bridges are and will continue to be the main source of attacks, which has bought us time, but we need a parallel social media ecosystem. The leaders in the club are also the large-scale agreements, which involve a lot of money with the US presidential election. It is predicted that the cryptocurrency market may double this year, but the most sustainable opportunity for high-cryptocurrency betting is in the gambling field, where cryptocurrency performs well in the gray market and unclear supervision environment. The global demand for gambling betting is huge. The wallet war is the most interesting and risky but least mentioned war in the cryptocurrency field, and the ensuing competition will upgrade cryptocurrency from a speculative asset to a safer and easier mainstream consumer technology in. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。