去中心化数据与人工智能协同作用下透明高效的中小企业贸易融资

作者:Marjan Alirezaie, William Hoffman, Paria Zabihi, Hossein Rahnama and Alex Pentland;来源:JRFM;编译:刘诗钰

2024年1月,JRFM发布了“Decentralized Data and Artificial Intelligence Orchestration for Transparent and Efficient Small and Medium-Sized Enterprises Trade Financing”一文,该文对人工智能对中小型企业融资的作用进行了研究。由于数据源的差异性、合同的冲突、居住要求以及贸易金融供应链中对多种人工智能(AI)模型的需求,中小型企业(SMEs)由于资源有限,在利用人工智能能力以提高业务效率和可预测性方面受到阻碍。本文介绍了一种去中心化的AI编排框架,该框架优先考虑透明度和可解释性,为资金提供方(如银行)提供有价值的洞察,帮助他们克服评估SMEs财务信誉所面临的挑战。通过利用涉及符号推理器、语言模型和数据驱动的预测工具的编排技术,该框架使资金提供方能够就现金流预测、融资利率优化和生态系统风险评估做出更加明智的决策,最终促进SMEs更好地获取出货前贸易融资,增强整个供应链运作。中国人民大学金融科技研究所(微信ID:ruc_fintech)对研究核心部分进行了编译。

引言

全球经济的命脉——中小型企业(SMEs)在全球范围内提供了三分之二的就业机会,贡献了超过50%的全球GDP。尽管它们的重要性不言而喻,但SMEs在获取用于资助运营的营运资本方面面临着巨大挑战。这种限制可能严重影响它们的增长、扩张和竞争力。供应链中的SMEs由于评估其信用风险的困难,面临一系列额外的流动性挑战。它们通常有限的财务历史记录以及缺乏或不成熟的业务指标,使得金融服务提供商难以评估它们的信用状况并提供适当的贸易融资条件。这些因素可能导致SMEs在贸易融资方面长期被忽视,大约50%的融资申请被拒绝。SMEs通常不得不依赖出货后融资,这进一步导致了它们满足营运资本需求的过程中的低效率和延误。

本文基于一项为期多年、由联邦资助的政府试点项目的初步发现,推进了新兴人工智能(AI)和数据技术的应用——尤其是替代数据源和协同AI模型——以提高SME贸易信用风险评估的效果。该项目专注于使用人工智能(AI)创新性地强化供应链的韧性。本文提出了一个创新的框架,它在以下三个维度进行创新:

- 一个由AI驱动的协同能力套件(包括机器学习、机器推理和知识图谱),以提高AI使用的准确性、可靠性和合规性;

- 一个去中心化的、跨行业数据集网络,这些数据集已预先批准、符合法律合规,并旨在解决一系列潜在的隐私和数据风险;

- 提供基于文本的自然语言界面,依赖于大型语言模型(LLM),作为将决策支持能力扩展到一线从业者和相关利益相关者的手段。

这些基于AI的技术创新集体上旨在解决SMEs长期的流动性挑战,以加强供应链的韧性。除了增加向SMEs的营运资本流动(通过改善对出货前贸易融资的访问),本文还提供了关于如何实施可信AI治理原则和负责任的公私数据合作,以确保结果商业可持续、包容且值得信赖的新见解。

正如公私数据合作文献中广泛指出的,企业数据资产在用于公共利益的再利用方面被广泛低估。本文提供了一个更全面和应用性的理解,关于企业数据资产和协同AI能力如何可以被负责任且合法地整合和使用,以加强供应链的韧性以及全球供应链中SME供应商的经济增长。

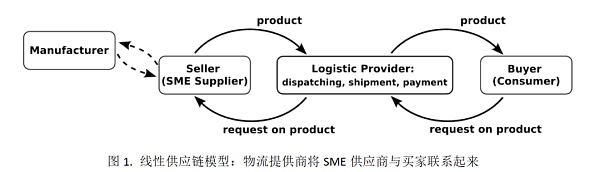

传统的线性供应链模型如图1所示。它由买家、中小型企业(SME)供应商和物流提供商组成。过程从买家对SME卖家提供的产品或服务表示兴趣开始。物流提供商在交付货物、管理物流和促进买家与SME卖家之间的沟通中扮演着关键角色。在此模型中,SME从制造商购买的货物提供了生产所需以满足客户订单的货物的必要资金。这意味着,如果SME没有足够的营运资本来交付发票中详细说明的物品,他们可能无法提供产品,这可能导致供应链中断。

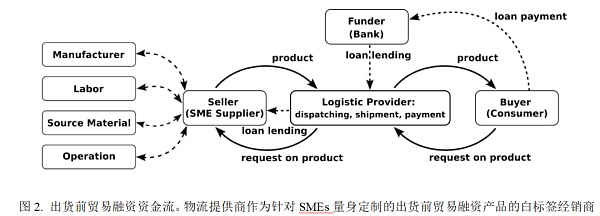

为应对这些挑战,作者提出了一个非线性的贸易融资模型,如图2所示,其中物流提供商和资金提供者共同以物流提供商向其SME供应商提供白标签出货前贸易融资的经销商协议进入市场。这个模型旨在帮助SMEs克服出货前的营运资本挑战,加强SMEs与物流提供商之间的关系,并为金融服务提供商创造市场扩张机会。

如图2所示,所提出的非线性贸易融资模型对供应链内SMEs、物流提供商和金融服务提供商之间的现有关系产生了显著影响。这个模型旨在解决SMEs的出货前营运资本挑战,加强SMEs与物流提供商之间的关系,并为金融服务提供商创造市场扩张机会。通过向SME供应商提供白标签出货前贸易融资,物流提供商成为促进SMEs金融需求的关键参与者。这不仅加强了SMEs与物流提供商之间的关系,还为他们的合作创造了一个新的维度,因为物流提供商在为SMEs提供财务支持方面扮演了角色。此外,该模型为金融服务提供商创造了市场扩张机会,使他们能够提供独特定制的解决方案来解决SME流动性问题。这种对SME信用状况的改进理解使银行能够以更具吸引力的利率提供贷款,最终降低了这些公司的资本成本。

在深入探讨所提方法的技术细节之前,作者简要回顾了现有解决方案和文献中解决类似问题的发展情况。

人工智能驱动的供应链解决方案:材料与方法

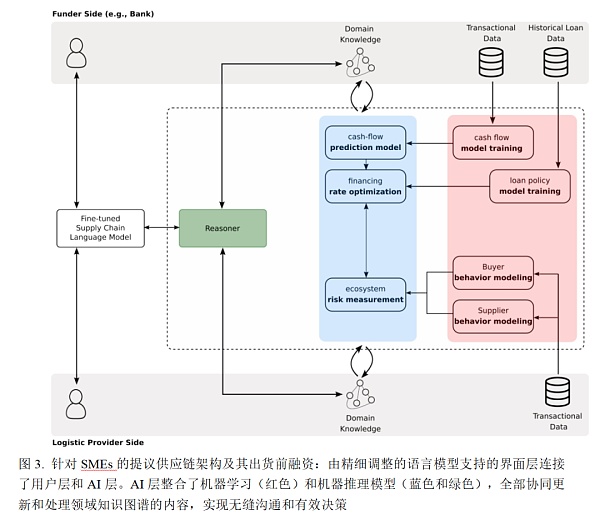

图3提供了针对中小型企业(SME)出货前贸易融资协调员的建议架构的概览。在应用层,该架构由两个主要部分组成:界面层(白色部分)和AI层(由绿色、蓝色和红色显示的子层组成)。此外,该系统涉及各种角色,如资金提供者、买家和SME供应商,他们都与系统进行交互。在本节中,将提供对所提出的协同AI模型的深入解释,阐述所涉及的材料和方法。

2.1数据

该模型的架构整合了来自物流、银行和供应等不同商业领域的交易数据。物流提供商贡献的数据包括装运细节、发票、客户档案和反映财务行为(如付款延迟和交易价值)的元数据。这种静态(客户信息、位置)和动态(带时间戳的发票解决方案)数据的混合提供了对客户互动的全面视图。金融机构(如银行)通过交易记录、存取款时间戳、贷款历史和遵守银行政策等数据增加深度。

值得一提的是,为了实施所提模型,作者提倡使用分布式和跨域数据源,提供对专门设计用于分析和解释特定领域数据的协同AI算法套件的授权访问。如图所示,基于API的数据传输架构使得跨机构和边界的洞察(通过预定义查询)的传输成为可能,但原始数据不会跨机构或地理边界移动。这确保了一种去中心化的方法,消除了集中所有数据的需求,并减少了数据传输实例,可能缓解了安全和隐私方面的担忧。第4节将详细介绍数据去中心化,涵盖其分布式特性、提高的安全性、可扩展性和效率。

2.2 方法

如图3所示,开发协同AI解决方案的方法依赖于神经符号方法(Hitzler et al., 2022),该方法由数据驱动的机器学习技术(由红色层表示)与知识驱动模型(由蓝色和绿色层表示)的融合组成。从最接近原始数据的右侧开始,红色层包含持续进行的学习过程,这些过程不断从各种来源接收数据并更新模型的参数,以确保其相关性和准确性。相比之下,蓝色层选择了迄今为止训练精度最高的最佳性能模型,并将其与来自不同方,包括资金提供者、物流提供者等的额外领域知识整合。

在融合学习和推理模型的提出的神经符号架构中,过程始于学习阶段,不同的AI模型在此阶段被训练以理解和解释数据。一旦模型训练完成,就会应用推理阶段。这个推理阶段至关重要,因为它验证了生成和预测响应的合理性和一致性。通过结合这两个方面——从数据中学习和应用逻辑推理——系统确保响应不仅基于学习到的模式,而且遵循逻辑框架,从而导致更准确和可靠的结果。

本文所提出的协同AI框架包含了用多样化数据集训练的不同类型的AI模型。为了协调分布式数据源训练的结果和模型,作者采用了用这些多样化模型的输出填充的知识图谱,使整个过程易于进行推理。这种协同AI方法在解决需要从各种数据源获取洞察的问题中发挥着关键作用。通过赋予商业从业者与跨行业数据进行可靠交互的能力,本文展示了目前正在进行试点测试的新兴框架。这些框架增强了供应链生态系统中中小型企业(SMEs)的韧性和增长潜力。此外,它们还揭示了为金融服务提供商提供附加价值的创新方式。借助AI,这些提供商可以更深入地了解不同SMEs、物流提供商和生态系统风险之间的现金流动态,最终使市场能够提供更高效的贸易融资解决方案。

总之,本文提出了一个独特的系统,该系统整合了一个使用精细调整的大型语言模型的用户友好界面层和一个新颖的参考架构,以满足供应链用户和角色的多样化需求。该界面通过将查询转换为正式脚本,以便于与AI层的交互,然后使用机器学习技术和知识驱动模型的组合进行处理。这种创新方法不仅增强了数据处理和模型性能,而且还建立在对SME挑战的现有理解基础上。它与之前专注于金融创新和供应链融资(SCF)解决方案的研究不同,后者通常缺乏普遍适用性并且需要复杂的技术基础设施。相比之下,我们的系统使商业从业者能够使用先进的计算模型应对复杂挑战并做出明智的决策,从而加强全球供应链的韧性。我们的模型独特地融合了AI编排与数据去中心化,强调AI与去中心化数据之间的协同作用。这不仅提高了SMEs的效率和金融准入,还代表了贸易融资中AI和技术创新的新路径,突出了与以往研究在这一领域的相似之处和关键差异。

为了验证AI模型的最终响应,特别是考虑到数据集的多样性和不同的经济条件,作者强调在验证过程中涉及人类专家的参与。这种方法认识到了人类判断和专业知识在评估AI生成响应的准确性和可靠性方面的重要性。因此,所提出的系统更多地作为这些专家的助手,而不是人类决策的替代品。AI模型提供了有价值的见解和分析,但最终的决策权仍然掌握在人类专家手中,他们可以以更广泛和更细腻的方式解释和放置AI的发现。这确保了AI在复杂和多变的环境中的平衡和有效使用。

在下一步中,作者旨在将所呈现的模型推进到超越目前的示范级实施,后者依赖于人工生成的数据。通过在实时商业环境中利用现实世界的数据,目标是验证模型的商业、法律、运营和伦理方面,确保其实际可行性和相关性。

所提出方法的好处是多方面的,正如我们在引言部分所讨论的那样,它们如下:

对工作资本的获取对于企业的增长和成功至关重要,尤其是对于跨国物流公司而言。通过授予资金提供者他们的数据访问权限,物流提供商不仅增加了对他们合作的SMEs信用状况的了解,而且还使银行能够为流动性问题提供量身定制的解决方案。直接参与方法确保了个性化和有效的沟通,为物流提供商提供了必要的支持和财务解决方案。银行通过使用高级AI分析技术来深入了解发票、付款条款、应收账款、应付账款和其他财务方面的信息,可以更好地理解物流提供商的运营、现金流和业务周期。这种改进的理解使银行能够以更有吸引力的利率提供贷款,从而降低这些公司的资本成本。

Liu Shiyu, the author's source compilation, published an article in June, which studies the role of artificial intelligence in financing of small and medium-sized enterprises. Due to the differences of data sources, the conflicting requirements of contracts and the demand for various artificial intelligence models in the trade and finance supply chain, small and medium-sized enterprises are hindered in using artificial intelligence capabilities to improve business efficiency and predictability due to limited resources. This paper introduces a decentralized arrangement framework, which gives priority to transparency and interpretability as funds. Providers, such as banks, provide valuable insights to help them overcome the challenges of evaluating financial reputation. By using the arrangement technology involving symbolic reasoning language model and data-driven forecasting tools, this framework enables fund providers to make more informed decisions on cash flow forecasting, financing interest rate optimization and ecosystem risk assessment, and ultimately promote better access to pre-shipment trade financing and enhance the operation of the entire supply chain. WeChat at the Institute of Financial Technology of China Renmin University is the core part of the research. Small and medium-sized enterprises, the lifeblood of the global economy, have provided two-thirds of employment opportunities and contributed more than the whole world. Although their importance is self-evident, they are facing great challenges in obtaining working capital for financing operations. This restriction may seriously affect their growth, expansion and competitiveness. Due to the difficulty in evaluating their credit risk, they are faced with a series of additional liquidity challenges. They usually have limited financial history and lack or fail. Mature business indicators make it difficult for financial service providers to evaluate their credit status and provide appropriate trade financing conditions. These factors may lead to long-term neglect in trade financing. About financing applications are rejected, and they usually have to rely on post-shipment financing, which further leads to their inefficiency and delay in meeting working capital requirements. Based on the preliminary findings of a government pilot project funded by the federal government for many years, this paper promotes the application of emerging artificial intelligence and data technology. In order to improve the effect of trade credit risk assessment, the project focuses on using artificial intelligence to creatively strengthen the resilience of supply chain. This paper puts forward an innovative framework, which innovates in the following three dimensions, a driven collaborative capability suite including machine learning, machine reasoning and knowledge map to improve the accuracy, reliability and compliance of use, and a decentralized cross-industry data set network. These data sets have been pre-approved to meet legal compliance and In order to solve a series of potential privacy and data risks, providing a text-based natural language interface relies on a large-scale language model as a means to extend decision support capabilities to front-line practitioners and related stakeholders. These technological innovations are collectively aimed at solving long-term liquidity challenges and strengthening the resilience of the supply chain. In addition to increasing the flow of working capital and improving access to pre-shipment trade financing, this paper also provides information on how to implement the principle of credible governance and responsible fairness. Private data cooperation to ensure the sustainable, inclusive and trustworthy results of business. As widely pointed out in public-private data cooperation literature, enterprise data assets are widely underestimated in the reuse of public interests. This paper provides a more comprehensive and applied understanding of how enterprise data assets and collaborative capabilities can be integrated and used responsibly and legally to strengthen the resilience of the supply chain and the economic growth of suppliers in the global supply chain. The traditional linear supply chain model is shown in the figure. It shows that it is composed of buyers, small and medium-sized enterprises, suppliers and logistics providers. From the time when buyers express interest in products or services provided by sellers, logistics providers play a key role in delivering goods, managing logistics and promoting communication between buyers and sellers. In this model, goods purchased from manufacturers provide the necessary funds to produce goods needed to meet customers' orders, which means that if there is not enough working capital to deliver the goods specified in the invoice, they may not be able to provide production. This may lead to the interruption of supply chain. In order to cope with these challenges, the author puts forward a nonlinear trade financing model, as shown in the figure, in which logistics providers and fund providers jointly enter the market with the dealer agreement that logistics providers provide their suppliers with white label pre-shipment trade financing. This model aims to help overcome the working capital challenges before shipment, strengthen the relationship with logistics providers and create market expansion opportunities for financial service providers. The nonlinear trade financing proposed in the figure is shown. The capital model has a significant impact on the existing relationship between logistics providers and financial service providers in the supply chain. This model aims to solve the working capital challenge before shipment, strengthen the relationship with logistics providers and create market expansion opportunities for financial service providers. By providing suppliers with white labels, logistics providers become key participants in promoting financial demand, which not only strengthens the relationship with logistics providers, but also creates a new cooperation for them. Dimension because logistics providers play a role in providing financial support, in addition, this model creates market expansion opportunities for financial service providers, so that they can provide unique customized solutions to solve liquidity problems. This improved understanding of credit status enables banks to provide loans at more attractive interest rates, which ultimately reduces the capital costs of these companies. Before going into the technical details of the proposed methods, the author briefly reviews the existing solutions and similar solutions in the literature. The development of the problem The artificial intelligence-driven supply chain solution materials and methods diagram provides an overview of the proposed framework for the pre-shipment trade finance coordinator of small and medium-sized enterprises. At the application level, the framework consists of two main parts: the interface layer, the white part and the layer, which are displayed in green, blue and red. In addition, the system involves various roles, such as fund providers, buyers and suppliers, who all interact with the system. In this section, an in-depth explanation of the proposed collaborative model will be provided. Materials and method data involved: The framework of this model integrates transaction data from different commercial fields such as logistics banks and suppliers, and the data contributed by logistics providers include shipping details, invoices, customer files and metadata reflecting financial behaviors such as payment delay and transaction value. The mixture of static customer information location and dynamic time-stamped invoice solution data provides a comprehensive view of customer interaction. Financial institutions such as banks increase the depth of data such as deposit and withdrawal, time stamp, loan history and compliance with bank policies through transaction records. It is worth mentioning that in order to implement the proposed model, the author advocates the use of distributed and cross-border 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。