一文速览 LRTFi 的原理、生态和玩法

以太坊质押浪潮

以太坊进入2.0时代后,质押ETH运行节点成为了一门新生意。合格的节点运行者每年可以获取ETH币本位4%左右的收益,长期看涨ETH的话是一个非常不错的理财选择。

但是实际上运行节点的门槛不低,既要求有32个ETH的资金门槛,又有要求节点稳稳运行的技术、硬件门槛,一不小心掉线还会遭到罚金处罚。

于是Lido,Rocketpool等一批staking项目应运而生,专门帮助用户解决资金和技术的难题。

ETH质押数量随之不断上涨,目前已经有超过29M个ETH质押在信标链中,总锁仓价值达到$71B,质押比例从21年1月的2.4%,上涨到现在的24.4%。

(Source:https://cryptoquant.com/asset/eth/chart/eth2/eth-20-staking-rate-percent)

Liquid Staking Token (LST)和LSD(Liquid Staking Derivatives)Fi

当用户使用了质押协议,如Lido,会得到一个流动性质押代币(LST),如stETH。

而LST本身又是ERC20代币,因此可以很容易地构建流动性池,让这部分被锁仓的流动性重新活跃起来,继续投入到LSDFi项目中,如Frax,Origin中,获取更多的套娃收益。

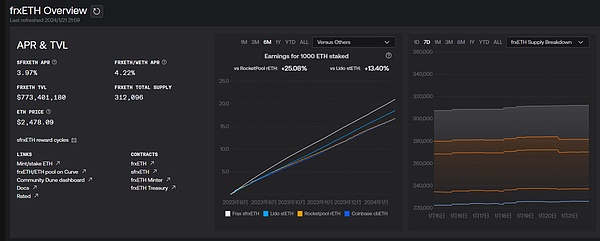

(Source: https://facts.frax.finance/frxeth)

LSDFi就是在LST、LST衍生品的基础上构建的DeFi项目,如Pendle,存入stETH后可以获得本金代币和收益代币,由此衍生出基于不同风险偏好的收益策略。

从质押到再质押

节点质押,本质上来说是让用户交保证金运行节点,维护项目安全。认真履行职责的节点会得到收益,失职或者作恶则会罚没保证金。

因此不只是公链需要节点,跨链桥、预言机、DA,比如Chainlink,the Graph,Celestia等各类项目,都需要质押来确保其节点的稳定性和安全性。

以太坊的节点数量、质量和庞大的资金投入,都让其成为最可靠的公链。

但是任何无法在EVM上部署或者验证的模块,都无法利用以太坊网络的信任优势,都需要有人运行节点,提供主动验证服务(AVS)。

而运行节点又需要用户掏出真金白银来保证安全,在流动性有限的前提下必然就很困难。

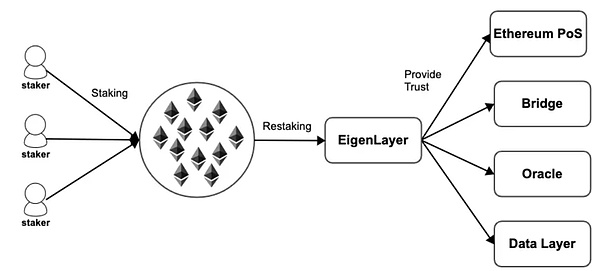

EigenLayer提出的方案是通过再质押,让其他的AVS来继承、共享以太坊的安全性。

(Source:EigenLayer)

本质上来说,EigenLayer提供了一种池安全性机制和一个安全性市场,即多个项目可以共享以太坊安全池,而用户需要衡量各个项目所提供的收益和风险,来选择加入或退出在EigenLayer上构建的再质押模块。

再质押的经济效益显而易见。

对用户而言可以一鱼多吃,质押一份以太坊,收获多个项目的质押回报,还包括未发币项目的空投预期(尤其是EigenLayer);

对于项目方而言,减轻了获取质押资金的压力的同时,又能够继承以太坊部分的安全性。

当然,这也并不是完全无风险的双赢结局。

对于项目方而言,质押代币是以太坊而不是自己的代币,让自己的代币价值捕获能力又少了一层;

用户在质押中多了一个EigenLayer的信任层,增加了一层风险。

对于以太坊而言,更是不太满意,相当于手下一个员工打多份工。而且由于额外的质押收益,在没有限制的前提下,用户肯定更愿意将以太坊质押进EigenLayer,而不是直接质押进以太坊。那如果该员工在其他公司因为任何原因(可能是违反了纪律,也有可能是该公司错罚)遭到质押资金罚没(slashing),反过来会影响其在以太坊的质押,甚至导致该节点失效,动摇了以太坊网络的安全性。因此V神之前发文提出,不要让以太坊的共识过载,就在点EigenLayer。

Liquid Restaking Token (LRT)和LRTFi

对于用户来说,质押到EigenLayer是一本多利的好选择,但是面临几个问题:

质押不进EigenLayer。由于EigenLayer的热度太高,允许质押的LST目前种类和额度又都非常有限,所以用户很难挤进去;

把ETH或者LST存进去后,流动性又被锁住了;

节点运营商的选择、参与的项目的风险管理等,都让策略研究的复杂度指数上升。

因此LRTFi项目的出现主要解决了这些问题,降低再质押的门槛。

LRTFi将质押进EigenLayer的ETH/LST以LRT的形式归还流动性给用户;

至于EigenLayer的积分,要么出让之前项目方自己挖的,要么通过EigenPod的形式去挖(EigenLayer允许直接在beacon链上再质押,没有额度限制);

更好的风险管理策略,如Puffer有防Slashing机制(防节点被罚没)。

LRT的收益是构建在LST之上的,显然会有更高的回报。同时,LRT项目也会有更高的风险,主要风险如下。

多重协议套娃的合约风险,因此一定要谨慎选择经过审计的LRT项目;

LRT的项目涉及到的资产也多,因此也包含了可质押的LST的风险;

为了高收益而参与更多的AVS,会导致保证金罚没风险敞口增加;

另外就是LRT本身的流动性风险,和LST一样也会出现脱锚等现象,这些都是参与LRT项目的风险。

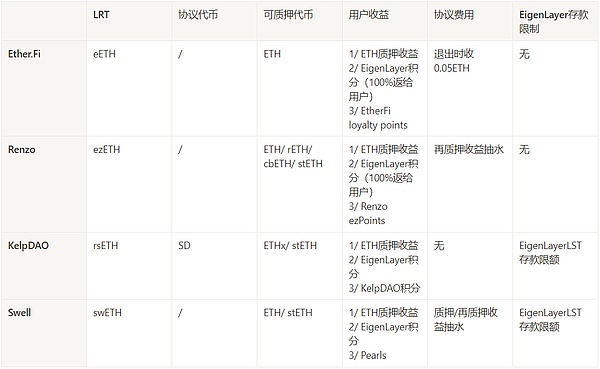

LRT 项目

目前,LRT项目已经上线的有EtherFi,Renzo,Swell和KelpDAO,还有近十个在测试网,项目的玩法差异性不大,区别主要在挖EigenLayer积分的能力和退出流动性上,接下来就为大家介绍已经上线的这四个项目。

Ether.Fi

EtherFi在去年2月完成了530万美元的种子轮融资,目前TVL超过3.3亿美元。

用户存入ETH可以获得$eETH,参与即可同时获取EigenLayer积分和EtherFi自己的loyalty points,都是后续空投的参考标准。退出流动性也很方便,目前unstake功能已经上线,退出摩擦较小。

(Source:https://defillama.com/protocol/ether.fi)

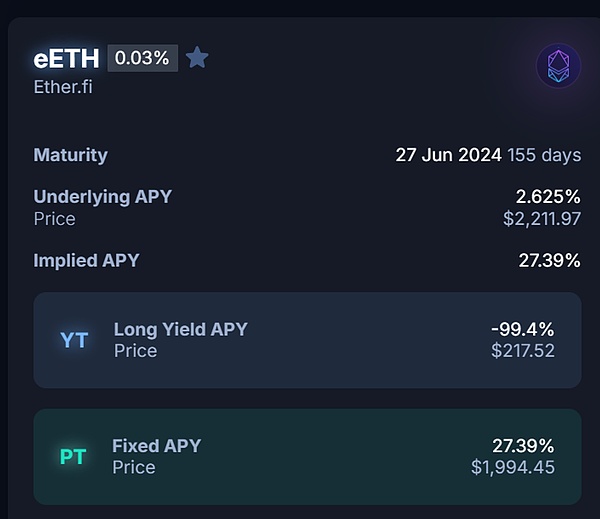

进一步地,可以将$eETH存入Pendle中进行PT和YT的拆分,目前YT溢价很高,立即卖出就有10%的收益,剩下的PT等到到期后又能赎回完整的本金。

具体操作请看:

一鱼三吃:使用 Pendle 获取十倍 EigenLayer 积分教程

https://mirror.xyz/0x30bF18409211FB048b8Abf44c27052c93cF329F2/X6_C9xgM2-t0fbjCSDtLBwxkXDPVf2rXF-JoKQVwRJg

(Source:https://app.pendle.finance/trade/markets)

Renzo

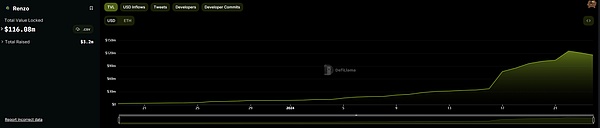

Renzo之前披露的信息较少,上周宣布了由Maven11领投的320万种子轮融资之后,TVL应声而涨,目前达到1亿美元。

除了ETH,Renzo还支持LSTs,如rETH,cbETH,stETH。Renzo的LRT代币是$ezETH,推出了积分计划Renzo ezPoints,获取积分的方式就是铸造$ezETH,暂时还没有退出流动性的方法。

(Source: https://defillama.com/protocol/renzo)

KelpDAO

KelpDAO是老牌项目Stader推出的,类似的,质押后获得LRT $rsETH,可以获取KelpDAO积分。

在1月29日EigenLayer开放存款后,目前存的币都会转移到EigenLayer,获得双重积分。

相比其他项目少了些空投预期,已经有Stader的代币$SD了。而且KelpDAO的质押是通过EigenLayer的LST开放质押进去的,因此可容纳的资金有上限,但是暂时不能退出。

(Source:https://defillama.com/protocol/kelp-dao)

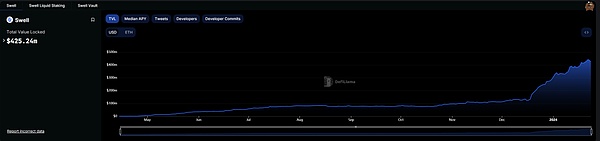

Swell

Swell是LST项目,顺势加入了LRT行列,用户可以存入ETH来赚取质押收入,也可以拿swETH去参与Pendle等项目。

它的Super swETH产品允许用户存入ETH或者stETH获取高达18%的年化收益。除了质押收益,还可以获取Pearls(珍珠,类似一种积分凭证),或许在TGE时可以换取Swell的代币。

协议目前TVL超过$425M,存入swETH要到1月29日EigenLayer开放挖矿才能获取EigenLayer的积分,后续推出LRT的rswETH可以直接参与双挖,退出流动性也十分方便,有交易池可以直接swap换成ETH。

(Source: https://defillama.com/protocol/swell)

Puffer

Puffer是基于Eigenlayer 上的流动性质押协议,是个技术性非常强的再质押项目,早期收到了以太坊基金会的资助,用于开发Secure-Signer 技术,以降低罚没风险并尽可能提高独立运营商的数量,从而实现网络去中心化。

Puffer的节点既是以太坊的验证节点,又是EigenLayer上的原生节点,因此可以同时获取以太坊的奖励和 Eigenlayer 再质押奖励。Puffer收到了550万美元的种子轮投资,投资人包括EigenLayer的创始人。

以太坊和 EigenLayer 都有惩罚机制,Puffer节点的私钥安全和抗罚没问题得到 Secure-signer、RAV 软件和 TEE 硬件的共同保护,有效降低了 LSD 和 LSDFI 资产的风险。

已上线的项目总结表格如下:

基于EigenLayer的LRT项目都比较复杂,涉及到方方面面的细节。

比如可以质押的代币种类(ETH、LSTs),协议本身的代币(LRT),分发的奖励来源,协议收费模式,质押到EigenLayer的途径(是通过LST质押还是通过EigenPod质押,这决定了协议资金帽的上限)。

和LST项目类似,在合约审计安全的前提下,LRT项目越早上线的协议越容易有先发优势,打造自己的品牌和网络效应。

市面上的资金本就有限,抢占先机和龙头地位至关重要。但是LRT有它的复杂性,如何做好风险管理也是LRT项目的一大竞争力。

LRT项目也会和LST项目一样,为了确保节点运行稳定,会寻求和DVT技术项目的合作,如Obol,SSV;基于LRT的借贷、dex、衍生品也会逐步出现;另外,为多链项目提供支持,也会是LRT项目的发展方向之一。

Ethereum Pledge Wave After Ethereum entered the era, the pledge operation node became a new business. Qualified node operators can get the income around the currency standard every year, which is a very good financial choice if they are bullish for a long time. However, in fact, the threshold for operating the node is not low, which requires both a new capital threshold and a technical hardware threshold for the stable operation of the node. If they accidentally drop the line, they will be fined. So a number of projects came into being to help users solve the financial and technical problems. At present, there are more than one pledge in the beacon chain, and the total warehouse value has reached the pledge ratio, which has risen from January to now. When users use the pledge agreement, they will get a liquid pledge token, such as a token itself, so it is easy to build a liquidity pool to make this part of the locked warehouse active again and continue to invest in the project, so as to obtain more doll's income, which can be obtained after the project is built on the basis of derivatives. Principal tokens and income tokens derive income strategies based on different risk preferences. From pledge to re-pledge, node pledge is essentially to let users pay a deposit to maintain the safety of the project. Nodes that conscientiously perform their duties will get benefits, and if they neglect their duties or do evil, they will be fined. Therefore, it is not only the public chain that needs nodes to cross the chain bridge, but also all kinds of projects need pledge to ensure the stability and safety of their nodes. It has become the most reliable public chain, but any module that can't be deployed or verified on the Internet can't take advantage of the trust advantage of the Ethereum network. It needs someone to run the node to provide active verification service, and the running node needs users to pay out real money to ensure security. Under the premise of limited liquidity, it is bound to be difficult to put forward the scheme that others can inherit and share the security of the Ethereum through re-pledge, which essentially provides a pool security mechanism and a security market, that is, multiple projects. The security pool of Ethereum can be shared, and users need to weigh the benefits and risks provided by each project to choose to join or quit the re-pledge module built on the Internet. The economic benefits of re-pledge are obvious. For users, one fish can be pledged and one Ethereum can reap the pledge returns of multiple projects, including the expectation of airdrop of unissued projects, especially for the project parties, which can reduce the pressure of obtaining pledged funds and inherit the security of Ethereum. Of course, this is not completely without it. The win-win outcome of risk: for the project, the pledged token is Ethereum instead of its own token, which makes its own token value capture ability less by one layer, and the user has one more layer of trust in the pledge, which increases the risk. For Ethereum, it is even more dissatisfied, which is equivalent to one of its employees working multiple jobs, and because of the extra pledge income, the user is definitely more willing to pledge it to Ethereum instead of directly pledge it into Ethereum. If the employee is in other companies, For any reason, it may be a violation of discipline, or it may be that the company was wrongly punished and confiscated by the pledged funds, which in turn will affect its pledge in Ethereum and even lead to the failure of the node, shaking the security of Ethereum network. Therefore, God issued a document earlier saying that it is difficult for users not to overload the consensus of Ethereum, but it is a good choice for users to pledge, but they are faced with several problems. Because of the high heat, the current types and quotas of pledge are very limited, it is difficult for users. After squeezing in, the liquidity is locked, and the risk management of the projects that node operators choose to participate in all increase the complexity index of strategy research. Therefore, the emergence of projects mainly solves these problems, lowers the threshold of re-pledge, and returns the pledged liquidity to users in the form of points. As for the points, the project party either digs them before transferring them or digs them in the form of allowing them to re-pledge directly on the chain without quota restrictions, such as better risk management strategies with prevention mechanisms to prevent festivals. The income from fines and confiscations is built on it, and obviously there will be higher returns. At the same time, the project will also have higher risks. The main risks are as follows: the contract risks of multiple agreements and dolls. Therefore, we must carefully choose the audited projects, which involve many assets, so it also includes the risks that can be pledged. Participating in more for high returns will lead to an increase in the risk exposure of margin fines and confiscations. In addition, the liquidity risk of the project itself and the phenomenon of anchoring will also occur. These are the wind of participating in the project. At present, there are some insurance projects that have been launched, and there are nearly ten projects that are on the test network. There is little difference in the gameplay, mainly in the ability to dig points and exit liquidity. Next, I will introduce these four projects that have been launched. Last month, they completed the seed round financing of 10,000 US dollars. At present, users who deposit more than 100 million US dollars can get points at the same time and their own are the reference standards for subsequent airdrops. Exit liquidity is also very convenient. Step by step, you can split the sum in deposit. At present, the premium is very high, and the rest can be redeemed when it expires. Please see the specific operation of "one fish, three meals, and ten times points". The information disclosed before the tutorial is less. Last week, it was announced that the ten thousand seed rounds of financing led by the investment went up, and now it has reached $100 million. In addition to supporting such tokens, the way to get points is casting, and the way to get points is to launch old-fashioned projects. After a similar pledge, you can get points. After the deposit is opened on, the current money will be transferred to get double points. Compared with other projects, there are fewer tokens that are expected to be airdropped, and the pledge is entered through the open pledge, so there is an upper limit on the funds that can be accommodated, but you can't quit for the time being. Users can deposit to earn pledge income or take part in projects. Its products allow users to deposit or get as high annualized income as quality. The pledge proceeds can also be obtained from pearls, similar to a kind of integral voucher, which may be exchanged at the time. At present, the token agreement is more than the points that can be obtained only after the opening of mining on January. It is also very convenient to participate in the double excavation and withdraw from the liquidity. Some trading pools can be directly replaced by the liquidity pledge agreement based on the platform. It is a very technical re-pledge project. In the early days, it received funding from the Ethereum Foundation to develop technology to reduce the risk of confiscation and increase the number of independent operators as much as possible, so as to realize the decentralization of the network. Therefore, the nodes of Ethereum are both the verification nodes and the 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。