行情震荡:BTC ETF的影响还能持续多久?

2024年,随着10只新的现货ETF开始在美国市场交易,比特币的走势新年伊始就震荡如同过山车。但这次事件虽然带来了市场混乱却极具历史意义。在此期间,比特币价格创下了多年来的新高和年初至今的低点。但毋庸置疑,比特币欢迎传统金融的力量进入它的世界。

摘要

美国证券交易委员会批准上市了十种新的比特币现货ETF产品,这为比特币投资者带来了历史性的混乱一周。

比特币价格创下多年新高,随后跌至年初至今低点,周末市场抛售18%。这是由衍生品杠杆和现货获利了结推动的。

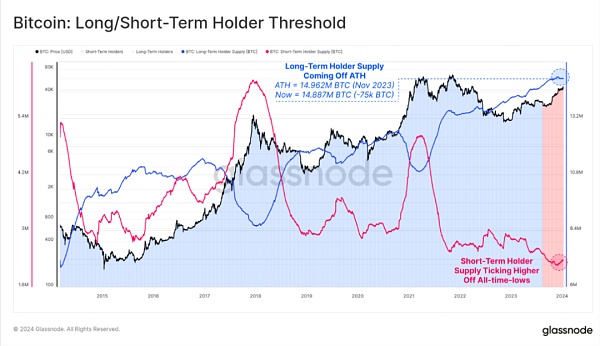

多项指标达到了过去周期遇到重大阻力时的水平,长持投资者抛售约7.5万枚比特币获利回吐。

在短短的两周内,2024年对于比特币投资者来说已经被证明是真正的过山车之旅。美国证券交易委员会批准了10种比特币现货ETF产品在美国市场进行交易,这可以说是历史上最重大的金融产品上市事件之一。

在很多方面,比特币成功地将传统金融界和美国监管机构拉入了臭名昭著的混乱和波动的世界。1月9日,在 SEC 的社媒账户被盗后,关于 ETF 被批准的消息出现了乌龙——黑客发布了虚假的批准通知。这一消息使 BTC 价格飙升至4.72万美元,但随着权威辟谣的到来,比特币价格迅速回落至4.45万美元。

第二次乌龙发生在1月10日,当时,真正的 SEC 批准文件在美国市场收盘前从 SEC 官方网站泄露。但最终,所有10种ETF产品还是均获得批准,并于1月11日开始交易。

比特币价格受此影响创下多年新高,达到略低于4.88万美元的水平。但随后在周末下跌了18%,在传统市场休市时下跌至4万美元,是年初至今的新低。即便如此,比特币仍旧再次欢迎华尔街来到它的世界。

比特币现货ETF上线

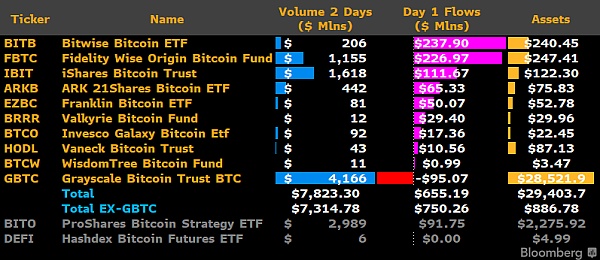

在交易的前两天,现货ETF总成交量达到78.23亿美元,流入的资产管理规模超过14亿美元。这超过了当前交易中的GBTC ETF产品的5.79亿美元的流出量,这是因为投资者在多年的投资之后进行了投资的重新分配。而究其原因,是因为后者作为封闭式基金期间的表现不佳(ETF费用最高为1.5%,低于2.0%)。

尽管有这些资金流出,GBTC 仍然是场内的ETF中的巨擘,它在两个交易日的交易量为41.66亿美元,约占交易总量的57%。在未来几周,资金仍然很可能会继续在 GBTC 内部进行流转和洗牌。

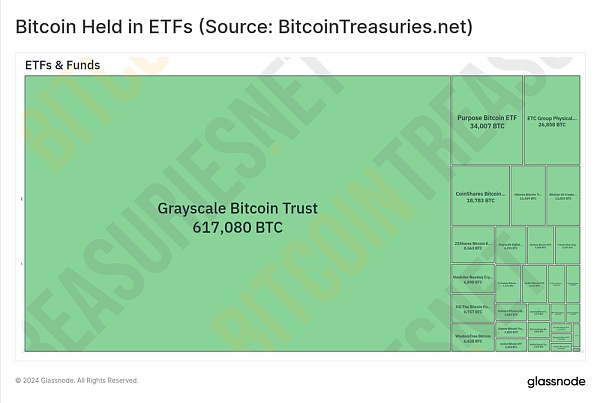

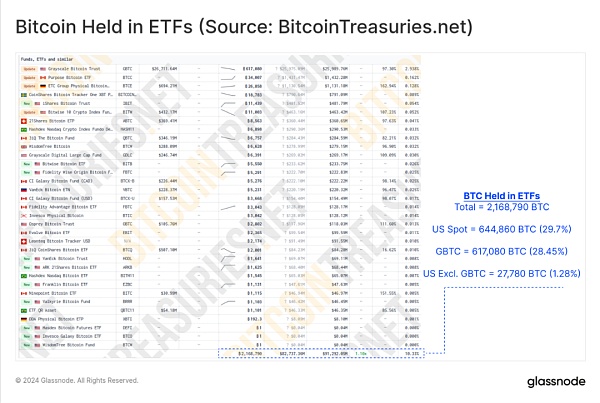

GBTC相对于其他ETF产品的绝对规模可以从下图看出。尽管GBTC出现流出,但他们持有的高达 617,080 BTC的巨额份额仍旧令竞争对手相形见绌,而且相关的流动性状况对于任何对市场流动性和深度敏感的交易者和投资者来说仍然具有吸引力。

仅仅两个交易日后,美国现货ETF产品目前总共持有量达644,860 BTC(约合272亿美元),占全球ETF持有量的29.7%。

总体而言,交易量和资产管理规模业已使其成为历史上规模最大、最重要的ETF发行事件之一,该事件在许多方面标志着比特币成熟和成长开始阶段的结束。

新闻炒作事件?

无论是减半、ETF推出,还是又一个周四的到来,比特币投资者都喜欢争论这些事件如何以“市场定价”的方式折现。尽管一路上出现了大幅波动,但比特币价格自年初至今仍基本持平,这表明这一特殊事件的定价非常完美。

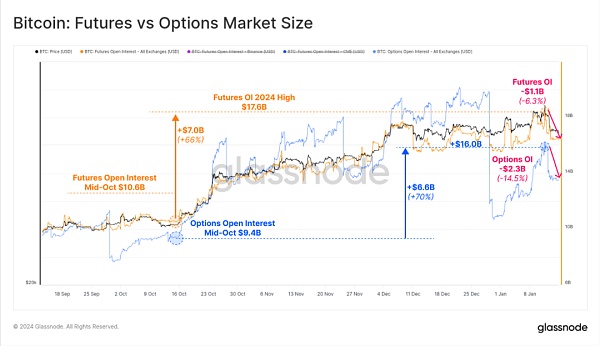

当然,中期波动背后有关键的驱动因素,自10月中旬以来,期货和期权市场的未平仓合约(OI)均出现显著上升:

BTC 期货OI(黄色)增加了70亿美元(+66%),本周有11亿美元被冲出市场。

BTC 期权OI(蓝色)增加了66亿美元(+70%),本周因合约到期和平仓兑现23亿美元。

我们仍然需要注意到,两个市场的未平仓合约仍接近多年高位,这表明杠杆率上升,并正在成为市场中更具主导性的力量。

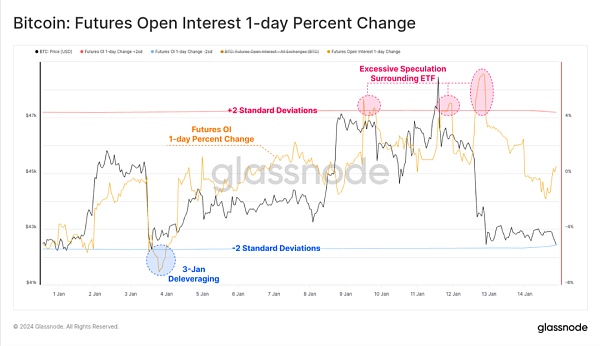

下图显示了期货未平仓合约百分比变化的振荡指标。该工具可用于发现总体市场杠杆率快速变化的时期。

(红色)高值表示OI增加了+2个标准差。

(蓝色)低值表示OI降低了-2个标准差。

我们可以看到,1月3日发生了一次重大的去杠杆事件,单日就有近15亿美元的OI被平仓。相反,随着ETF投机活动达到顶峰,1月9日至11日期间的OI显著增加,价格接近4.9万美元。

随着ETF股票的新所有者进入比特币的24/7交易环境,在周末,因抛售导致OI价格跌至4万美元。

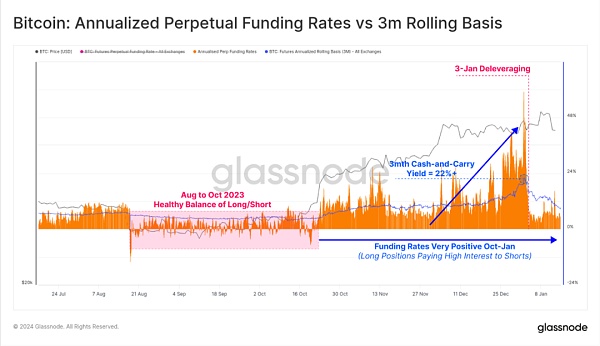

永续资金利率也一直保持着强烈的正向偏差,这当前表明杠杆交易者处于净多头状态,并且有时支付的空方年化收益率超过50%。我们还可以看到在10月中旬发生的明显阶段性转变,这表明融资利率从围绕中间位振荡的结构转变为持续正值。

本周资金利率有所降温,但总体仍保持正值。

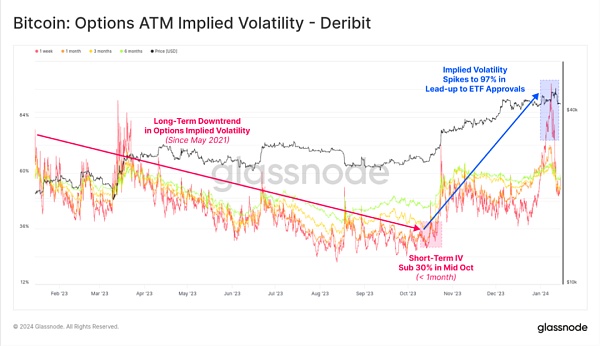

自10月中旬以来,期权隐含波动率也发生了逆转,该指标在本周的混乱中开始飙升。而自2021年5月以来,随着熊市期间,投资者的兴趣减弱,这一指标多年来一直在下降。还值得注意的是,期权市场基础设施、流动性和深度在2023年明显成熟,未平仓合约目前与期货市场持平。

期权隐含波动率(IV)这一指标的这种下降趋势似乎在短期内发生了逆转,相较于10月份约30%的低点以来增加了两倍多,本周更是达到97%以上。随着现货ETF产品为机构和零售资本打开新的大门,比特币的波动性很可能也将开始演变。

长持者与新操盘手

长期休眠比特币的持有者在重大市场事件期间做出反应是很常见的。这包括市场突破新的历史高值的时期、周期顶部和底部周围以及市场结构发生重大转变的时期(例如Mt Gox、减半以及现在推出现货ETF等)。

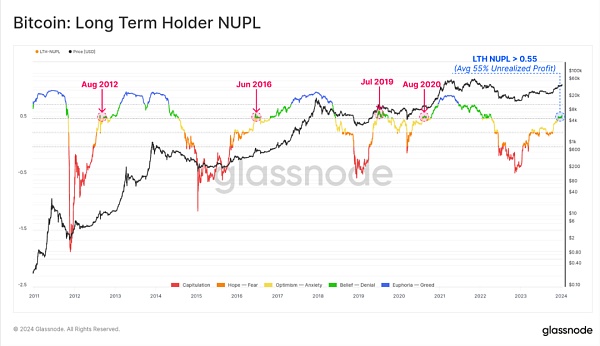

这些长持投资者持有的未实现损益程度可以通过LTH-NUPL这一指标来衡量。该指标本周达到了0.55,这是一个有意义的正数,它意味着长持投资者的平均未实现利润达到55%。这也是比特币多头在之前周期中遇到的有意义的阻力的水平。

当前,来自长持投资者的供应量也略微低于其历史高值,其自11月以来减少了约75,000BTC,因为更多的休眠比特币被用来获利了结。

虽然75,000 BTC是一个有意义的数字,但也应该在长持投资者供应总量占流通供应量的76.3%的背景下看待它。随着上述支出的发生,与此对应的指标——短持投资者供应,才刚刚从历史低点开始回升。

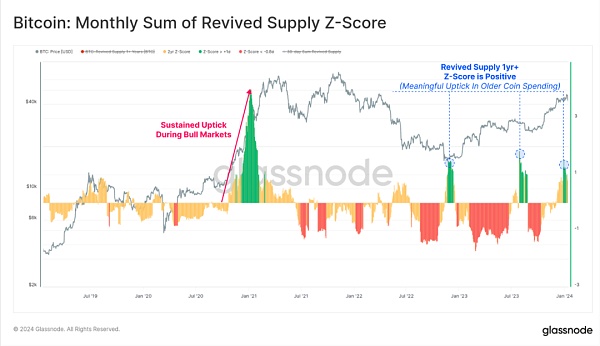

话虽如此,这些来自老操盘手的支出金额在统计上是显著的,而这也导致恢复供应(使用休眠时间超过1年的比特币)的标准差增加1。

如下图所示,尽管此类事件相对较少发生,但其发生通常与处于上升趋势的市场遇到有意义的阻力的情形相一致。

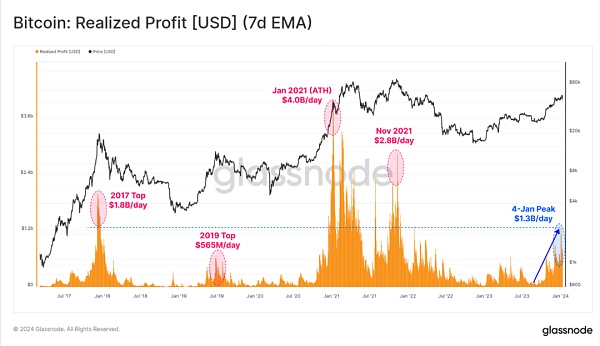

随着这些休眠已久的“旧比特币”重新投入流动市场,它们促成了自2021年11月的历史高值以来最大的获利回吐事件。在本周期中,已实现利润峰值发生于1月4日,由于这些比特币以更高的基础成本易手,因此其得以每天锁定超过13亿美元的利润。

在市场上涨趋势中,获利回吐是正常现象,真正的问题是新出现的需求是否足以吸收这一切回吐的获利。

总结

上周发生的事件无论从字面意义上还是比喻意义上来说都是历史性的。这些新的现货比特币ETF在规模上创下新纪录,行业十年的努力终于有了成果。这意味经过十多年的努力,在政治、监管和金融方面面临重大阻力的背景下,比特币现货ETF终于达成了业内所一直孜孜以求的目标。

有点诗意的是,自Hal Finney于2009年1月11日首次在推特上发表推文“Running bitcoin”以来,这套现货比特币ETF自开始交易距今已经整整15年了。而他和中本聪之间的第一笔比特币交易发生在第二天,即2009年1月12日。

链上和衍生品领域的多项指标表明,相当一部分比特币投资者确实将其视为抛售新闻。未来的关键问题是,来自ETF的需求流入,对4月份减半的预期,以及静持投资者的需求流入,是否足以突破这一阻力。

ETF上市可能已被市场定价,但它能持续多久呢?

In, with the trend that only a new spot began to trade bitcoin in the American market, it fluctuated like a roller coaster at the beginning of the new year. However, although this incident brought market chaos, it was of great historical significance. During this period, the price of bitcoin hit a new high for many years and a year-to-date low. However, there is no doubt that Bitcoin welcomed the power of traditional finance into its world. The US Securities and Exchange Commission approved the listing of ten new bitcoin spot products, which brought a historic chaotic week to bitcoin investors. The price of bitcoin hit a new high for many years, and then fell to a year-to-date low. The weekend market selling was driven by derivative leverage and spot profit-taking. Many indicators reached the level when there was great resistance in the past cycle. Long-term investors sold about 10,000 bitcoins, and profit-taking has proved to be a real roller coaster ride for bitcoin investors in just two weeks. The US Securities and Exchange Commission approved a bitcoin spot product to be traded in the US market, which can be said to be history. One of the most important financial product listing events in the world, in many ways, Bitcoin successfully pulled the traditional financial circles and American regulators into the notorious chaotic and fluctuating world. After the social media account was stolen on April, the news of approval appeared. The hacker issued a false approval notice, which made the price soar to $10,000, but with the arrival of authoritative rumors, the price of Bitcoin quickly fell back to $10,000. The second oolong occurred on April, when the real approval document was in the American market. It leaked from the official website before the close, but all kinds of products were finally approved and started trading on June. As a result, the price of bitcoin hit a new high for many years, reaching a level slightly lower than 10,000 US dollars, but then fell over the weekend. When the traditional market was closed, it fell to 10,000 US dollars, which is the lowest since the beginning of the year. Even so, Bitcoin still welcomes Wall Street to its world again. In the first two days of trading, the total spot turnover reached 100 million US dollars, and the asset management scale of the inflow exceeded 100 million US dollars. This exceeds the $ billion outflow of products currently traded, because investors have redistributed their investments after years of investment, and the reason is that the latter's performance as a closed-end fund is poor, and the highest cost is lower than that of other products. Despite these outflows, its trading volume in two trading days is $ billion, accounting for about the total trading volume. In the next few weeks, funds are likely to continue to circulate and shuffle internally. As for the scale, we can see from the following figure that despite the outflow, the huge share they hold still dwarfs their competitors, and the related liquidity situation is still attractive to any trader and investor who is sensitive to market liquidity and depth. Only two trading days later, the total holdings of spot products in the United States now reach about 100 million US dollars, accounting for the global holdings. Overall, the trading volume and asset management scale have made it the largest and most important issuance event in history. First, this event marks the end of the initial stage of maturity and growth of Bitcoin in many ways. Whether the news hype event is halved or another Thursday comes, Bitcoin investors like to argue about how these events are discounted by market pricing. Although there have been great fluctuations along the way, the price of Bitcoin has remained basically the same since the beginning of the year, which shows that the pricing of this special event is perfect. Of course, there are key driving factors behind the mid-term fluctuations since the middle of the month. The futures yellow has increased by $ billion, and the options blue has increased by $ billion this week. We still need to pay attention to the fact that the open contracts in the two markets are still close to multi-year highs due to contract expiration and liquidation, which shows that the leverage ratio has increased and is becoming a more dominant force in the market. The following figure shows the oscillation index of the percentage change of open futures contracts. This tool can be used to find the rapid change of leverage ratio in the overall market. During the period, the high value of red indicates an increase of 100 standard deviation, and the low value of blue indicates a decrease of 100 standard deviation. We can see that there was a major deleveraging event on January, and nearly 100 million US dollars were liquidated in a single day. On the contrary, with the peak of speculative activities, the price was close to 10,000 US dollars. As the new owner of the stock entered the bitcoin trading environment, the price fell to 10,000 US dollars due to selling at the weekend, and the interest rate of perpetual funds has maintained a strong positive deviation. This shows that leverage at present. Traders are in a net long position and sometimes pay more than the annualized rate of return of the short position. We can also see the obvious stage change in the middle of the month, which shows that the financing interest rate has changed from a structure that oscillates around the middle position to a continuous positive value. This week, the interest rate of funds has cooled down, but the overall interest rate has remained positive. Since the middle of the month, the implied volatility of options has also reversed. This indicator has soared in this week's chaos and has weakened with the interest of investors during the bear market since January. It is also worth noting that the liquidity and depth of the infrastructure in the options market are obviously mature in 2008. The open interest contract is now at the same level as the futures market. This downward trend of the index of implied volatility of options seems to have reversed in a short period of time, which has more than tripled since the low point of the month. This week, it has reached the above level. As spot products open new doors for institutions and retail capital, the volatility of Bitcoin is likely to begin to evolve. Long-term holders and new traders have been dormant for a long time. It is very common for holders to react during major market events, including the period when the market breaks through a new historical high value, the period around the top and bottom of the cycle, and the period when the market structure has undergone major changes, such as halving and now launching the spot, etc. The degree of unrealized gains and losses held by these long-term investors can be measured by this indicator, which has reached a meaningful positive number this week, which means that the average unrealized profits of long-term investors have reached, which is also the week before Bitcoin bulls. The level of meaningful resistance encountered in the interim is also slightly lower than its historical high value, which has decreased since January because more dormant bitcoins have been used for profit-taking. Although it is a meaningful figure, it should also be viewed in the context that the total supply of long-term investors accounts for the circulation supply. With the occurrence of the above expenditures, the supply of short-term investors has just started to rebound from the historical low point. Even so, the amount of expenditures from old traders is statistically significant, which also leads to the standard deviation of bitcoin that has been dormant for more than years. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。