实务合规篇:私募基金出海香港如何实现合规?

香港以其靠近内地的天然地缘以及国际金融中心的优势,成为内地私募管理机构投资的首选平台。随着越来越多的内地私募管理机构涌入香港市场,如何提前布局好流程中的合规工作就显得尤为重要。

当下,香港金融9号牌照是目前国内大型私募出海的主流方式之一,持有香港证监会证监会颁发的9号牌照相当于拥有了一张国际资本市场的“绿卡”,不仅可以直接参与境外的投资,还可以依据香港的相关法例来管理运用这些外海投资者的资金。在本文中,刘磊律师团队将从多角度解析香港资产管理9号牌的申请条件及流程,旨在为有意在港展业的相关人士提供合规指引。

一、私募基金牌照与虚拟资产牌照的不同

(一)、申请牌照条件

私募基金牌照与虚拟资产管理牌照虽然都需要申请到香港金融9号牌,但是,二者在申请条件上存在很大差异。首先,从事私募基金业务只需要申请到9号牌即可,但要从事虚拟资产管理业务,则不仅需要9号牌,还需要申请到可以做虚拟资产业务的副牌(亦即“9号牌升级”)。除此之外,在私募基金业务和虚拟资产业务的牌照申请中,对公司注册资本、公司架构、人员、办公场地等方面的要求也都存在不同之处。

(二)、持牌代表要求

在持牌代表(RO)的人数要求上,私募基金牌照一般只需要2名即可;但是,由于虚拟资产市场是7天×24小时不休市运作的,不同于传统的基金或股票市场,所以一般需要至少3名负责人“三班倒”。并且,二者对于RO的学历、从业年限等资质要求也是不同的,这点将会在下文第三点“申请9号牌的前期准备”中进行详细介绍。

(三)、牌照功能范围

符合本文所介绍的私募基金从业要求,按流程申请到相应牌照后,便可从事私募基金相关业务,但是,产品范围一般不得涉及虚拟资产。若想进行虚拟资产类产品的私募业务,则还需要申请到上文提到的9号牌虚拟资产副牌,否则将可能被认定为“无照经营”,受到证监会的责任追究。

二、私募基金牌照的定位及申领

根据香港证监会监管规定,现行的金融牌照共有十种,金融机构在获准持牌后,可以同时开展股票、金融衍生品、外汇以及黄金等品种的交易。其中,在香港设立私募基金需要获取9号牌照,即《证券及期货条例》第9类“受规管业务资格牌照”。

(一)、定位:9号牌是香港证监会(SFC)发布执行的《证券及期货条例》中规定的第9类受规管业务资格牌照,即资产管理牌照。拥有9号牌照的金融主体,可以依照相关法律法规对他人的资产进行管理。

(二)、作用:香港9号牌是目前国内大型私募出海主流方式之一,也是国内资本市场的“通行证”,拥有该牌照,意味着可以直接参与境外投资以及管理、运用海外投资者的资金。并且,由于香港《证券及期货条例》“证券”的范围远远大于一般意义上的证券,包括公司或非公司团队或者政府主体发行的股份(shares)、股票(stocks)、债权证(debentures)、债券(bonds)、债权股份(loan stocks)、基金、票据及其权利、期权、权益,或者权益证明书、参与证明书、临时证明书、中期证明书、收据,或认购或购买该等项目的权证,以及其他通常成为证券的权益或财产。因此,获香港9号牌后,公司将有资格为境外机构提供股票、基金、债券等投资组合管理服务。

(三)、业务范围:香港9号牌涵盖的业务类型相当于内地的私募基金牌照,但相比于内地的私募管理人登记备案,香港对投资群体则没有那么多的限制。

(四)、获取9号牌的两种方式:

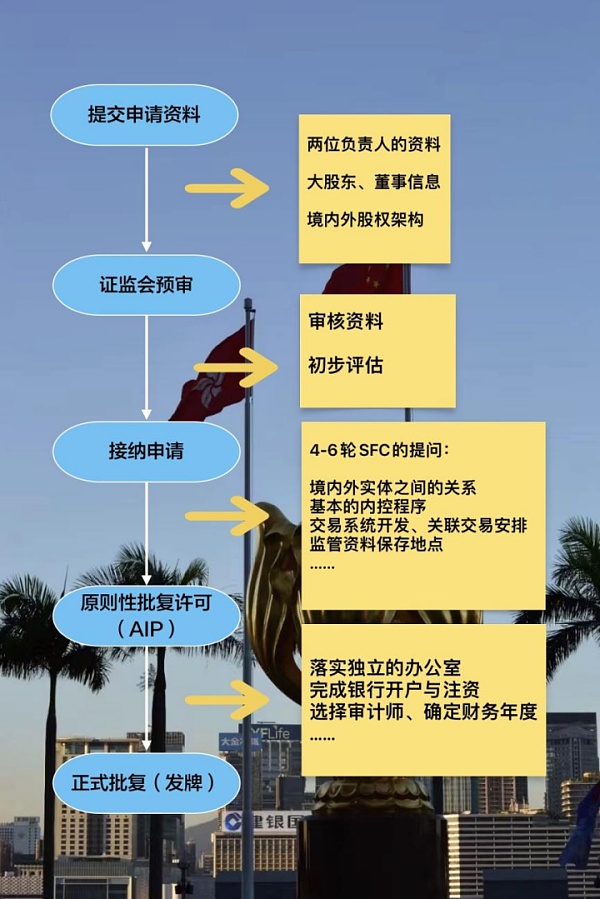

目前,在香港获取9号牌主要有以下两种方式:第一、在香港设立一家公司,并向SFC申请9号牌;第二、直接收购一家持9号牌的香港公司。对于第二种收购牌照的方式,由各方主体提出申请走正常的收购流程即可,本文将不做过多分析;下文将主要重点介绍第一种获牌方式。

三、申请9号牌的前期准备

(一)、设立有合适人员架构的公司

该要求主要是为了保障申请主体在香港有真实的“经营”情况发生,避免在香港虚假设立公司的情况发生。此外,公司还需要至少开设一个香港银行账户,用于走账和统计收支。

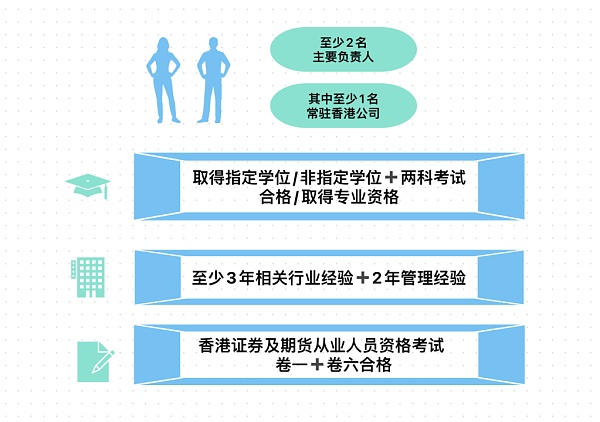

(二)、符合条件的持牌代表(RO)

1、人数:名义上需要2人,且至少1位主要负责人常驻于香港公司,进行必要的经营沟通。此外,持牌机构还需要具备应对投诉处理与突发状况的紧急联络人。

2、持牌代表(RO)的资格要求

(1)主要负责人员的要求

①行业资格:持有指定的大学学位,如会计、工商管理、经济、财务、法律等),或者持有其他大学学位,且至少2科指定科目考试合格,或者取得专业资格,如特许财务分析师、认可财务策划师等。

②行业经验:至少3年以上相关行业经验,且具有2年以上的管理经验。(在证监会的规定中,“以上”的含义和其数学含义不同,均指包含本数)

③考试:参加香港证券及期货从业人员资格考试,并且卷一和卷六必须合格。

(2)持牌代表要求

与主要负责人员相比,对于普通持牌代表的要求相对较低,没有上述行业资格和行业经验的要求,且在香港证券及期货从业人员考试中,卷一及格即可。

(三)、办公场地

1、必须有实体的办公室,对于具体的面积数没有要求,但是必须要有和物业或其他办公楼出租者的租赁合同或“业主同意书”,从而证明该金融主体在线下确实有实体场地进行办公。

2、公司必须有独立的办公空间,并配有只有本公司员工可使用的基本办公设施,不能与其他公司存在混淆。在香港,租赁一间独立办公室的月租金大约为5万到10万港币,另外香港物业还会收取一定的管理费。

3、若公司使用“共享办公室”办公的,须充分说明“共享办公室”能满足其办公需求的原因,并保证证监会代表可以访问该共享办公室,证监会可能会不定期派出督查人员进行到场抽查。

4、数量:不持资9号牌的申请须1个以上办公室,持资9号牌的申请须4个以上办公室,且各办公室均需符合前三点的要求。

我们建议:国内私募基金来港初期,可以考虑先租用服务式办公室的独立办公空间或者面积较小的办公室,等到业务规模增长之后,再考虑迁移到更大的办公空间,从而同时满足行业合规和成本控制的要求。

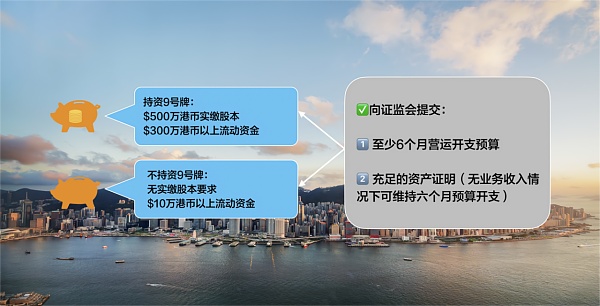

(四)、充足的资产

1、注册资本要求

(1)不持有客户资产的9号牌:无实缴资本要求,但须保持10万港币以上的流动资金。

(2)持有客户资产的9号牌:须满足500万港币的实缴资本,且须保持300万港币以上的流动资金。

2、向证监会提交材料

公司设立人须向证监会提交至少6个月的营运和开支预算表,表明自己具备持续盈利的能力。此外,还需要提交充足的资产证明,保证公司在无业务收入的情况下,仍具备足以满足财务指标并符合至少运营6个月开支预算的财政资源。

四、获牌后的合规经营

(一)、公司基本情况变动通知

获牌经营后,公司须将牌照申请情况、使用情况、大股东及董事基本情况、有联系实体的情况等一切与牌照申请相关的信息变更情况及时通知SFC,并及时更新相关的信息。

(二)、财务

公司须按年进行财务审计,并向SFC递交财务审计报告。从实务操作层面上,可以找会计师事务所计算扣除掉运营成本(如:员工工资、办公费用等)之后的企业盈利。一般来说,对于盈利小于200万港币的部分收取8.25%的税率,超过200万港币的部分收取16.5%的税率。此外,还需要计算公司盈利在财务年度对应的估值,交给专门的审计师事务所审核后出具审计报告,才能完成财务报税。香港的财务年度一般在12月底或者3月底,申请主体可以结合自身的经营状况和时间段从两者中选择一个时间段进行申报。

除了以上要求之外,公司的最低实缴股本及流动资金须在整个持牌期间维持。公司每月或每半年需要向SFC递交财政资源申报表或周年申报表。

(三)、人员

公司须对其管理人员进行持续的培训,且必须保证每个持牌人员均实际接受了持续培训,对相关领域的法律、政策、行业规定等保持高度的掌握。对于普通员工,虽然SFC没有在明面上作出要求,但是获牌经营的主体尽量也要对员工进行相关行业知识的基础培训,从而促进公司整体的合规持续性经营。

(四)、其他

1、须按时缴付年费,如果不按时支付,可能会受到证监会的相应处罚,比如支付一定的罚款等。

2、公司须每年向香港证监会提交年度报告,明确显示本年度公司经营管理的各方面情况,包括公司实际创收、利润率、分红情况、资产变动情况等。

五、律师有话说

香港私募基金牌照的申请要求,虽然与虚拟资产9号牌十分相似,但两者还是存在一些不同之处:比如注册资本、办公场所、持牌人员等方面。自从香港通关以来,香港和内地的经济一直处于密切交流的状态。香港在信息、资金流动和出入境等方面的自由便利,国际金融中心的就业机会,对内地人士有很大的吸引力。对有志出海的私募领域投资者,香港堪称最佳选择。同时,律师也在此提醒:一定要提前做好私募基金牌照申领和运营各流程的合规工作,必要时可以咨询专业律师,从而尽可能规避相关法律风险。

With its natural geographical proximity to the mainland and the advantages of being an international financial center, Hong Kong has become the preferred platform for mainland private equity management institutions to invest. With more and more mainland private equity management institutions pouring into the Hong Kong market, it is particularly important to arrange the compliance work in advance. At present, the Hong Kong financial number license is one of the mainstream ways for large-scale private equity to go to sea in China. Holding the number license issued by the Hong Kong Securities Regulatory Commission is equivalent to having a green card in the international capital market, which is not only for direct participation. Investment with overseas investors can also be managed and used according to the relevant laws of Hong Kong. In this paper, Liu Lei's team of lawyers will analyze the application conditions and procedures of Hong Kong asset management license plate from many angles, aiming at providing compliance guidance for those interested in exhibiting in Hong Kong-the different application conditions of private equity license and virtual asset license. Although both private equity license and virtual asset management license need to apply for Hong Kong financial license plate, they exist in the application conditions. There is a big difference. First of all, you only need to apply for a number plate to engage in private equity business, but to engage in virtual asset management business, you need not only a number plate, but also a sub-brand that can do virtual asset business, that is, the number plate upgrade. In addition, there are also differences in the requirements for the company's registered capital, corporate structure, office space and other aspects in the license application for private equity business and virtual asset business. Second, licensed representatives require that private equity licenses are generally only required in terms of the number of licensed representatives. However, because the virtual asset market operates round the clock, which is different from the traditional fund or stock market, it generally requires at least three responsible persons to work in three shifts, and the qualifications of the two are also different. This will be introduced in detail in the preliminary preparation for applying for the license plate in the third point below. The functional scope of the three licenses meets the requirements of the private equity industry introduced in this paper, and you can engage in private equity-related business after applying for the corresponding license plate according to the process, but the product model. Generally speaking, virtual assets are not allowed to be involved. If you want to engage in the private placement of virtual assets, you need to apply for the above-mentioned number plate and virtual assets sub-card, otherwise you may be considered as operating without a license and be investigated by the CSRC. 2. Positioning and application of private equity fund licenses According to the regulatory requirements of the Hong Kong Securities Regulatory Commission, there are ten kinds of financial institutions that can simultaneously conduct trading in stocks, financial derivatives, foreign exchange and gold after being licensed, among which private equity funds are established in Hong Kong. Need to obtain a license plate, that is, the securities and futures regulations, class I regulated business qualification license plate, a positioning license plate is the class I regulated business qualification license plate stipulated in the securities and futures regulations promulgated and implemented by the Hong Kong Securities Regulatory Commission, that is, the asset management license plate. The financial entity with a license plate can manage other people's assets in accordance with relevant laws and regulations. The Hong Kong license plate is one of the mainstream ways of large-scale private placement going to sea at present and a pass for the domestic capital market. Having this license plate means that it can directly participate. Overseas investment and management of the use of overseas investors' funds, and because the scope of securities in the Hong Kong Securities and Futures Ordinance is far greater than that in the general sense, including shares, stocks, debentures, bonds, equity fund bills and their rights, options, rights and interests or rights certificates, certificates of participation, interim certificates, receipts or warrants for subscription or purchase of these projects, and other rights or properties that are usually securities, it was awarded the Hong Kong number. After the license, the company will be qualified to provide overseas institutions with portfolio management services such as stocks, funds and bonds. 3. Scope of business. The business type covered by the Hong Kong license plate is equivalent to the private equity license in the Mainland, but compared with the registration of private equity managers in the Mainland, there are not so many restrictions on investment groups in Hong Kong. 4. There are two ways to obtain the license plate in Hong Kong. At present, there are two main ways to set up a company in Hong Kong and directly acquire a Hong Kong company with a license plate from the applicant. For the second way to acquire a license plate, all parties should apply for it and follow the normal acquisition process. This article will not make too much analysis. The following will mainly introduce the first way to obtain a license plate. Third, the preparation for applying for a license plate. First, set up a company with a suitable personnel structure. This requirement is mainly to ensure that the applicant has real business conditions in Hong Kong and avoid the false establishment of a company in Hong Kong. In addition, the company needs to open at least one Hong Kong bank account for bookkeeping and statistical income and expenditure. The number of qualified licensed representatives nominally requires people and at least one principal responsible person to be resident in the Hong Kong company for necessary business communication. In addition, the licensed institution also needs to have the qualification of an emergency contact person to deal with complaints and emergencies. The requirements of the principal responsible person are industry qualifications, such as accounting, business administration, economics, finance and law, or other university degrees, and at least pass the examination in designated subjects or obtain professional qualifications such as chartered finance. Analysts recognize financial planners and other industry experience for at least years, and have more than years of management experience. In the provisions of the CSRC, the above meanings and their mathematical meanings are different. They all mean that they include this number of exams to take the qualification examination for securities and futures practitioners in Hong Kong, and volumes 1 and 6 must be qualified. Compared with the main responsible persons, the requirements for ordinary licensed representatives are relatively low, and there are no requirements for the above-mentioned industry qualifications and industry experience, and securities and futures practitioners in Hong Kong. You can pass the exam as soon as you pass the exam. 3. The office space must have a physical office. There is no requirement for the specific area, but there must be a lease contract or owner's consent with the lessor of the property or other office buildings to prove that the financial entity does have a physical office offline. The company must have independent office space and be equipped with basic office facilities that can only be used by its employees. The monthly rent for renting an independent office in Hong Kong is about 10,000. In addition, a certain management fee will be charged for the property in Hong Kong if the company uses the shared office, it must fully explain the reasons why the shared office can meet its office needs and ensure that representatives of the CSRC can visit the shared office. The CSRC may occasionally send inspectors to conduct spot checks on the number of applications without the number plate. Applications with the number plate must have more than one office, and all offices must meet the requirements of the first three points. We suggest that domestic private equity funds can consider renting independent office space in serviced office or offices with smaller areas at the beginning of their arrival in Hong Kong until the business regulations. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。