ETF终局将至 比特币或许「轻舟已过万重山」

1 月 10 日凌晨,就在市场对现货比特币 ETF 申请的最终结果翘首以待的时候,美国证券交易委员会(SEC)却闹了一个大乌龙——SEC X 账户离奇被盗,并发布「比特币现货 ETF 获批」假消息。

这次假消息乌龙先是导致比特币迅速拉涨,一度触及 48000 美元,随后证伪后又大幅下跌,最低下破 44700 美元,这也再一次从侧面佐证了目前在现货 ETF 这件事上,消息面的一举一动对二级市场行情的巨大影响力。

如今距离 ETH 申请的最终结果出炉已不足 20 小时,让我们简单回顾下比特币 ETF 的发展历程,以及未来可能会带来什么影响?

持续 10 年的 ETF 上市路

自从 2013 年 Winklevoss 兄弟首开比特币 ETF 的滥觞, 10 年间每年都有不同的机构提出比特币 ETF 申请,但都无一例外,均以失败告终(或被美国 SEC 拒绝,或主动撤销),甚至都成了一个“通过永远在明年的魔咒”。

不同于美国诸多比特币 ETF 数年申请而不得的无奈等待,2021 年 2 月 18 日加拿大 Purpose 投资公司吃了“比特币 ETF 的首只螃蟹”——Purpose Bitcoin ETF:

它推出了世界第一支比特币 ETF——Purpose Bitcoin ETF,并在多伦多证券交易所挂牌交易,发行第一天交易量就达到了近 4 亿美元,足见市场对比特币 ETF 的期盼。

根据 CoinGlass 数据,截至 2024 年 1 月 10 日,加拿大 Purpose Bitcoin ETF 持有的比特币数量已经达到 3.55 万枚,资产管理规模超 16.5 亿美元。

且在 Purpose Bitcoin ETF 推出后的第二天,加拿大资产管理公司 Evolve Funds Group 就紧接着推出了第二支比特币 ETF,不过最受市场关注的无疑还是 SEC 对美国比特币ETF的申请情况——在加拿大批准了一系列比特币 ETF 之后,美国 ETF 的申请量也开始呈显著上升趋势。

2021 年之后,VanEck、NYDIG 、Valkyrie、Simplify、 Anthony Scaramucci 旗下对冲基金天桥资本(SkyBridge Capital)以及富达子公司 FD Funds Management 等多个金融公司的比特币 ETF 相继问世。

而灰度也打算将其比特币信托(GBTC)转换为交易所交易基金(ETF),转换的时间取决于监管环境。

总的来看,从 2013 年 Winklevoss 兄弟第一次向美国证监会(SEC)提交比特币 ETF 申请至今,SEC 尚未批准通过任何一家美国公司的申请,因此谁能拔得“美国第一支比特币ETF”的头筹,至今仍是未定之数。

2023 年以来的新变数:传统巨头入场

不过不同于之前多集中在圈内色彩浓厚的机构申请来源,2023 年以来,尤其是近半年以来,传统金融世界中的资产管理公司、投资银行等传统金融民工世界中的关键角色也开始密集进场,甚至堪称井喷,分羹意图明显。

据笔者不完全统计,2023 年 6 月以来见诸报道的已有美国资管巨头贝莱德、富兰克林邓普顿、方舟投资管理公司(Ark Investment Management)、瑞士加密货币 ETP 发行商 21Shares、资管巨头景顺(Invesco)等等:

此外,2023 年 10 月 24 日凌晨,贝莱德的 iShares 比特币信托(iShares Bitcoin Trust)更是一度被列举在美国证券存托清算公司(DTCC)交易所交易基金(ETF)清单上,交易代码为 IBTC,这也是推动比特币现货 ETF 上市的一个环节。

不过 DTCC 也强调,将证券添加到 NSCC 证券资格文件中,为向市场推出新 ETF 做准备是标准做法,出现在名单上并不表示特定 ETF 基金的任何未完成的监管或其他审批程序的结果。

尤其有意思的是,DTCC 发言人表示贝莱德的现货 ETF 实际上自 8 月份以来就一直存在,也就是说过去两个月只是没有被媒体广而告之。

总的来看,对美国的一众比特币 ETF 申请而言,目前最值得关注的其实是监管者的态度,虽然美国 SEC 主席 Gary Gensler 在任职之前被认为是加密行业的友好人士,但其接任以来并未明显有较为积极的表态(ETF 照样不通过),甚至多次言辞激烈地对加密行业进行抨击。

ETF 到底影响几何?

那 ETF 一旦通过,对加密行业的具体影响会如何?

灰度的 GBTC 信托其实就是最好的例证——最新数据显示,灰度 GBTC 负溢价率已进一步收窄至 6% 昨夜,主要原因便是市场预期美 SEC 批准将 GBTC 转换为 ETF 的可能性不断加大。

一旦转换为 ETF,由于 ETF 结构的灵活性,GBTC 将不再以大幅度的折扣或溢价进行交易。这也能从说明了 ETF 对比特币现货市场的影响究竟是什么:

带来天量规模的增量资金,打通传统主流投资者投资加密货币的道路,并尽可能推动比特币等被华尔街大规模地接受,使得加密资产配置获得更广泛的认可。

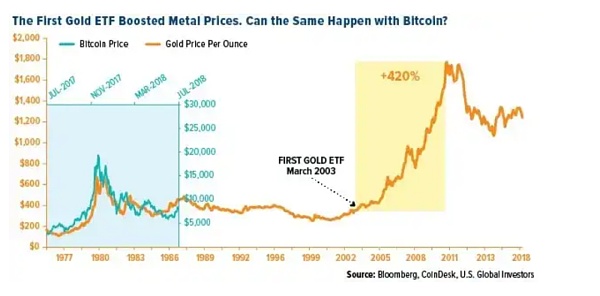

我们以黄金作为参照,首支黄金 ETF SPDR Gold Trust(GLD)于 2004 年在美国上市,在上市后的一年内,黄金价格上涨了 25%,而接下来 5 年,黄金更是上涨了 500%。

总的来看,对于 2013 年就开始吹响进攻号角的「比特币ETF」而言,经过了整整 10 年行业内众人的不断「申请-失败-再申请」循环,今年也算是终于看到了最接近成功的曙光。

尤其是贝莱德、富达等一众传统金融机构巨头相继下场,华尔街、媒体的关注度前所未有。

从这个角度看,无论是否能够在明天通过,现货比特币 ETF 都已经赢了一大步。

In the early morning of April, while the market was waiting for the final result of the application for spot bitcoin, the US Securities and Exchange Commission made a bizarre theft of a big oolong account and released false news that the spot bitcoin was approved. This false news oolong first caused bitcoin to rise rapidly, once touched the US dollar, then fell sharply and broke the US dollar at the lowest level, which once again proved the great influence of every move of the news on the spot on the secondary market. Less than an hour after the final result of Bitcoin was released, let's briefly review the development of Bitcoin and what impact it may bring in the future. Since the beginning of Bitcoin opened by my brother in, different organizations have applied for Bitcoin every year, but without exception, they all ended in failure or were rejected or voluntarily revoked by the United States, and even became a Canadian investment company that could not but wait for the application of Bitcoin for several years through the spell of forever next year. The first crab that ate bitcoin launched the world's first bitcoin and was listed on the Toronto Stock Exchange. On the first day of issuance, the transaction volume reached nearly US$ 100 million, which shows the market's expectation for bitcoin. According to the data, the number of bitcoins held by Canada has reached 10,000, and the scale of asset management has exceeded US$ 100 million. The second day after the launch, Canadian asset management companies immediately launched the second bitcoin, but the application for US bitcoin is undoubtedly the most concerned by the market. After Canada approved a series of bitcoins, the number of applications in the United States began to show a significant upward trend. Years later, the bitcoins of its hedge fund Tianqiao Capital and Fidelity subsidiary and other financial companies came out one after another, and Grayscale also planned to convert its bitcoin trust into an exchange-traded fund. The time for conversion depends on the regulatory environment. Generally speaking, since Nian Brothers first submitted a bitcoin application to the US Securities and Futures Commission, it has not been approved by any American company, so who can? Winning the first bitcoin in the United States is still a new variable for several years, but it is different from the traditional giants' admission. Since the past few years, especially in the past six months, key players in the traditional financial world, such as asset management companies, investment banks and other traditional financial migrant workers, have also begun to enter the market intensively, and even the intention of taking a share is obvious. According to the author's incomplete statistics, BlackRock Fulan, an American asset management giant, has been reported since September. Kline Templeton Ark Investment Management Company, Swiss cryptocurrency issuer, asset management giant Jing Shun, etc. In addition, BlackRock's Bitcoin Trust was once listed on the list of exchange-traded funds of the American Depository Clearing Corporation, with the trading code as a link to promote the spot listing of Bitcoin, but it is also emphasized that it is standard practice to add securities to the securities qualification documents to prepare for the launch to the market. The appearance on the list does not mean any unfinished supervision of specific funds. What is particularly interesting is that the spokesman said that BlackRock's spot has actually existed since June, that is to say, it has not been widely publicized by the media in the past two months. Generally speaking, the attitude of the regulators is the most noteworthy for a number of bitcoin applications in the United States. Although the US president was considered a friendly person in the encryption industry before taking office, he has not obviously made a more positive statement since he took office, and he still refused or even made many fierce remarks. The latest data shows that the negative premium rate of gray scale has been further narrowed until last night, mainly because the market expects that the possibility that the US approval will be converted into it is increasing. Once it is converted into a flexible structure, it will no longer be traded at a large discount or premium, which can also explain the impact on the bitcoin spot market. The incremental funds of scale open the way for traditional mainstream investors to invest in cryptocurrency and try their best to promote the large-scale acceptance of Bitcoin by Wall Street, which makes the allocation of cryptoassets more widely recognized. We took gold as a reference and listed the first gold in the United States in, and the price of gold rose within one year after listing, and the price of gold rose in the following year. Generally speaking, for Bitcoin, which began to blow the offensive horn in, it took a whole year to apply again after all the people in the industry failed. Cycle finally saw the dawn of success this year, especially BlackRock Fidelity and many other traditional financial institutions. The attention of Wall Street media is unprecedented. From this perspective, whether it can pass the spot bitcoin tomorrow has won a big step. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。