NFT 拆分协议 ERC-404 昙花一现?

作者:SANYUAN Labs 来源:X,@SanyuanCapital

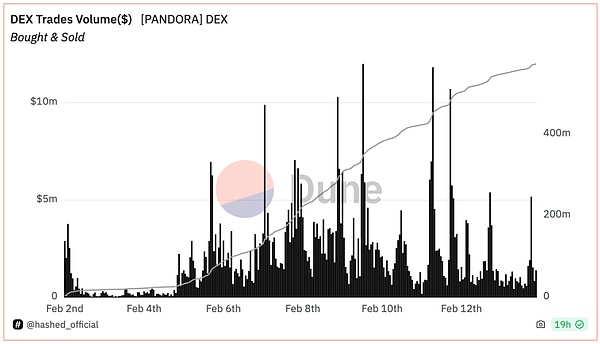

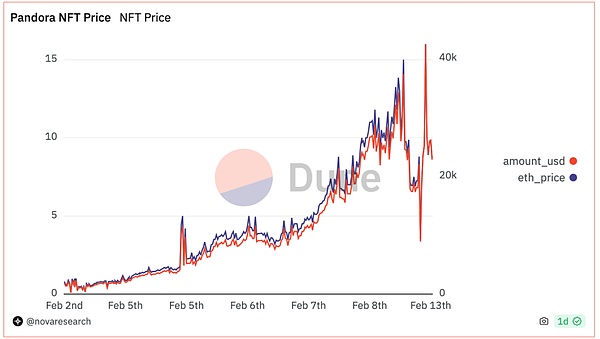

年前 ERC404 引起了诸多关注,一度导致以太坊 gas 飙升,目前 $PANDORA 回调到了 1 万多。刚好在初期热度回落时我们来理性聊一聊。

NFT 拆分赛道的发展历程

Pandora_ERC404 提出的 ERC404 是一种用于 NFT 碎片化的 FT/NFT 混合协议,所以就从 NFT 拆分赛道的发展历程聊起吧。

随着 2021 年 NFT summer 的到来,CryptoPunk、无聊猿等蓝筹 NFT 的价格已经涨到了让普通用户望洋兴叹的地步,流动性问题也一直是 NFT 的一大痛点,因此 NFT 的拆分需求在当时达到顶峰,这一需求其实在很早期就被许多项目方洞察到。

早期解决方案之一是 NFT 众筹,一般是通过中心化方式进行众筹购买 NFT,但是众筹的方式存在诸多问题:比如 NFT 的保管问题,退出或转让不够便利等。于是采用去中心化的方式将 NFT 碎片化的项目应运而出。

这些 NFT 碎片化协议都是采用智能合约托管 NFT,比如早在 2020 年 NIFTEX 就提出了 NFT 碎片化方案,用户可以铸造碎片化 NFT(shard),碎片持有人享有原始 NFT 的治理权;并且引入了买断条款,比如当触发买断的最低条件为至少 10% 的碎片时,买家可以通过持有 10% 以上碎片,再添加其余价值的 ETH 即可购买得到该 NFT。但 NIFTEX 在 2022 年公布已被收购,域名停用,且不会发币,目前已逐渐淡出视野。

考虑到一个系列的 NFT 价格可能不同,因此有的项目考虑将同一系列的多个 NFT 进行打包,一起碎片化发行指数代币 uToken,比如 Unicly uniclyNFT。Unicly 还考虑到了 FT 代币的 Defi 场景,通过发行治理代币 $UNIC,利用流动性挖矿的方式增加 uToken 的流动性。在 NFT 赎回方面,Unicly 的 uToken 创建者可以设置比例,当超过比例的 uToken 持有者同意解锁时,竞拍成功者获得该 NFT 并向 uToken 持有者支付对应金额,但目前交易量寥寥。该项目 2021 年融资了 1000 万美元,Blockchain 和 Animoca 投资,家底的厚实支撑它走过寒冬,上个月 Unicly 公布今年将要上线 V3 版本,并且将其部署在 frame.xyz,但是仍然冷清,目前主页上已经不显示 TVL 和交易量等数据了。

还有融资约 2800 万美元的明星项目 Fractional,其设计一个用于单个碎片化 NFT 的金库和一个用于多个碎片化 NFT 的金库。将 NFT 进行碎片化的人叫策展人(curator),他们可以从碎片拍卖中获取费用收入。另外,NFT 碎片持有者可以对金库底价进行投票,投票的加权平均值决定了发起收购所需的价格,任何持有大于或等于该底价的人可以进行金库收购,拍卖成功后,对应金库的 NFT 碎片持有者可以用他们的 ERC20 代币兑换成 ETH。Fractional 后改名 Tessera,很遗憾,几经变革后 Tessera 还是在去年宣布将逐步关闭。

除了将特定的 NFT 进行碎片化外,还有一种指数化的拆分方式,比如 NFTX,将同类 NFT 相似价格的 NFT 放入一个金库中,金库发行对应 vToken,这种方式的好处是,只需要持有足够的 vToken 就可以从金库中随机赎回 NFT,不需要投票通过,存入和赎回较为便捷,但是不一定能够赎回指定的 NFT。类似的项目 NFT20 就对 NFTX 进行了改进,首先是允许赎回指定的 NFT,其次是给治理代币 $MUSE 增加赋能,FT 代币铸造费用一部分返还给 $MUSE 持有人。NFT20 在 2021 年也完成了 75 万美元融资。

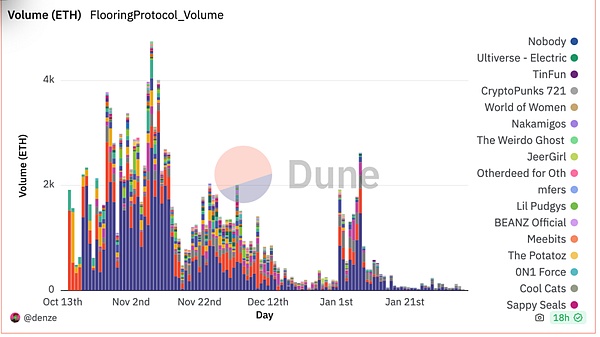

就在 NFT 熊市,许多项目陷入困境之时,去年一个 NFT 碎片化的新项目 Flooring Protocol floorprotocol 却宣布上线,Flooring Protocol 将某个高净值 NFT 碎片化成 100 万个 ERC-20 μTokens,不同 NFT 集合之间的 μTokens 并不相通,同一 NFT 集合中的 NFT 碎片化后的 μTokens 一致。Flooring Protocol 有 Valut 和 Safebox 两种碎片化模式,用户可以选择将 NFT 存入 Vault,获得 100 万 μTokens,并放弃该 NFT 的所有权;也可以选择将 NFT 存入 Safebox ,并选定存放时间和质押一定数量的平台币 FLC(存放时间越长,质押 FLC 越多),从而获得 100 万 μTokens 和用于验证该 NFT 所有权的 Safebox Key, Safebox Key 可以拍卖和交易。进行赎回时, Vault 模式要销毁与 NFT 集合相对应的 100 万 μTokens,但是赎回时随机的;而 Safebox 模式通过持有 Safebox Key 赎回之前存入的 NFT,也需要销毁 100 万 μTokens。当 Safebox 存放时间超期时,有部分用户会面临着无法赎回 Safebox 中的 NFT(质押的 FLC 可以拿回)的问题。到期后的 24 小时内,任何用户都可以使用 FLC 对过期的 Safebox Key 发起拍卖,但需要向协议支付 20% 的费用,若没人拍卖,则任何用户都可以使用 100 万 μTokens 解锁 Safebox 并兑换 NFT。

目前Flooring 中最多的系列也是 CryptoPunks,在刚上线时的 FLC 激励热潮退去之后,目前 TVL 处于低位。

可见,目前的 NFT 拆分项目基本都是采用质押 NFT 发行 FT 代币的方式进行拆分,拆分和赎回的规则各项目有所不同,发行治理代币的项目热度会相对高一些,但热度难以为继,并且基本都仅支持蓝筹 NFT 的拆分。

ERC-404 标准详解

PANDORA 提出了一种全新的碎片化 NFT 的方式——ERC-404 标准,ERC-404 是一种试验性的代币标准,ERC404 代币是同质化代币,1 枚 ERC404 代币对应 1 枚 Replicant NFT。

与 ERC721 标准的 NFT 不同,Replicant NFT 有着燃烧和重新铸造的机制,当用户对 ERC404 进行转账或交易等操作时即会触发,即当 ERC404 代币发生变动时,Replicant NFT 也会发生变动,比如当用户出售 ERC404 代币时,钱包中的 Replicant NFT 会被燃烧;当用户转账时,Sender 钱包中的 Replicant NFT 会被燃烧并在 Receiver 钱包重新铸造新的 Replicant NFT。值得一提的是,每一次重新铸造,Replicant NFT 的特征都会重新刷新,稀有度也可能随之发生变化。因此用户可以不断转账来刷新 NFT 特征,如果用户不想改变其 Replicant NFT 特征又想将其出售或者转账时,可以在 OpenSea 上出售或发送(即仅对 Replicant NFT 进行操作)。

ERC404 与之前的 NFT 拆分方案均不同,它是从协议底层来解决拆分的问题,惊人涨幅也体现了币圈对于新概念的追捧。但目前处于早期阶段,还有诸多提升空间,未来是否能通过 EIP 提案也是未知数。

上周 Pandora 宣布成为一个完整实体,后续不排除有融资和合作的消息;最近推出了 V2.1 版本,主要是解决吐槽较多的 gas 费高的问题。

个人认为 NFT 赛道很久没有出现新概念了,而且还是从底层标准角度聚焦流动性问题的,肯定要保持关注;未来随着协议的完善,有可能出现更多项目的支持和更多应用场景。

The author's source attracted a lot of attention years ago, which once led to the soaring of the Ethereum. At present, it has been adjusted back to more than 10,000. Just when the initial heat dropped, let's talk about the development of the split track rationally. We proposed a mixed protocol for fragmentation, so let's start with the development of the split track. With the arrival of the year, the prices of blue chips such as boring apes have risen to the point where ordinary users sigh, and the liquidity problem has always been a big pain point, so the split demand reached its peak at that time. In fact, the demand was perceived by many project parties at an early stage. One of the early solutions is crowdfunding. Generally, crowdfunding purchases are made through centralized methods. However, there are many problems in crowdfunding methods, such as storage problems, inconvenient withdrawal or transfer, which is equivalent to adopting decentralized methods to bring out fragmented projects. These fragmentation agreements are all managed by smart contracts. For example, as early as 2000, the fragmentation scheme was put forward, and users can cast fragmented fragments and the holders can enjoy the original governance rights. And the buyout clause is introduced. For example, when the minimum condition for triggering buyout is at least fragments, the buyer can buy it by holding the above fragments and adding the rest of the value. However, it was announced in 2000 that the acquired domain name has been deactivated and no coins will be issued. At present, it has gradually faded out of sight. Considering that the price of a series may be different, some projects consider packaging multiple of the same series and fragmenting them together to issue index tokens. For example, the scenario of tokens is also considered, and liquidity is utilized by issuing governance tokens. The founder of the increased liquidity in the way of mining can set a proportion. When more than a proportion of the holders agree to unlock, the successful bidder will get it and pay the corresponding amount to the holders. However, at present, the transaction volume is very small. The project has raised $10,000 a year and the solid support of the investors. Last month, it announced the version that will be launched this year and deployed it on the home page, but it is still cold. At present, there are no data such as display and transaction volume, as well as star projects with financing of about $10,000. Counting a vault for single fragmentation and a vault for multiple fragmentation, the person who will fragment is called a curator. They can get the fee income from the fragment auction. In addition, the weighted average value of the fragment holders can vote on the reserve price of the vault determines the price needed to initiate the acquisition. Anyone who holds the reserve price or more can purchase the vault. After the auction is successful, the fragment holders of the corresponding vault can exchange their tokens and change their names. Unfortunately, after several changes, Last year, it was announced that it would gradually close down. In addition to fragmenting the specific items, there is also an exponential splitting method, such as putting the same kind of products with similar prices into a vault and issuing them. The advantage of this method is that you can redeem them randomly from the vault as long as you have enough, and you don't need to vote. It is more convenient to deposit and redeem, but you may not be able to redeem the designated similar items. The first is to allow redemption, and the second is to add empowerment tokens to the governance tokens. Part of the manufacturing cost was returned to the holder, and the financing of $10,000 was completed in. Just when many projects were in trouble in the bear market, a new fragmented project was announced last year, which fragmented a certain high net worth into 10,000 different sets, which were not connected. There are two fragmentation modes after fragmentation in the same set. Users can choose to obtain 10,000 yuan from the deposit and give up the ownership of the deposit, or they can choose to deposit and select the storage time and pledge a certain number of platform coins. The longer the storage time, the better the quality. The more you bet, the more you can get. You can auction and trade to verify the ownership. When redeeming, the model will destroy the million corresponding to the collection, but when redeeming, the model will be random, and the million deposited before redeeming will also need to be destroyed. When the storage time is overdue, some users will face the problem that the pledge that cannot be redeemed can be taken back. Within hours after the expiration, any user can use the expired auction, but the fee that needs to be paid to the agreement can be used by any user. Unlocking and redeeming by using Wanwan is the most popular series at present, and it is at a low level after the enthusiasm ebbed when it was first launched. It can be seen that the current splitting projects are basically divided, split and redeemed by pledge issuing tokens, and each project has different rules. The popularity of issuing governance tokens will be relatively high, but it will be unsustainable, and it basically only supports the splitting standard of blue chips. A new fragmentation mode standard is proposed, which is a tentative token standard generation. Coins are homogeneous tokens, and the corresponding coins are different from the standard, and there is a mechanism of burning and recasting. When users transfer money or trade, it will be triggered, that is, when contemporary coins change. For example, when users sell tokens, what is in their wallets will be burned, and when users transfer money, what is in their wallets will be burned and recast. It is worth mentioning that the characteristics of recasting will be refreshed every time, and the rarity may also change accordingly, so users can transfer money continuously. If users don't want to change their features and want to sell or transfer them, they can sell or send them online, that is, only for operation, which is different from the previous splitting scheme. It solves the problem of splitting from the bottom of the agreement. The amazing increase also reflects the pursuit of new concepts by the currency circle, but it is still in the early stage, and there is still much room for improvement. It is also unknown whether it can be announced as a complete entity in the future through the proposal last week, and the news of financing and cooperation will not be ruled out. Recently, a version has been released. It is mainly to solve the problem of high cost. Personally, I think the new concept of the track has not appeared for a long time, and I still focus on the affirmation of the liquidity problem from the perspective of the bottom standard. We should pay attention to it. With the improvement of the agreement, there may be more project support and more application scenarios in the future. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。