LD Capital宏观周报:美股走强闪烁过热信号 中国股市外资流入再创历史新高

即便面临着更长时间高位利率的预期转变(市场从年初时对3月85%的降息概率定价,已经下降到约20%),并且围绕区域银行和国债拍卖一度出现紧张情绪,但标普500指数上周仍上涨1.4%,在过去15周中的14周都呈上涨趋势,并首次突破了5000点大关。这一现象反映出投资者目前更看重不断改善的盈利季数据以及经济活动热度不减。

过去一周对空头对打击重大,在“软着陆”的叙述持续的同时,一些盈利数据激发了一些在被大量做空的股票的空头平仓,例如ARM在一周内上涨了超过50%,PLTR上涨了超过40%。今年做空半导体股票令人痛苦,按市值计算空头的损失已超过 70 亿美元。

77%的标普500指数公司已公布2023年第四季度业绩,整体表现好于预期。57%的公司EPS大幅超出了华尔街预期,保持了与前两个季度一致的趋势,并超过了 48% 的长期平均水平。META 50亿美元的派息和500亿美元的回购引起了人们对股息策略的高度关注,像 META 这样的大公司开始派发股息会显着提高美股派息预期,例如高盛将2024SP500的股息率从4%大幅上调至6%,并提示关注 GOOGL 和 AMZN 这两家目前最大的不派发股息的公司,若这两家跟META一样以 10% 的派息率启动股息则可让SP500股息率提升1.8个百分点。结合债券收益率下降的背景,高股息策略有望跑赢大盘。

图:乔治•埃尔加•希克斯的画作《英格兰银行的股息日》。一个世纪前,投资者获取公司运营信息途径有限,所能获得的最大信号往往是某家公司未能派息。

中国市场在本周出现深V反弹,上证指数/CSI300指数分别上涨了5%和5.8%,其中受限制做空政策影响小盘股和中盘股的表现更好,CSI500和CSI1000指数分别上涨了13%和9%。主要新闻包括:

据彭博社报道,中国证监会正计划向president Xi汇报市场状况和最新的政策措施。

融券T+1新政之后,2月6日证监会要求暂停新增融券规模,并要求存量逐步了结,这使得空头被迫平仓。

2月6日,中央汇金公司宣布将持续加大增持ETF的力度和规模

2月7日,吴清被任命为新的证监会主席,接替了易会满。

CPI同比下降0.8%(前值-0.3),为连续第四个月同比下降,并且创下自2009年以来最大单月同比降幅,PPI的通缩幅度减小到了年率-2.5%(前值-2.7)。

美股市场

“顶部是一个过程,底部是一瞬间”

美银的Hartnett在本周的报告中引用这句格言,意思是市场顶部通常是通过渐进的积累和情绪建立形成的,而市场底部则可能由于突发事件或情绪的急剧转变而迅速到来。这反映了投资心理学的一面,其中恐惧可以驱动快速的抛售,导致市场急剧下跌,而贪婪和乐观情绪的建立则更为缓慢,导致市场顶部的逐渐形成。

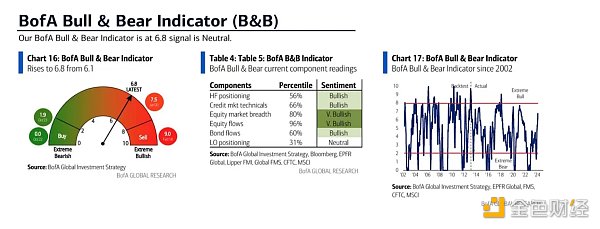

接近“卖出信号”但还没到,美国银行牛熊指标现为 6.8,大于8是反向卖出信号。

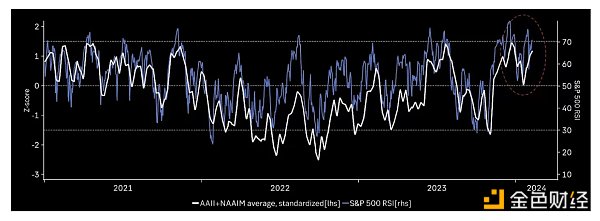

AAII+NAAIM情绪和动能仍然非常积极,接近顶部水平:

CNN信号极度贪婪:

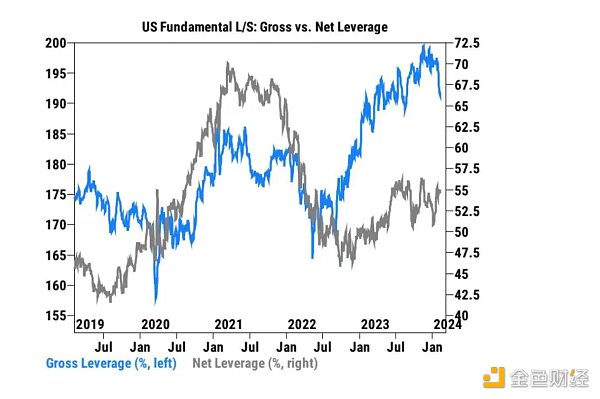

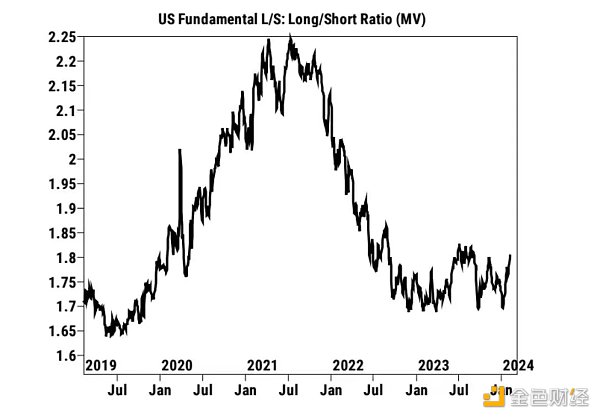

根据高盛但数据,过去几周,美国基本对冲面基金总敞口迅速下降,降至191.8%。这一水平在过去三年中位于第78个百分位。净杠杆连续第五周小幅上升达到55.3%。这一水平在过去三年中位于第57个百分位,说明当前的净杠杆水平虽然有所增加,但相比于过去三年的历史数据并不算极端:

多空比率达到1.809。这一比率在过去三年中位于第48个百分位,并不算高:

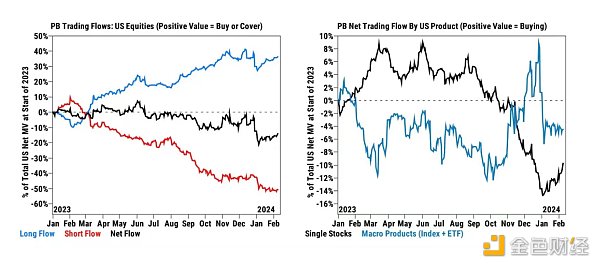

个股自2023年3月以来看到了最大的净买入量(高出1.35个标准差),主要是多头买入,空头回补偏小(比例为4.5比1)。但这是7周来首次集体净回补单只股票的空头头寸:

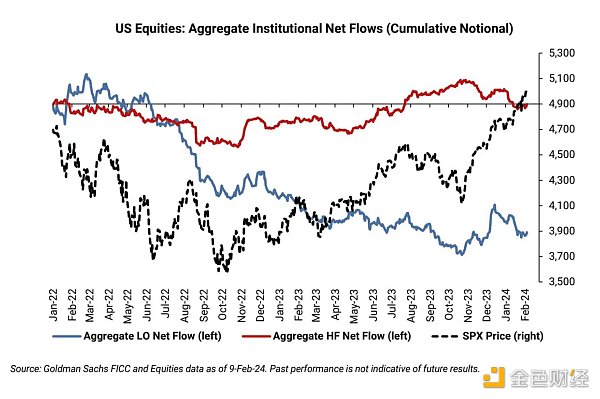

总体来说从高盛的订单簿来看,最近对冲基金和纯多头基金的净买入/卖出基本平衡,似乎没有看到随着行情持续上涨而出现FOMO现象。

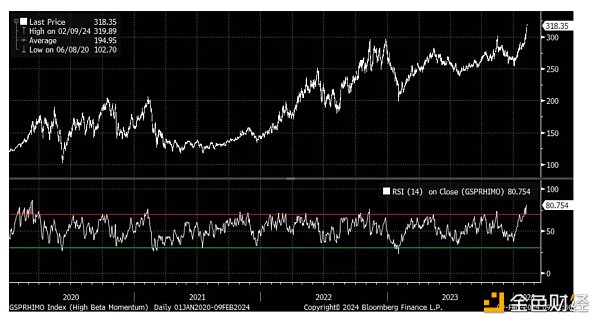

高盛的高Beta 动能组合今年迄今上涨了近 20%。 14 天RSI 为 80,现在是2020年3月来最“超买”的水平:

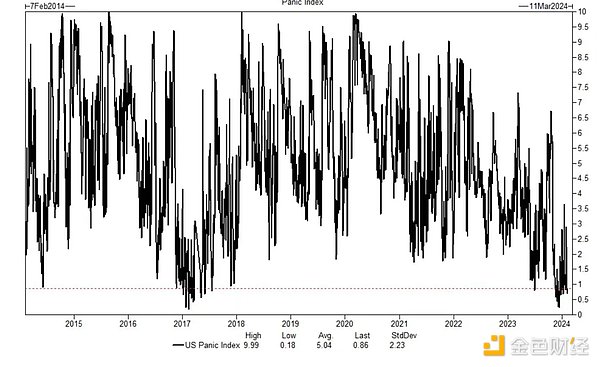

期权市场几乎没有任何恐慌,高盛恐慌指数跌至在10年来几乎最低的水平:

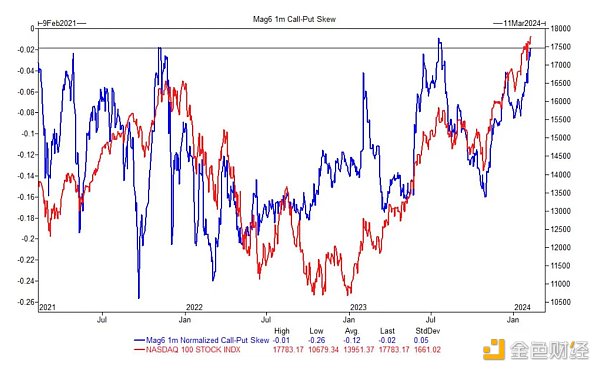

高盛交易台观察到Mag6大型科技公司(META、AAPL、AMZN、GOOGL、NVDA、MSFT)中极度乐观的期权活动(以call-put skew衡量),这种情况在过去三年观察到五次,当这种期权市场活动发生时,未来2–4周的回报倾向于负值,这意味着当期权市场对这些科技巨头极为乐观时,随后的股价往往会下跌。

下方的表格提供了过去几次出现类似期权市场活动时,纳斯达克100指数在之后的12个月的回报情况:

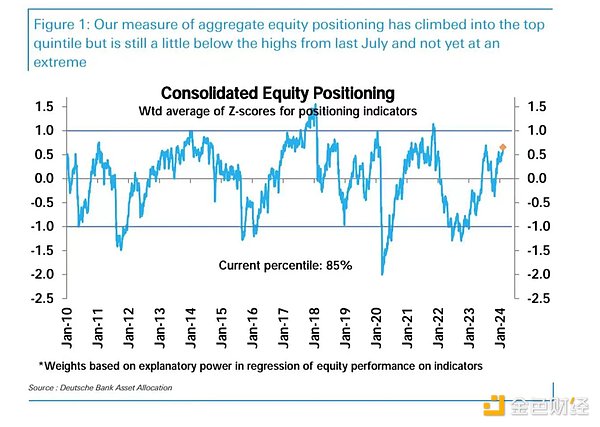

按德银口径,综合股票仓位升至历史85百分位,高但并不极端,德银认为配置的上升与近期经济数据的加强密切相关,另外随着财报季的到来,公司回购公告的增加,这也是提高股票需求的一个因素:

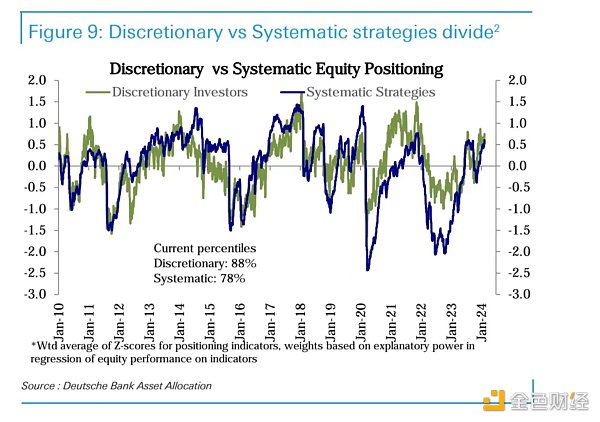

其中自主投资者仓位88百分位较高,系统性策略投资者仓位78百分位:

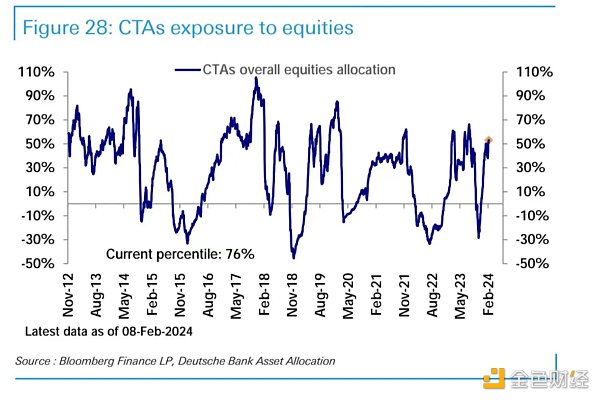

CTA资金仓位76百分位,位于偏高水平:

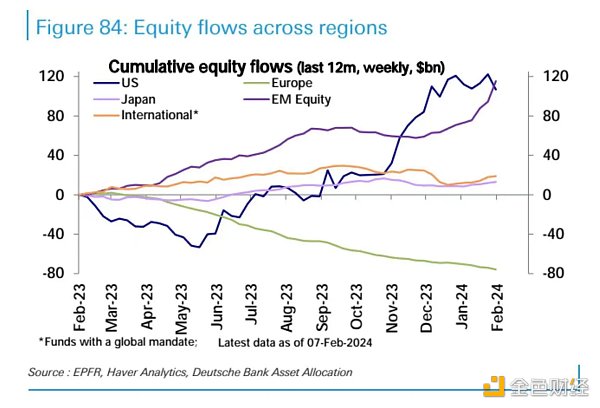

美股基金上周出现了较大幅度的净流出-156亿美元,为9月中旬以来最高:

中国市场

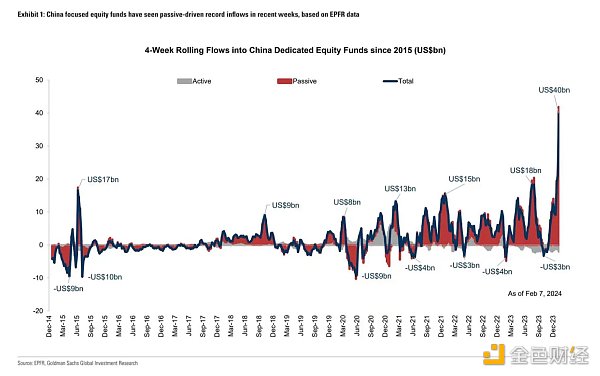

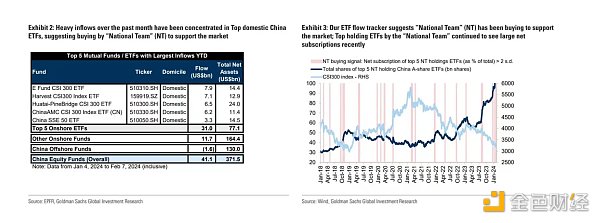

过去一个月中国股票基金整体上流入了411亿美元,高盛的ETF流动追踪器显示“国家队”持续买入以支持市场:

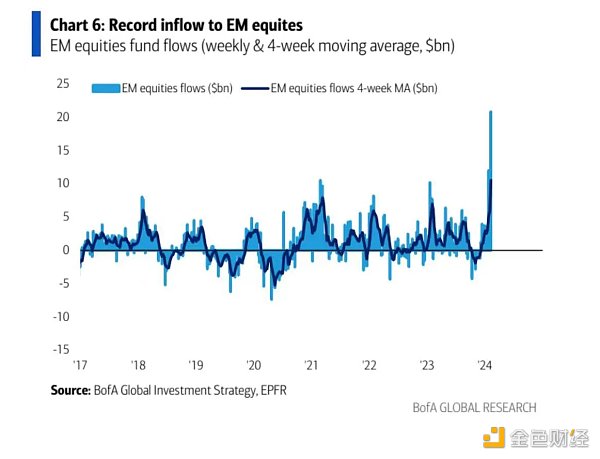

外资上周大量流入A股和中国A股ETF,金额达到190亿美元再创历史新高,贡献了新兴市场几乎全部的资金净流入:

北向资金连续三周净买入:

国家队的买入主要集中在300系ETF上:

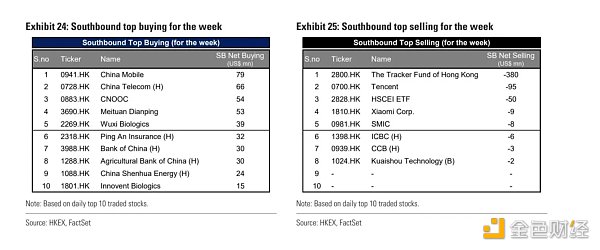

南向资金买入最多和抛售最多的股票:

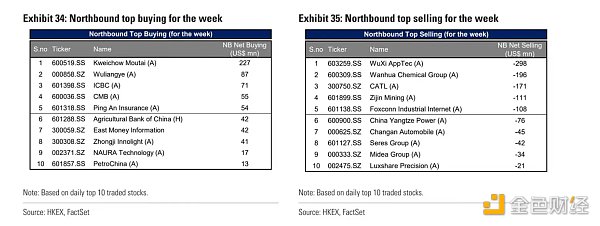

北向资金买入最多和抛售最多的股票:

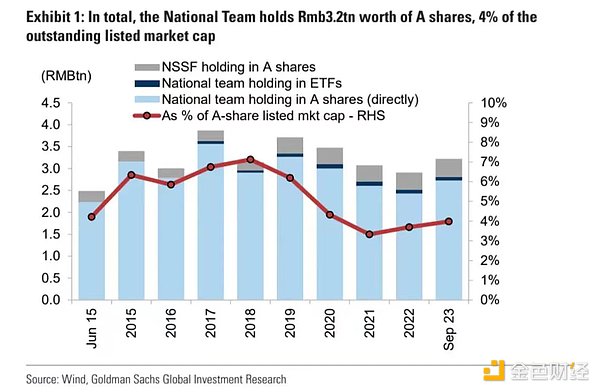

国家队持有价值3.2万亿元人民币的A股,占自由流通市值的4%:

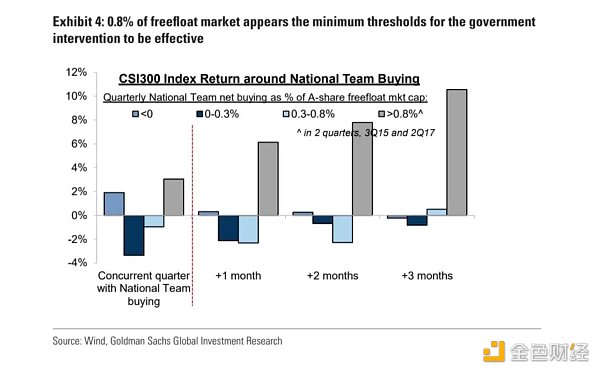

高盛估计“国家队”在过去一个月(不包含本周)大约购买了700亿元人民币的A股,但根据历史约2000亿元人民币(占自由流通市值的0.8%)可能是短期稳定市场的最低门槛,如下图所示历史上只有当国家队购买超过0.8%时后续沪深300指数才有显著的正回报:

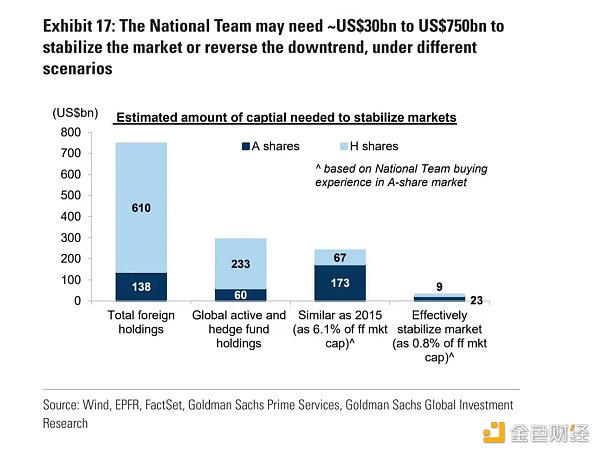

估计当前外资持有A股自由流通市值比例只有4.4%约合1380亿美元,其中650亿属于主动基金,如果全卖光(当然不太可能)的抛压也时可控的,尤其考虑到现在中国国内资本更具粘性,当下处于不能卖或者惜售状态:

算上港股和更极端的外资抛售情况,国家队需要300~7500亿美元来稳定市场,当然7500亿是假设A和港股的外资全部离场:

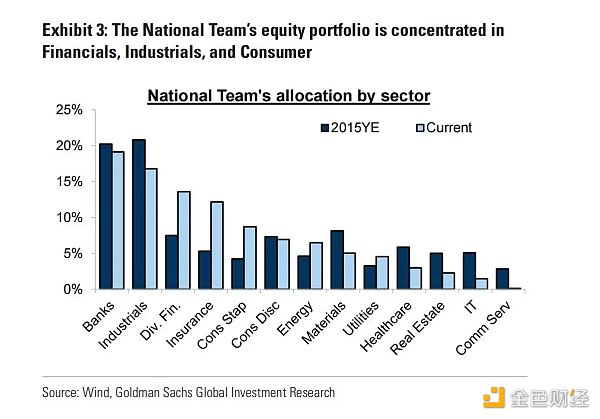

国家队持仓情况:

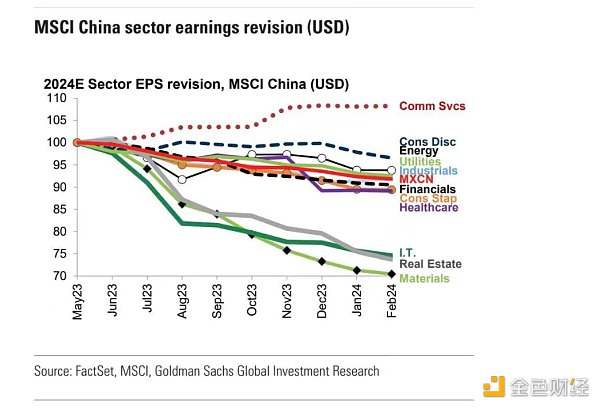

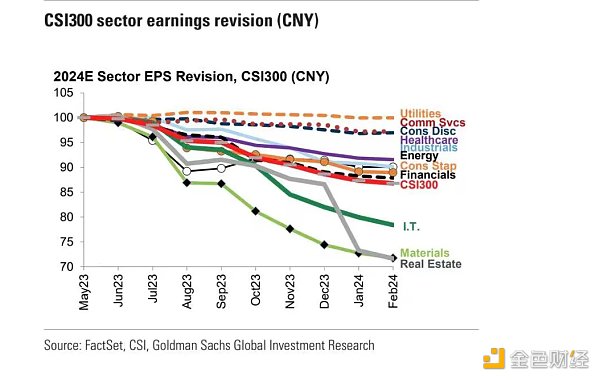

MSCI中国指数和CSI300指数的行业盈利修正情况:

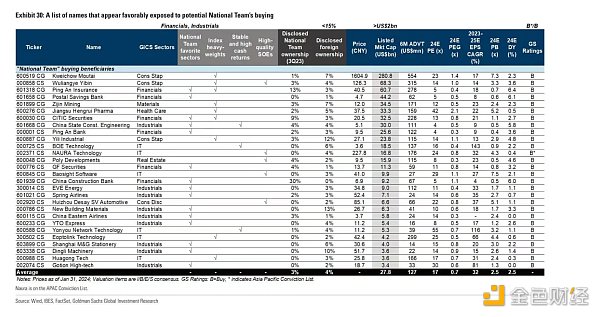

高盛筛选的潜在受益于国家队购买的股票篮子,考量是国家队青睐的行业、指数权重、拥有 较高且稳定的现金流,是否是高质量国企:

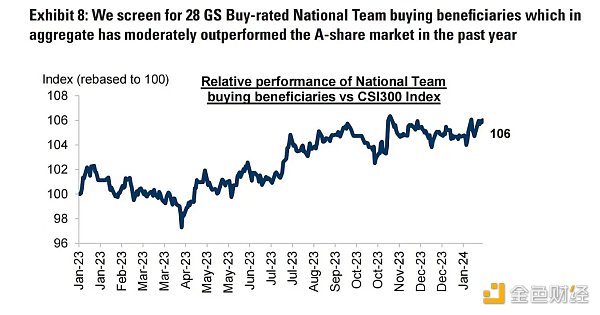

这28家GS 买入评级的国家队受益者,在过去一年中总体表现略好于 A 股市场:

如何交易可能被“国家队”购买的股票的策略:

国家队的行业偏好:国家队在市场干预期间倾向于金融和工业部门,分别占其预估购买量的38%和21%。报告建议关注这些行业中外资持股比例低且基本面稳健的股票。

指数/ETF重量级股票:市场干预更多是ETF导向。这意味着在基础指数中占比重较大的股票可能会获得超额收益。

稳定且高现金回报:在2024年全球利率周期背景下,现金回报策略受到青睐。低市盈率但高稳定股息收益的股票被视为有吸引力的选择,特别是在指数股息收益率首次高于10年期政府债券收益率的历史时刻。另外关注回购,也是回报的重要来源。

高质量国有企业(SOEs):继续推荐高质量的国有企业。这些公司在基本面表现良好,高ROE,并且具有吸引人的估值、公司治理和分红。这些因素使它们对国家队具有吸引力。

加密货币市场

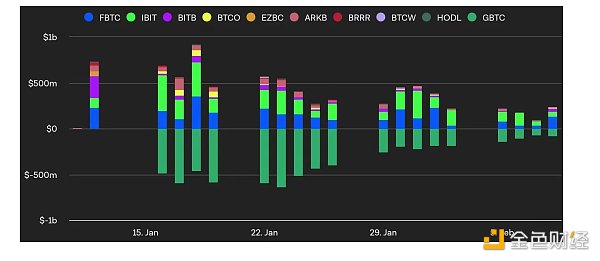

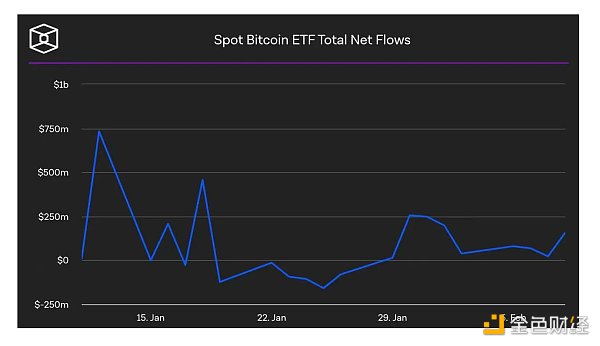

ETFs持续净流入但速度放缓

自从BTC ETF开始交易以来已经过去了三个星期,总流入额为78亿美元(不包括GBTC),其中IBIT(iShares)和FBTC(富达)分别领先,资产管理规模分别为32亿美元和27亿美元。但是总体流入速度有所放缓。GBTC产生了61亿美元净流出,自从转变为ETF后,GBTC的资产管理规模已经下降了20%,赎回高峰出现在交易的第一周,并且从每日6.4亿美元净流出逐渐放缓至每日8000万美元净流出。

目前尚不清楚需求中有多少是散户驱动的,有多少是机构驱动的;也不清楚GBTC赎回中有多少被转换成其他BTC ETFs。只有当GBTC赎回稳定下来时,我们才能更好地了解市场对于BTC ETF需求究竟是积压需求还是从GBTC转移而来。

有报道称FTX已经清算了大部分GBTC股份,这被认为是赎回的原因之一。据报道,加密货币借贷机构Genesis要求破产法庭批准14亿美元的GBTC股份销售 – —市场将密切关注是否会获得批准。

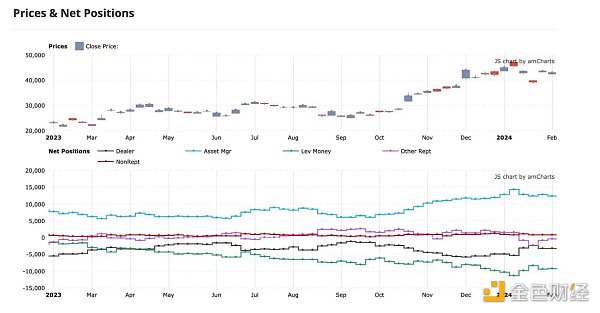

CME对冲基金和资管机构的仓位在过去两周几乎没有变化,空头回补暂停:

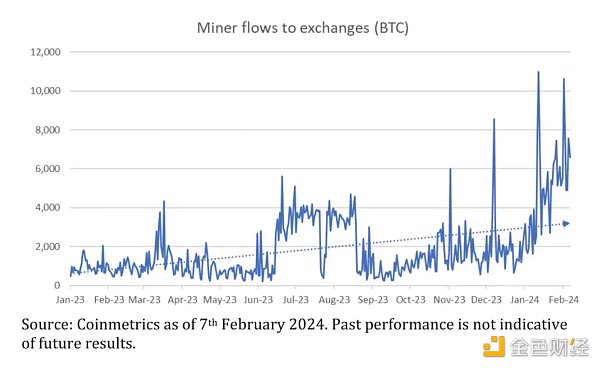

矿工出售,MSTR购买

下一次比特币减半将在2024年4月到来 – —挖矿奖励将从每个区块的6.25比特币减少到3.125比特币。随着减半的临近,矿工们越来越多地出售他们的比特币贮备。仅在1月份,据估计矿工们已经向交易所发送了14.2万比特币。我们可以看到,平均每日发送到交易所的比特币数量呈现出上升趋势:

但也有机构专注于增加敞口 – —MicroStrategy最新的文件显示,这家最大的公开交易的公司持有者在1月份又购买了850比特币(价值3750万美元),现在持有19万个比特币。

Dencun升级热度远不及Shapella

以太坊的下一个协议升级 – —Dencun,在此之前的最后一个测试网络Holesky已经成功升级,并且主网升级的日期也将很快公布。在2023年4月进行的上一个升级 – —Shapella之前,市场关注的是提款影响以及可能的ETH抛售,这些ETH是作为从工作量证明(Proof of Work, PoW)向权益证明(Proof of Stake, PoS)过渡的一部分而锁定的。Shapella升级前市场热度的积聚是明显的,并且FTX崩溃之后的市场正在寻找任何建设性进展的迹象,相应的ETH的价格在2023年第一季度大涨了51%,达到了2100美元的高点,事后看来这几乎是ETH在2023年的最高价格水平。

现在即将进入Dencun阶段,市场对ETH价格预期的关注似乎减弱了。围绕ETH的各种叙述也已经退居次要位置。相反,市场更关注那些依赖以太坊安全性的二层协议,并且可能从升级中受益。Dencun的主要影响将是通过proto-danksharding增加其二层网络rollups的数据可用性,从而减少rollup交易成本,这些好处将传递给最终用户。Dencun将有效降低layer2的运营成本。这些好处可能不会立即出现,因为也将取决于layer2能多快支持Dencun。

另外,以太坊ETF的潜在通过的情绪似乎也没有被完全释放,美国SEC在去年6月明确将其(和比特币)从67个被视为证券的代币名单中剔除。此外,以太坊期货也在芝商所进行交易,并且SEC已经根据现有协议对基于期货的ETF进行监控和保护措施,这可能使SEC难以任意否决现货以太坊ETF。并且与比特币一样,以太坊具有高度分散化和悠久运营历史等特点。以太坊ETF的通过只是时间问题。

机构观点

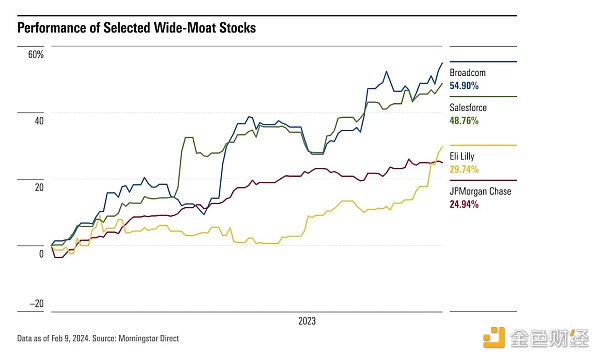

【MorningStar:除了七强之外,还有这些宽护城河股票】

根据网络效应的强度、涉及的转换成本的程度、专利和品牌标识等无形资产、成本优势以及效率等,在晨星分析师研究得出宽护城河股票仅占美国市场指数的 12%。宽阔护城河指将拥有超过 20 年的市场优势。窄护城河的公司预计将在 10 年内避开竞争对手,例如晨星认为特斯拉就是窄护城河,而另外的Mag6是宽护城河( NVDA、META、AAPL、AMZN、MSFT、GOOGL),除了几个人大家耳熟能详的公司还有Broadcom AVGO, Eli Lilly LLY, JPMorgan Chase JPM, and Salesforce CRM这几家宽护城河股票也值得关注。

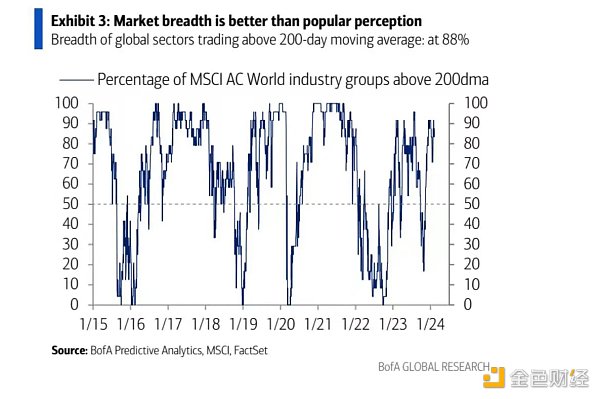

【美银:只要不见股票市场宽度崩溃,多头立场仍然可取】

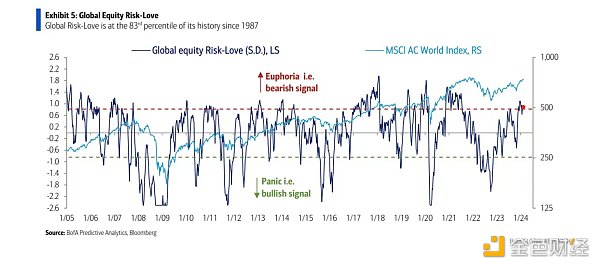

根据美银的“Global Equity Risk-Love”指标,全球市场情绪处于极度欢快状态(euphoria),并且自1987年以来的历史百分位数位于83百分位。这种情绪并没有自上个月以来发生显著变化,表明在全球股市迈向新高的同时,投资者的热情保持稳定。在牛市中,欢愉情绪并不是不好的现象,虽然过度的乐观可能会导致市场回调。

据历史数据,在过去亢奋情绪持续4周以上 的23次情况中,后6个月全球股票平均上涨3.7%值得注意的是,在这22次事件中,有40%即9次事件中的回调小于2%,因为延长的欢愉情绪通常会带来积极的结果。

只要不见股票市场宽度崩溃迹象,多头立场仍然可取,不少投资者低估了目前实际情况。亚洲和新兴市场投资情绪多处于中性水平。尽管中国股市大跌19%,但中国投资情绪也回升至低中性。印度等新兴市场投资者情绪也较为平稳。

市场的广度(breadth)指参与拉升市场的个股或行业的数量。当大部分股票或行业都在上涨时,breadth较好;当仅仅少数个股或行业上涨时,breadth较差。

Even in the face of the expected change of high interest rates for a longer period of time, the market's probability pricing of monthly interest rate cuts has dropped to about 0 from the beginning of the year, and there was once nervousness around regional banks and government bond auctions, but the S&P index rose last week, and it showed an upward trend in every week of the past week and broke through the point mark for the first time. This phenomenon reflects that investors are now paying more attention to the constantly improving profit quarter data and the enthusiasm of economic activities. While the narrative of the heavy blow to bears in the past week continued, the soft landing continued. Some profit data have stimulated some short positions in stocks that have been heavily shorted. For example, it has risen more than this year in a week. It is painful to short semiconductor stocks. According to market value, the loss of short positions has exceeded $ billion. The S&P index company has announced that the overall performance in the fourth quarter of 2008 was better than expected. The company has greatly exceeded Wall Street's expectations, maintained a trend consistent with the previous two quarters and exceeded the long-term average. The dividend of $ billion and the repurchase of $ billion have aroused people. Pay close attention to dividend strategy. Large companies like this will start to pay dividends, which will significantly improve the dividend expectation of US stocks. For example, Goldman Sachs will raise the dividend rate from a large margin to and prompt attention. If the two largest companies that do not pay dividends at present start dividends at the same rate, the dividend rate will increase by 1 percentage point. Combined with the background of falling bond yields, the high dividend strategy is expected to outperform the broader market. George elgar Hicks' painting The dividend day of the Bank of England was a century ago. The biggest signal that can be obtained from limited access to company operation information is often that a company fails to pay dividends. The China market rebounded deeply this week, and the Shanghai Composite Index rose respectively. Among them, small-cap stocks and mid-cap stocks performed better and the index rose respectively due to the restricted short-selling policy. The main news includes that according to Bloomberg News, the China Securities Regulatory Commission is planning to report the market situation and the latest policy measures. After the new securities lending policy, the CSRC requested to suspend the scale of new securities lending and require the stock to gradually increase. This forced the bears to close their positions. On May, Central Huijin announced that it would continue to increase the strength and scale of its holdings. On May, Wu Qing was appointed as the new chairman of the China Securities Regulatory Commission to replace Yi Huiman. The previous year-on-year decline was the fourth consecutive month, and it was the largest monthly year-on-year decline since 2006. The deflation rate decreased to the previous year. The top of the US stock market is a process, and the bottom is a moment. In this week's report, Bank of America quoted this adage, which means that the top of the market is usually accumulated gradually. And the bottom of the market may come quickly due to unexpected events or sharp changes in emotions, which reflects one aspect of investment psychology, in which fear can drive rapid selling, leading to a sharp decline in the market, while the establishment of greed and optimism is slower, leading to the gradual formation of the top of the market, which is close to the selling signal, but has not yet reached the Bank of America. The bull and bear index is now greater than the reverse selling signal, and the emotion and kinetic energy are still very positive and close to the top level. According to Goldman Sachs, the signal is extremely greedy. However, in the past few weeks, the total exposure of basic hedge funds in the United States has dropped rapidly to this level, and the net leverage has risen slightly for the fifth consecutive week in the past three years, which means that although the current net leverage level has increased, it is not extreme compared with the historical data of the past three years. When the ratio reaches this level, it is not high in the first percentile in the past three years, and individual stocks have seen the largest net purchase since June. The higher standard deviation is mainly due to the smaller proportion of bulls buying short covering, but this is the first time in the past week that the short position of a single stock has been collectively covered by net. Generally speaking, from the order book of Goldman Sachs, the basic balance of net buying and selling of hedge funds and pure long funds seems to have not been seen recently. The high kinetic energy portfolio of Goldman Sachs has risen for nearly days so far this year, and it is now the most overbought level option market. There is almost no panic. The panic index of Goldman Sachs fell to last year. Almost the lowest level Goldman Sachs trading desk has observed extremely optimistic option activities in large technology companies to measure this situation. In the past three years, it has observed five times that when this option market activity occurs, the return in the next week tends to be negative, which means that when the option market is extremely optimistic about these technology giants, the subsequent share price tends to fall. The table below provides the return of Nasdaq index in the next month when similar option market activities have occurred in the past few times. Deutsche Bank believes that the increase in allocation is closely related to the strengthening of recent economic data. In addition, with the arrival of the earnings season, the increase in the company's repurchase announcement is also a factor to increase the demand for stocks. Among them, the percentage of independent investors' positions is higher, and the percentage of systematic strategic investors' positions is at a high level. Last week, US stock funds experienced a large net outflow of US$ 100 million, the highest China stock in the China market in the past month since the middle of the month. The flow tracker of Goldman Sachs showed that the national team continued to buy to support the market. Last week, a large amount of foreign capital flowed in and China shares reached a record high of $ billion, which contributed to almost all the net inflow of funds from emerging markets. For three consecutive weeks, the net purchase of the national team was mainly concentrated in the stocks that were bought the most in the southbound direction and sold the most in the department. The national team held the stocks that were bought the most and sold the most in the northbound direction, and the stocks worth trillions of yuan were free. Goldman Sachs, which has a circulating market value, estimates that the national team did not include the shares that it bought about 100 million yuan this week. However, according to history, about 100 million yuan accounts for the market value of free circulation, which may be the lowest threshold for short-term stability of the market. As shown in the following figure, only when the national team buys more than it, will the subsequent Shanghai and Shenzhen stock indexes have a significant positive return. It is estimated that the current market value ratio of foreign-owned shares in free circulation is only about 100 million dollars, of which 100 million yuan belongs to active funds. If all of them are sold out, it is of course impossible to sell In particular, considering that China's domestic capital is more sticky now, it is in a state of being unable to sell or reluctant to sell, including Hong Kong stocks and more extreme foreign selling, the national team needs hundreds of millions of dollars to stabilize the market. Of course, 100 million dollars is the assumption that all foreign capital from Hong Kong stocks will leave the national team's positions, and the industry profit correction of the China index and index. The consideration of Goldman Sachs' selection of the stock basket that potentially benefits from the national team's purchase is whether the national team's favored industry index has a high and stable cash flow is a high-quality state-owned enterprise. The beneficiary of the national team who bought the rating has performed 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。