代币化的未来:RWA 的重要性和潜在影响

作者:Presto Labs 来源:medium 翻译:善欧巴,比特币买卖交易网

在过去的五年里,加密货币行业经历了不断的演变,引入了新的流行语和主题。最初,区块链去中心化的概念引起了广泛关注,随后出现了 GameFi、Move-to-Earn (M2E) 和区块链驱动的 Metaverse 项目等新兴趋势。然而,其中许多趋势未能解决“为什么是区块链?”的基本问题。对于普通人来说。

相比之下,“代币化”和“现实世界资产(RWA)”等最近的主题使不太熟悉该技术的个人更容易理解区块链的好处。考虑到这一点,本文旨在深入研究代币化的概念,并探讨其优势和局限性,并从美联储发布的“代币化:概述和金融稳定影响”报告中汲取见解。

什么是代币化和现实世界资产(RWA)?

“代币化”涉及使用分布式账本技术将特定资产转换为数字形式。在此过程中,代币的价值与基础资产的价值直接挂钩,代币持有者获得该资产的合法所有权。本质上,代币化将资产转变为区块链上可交易的数字形式。

“RWA”代表真实世界资产,这意味着任何现实世界的资产,不仅限于证券,都可以被代币化并带入区块链。最近人们努力将美国国债、黄金、货币、基金等资产代币化。据波士顿咨询集团预测,到 2030 年,RWA 市场预计将达到约 16 万亿美元。此外,贝莱德首席执行官 Larry Fink 强调,金融的未来在于资产代币化,他表示:“下一代金融市场和证券将建立在资产代币化的基础上。”

RWA代表性项目

(1) Circle ( https://www.circle.com/en/ ) — 代币化美元 ($USDC)

(2) Ondo ( https://ondo.finance/ ) — 代币化美国国债 ($OUSG)、代币化货币市场 ($OMMF)

(3) Securitize ( https://securitize.io/ ) — 代币化基金(例如KKR Health Care Growth II 代币化基金)

代币化的好处

1. 快速结算,降低成本

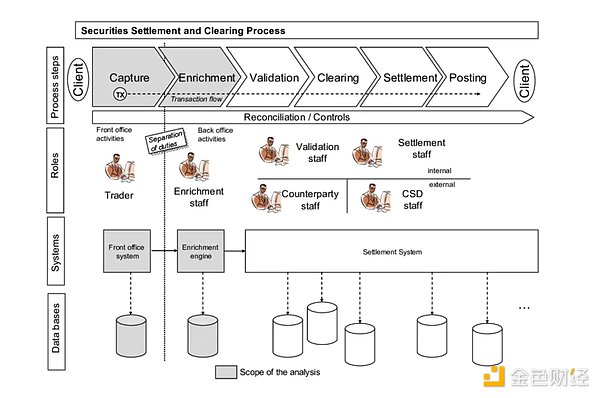

尽管许多人认为股票交易等金融交易几乎是立即发生的,但现实却大不相同。这些交易涉及中后台操作的密集劳动力,并且通常需要比预期更长的时间才能达成完全结算。例如,股票交易通常遵循T+2模式,这意味着包括交易日在内总共需要三个工作日才能完成结算。该时间范围包括涉及多方的核对和验证过程,例如向证券存管机构登记以及将姓名记录到股东名册中。

然而,通过资产代币化和区块链技术的应用,这些繁琐的流程和延迟可以大大减少。区块链允许实时交易记录,并减少交易过程中对众多中介机构的需求,消除不必要的复杂性和延迟。因此,与传统的金融交易相比,代币化资产可以在几分钟甚至几秒钟内实现最终确定(交易无法更改),从而通过消除中介机构来节省大量成本。

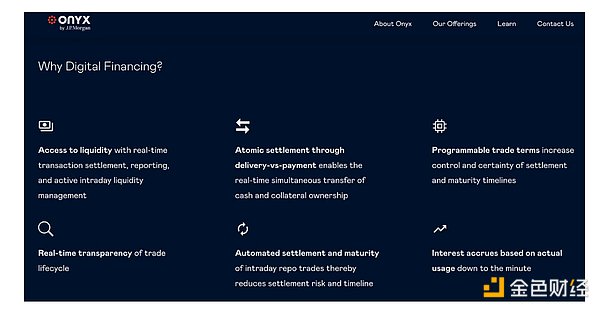

利用这些优势,摩根大通旗下的Onyx推出了类似于回购交易的日内交易系统,称为日内借贷便利。此前,由于抵押品和贷款流程冗长,当日借款和还款是不切实际的。然而,由于代币化资产交易提供的快速交易和结算能力,当日借贷和还款变得可行。此外,花旗银行最近与新加坡金融管理局合作进行了涉及代币化美元和新加坡元交易的测试,并宣布计划建立一个具有实时结算优势的新交易平台。

2. 创新投资机会

代币化为投资者打开了参与传统上难以获得的较大资产的较小部分的大门。以房地产投资领域为例,该领域通常需要大量资金。然而,随着“零碎投资”的出现,即使是资金相对有限的散户投资者也可以参与。这种方法之所以引人注目,是因为它提供了对特定财产进行“直接投资”的机会,而不是投资于房地产“投资组合”,例如房地产投资信托基金(REIT)。

此外,由于代币化简化了流程并降低了交易成本,以往仅限于机构投资者的私募股权投资对于普通投资者来说变得更加容易实现。这种转变也在音乐版权和艺术等领域留下了印记,这些领域以前很难甚至不可能进行交易。因此,代币化正在使各种资产的获取变得民主化,使投资机会更具包容性并为更广泛的受众所接受。

3. 增强流动性和价格发现

加密货币市场超越地理界限,为全球投资者提供了机会。例如,GoldFinch 等平台几乎可以在任何地方对非洲企业进行投资,而个人可以在 Circle 等平台上购买 USDC,本质上拥有等值美元的资产。此外,加密货币市场拥有 24/7 运行的显着优势,确保交易可以在任何时候发生,无论一个人在哪个时区。这些优势有望提高房地产和艺术品等以前被认为缺乏流动性的资产的流动性,从而开启更精确的价格发现过程的新时代。

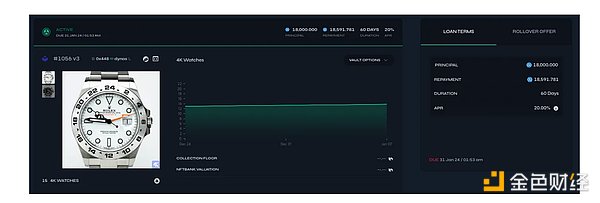

4.利用区块链上的资产

代币化释放了区块链生态系统中现实世界资产的效用。一个典型的例子是将代币化资产整合到 DeFi 领域。在 DeFi 中,这些资产充当抵押品,简化了借贷和清算流程,这些流程在 TradFi 流程中曾经是漫长而复杂的。通过多样化资产的代币化,以前被忽视的资产现在可以用作抵押品,从而简化了市场所有参与者的借贷程序。此外,随着 DeFi 的不断发展,我们预计代币化资产将在借贷之外得到更广泛的应用,从而扩大其在 DeFi 领域的影响力。

未解决的问题

1. 监管挑战:促进信任和安全

正如我们之前强调的,缺乏全面的监管仍然是加密货币行业发展的最大障碍之一。鉴于加密货币市场的固有特征,出现了多种担忧,从发行实体的模糊性到黑客等事件发生时的责任问题。在金融领域,信任至关重要,主要机构的参与取决于监管框架。显然,如果没有有效的监管和稳定机制,在加密市场内建立信任并确保安全将是一个艰巨的挑战。

2. 过度杠杆和过度利用的陷阱

2021 年加密货币市场的低迷是由过度使用杠杆引发的,这种做法涉及通过重复借贷抵押资产来寻求更高的回报。即使市场出现轻微波动,这也导致了破产的多米诺骨牌效应,不仅对 DeFi 行业,而且对整个加密行业产生了深远的影响。鉴于加密货币行业追求利润最大化的风险偏好以及高杠杆的持续盛行,这种行为对金融市场的稳定构成了重大风险。

3. 其他注意事项

虽然代币化为传统上被认为缺乏流动性的资产提供了提高流动性的好处,但它也带来了这些资产价格波动性增加的缺点。

尽管代币化资产可以 24/7 进行交易,但某些基础资产的原始市场交易时间可能有限,应考虑到这种交易时间的差异。

需要检查各种情况。例如,比特币价格下跌可能会影响代币化资产的价值,或者代币化资产的抵押品可能与传统加密资产挂钩。

需要思考的事情

关于代币化和价格的考虑因素

RWA 的广泛采用与加密货币市场价格飙升之间的相关性并不能得到保证。虽然 RWA 的崛起显然对整个加密货币市场产生了有利影响,但仅仅因为代币化的采用而预期加密货币价格会直接上涨可能并不切合实际。正如之前对代币化的定义所示,它更多的是改变现有资产的形式,强调了区块链技术的重要性,而不是仅仅关注加密资产价格。

从这个角度来看,RWA代币化旨在刺激区块链技术的实际应用和创新,而不是成为加密货币价格上涨的主要驱动力。RWA 代币化提供了一个彻底改变金融体系、提高其效率并增强金融交易透明度和安全性的机会。因此,认识到虽然 RWA 的扩散有可能对加密货币市场产生积极影响,但它对现实世界具有更广泛的影响,这一点至关重要。

权力下放的意义

在加密行业的早期阶段,“去中心化”作为一个关键信息占据着核心地位,被广泛视为行业内的关键因素。这种强调导致了对许可区块链的相当大的怀疑,通常被认为达不到“真正的”区块链。

然而,与其他行业相比,金融行业的特点是更加保守,极其重视金融交易的稳定性和透明度。这种倾向促使很大一部分金融机构和项目接受许可的区块链。值得注意的是,摩根大通的 Onyx 等区块链计划采用了自己的许可区块链,强调稳定性和遵守监管合规性。此外,许多协议和平台都需要 KYC 程序来购买加密货币,而像 Securitze 这样的平台,促进 KKR 基金的交易,只向认可的投资者授予访问权限。因此,RWA行业似乎更看重“稳定性”,而不是最初的区块链意识形态“去中心化”。

In the past five years, the cryptocurrency industry has undergone continuous evolution, and new buzzwords and themes have been introduced. At first, the concept of decentralized blockchain attracted widespread attention, and then there were emerging trends such as blockchain-driven projects. However, many of these trends failed to solve the basic problems of blockchain. Compared with ordinary people, recent themes such as tokenization and real-world assets make individuals who are not familiar with the technology more tolerant. It is easy to understand the benefits of blockchain. In view of this, this paper aims to deeply study the concept of tokenization, discuss its advantages and limitations, and draw insights from the overview of tokenization and the report on the impact of financial stability issued by the Federal Reserve. What is tokenization and real-world asset tokenization involves using distributed ledger technology to convert specific assets into digital forms. In this process, the value of tokens is directly linked to the value of underlying assets, and token holders gain legal ownership of the assets. In essence, tokenization will be capital. The transformation of production into a tradable digital form on the blockchain represents real-world assets, which means that any real-world assets can be tokenized and brought into the blockchain. Recently, people have made efforts to tokenize assets such as US Treasury bonds, gold money funds, etc. According to the prediction of Boston Consulting Group, the market is expected to reach about one trillion US dollars by 2008. In addition, BlackRock CEO stressed that the future of finance lies in asset tokenization, and he said that the next generation of financial markets and securities will be based on asset tokenization. On the basis of representative projects, token dollar token US Treasury bonds token money market token funds such as token funds, the benefits of quick settlement and cost reduction. Although many people think that financial transactions such as stock trading are almost immediate, the reality is quite different. These transactions involve intensive labor in the middle and back office operations and usually take longer than expected to reach a complete settlement. For example, stock trading usually follows the pattern, which means that it takes a total of three. The settlement can only be completed in working days. The time range includes the verification and verification process involving many parties, such as registering with the securities depository and recording the name in the register of shareholders. However, through the application of asset token and blockchain technology, these cumbersome processes and delays can greatly reduce the blockchain to allow real-time transaction records and reduce the demand for many intermediaries in the transaction process, eliminating unnecessary complexity and delay. Therefore, compared with traditional financial transactions, token assets can be used in a few minutes. Even within a few seconds, it can be finalized that the transaction cannot be changed, thus saving a lot of costs by eliminating intermediaries. Taking advantage of these advantages, JPMorgan Chase has launched an intraday trading system similar to repurchase transactions, which is called intraday lending convenience. Previously, it was unrealistic to borrow and repay on the same day because of the lengthy collateral and loan process. However, due to the rapid trading and settlement capabilities provided by token assets trading, it became feasible to borrow and repay on the same day. In addition, Citibank recently cooperated with monetary authority of singapore. Co-conducted a test involving the transaction of token dollars and Singapore dollars, and announced plans to establish a new trading platform with real-time settlement advantages to innovate investment opportunities. Tokenization opened the door for investors to participate in a smaller part of larger assets that are traditionally difficult to obtain. Take the real estate investment field as an example, this field usually needs a lot of money. However, with the emergence of piecemeal investment, even retail investors with relatively limited funds can participate in this method. What is striking is that it is proposed. It provides opportunities for direct investment in specific properties instead of investing in real estate investment portfolios, such as real estate investment trust funds. In addition, because tokenization simplifies the process and reduces transaction costs, private equity investment, which used to be limited to institutional investors, has become easier for ordinary investors to achieve. This change has also left its mark on music copyright and art, which were difficult or even impossible to trade before, so tokenization is making the acquisition of various assets democratic. Making investment opportunities more inclusive and acceptable to a wider audience, enhancing liquidity and price discovery, the cryptocurrency market transcends geographical boundaries and provides opportunities for global investors. For example, platforms can invest in African enterprises almost anywhere, while individuals can buy assets with the equivalent value of US dollars on such platforms. In addition, the cryptocurrency market has obvious advantages in operation, ensuring that transactions can take place at any time, no matter which time zone a person is in. These advantages are expected to improve the housing market. The liquidity of assets that were previously considered illiquid, such as real estate and works of art, thus opens a new era of more accurate price discovery process. The use of assets token in blockchain releases the effectiveness of real-world assets in blockchain ecosystem. A typical example is the integration of token assets into the field. These assets serve as collateral to simplify the lending and liquidation processes, which used to be long and complicated in the process, and the assets that were previously ignored through the token of diversified assets are now. Now it can be used as collateral, thus simplifying the lending procedures of all participants in the market. In addition, with the continuous development, we expect that token assets will be widely used in addition to lending, thus expanding their influence in the field. Unresolved problems, regulatory challenges, promoting trust and security, as we emphasized before, lack of comprehensive supervision is still one of the biggest obstacles to the development of cryptocurrency industry. In view of the inherent characteristics of cryptocurrency market, there have been many concerns, from the fuzziness of issuing entities to black. The responsibility of customers and other events is very important in the financial field. The participation of major institutions depends on the regulatory framework. Obviously, if there is no effective supervision and stability mechanism to build trust and ensure security in the encryption market, it will be an arduous challenge. The trap of excessive leverage and overuse is caused by the excessive use of leverage. This practice involves seeking higher returns by repeatedly borrowing mortgage assets, which leads to bankruptcy even if the market fluctuates slightly. The domino effect of cryptocurrency has a far-reaching impact not only on the industry, but also on the whole cryptocurrency industry. In view of the risk preference of the cryptocurrency industry to maximize profits and the continued prevalence of high leverage, this behavior poses a major risk to the stability of the financial market. Other precautions: Although tokenization provides the benefits of improving liquidity for assets that are traditionally considered illiquid, it also brings the disadvantages of increased price volatility of these assets. Although tokenized assets can be traded, the trading time of some basic assets in the original market may be limited, and this difference in trading time should be taken into account, and various kinds of checks should be made. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。