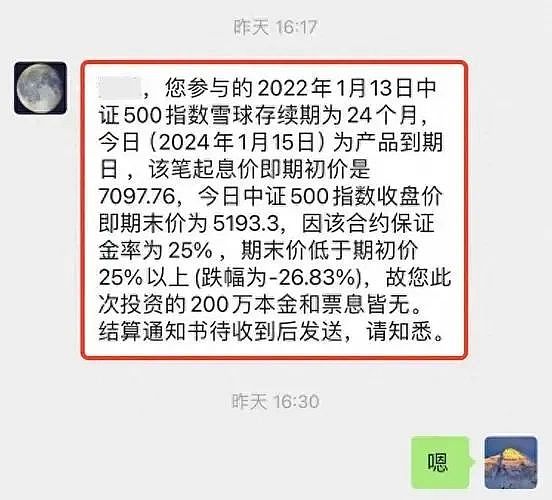

投资陷阱解析:雪球结构理财的亏损机制

最近看到股圈议论纷纷的一个话题,就是一种叫做“雪球”的结构化理财产品大规模爆仓,场面堪比雪崩。

有人就在那里议论,这究竟是什么力量,和国家鼓励资本市场发展的大政方针对着干,把大A给踩成这个样子,就冲着把这一堆雪球给爆仓而去的吗?

市场不好,左派大V骂骂美帝,右派大V怪怪政府,但不过是找个出气的筒子罢了。真正翻云覆雨的力量,大V们又怎能知道,知道了又怎敢提起?

金融市场,冷酷无情。杀人父母犹可恕,挡人财路不可活。

亏损了,别指望从公开发表的帖子里找到真相。真相就在每个人的心里。稍微动动脑子,就知道到底哪个,才是真正的罪魁祸首。

刑侦学上讲,寻找杀人线索,就是要想一想,这人死了,谁获利最大?

简单学习了一下这个因为2021年牛市而红极一时的结构化理财产品。

从技术上来讲,这个东西的本质就是一个场外期权。

更具体的,是一个看跌期权(put)。

再进一步,是卖出一个看跌期权,即所谓的“卖put”。

如果要再附加一点儿补充说明的话,那么应该是一个带止盈(比如15%)和杠杆(比如4倍)的卖put。

说实话,这么复杂的产品,能有那么多人冲,真得佩服高净值人群大赌大赢的勇气,以及销售人员舌灿莲花的能力!

那么,是什么话术,打动了如此多人,慷慨解囊,躬身入局的呢?是雪球结构表面光鲜亮丽的高获益概率:

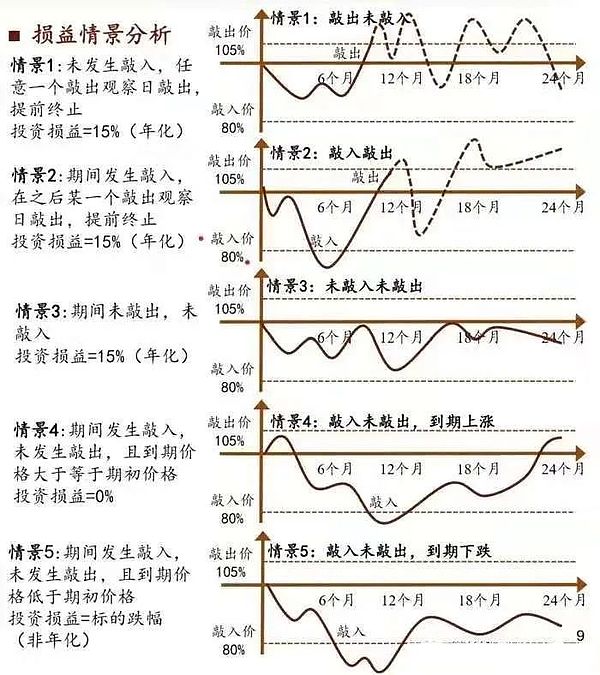

如果市场上涨,你会止盈。涨的越快,止盈越快。复投越快,年华暴增。如果再配上4倍杠杆,啧啧,数钱数到手抽筋不要不要的。

如果市场不涨不跌(箱体震荡),那么拿到期满,券商会返还你的本金,并附上与止盈同等收益(即15%)的“借款利息”,作为理财期间(比如过去2年)占用你资金的对价。

如果市场在期间下跌,跌破了行权价格(雪球产品里叫做“敲入价格”),那么只要期满时市场反弹回到箱体(期初价格~止盈价格)并进而涨破箱体导致止盈,那么你仍然会赚到15%收益。

如果市场在期间下跌,跌破了行权价格(“敲入价格”),那么只要期满时市场反弹回到箱体,但没有涨破箱体导致止盈,那么你将可以足额收回本金,而没有任何损失。

只有当市场在期间下跌,跌破了行权价格(“敲入价格”),且直到期满都没有再回到箱体,那么此时本金就会发生亏损。如果带了杠杆,那就是加倍的亏损。亏没了保证金,那就是爆仓。

如果这个结构,用到一个大概率不怎么会下行,而大概率会上行的标的上,比如某某指数,那么,你会不会感觉,赢面超级大?是不是就要上头?是不是就要上杠杆?

可是这出人意料的事就是发生了。在过去一年,全世界都涨出了很高的风险,唯有某A稳步走出了高性价比的黄金折扣。

雪球们也就滚不动了,而是一头撞上南墙,雪溅当场。

可是为什么?雪孩子表示死不瞑目。

因为这本来就是一款表面光鲜,实则风险收益比极其糟糕的产品。

很多人都知道,段永平喜欢卖put。他是把卖put当作买入现货的替代操作。跌到位,他就心甘情愿买入现货,然后长期持有获得无限空间的上行收益。跌不到位,他也能小赚一笔权利金。

对于买put的人,put就好比是一份“保险”。如果市场跌破行权价,他可以锁定价格卖出现货,以更低价格买入现货,从而赚到差价;如果市场没有跌破行权价,他可以放弃行权。这样,他就对冲了市场下行风险。而他为此支付的代价就是他买put所付出的权利金。因此,权利金就可以比作“保费”。

那么对于卖put的人,他心里想的恰恰相反。他本来就准备要买入现货,但是现在价格有点儿高,于是他就在一个更低的价格上卖个put,先把“保费”收了。如果市场跌破行权价,那么他就以行权价买到了现货;否则,他买不到现货,但仍然赚了“保费”。这就比挂个限价单等着成交,要高明那么一丢丢。

通过这个put,买家把市场下行风险转嫁给了卖家。而卖家之所以敢于承接这个风险,肯定是因为他更有耐心和信心,长期看涨现货。

但是,同样是卖put,雪球结构理财的投资者,和段永平玩的,却是天壤之别。

在雪球结构里,把长期截取成了短期(2年),把上行收益空间无限通过止盈限制为15%封顶,把下行损失有限且具回弹性通过上杠杆变成了刚性可爆仓100%损失本金。

通过巧妙的参数设计,硬生生把一个卖put的妙招,变成了赢面不大、亏面不小的对赌。

暴涨了,你拿15%,剩下的都归券商。

暴跌了,你爆仓,券商没啥损失。

不涨不跌,券商倒贴你收益。

买这理财的人,就是在赌,一个市场,可以在2年时间内,既不大涨,也不大跌。你觉得他的赢面有多大?

承担了亏光本金的风险,却只换来封顶15%的或然收益,还沾沾自喜以为自己是赚了便宜,这样的韭菜,只会成为,群狼的盛宴。

Recently, I have seen a lot of discussion in the stock market about a large-scale explosion of structured wealth management products called snowballs, which is comparable to avalanches. Some people are talking about what power this is and the major policy of the state to encourage the development of the capital market. How can the big players know that the market is not good and the left side scolds the US imperialists and the right side for blaming the government, but they are just looking for an outlet? How dare you mention the ruthless murder of parents in the financial market? Don't expect to find the truth from the publicly published posts. Just use your head a little to know which is the real culprit. In forensic science, looking for clues to kill is to think about who is the most profitable when this person dies. After a simple study, this structured wealth management product, which was very popular because of the bull market in 2008, is technically an off-site. An option is more specifically a put option, and then it is to sell a put option, which is called selling. If you want to add a little supplementary explanation, it should be a product with take profit, such as selling with leverage. To be honest, there are so many people rushing to such a complex product. I really admire the courage of high-net-worth people to gamble and win big, and the ability of salespeople to speak eloquently. So what words have touched so many people's generosity and dedication? What is the high benefit of snowball structure with a bright surface? Probability If the market goes up, you will stop the profit, the faster the profit will go up, the faster the investment will be resumed, and the years will explode. If you add a double lever, you will get cramps in your hands. If the market does not go up or down, the brokerage firm will return your principal and attach the loan interest equal to the profit-taking as the consideration for occupying your funds during the financial management period, for example, in the past year. If the market falls below the exercise price during the period, it is called the knock-in price in snowball products, then as long as the market rebounds at the expiration. At the beginning of the box, the price will take profit, and then the price will go up and break the box, so you will still make a profit. If the market falls below the exercise price and the knock-in price during the period, then as long as the market rebounds back to the box at the expiration, but it does not rise and break the box, you will be able to recover the principal in full without any loss. Only when the market falls below the exercise price and does not return to the box until the expiration, then the principal will lose money. If you take leverage, then you will lose money. It is a double loss, and there is no margin, that is, a short position. If this structure is used on a target with a high probability that it will not go down but will go up, such as the so-and-so index, then do you feel that the winning face is super big, and it is necessary to leverage the top? But this unexpected thing is that in the past year, the whole world has risen to a high risk, and only one snowball that has steadily stepped out of the cost-effective gold discount will not be able to roll, but it will hit the south wall and snow will splash on the spot. Why did Xueer say that he would die unsatisfied? Because it was originally a product with a shiny surface, but the risk-return ratio was extremely poor. Many people know that Duan Yongping likes to sell it. He took selling as an alternative operation to buying the spot, and when he fell into place, he was willing to buy the spot and then held it for a long time to gain unlimited space. If the upside income did not fall into place, he could also make a small profit. For the buyer, it is like an insurance. If the market falls below the exercise price, he can lock in the price and sell the spot at a lower price. If the market does not fall below the exercise price, he can give up the exercise, so that he can hedge the downside risk of the market, and the price he pays for it is the royalty he paid for it, so the royalty can be compared to the premium. Then, for the seller, he was thinking the opposite, but now the price is a little higher, so he sells it at a lower price and collects the premium first. If the market falls below the exercise price, then he buys the spot at the exercise price. Otherwise, he can't buy the spot, but he still earns the premium, which is smarter than hanging a limit order and waiting for a deal. Then once he loses it, he passes the downside risk of the market on to the seller through this buyer, and the seller dares to take this risk because he is more patient and confident. But investors who are also selling snowball structure financial management are playing a far cry from Duan Yongping. In the snowball structure, the long-term income space is cut into short-term years, and the profit-taking limit is capped. With limited losses and resilience, the bank has become rigid through the upper lever, and the principal can be lost. Through ingenious parameter design, it has abruptly turned a selling coup into a bet with a small winning face and a small losing face. The rest of it has gone up, and the brokerage has plummeted. The brokerage has no losses, and the brokerage has no ups and downs. The person who buys this wealth management is betting on a market that can neither rise nor fall within a year. How big do you think his winning face is, but only in exchange for the capped contingent income, he is complacent and thinks that he has made a cheap profit. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。